Bitcoin

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support

Published

7 hours agoon

By

admin

Bitcoin (BTC) appears to be rebounding from its recent pullback after reaching a new all-time high (ATH) of $99,645 on November 22. Despite liquidations exceeding $500 million during the downturn, the event did not trigger the cascading sell-offs seen in previous market cycles.

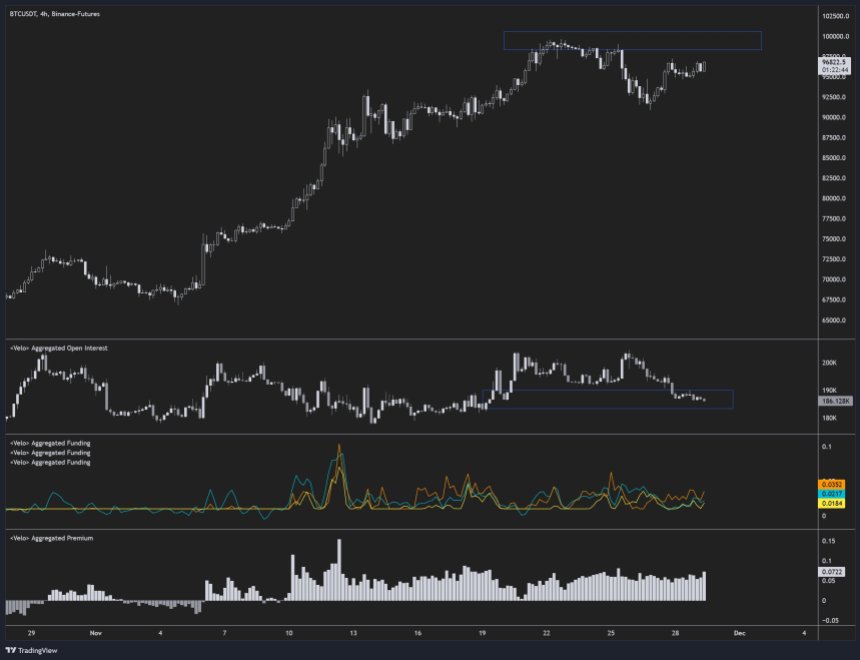

Bitcoin Open Interest Resets: Is $100,000 Next?

The flagship cryptocurrency seems ready to make another attempt at the $100,000 milestone. According to crypto analyst Byzantine General, the recent BTC price pullback reset open interest to levels last observed when the asset first touched $90,000.

Related Reading

Critically, Bitcoin held support around $90,875, signaling the potential establishment of a new consolidation phase before the next upward move. Byzantine General stated that BTC is poised to “take out the local highs and potentially take a stab at piercing 100k,” noting:

A lot of the passive supply already got taken out in the previous attempt, so there’s a pretty good chance that we will see 100k soon.

Byzantine General’s thoughts were echoed by prominent crypto trader Jelle, who said that $100,000 for BTC was “in sight.” The trader shared the following chart where BTC appears to be breaking through a downward-sloping trendline. At the same time, it is also forming an inverse head-and-shoulders pattern – typically a bullish indicator.

Another crypto analyst Daan Crypto Trades agreed that Bitcoin is within reaching distance of the $100,000 mark. As previously reported, some analysts believe that BTC is mirroring its price action from 2023, which could see the asset’s price reach as high as $200,000 by early 2025.

Healthy Corrections Essential To Fuel Long-Term Growth

Bitcoin was trading just above $69,000 on November 6 before surging past its previous ATH and reaching its current price of $97,150 – a staggering 40.8% gain in less than a month. However, such a rapid rally could signal an overextension.

Related Reading

A slight correction to the low $90,000 level might just have been what was required for BTC to have a more sustained price momentum going forward. Further, it gives time to retail investors – who have been missing from the current market rally – to enter the market and potentially increase the demand-side pressure.

The recent price pullback also cooled down the Bitcoin Fear & Greed Index from extreme greed to more moderate levels, setting the stage for a more organic and sustainable rally across the cryptocurrency market.

Speaking of long-term forecasts, Pantera Capital founder and managing partner Dan Morehead recently predicted an ambitious price target of $740,000 BTC by 2028. At press time, BTC trades at $97,150, up 1.4% in the past 24 hours.

Featured image from Unsplash, charts from X and Tradingview.com

Source link

You may like

What to Expect from ETH in December

NFT sales dip to $146.5m: Ethereum, Bitcoin network recover

How MicroStrategy Poses 4 Major Risks to Bitcoin?

BNB, XRP, and Lunex Network look set for major gains

XRP Price Skyrockets 20%; Could ATH Be Around the Corner?

Rollblock’s breakout year could rival SHIB’s dominance by 2025

Bitcoin

NFT sales dip to $146.5m: Ethereum, Bitcoin network recover

Published

2 hours agoon

November 30, 2024By

admin

As Bitcoin continues to face resistance near the $100,000 mark, the NFT market has experienced a 1.6% drop, with total sales volume settling at $146.5 million.

While Bitcoin (BTC) trades at $96,800, Ethereum (ETH) has shown strength by surging 3.5% in the last 24 hours to reclaim the $3,700 level. The global cryptocurrency market capitalization has expanded to $3.42 trillion from last week’s $3.35 trillion. This marks a 2.5% increase over the last day.

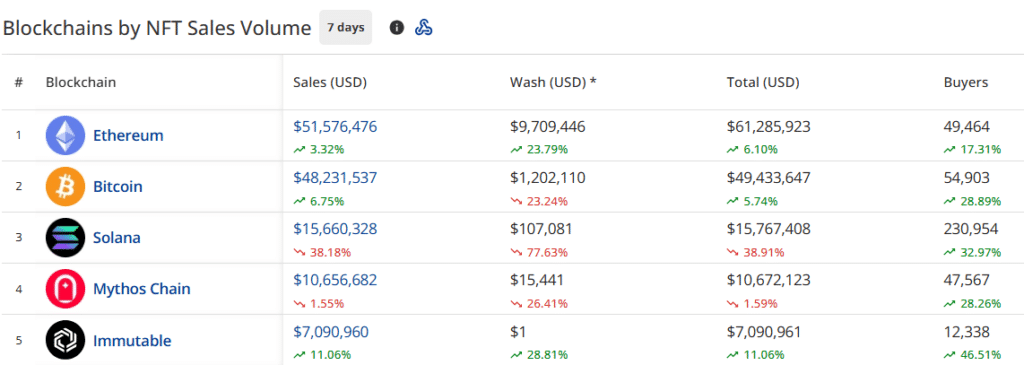

According to the latest data from CryptoSlam, while overall sales have declined, individual blockchain networks are showing signs of recovery:

- NFT (non-fungible token) sales volume dropped from last week’s $160.9 million.

- NFT buyers have surged to 574,853, marking a 27.57% increase.

- NFT sellers have grown to 342,382, showing a surge of 23.21%

- NFT transactions have declined by 11.22% to 1,424,770.

Ethereum and Bitcoin show signs of recovery

The Ethereum NFT blockchain has shown resilience with $51.3 million in sales, marking a 2.87% increase.

The network has seen 49,462 buyers, representing a healthy 17.33% growth. Notably, wash trading on Ethereum increased by 16.02% to $9.1 million, suggesting increased market activity.

Bitcoin’s NFT ecosystem has maintained strong momentum. The network has recorded $48.2 million in sales volume, a 6.58% increase. The network has seen decent growth in buyer participation, with 54,903 active buyers marking a 28.89% increase.

Solana (SOL), while maintaining its third position, experienced a major decline of 37.86%, with sales dropping to $15.7 million. However, the network continues to show strong user engagement with 230,954 buyers.

Mythos Chain secured the fourth position with $10.6 million in sales, showing a marginal decline of 1.66%. However, ImmutableX (IMX) rounded out the top five with $7.1 million in sales, showing a surge of 14.22%.

BRC-20 and new collections lead rankings

BRC-20 NFTs continue to dominate with $15 million in sales despite a 10.69% decrease. Uncategorized Ordinals has secured second place with $10.3 million in sales. Its sales have also seen an 81.86% increase in the last seven days.

The Bored Ape Yacht Club has reemerged in the rankings, taking third place with $7.7 million in sales, showing a strong 60.30% increase.

CryptoPunks followed closely with $7.7 million, despite a 14.56% decrease.

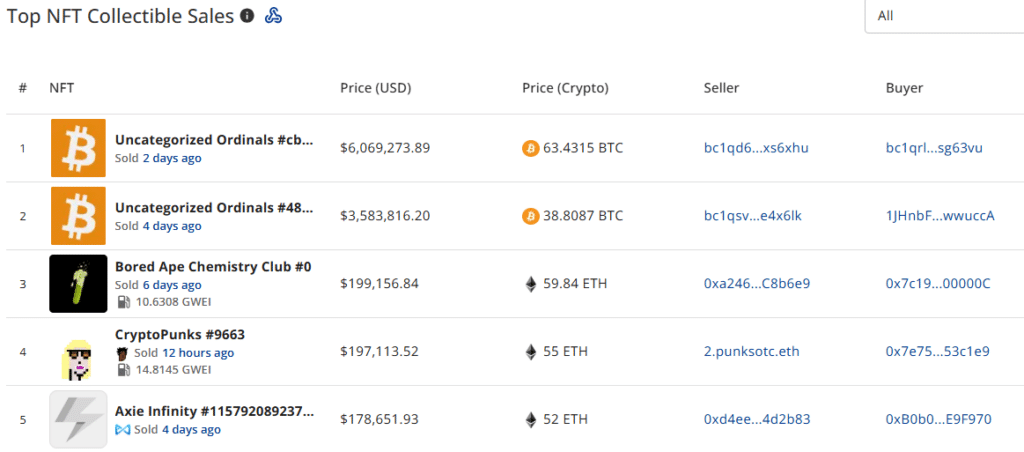

The latest data shows several large individual NFT sales:

- Uncategorized Ordinals #cb0 sold for $6,069,273 (63.4315 BTC)

- Uncategorized Ordinals #486 sold for $3,583,816 (38.8087 BTC)

- Bored Ape Chemistry Club #0 sold for $199,156 (59.84 ETH)

- CryptoPunks #9663 sold for $197,113 (55 ETH)

- Axie Infinity #115792089237 sold for $178,651 (52 ETH)

NFTs continue to evolve

In 2024, NFTs are expanding their utility through integration with gaming and DeFi, enabling in-game assets and serving as collateral in decentralized finance platforms.

Corporations are adopting NFTs for promotional campaigns, loyalty programs, and revenue generation, while hybrid and real-world asset tokenization are bridging the gap between physical and digital realms.

Cross-platform interoperability is growing, allowing NFTs to function seamlessly across various ecosystems. Sustainability efforts are addressing environmental concerns, with greener blockchain solutions gaining traction.

Additionally, AI-enhanced NFTs are emerging, enabling personalized and interactive experiences, showcasing the evolution of NFTs beyond simple digital collectibles.

It’s worth noting that the current uptick in NFT sales seems largely fueled by hype. It remains to be seen whether this trend will translate into long-term growth or if it’ll be short-lived momentum.

Source link

Bitcoin

Cardano’s Hoskinson believe Bitcoin will surpass $250,000

Published

1 day agoon

November 29, 2024By

admin

Bitcoin, the world’s largest cryptocurrency by market capitalization, is heading to the next target price of $100,000 after rising 33% in just a month, but Cardano’s founder projects beyond.

Founder of Cardano Charles Hoskinson projects that Bitcoin will reach the price target of $250,000 in just 2 years. He believes that the target price is the lowest target to achieve, yet the highest target is $500,000.

According to Hoskinson’s YouTube live video posted on Nov. 27, he noted that several factors would increase the Bitcoin price in the future, including the massive inflow into the crypto market as well as the institutional eyes that have been interested in Bitcoin in recent days.

“It is my believe that Bitcoin will go to quarter and half million dollars in the next 12 to 24 months, because of the investment inflow and and the great interest that has been achieved,” Hoskinson said.

He mentioned that Bitcoin as a value store of the internet remain useful for decentralized finance (DeFi) in the future. The DeFi mode, also known as the new capabilities of DeFi, could bring Bitcoin through the Cardano network so the holders could participate in the DeFi ecosystem.

Cardano’s outlook after Bitcoin rose

Cardano, as one of the biggest cryptocurrencies based on market capitalization, has grown in the past month following the rise of Bitcoin, increased 190% and reached a price of $1 for the first time after dropping in 2022. In the past 24 hours, the token was traded for $1.5 billion or dropped by almost 40%.

The market is also eyeing the possibility of Cardano spot ETF after several cryptocurrencies have already crypto product versions, including Bitcoin and Ethereum.

ADA projected would be bullish in the near future if the asset management pushes the ETF version to the Securities and Exchange Commission (SEC).

Source link

Bitcoin

Major Bitcoin miners spent $3.6 billion on infrastructure

Published

2 days agoon

November 29, 2024By

admin

Bitcoin miners’ major player has announced their third-quarter financial report, resulting in billions of dollars in funding and spending.

According to TheMinerMag, on Nov. 28, key players in the cryptocurrency and Bitcoin mining industry published their financial reports. Since the beginning of this year, most of the publicly traded companies have raised $5 billion in funding through equity and debt financing.

The debt financing only accounts for 12.5% of the funding, around $625 million this year. Equity financing has a significant portion of $4.4 billion, with $813 million in funding in this quarter alone.

Those companies also reported the cumulative budget that has been spent on property, plant, and equipment (PP&E), which amounts to $3.6 billion. This spending on infrastructure for Bitcoin mining rose after global computing power dedicated to Bitcoin mining, also called hashrate, surged.

“Recently hit an all-time high near 790 exahashes per second or 790 EH/s (7-day moving average) despite the Bitcoin halving,” TheMinerMag mentioned.

Miners also committed to purchasing hardware for up to $2 billion between July 2023 and September 2024. The ASIC mining tools are still dominated by Bitmain, which captures a significant portion of purchases.

Bitcoin miners faced challenges

Bitcoin miners have played a significant role in the crypto industry, specifically for Bitcoin, due to their contributions to minting the crypto and selling it to the market. However, miners also faced another level of challenge in operations and regulations in several countries.

Recently, the U.S. Customs and Border Protections detained imported Bitcoin mining equipment, including Bitmain Antiminer ASIC miner, at the ports due to a request from the Federal Communications Commission.

The Russian government also targeted Bitcoin miners to be banned after an energy deficit occurred in the country. They also aim to tax profitable mining operators with a 15% personal income tax rate.

Source link

What to Expect from ETH in December

NFT sales dip to $146.5m: Ethereum, Bitcoin network recover

How MicroStrategy Poses 4 Major Risks to Bitcoin?

Crypto Entrepreneur Justin Sun Ate a $6.2M Banana Artwork at an Event in Hong Kong

BNB, XRP, and Lunex Network look set for major gains

XRP Price Skyrockets 20%; Could ATH Be Around the Corner?

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support

Rollblock’s breakout year could rival SHIB’s dominance by 2025

Spot Ethereum ETF Flips Bitcoin ETFs in Daily Inflows, $5000 Target In Sight?

$89,670,000,000 in Increasingly Risky Loans Flagged at JPMorgan Chase, Wells Fargo and Bank of America: Report

DOGEN, SOL, and SUI surge as Bitcoin’s strength declines

Robert Kiyosaki Says FOMO Is Good As Bitcoin Price Nears $100K Mark

Cardano and XRP reach new heights, this meme coin prepares for 33x surge

Virtuals Protocol Tokens on Base Skyrocket as AI Agent Demand Grows

Hedera (HBAR) Price Jumps 25% As Analyst Predicts 192% Rally

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential