Price analysis

XRP Price Skyrockets 20%; Could ATH Be Around the Corner?

Published

6 hours agoon

By

admin

XRP price experienced a remarkable surge, hitting its highest level since 2018 within just 24 hours. The cryptocurrency saw a significant jump in daily trading volume, defying broader market trends and reflecting heightened investor interest. Analysts suggest strong momentum could persist, with projections targeting a potential $2 valuation by the weekend. The impressive rally has positioned Ripple as a focal point for market attention as it edges closer to reclaiming its all-time high.

XRP Price Soars 20%: Is a New All-Time High Imminent?

In November, the value of XRP has seen a strong upward trend, climbing by 270%. Currently, it is trading at $1.93, and it has reached its highest level in years. The impressive rally has sparked speculation among analysts and investors about the possibility of a new all-time high.

XRP, which hit an all-time high of $3.84 in January 2018, has been trading significantly below that level for years. However, this recent surge in price has renewed optimism within the cryptocurrency community. With the asset up nearly 50% since the start of the year, its momentum appears strong. If the bullish trend continues the Ripple price might soar to ATH soon. The Relative Strength Index is at $78, indicating an overbought market.

Crypto analysts tweeted about XRP nearing its highest monthly candle close, signaling a potential historic breakout.

The tweet highlighted that XRP’s price chart shows significant bullish momentum. If the monthly close achieves this level, it could mark a major milestone for the cryptocurrency.

Chart analysis suggests that XRP is approaching a key resistance zone, with traders speculating on whether it will break through. Historical performance indicates such movements often precede major price rallies or corrections.

Will RIPPLE Price Hit $2 This Weekend?

The crypto expert shared an X post stating their bullish outlook for Ripple’s XRP. According to the expert, the target price for XRP remains firmly set at $2. This projection underscores their confidence in XRP’s growth potential within the cryptocurrency market.

The target for #Ripple $XRP remains $2! https://t.co/wVRIrLNvYY pic.twitter.com/YUWZwHmOY9

— Ali (@ali_charts) November 29, 2024

Bitcoin’s price surged past $96,000, with crypto market enthusiasm hinting at further gains. Ripple’s legal resolution and potential SEC Chair Gary Gensler’s exit spark optimism for a crypto-friendly regulatory shift. Institutional confidence grows, bolstered by interest in XRP-focused ETFs like Bitwise’s rebranded Physical XRP ETP. Investors believe XRP may soon hit an all-time high, supported by improving market conditions and heightened institutional activity.

XRP’s recent price surge has reignited investor excitement, with strong momentum suggesting a possible rally toward its all-time high. Favorable market conditions, increased institutional interest, and bullish sentiment make XRP a key cryptocurrency to watch in the coming days.

Frequently Asked Questions (FAQs)

It signals potential for a historic bullish breakout.

ETFs like Bitwise’s XRP ETP and optimism around Ripple’s growth.

XRP has surged 270%, hitting its highest level since 2018.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

What to Expect from ETH in December

NFT sales dip to $146.5m: Ethereum, Bitcoin network recover

How MicroStrategy Poses 4 Major Risks to Bitcoin?

BNB, XRP, and Lunex Network look set for major gains

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support

Rollblock’s breakout year could rival SHIB’s dominance by 2025

Algorand

Algorand price surges as crypto pundit sees it hitting $1.25

Published

1 day agoon

November 29, 2024By

admin

Algorand price experienced a strong bullish breakout on Nov. 29 as cryptocurrencies continued their uptrend.

Algorand (ALGO), a top layer-1 network, surged to $0.40, marking its highest level since November 2022. The cryptocurrency has risen for four consecutive weeks, climbing over 240% from its lowest level this year.

Crypto analysts are still optimistic about the ALGO price. In an X post, Steph is Crypto, a popular analyst, noted that the coin would jump to $1.26. He cited a double-bottom pattern that happened on the weekly chart. If this forecast is correct, it means that the coin may jump by 300%.

Another analyst noted that the coin would rally because of its strong tokenomics, its real-world adoption, and the best technology. For example, Algorand has a partnership with FIFA, which uses its blockchain to run its NFT marketplace.

The total value locked in Algorand’s DeFi ecosystem has also risen, hitting $170 million, the highest since February. Key dApps in its ecosystem have seen significant inflows, with Folks Finance’s assets rising by 200% in the last 30 days. Lofty has $45 million in assets, while Tinyman holds $34.6 million.

Algorand’s rally aligns with the broader cryptocurrency market performance. Bitcoin surpassed $98,000 on Friday, and the total market cap of all cryptocurrencies reached over $3.4 trillion. Other traditional coins from 2021, such as Theta Network, Stellar, and MultiversX (formerly Elrond), also recorded significant gains.

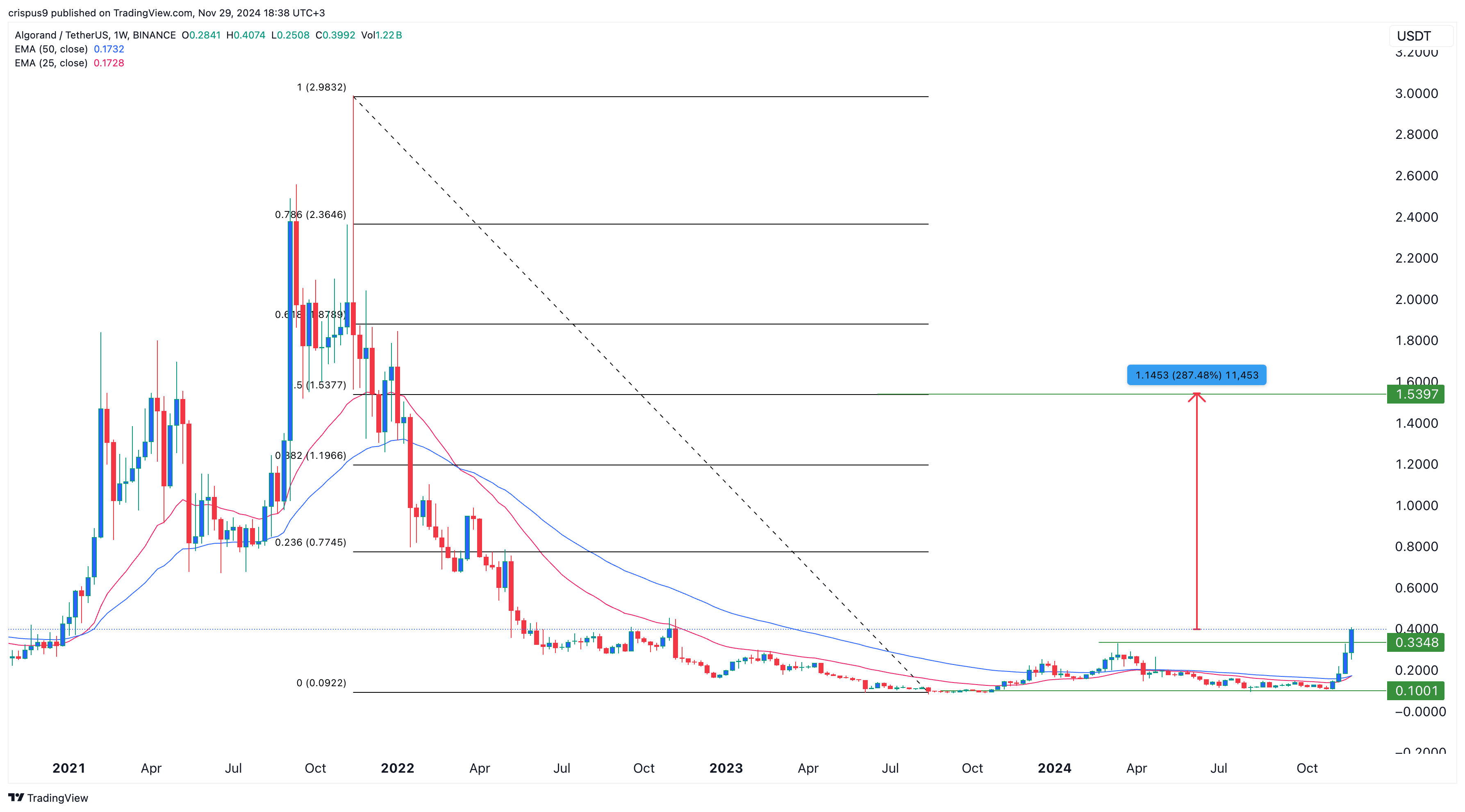

Algorand price analysis

The weekly chart supports the bullish outlook for ALGO, suggesting it may climb to $1.54 during the current bull run. The coin recently completed a double-bottom pattern at $0.10, which it has not breached since last year. It has now surpassed the neckline of this pattern at $0.3348, a typical bullish indicator.

If this trend continues, ALGO could target $1.54, representing a 287% increase from current levels and aligning with the 50% Fibonacci Retracement level. For this to happen, the coin must first break through the 23.6% retracement point at $0.7745 and the 38.2% level at $1.20. However, a drop below the support level at $0.20 could trigger downside momentum.

Source link

Price analysis

Solana Price Forecast: As SOL Flips Ethereum

Published

1 day agoon

November 29, 2024By

admin

Solana price, a Layer 1 blockchain token, has surged significantly this month, driven by robust bullish momentum in the cryptocurrency market. November has proven to be a month of remarkable gains for SOL, with its price climbing by over 40%, signaling the potential for further upward movement. The cryptocurrency’s performance has drawn market attention as it broke through multiple resistance levels, sparking speculation about an impending breakout. Solana now challenging Ethereum in market dynamics.

Solana Price Ready to Rally As SOL dApps Flips Ethereum

Raydium, Jito, and Solana have emerged as the top contenders in the decentralized application (DApp) space. Solana-based protocols outperformed Ethereum in 30-day protocol fees for the first time, marking a significant milestone for the blockchain. This shift highlights the growing adoption of Solana’s ecosystem, especially among retail users.

Raydium, a leading decentralized exchange on Solana, generated a record-breaking $203.13 million in fees over the past 30 days. Jito, a staking-focused protocol, followed closely, raking in $199.61 million. Meanwhile, Solana secured $192.06 million, narrowly surpassing Ethereum’s $187.67 million during the same period.

#Solana passes #Ethereum in monthly fees – it’s over.

Accumulate $SOL under $300 for the markup. pic.twitter.com/9LJ85uQLNk

— MartyParty (@martypartymusic) November 28, 2024

Solana has officially surpassed Ethereum in monthly fee generation, marking a significant milestone in blockchain competition. Recent data shows Solana generating $183.46 million in monthly fees, overtaking Ethereum’s $181.42 million for the same period.

This development highlights the growing adoption and usage of the Solana blockchain, often praised for its scalability and low transaction costs. Investors and analysts closely monitor Solana’s performance, with some advocating accumulating its native token, $SOL, below $300 for potential upside.

🚨JUST IN: Raydium, Jito, and Solana take the lead in 30D protocol fees, surpassing Ethereum and Circle for the first time. @RaydiumProtocol alone generated a record-breaking $200M in fees over the 30-day period. pic.twitter.com/Zs9OCXbsyS

— SolanaFloor (@SolanaFloor) November 28, 2024

SOL Price Forecast: This Pattern Hints Solana Could hit $1,300

Solana attracts the crypto market as a compelling technical setup suggests potential gains. Analysts highlight a bullish symmetrical triangle pattern, typically signaling a continuation of the prevailing trend. The SOL price is currently at $242, with a surge of 4%.

The resistance at $259 serves as a pivotal breakout point for the Solana price prediction. A sustained close above this level could validate the bullish trajectory. Conversely, critical support zones lie at $245 and $126. A breakdown below these levels would invalidate the bullish outlook, signaling a potential reversal in sentiment.

The broader market’s optimism adds to Solana’s momentum, reflecting a 900% rally from its previous consolidation phase. If the breakout confirms, the measured move points to a potential target near $1,300, aligning with historical patterns observed in similar setups.

Solana’s recent milestones, strong adoption, and bullish patterns signal significant upside potential. If key resistance levels hold, SOL could target $1,300. However, a breakdown below critical support zones may reverse sentiment, underscoring the importance of cautious, informed decision-making.

Frequently Asked Questions (FAQs)

Increased adoption and surpassing Ethereum in protocol fees.

Solana outperformed Ethereum in monthly protocol fees.

$259 is a critical breakout point for SOL.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Price analysis

XLM Price Kickstarts Parabolic Rally to $1 After Recent Breakout

Published

2 days agoon

November 28, 2024By

admin

XLM price has been on a steep ascent since mid-November. However, that momentum was briefly interrupted over the weekend as the wider crypto market followed Bitcoin’s downward cue. Nonetheless, the market returned to the upside on Wednesday, with Stellar breaking out of a bullish flag pattern. We discuss why this could be a pathway to the $1 mark.

XLM Price Triggers Parabolic Rally to $1

Consolidation phases typically follow exponential price gains like the one recently seen on Stellar price. The brief period of profit-taking is what forms the “flag.” In a market rally, a breakout from the flag pattern signals a return to the previous upward trajectory. In the case of XLM, the breakout happened on Wednesday, and a successive price gain on Thursday added credence to the bullish continuation pattern.

To get the price target in a bullish flag pattern, we measure the “flagpole,” which is the distance from the lows of the upward move to the highs at the flag’s formation point. We then use the same measurement to extrapolate to the upper target, starting from the flag’s lower trendline. Applying this method on the four-hour XLM price prediction chart below signals that the price could go as high as $1.11

Besides the technical outlook’s leaning toward the upside, a number of on-chain metrics also signal bullish control of the market, as discussed below.

Rising Open Interest Signals Increased Demand for XLM

Open Interest measures the value of options or futures contracts that are yet to expire, or investors are yet to exercise/close. In XLM’s case, the value of Open Interest in perpetual contracts rose by 3.2% in the 24 hours preceding this writing, as seen on the graphic below. That signals that more investors are predicting that the value of XLM will continue to rise in the coming days. This sentiment adds support to the coin’s demand side.

A Sharp Spike in XLM DeFi TVL Highlights Growing Adoption

According to recent DeFiLlama data, the Total Value Locked (TVL) in the Stellar chain DeFi ecosystem rose sharply by 63.5% in the last seven days to $56.18 million. That augurs well for XLM price as it points to increased utility in financial transactions.

Stellar Price’s Bullish Momentum Targets $0.50 Support

The RSI indicator reading is at 53, signaling a stronger upside potential. The next key barrier for XLM price is at $0.50, which is a psychological level. A break above that level will confirm the bullish bias. The coin has its immediate support at $0.48, the lower mark of the recent consolidation.

A break below that level will invalidate the upside thesis and potentially open up the path to test $0.40, near the last breakout zone before the parabolic.

Frequently Asked Questions (FAQs)

A bullish flag is a continuation pattern that comes after a brief consolidation period such as one seen on XLM price recently. We use the flagpole to measure the upper price target. A breakout from this pattern suggests that the price will likely continue soaring.

Rising Total Value Locked (TVL) highlights growing adoption of XLM in the DeFi ecosystem. With increased utility comes increased demand.

Rising Open Interest means investors are not in a hurry to exercise/close their perpetual contracts. That shows they are confident of the asset’s growth prospects, which signals growing demand.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

What to Expect from ETH in December

NFT sales dip to $146.5m: Ethereum, Bitcoin network recover

How MicroStrategy Poses 4 Major Risks to Bitcoin?

Crypto Entrepreneur Justin Sun Ate a $6.2M Banana Artwork at an Event in Hong Kong

BNB, XRP, and Lunex Network look set for major gains

XRP Price Skyrockets 20%; Could ATH Be Around the Corner?

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support

Rollblock’s breakout year could rival SHIB’s dominance by 2025

Spot Ethereum ETF Flips Bitcoin ETFs in Daily Inflows, $5000 Target In Sight?

$89,670,000,000 in Increasingly Risky Loans Flagged at JPMorgan Chase, Wells Fargo and Bank of America: Report

DOGEN, SOL, and SUI surge as Bitcoin’s strength declines

Robert Kiyosaki Says FOMO Is Good As Bitcoin Price Nears $100K Mark

Cardano and XRP reach new heights, this meme coin prepares for 33x surge

Virtuals Protocol Tokens on Base Skyrocket as AI Agent Demand Grows

Hedera (HBAR) Price Jumps 25% As Analyst Predicts 192% Rally

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: