analysis

Will December Surpass November’s Record-Breaking Bitcoin Price Increase?

Published

5 hours agoon

By

admin

Bitcoin is closing out one of its most remarkable months in history, surging over $30,000 in November and marking a renewed bullish sentiment in the market. As we look ahead to December and beyond, investors are eager to understand whether Bitcoin’s momentum can sustain itself into 2025. With macroeconomic conditions, historical trends, and on-chain data aligning in Bitcoin’s favor, let’s analyze what’s happening and what it could mean for the future.

November’s Record-Breaking Performance

November 2024 wasn’t just any month for Bitcoin; it was historic. Bitcoin’s price rose from around $67,000 to nearly $100,000, an approximate 50% peak-to-trough increase, making it the best-performing month ever in terms of dollar increase. This rally rewarded long-term holders who endured months of consolidation after Bitcoin’s all-time high of $74,000 earlier in the year.

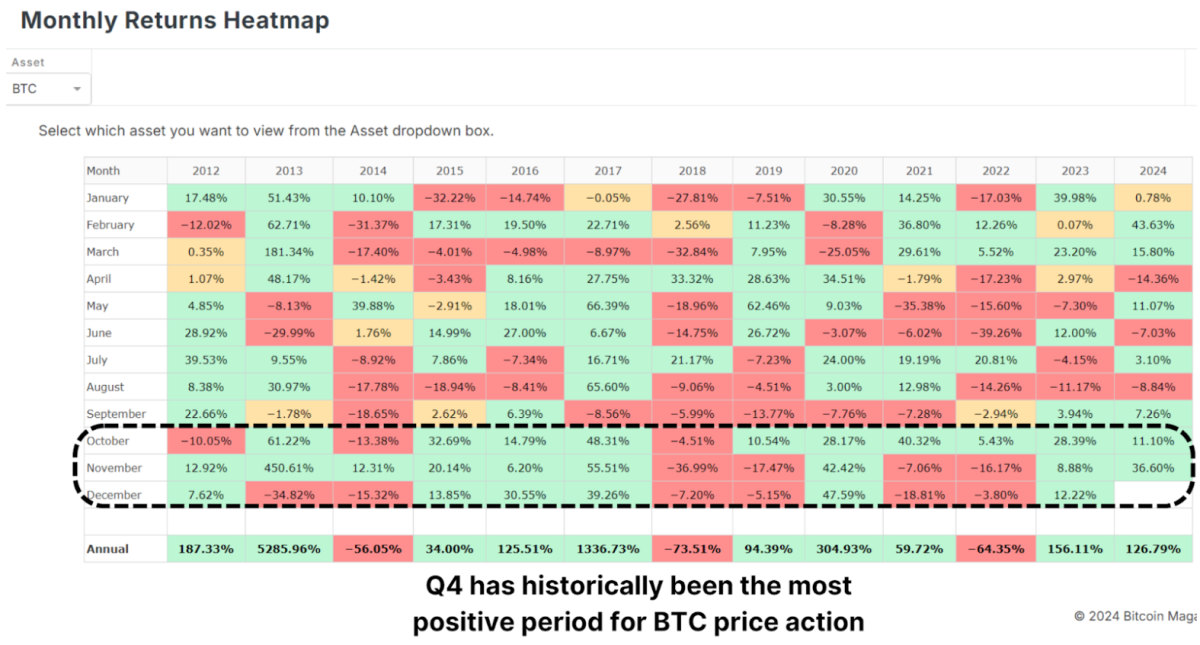

Historically, Q4 is Bitcoin’s strongest quarter, and November has often been a standout month. December, which has also performed well in past bull cycles, presents a promising outlook. But as with any rally, some short-term cooling might be expected.

The Role of the Dollar and Global Liquidity

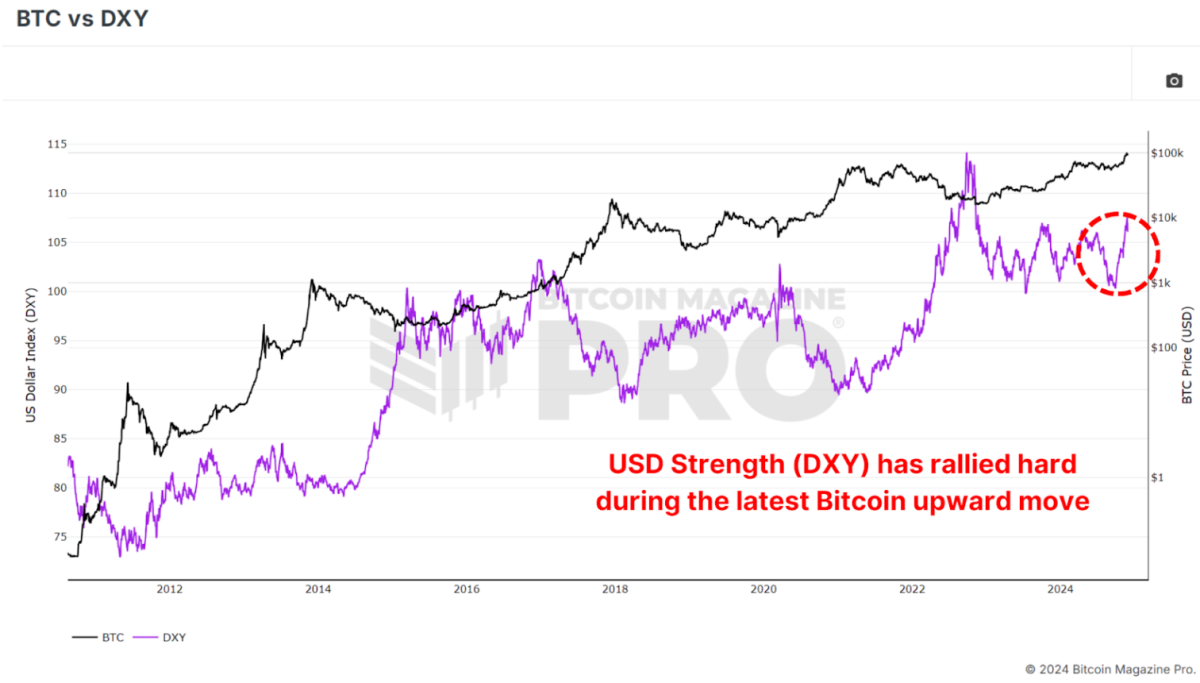

Interestingly, Bitcoin’s rise occurred against the backdrop of a strengthening U.S. Dollar Strength Index (DXY), a scenario that typically sees Bitcoin underperforming. Historically, Bitcoin and the DXY have maintained an inverse relationship: when the dollar strengthens, Bitcoin weakens, and vice versa.

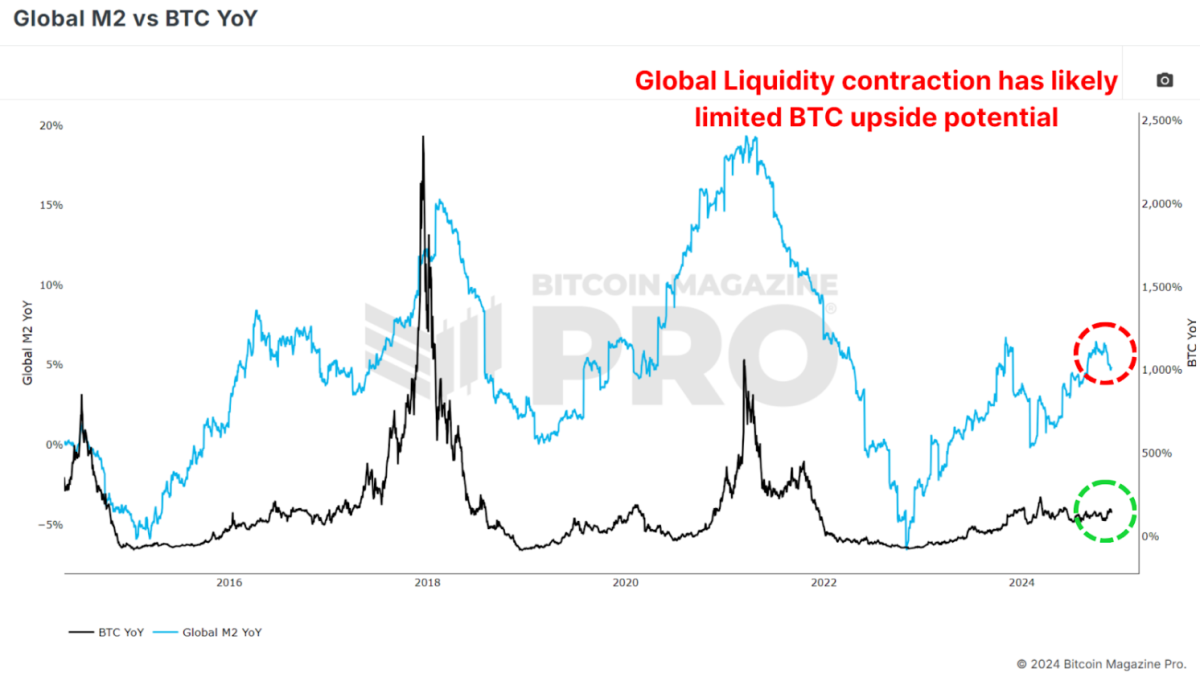

Similarly, the Global M2 money supply, another key metric, has shown a slight contraction recently. Bitcoin has historically correlated positively with global liquidity; thus, its current performance defies expectations. If liquidity conditions improve in the coming months, this could act as a powerful tailwind for Bitcoin’s price.

Parallels to Past Bull Cycles

Bitcoin’s current trajectory is strikingly similar to past bull markets, particularly the 2016–2017 cycle. That cycle began with gradual price increases before breaking key resistance levels and entering an exponential growth phase.

In 2017, Bitcoin’s price broke out from a key technical level of around $1,000, leading to a parabolic rally that peaked at $20,000, a 20x increase. Similarly, the 2020-2021 cycle saw Bitcoin rise from $20,000 to nearly $70,000 after breaking above the crucial YoY Performance threshold.

If Bitcoin can break out decisively from this historic level and above the key $100,000 resistance, we may witness a repeat of these explosive price movements as BTC enters its exponential phase of bullish price action.

Institutional Adoption and Accumulation

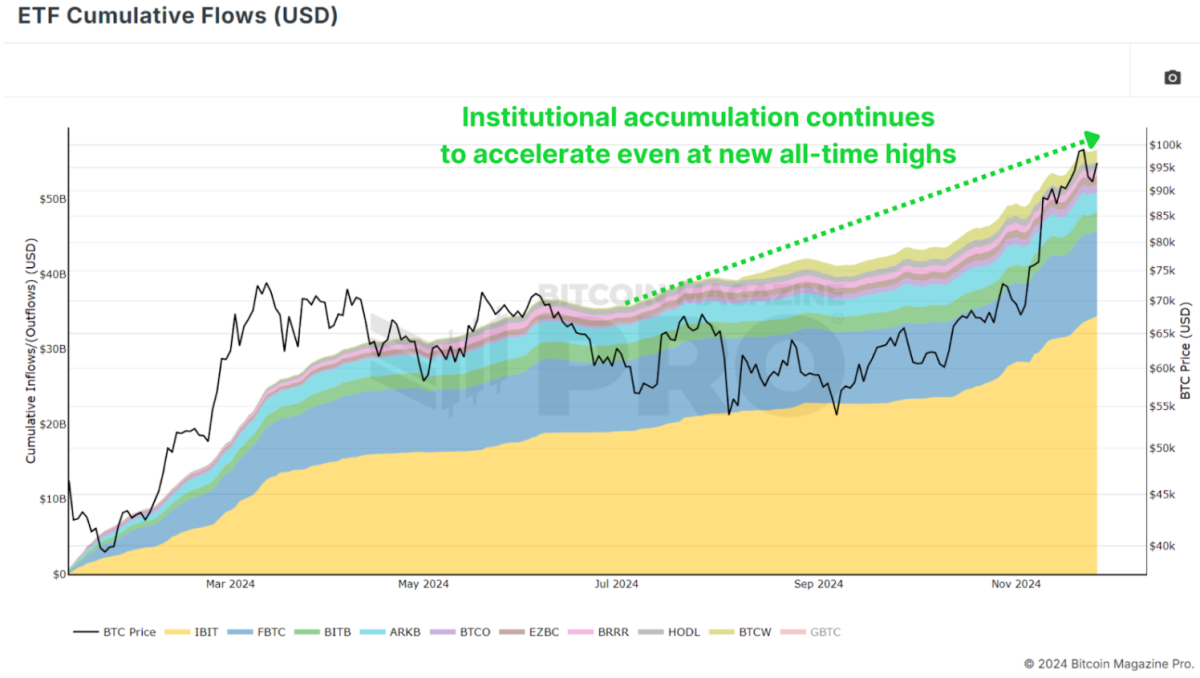

A key factor underpinning Bitcoin’s strength is the continued accumulation by institutions. Bitcoin ETFs are adding billions of dollars worth of BTC to their holdings, and corporations like MicroStrategy have doubled down on their Bitcoin strategy, now holding close to 400,000 BTC. Even with BTC rallying to new all-time highs, ‘smart money’ is scrambling to accumulate as much as possible to ensure they’re not left behind.

This institutional demand indicates growing confidence in Bitcoin as a long-term store of value, even in volatile market conditions. Such accumulation also tightens the available supply, creating upward pressure on prices as demand increases.

Conclusion

While December has historically been a strong month for Bitcoin, short-term volatility could temper gains as the market digests November’s sharp rally. Although given the aggressive accumulation we’re witnessing from institutional participants anything is possible.

Longer-term, however, the outlook remains exceptionally bullish. The obvious level to watch is $100,000 as the next major milestone, which, if breached, could pave the way for a much larger rally in 2025. Bitcoin is entering one of its most exciting phases yet, with the stars seemingly aligning across macroeconomic, technical, and on-chain metrics.

For a more in-depth look into this topic, check out a recent YouTube video here: The BIGGEST Bitcoin Month EVER – So What Happens Next?

🎁 Black Friday: Our Biggest Ever Sale

The BEST saving of the year is here. Get 40% Off all our annual plans.

- Unlock +100 Bitcoin charts.

- Access Indicator alerts – so you never miss a thing.

- Private TradingView indicators of your favorite Bitcoin charts.

- Members-only Reports and Insights.

- Many new charts and features coming soon.

All for just $15/month with the Black Friday deal. This is our biggest sale all year.

UPGRADE YOUR BITCOIN INVESTING NOW

Don’t miss out! 👉 https://www.bitcoinmagazinepro.com/subscribe/

Source link

You may like

Bitcoin (BTC) Miners Bitdeer (BTDR), MARA Holdings (MARA) Among Gainers as Price Nears $100K

Crypto whales secretly accumulate these 4 coins for 5,000% gains

Algorand (ALGO) Price Rockets 32% After Bullish Golden Cross

Crypto Guru Reveals His Top 10 AI Altcoins For 2025

Algorand price surges as crypto pundit sees it hitting $1.25

Solana Price Forecast: As SOL Flips Ethereum

analysis

Bitcoin (BTC) Price and Hashrate Divergence May Set the Scene for a Potential Rally, Historical Data Shows

Published

2 months agoon

September 22, 2024By

admin

Consistent with this pattern, bitcoin has already shown signs of recovery, gaining about $9,000 since the local bottom on Sept. 6, representing a 15% increase in value. This divergence between bitcoin’s (BTC) price and its hash rate started to shape up in July and then persisted into early September, when the computing power of the network reached an all-time high of 693 exahashes per second (EH/s) on a seven-day moving average, while bitcoin’s price was near $54,000.

Source link

Altcoins

Altcoins Outperform Bitcoin (BTC) and Ether ((ETH) Following Fed Meeting Due to Poor Liquidity, Higher Beta

Published

2 months agoon

September 21, 2024By

admin

Total3, an index that tracks the market capitalization of the top 125 cryptocurrencies, excluding bitcoin and ether (ETH), was trading 5.68% higher since the central bank’s announcement that it would slash the Federal Funds rate by 50 basis points, according to data on TradingView. Bitcoin’s market cap, by contrast, rose only 4.4%.

Source link

analysis

Ether-Bitcoin Ratio Drops to Lowest Since April 2021. Here’s Why It Matters

Published

2 months agoon

September 16, 2024By

admin

Analysts suggest the ETH/BTC ratio might drop further, potentially to the 0.02-0.03 range, unless there’s a significant change in investor sentiment or regulatory clarity that might favor riskier assets.

Source link

Bitcoin (BTC) Miners Bitdeer (BTDR), MARA Holdings (MARA) Among Gainers as Price Nears $100K

Crypto whales secretly accumulate these 4 coins for 5,000% gains

Algorand (ALGO) Price Rockets 32% After Bullish Golden Cross

Crypto Guru Reveals His Top 10 AI Altcoins For 2025

Will December Surpass November’s Record-Breaking Bitcoin Price Increase?

Algorand price surges as crypto pundit sees it hitting $1.25

Solana Price Forecast: As SOL Flips Ethereum

‘Very Promising Start’: Top Analyst Says Ethereum Headed Higher Against Bitcoin – Here Are His Targets

5 hidden gems to watch as the market gears up for 10,000% surge

BTC Monthly Chart Reveals Bull Market Target

AI bot transfers $50k in crypto after user manipulates fund handling

Perpetual DEX Hyperliquid to Launch Native Token Following Bullish October

Ethereum Foundation Invests Millions Into zkVM, What’s Happening?

Cardano’s Hoskinson believe Bitcoin will surpass $250,000

BTC AT $97K, XRP Rises 7%, ALGO Surges 23%

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential