Bitcoin

Can Increased Odds of a Recession Cause Crypto to Rise? – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

By Marcus Sotiriou, Analyst at the publicly listed digital asset broker GlobalBlock (TSXV:BLOK).

After a painful week for the stock market in the U.S., the S&P 500 had its best day since July, growing by 2.59%. S&P 500 futures are also up over 1.8%. This has led Bitcoin to rise over 4% overnight. This rise in the stock market was a result of weak manufacturing data that came in yesterday. The U.S. September manufacturing ISM was weaker than the expected 52 and dropped by 1.9pts to 50.9. Furthermore, employment & new orders fell below 50. Prices paid dropped by 1.9pts to 50.9 in addition to supplier deliveries and order backlogs falling These indicators are pointing to less inflation pressure, hence resulting in positive sentiment in global markets yesterday, including Bitcoin.

This does raise the concern, however, that the Federal Reserve could overtighten. Famous investor, and one of Wall Street’s most respected minds, Stan Druckenmiller, said last week, “I will be stunned if we don’t have a recession in ‘23. I don’t know the timing but certainly by the end of ‘23. I will not be surprised if it’s not larger than the so-called average garden variety. I don’t rule out something really bad.” The United Nations calls on the Fed and other central banks to halt interest rate increases, due to fears of extreme tightening conditions causing a global recession.

Based on the last two major stock market drawdowns, shown above by ecoinometrics, we could expect further downside for the stock market if a recession does occur. The dotcom bubble and Great Recession took many months to reach their ultimate bottom and markets took years to recover. However, the fact that the U.S. stock market rallied yesterday after weaker manufacturing data showed that the market is currently fearing persistently high inflation over the danger of a recession. This means that a wider relief rally could be on the cards in the coming months if we continue to see similar data this month regarding slowing inflation.

Source link

You may like

Bitcoin Volatility Soars Amidst Geopolitical Tensions as Halving Approaches – Blockchain News, Opinion, TV and Jobs

Liquid Mercury Partners with GFO-X to Provide RFQ Platform for Trading Crypto Derivatives – Blockchain News, Opinion, TV and Jobs

OSEAN DAO Celebrates Company Registration Milestone and Announces an Upcoming 5 Million $OSEAN Airdrop – Blockchain News, Opinion, TV and Jobs

Ethereum Price Faces Rejection, Is This A Fresh Bearish Signal?

AI-Powered Layer 3 for Gaming powered by Arbitrum Orbit, built on Gelato RaaS – Blockchain News, Opinion, TV and Jobs

Aark Raises $6M Funding to Accelerate LRT Liquidity Integration for High Leverage Trading – Blockchain News, Opinion, TV and Jobs

Bitcoin

Altcoin Market Cap Set for 350% Explosion As Technical Setup Forms: Glassnode Founders

Published

7 hours agoon

April 25, 2024By

admin

The founders of the analytics platform Glassnode are predicting the altcoin market cap will surge by 350% after the recent correction.

Glassnode co-founders Jan Happel and Yann Allemann, who share the Negentropic handle on the social media platform X, say the alt market cap may be forming a similar 2021 structure when there was a sudden retracement followed by a massive bull run.

The analysts use the Elliott Wave theory in their analysis, which states that an asset tends to witness a five-wave rally.

“The crypto bull market continues. ‘Others’ follow crypto excluding the largest ten cryptos. Observe that we in early 2021 had a strong correction. We believe that was a wave four. We now have a similar strong decline. More upside is coming. This index and our Fibonacci levels give us [reason to believe] we may see ~350% upside from current levels.”

The founders recently said another bullish catalyst for the crypto market is the waning strength of the US dollar index (DYX).

According to the analysts, the DXY likely printed a top earlier this month in an expanding diagonal pattern, implying that a significant downward move is underway, which may be a catalyst for a renewed bull market for Bitcoin (BTC).

The founders also weigh in on what they believe are the price impacts from the spot BTC exchange-traded funds (ETFs). They say that ETF investors are reactionary to price declines, but not a cause of them.

“The significant volume handled by ETFs also highlights their potential as catalysts in the market, potentially driving both short-term price movements and long-term strategic shifts in investment and trading behaviors. So far, however, significant ETF outflows often align with notable price drops in the Bitcoin market, indicating that investors tend to react to existing downturns rather than causing them.

This suggests a predominantly reactive investor behavior in times of market volatility, which is crucial for understanding the causality of price movements.”

Bitcoin is trading for $66,434 at time of writing, down slightly in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

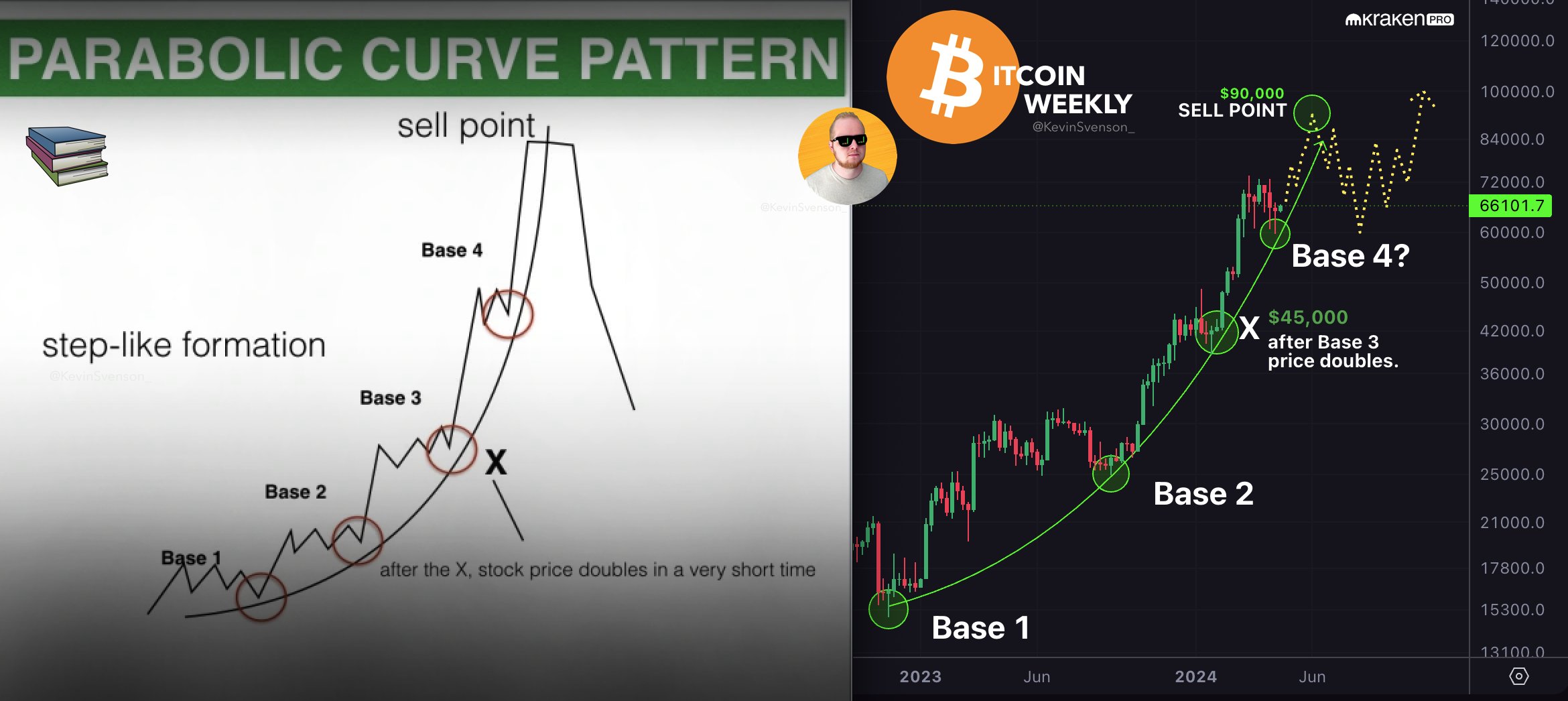

Bitcoin Looks Ready To Play Out Final Vertical Point of Parabolic Trend, Says Analyst – Here’s His Outlook

Published

23 hours agoon

April 24, 2024By

admin

A closely followed crypto strategist thinks that Bitcoin (BTC) is primed to launch the final steep rally of its parabolic trend.

In a new video update, analyst Kevin Svenson tells his 142,100 followers on the social media platform X that Bitcoin is about to ignite the last leg of its parabolic rally that could see prices close to $100,000.

“Bitcoin may be ready to play out the final vertical point on the parabolic trend, which is a big, big move. Bitcoin is currently sitting in base four. Once we break a new high that confirms base four, we could be headed up toward $90,000. This is a big move – $66,000 to $90,000 – that’s a big move, despite what it looks like on the weekly chart.

And there are indicators to suggest that we may be seeing this happen in the next month or two, and that is the weekly MACD (moving average convergence divergence). Holding the neutral zone is important in a momentum-based trend.”

The MACD is a technical indicator that gauges the momentum of a trend. According to Svenson, Bitcoin appears to be repeating the same pattern witnessed in 2017 when the crypto king sparked big rallies after holding the MACD neutral zone.

“Look at 2017. In 2017 when we went from just hundreds of dollars all the way up to $20,000, we held the MACD neutral zone on every pullback. And that marked the low with the next major parabolic advance – a huge move up for Bitcoin each time.

Right now, pretty clear, Bitcoin is playing out a similar pattern, a continuation pattern: hold the neutral zone [and then] parabolic advance… That’s going to give us our next vertical push toward the sell point, according to the textbook.

Is the sell point the end of the Bitcoin cycle? No. It is the end of the trend with a consolidation and a continuation up later.”

At time of writing, Bitcoin is worth $66,557.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Bitcoin Price Eyes Next Breakout As The Bulls Aim For $70K

Published

1 day agoon

April 24, 2024By

admin

Bitcoin price climbed above the $66,000 resistance zone and started consolidation. BTC is now eyeing the next move above the $67,200 resistance zone.

- Bitcoin is eyeing a decent increase above the $67,200 resistance zone.

- The price is trading above $65,500 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it clears the $67,200 resistance zone.

Bitcoin Price Eyes More Upsides

Bitcoin price started a fresh increase above the $65,500 and $66,000 resistance levels. BTC even climbed above the $67,000 level. It traded as high as $67,200 and is currently consolidating gains.

There was a minor decline below the $66,500 level, but the price remained stable above the 23.6% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low. Bitcoin price is still trading above $65,500 and the 100 hourly Simple moving average.

There is also a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair. The trend line is near the 50% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low.

Immediate resistance is near the $67,000 level. The first major resistance could be $67,200. A clear move above the $67,200 resistance might send the price higher. The next resistance now sits at $68,500. If there is a clear move above the $68,500 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $70,000.

Source: BTCUSD on TradingView.com

The next major resistance is near the $70,500 zone. Any more gains might send Bitcoin toward the $72,000 resistance zone in the near term.

Are Dips Limited In BTC?

If Bitcoin fails to rise above the $67,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $66,200 level.

The first major support is $66,000 or the trend line. If there is a close below $66,000, the price could start to drop toward $65,400. Any more losses might send the price toward the $64,200 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $66,200, followed by $66,000.

Major Resistance Levels – $67,000, $67,200, and $68,500.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin Volatility Soars Amidst Geopolitical Tensions as Halving Approaches – Blockchain News, Opinion, TV and Jobs

Liquid Mercury Partners with GFO-X to Provide RFQ Platform for Trading Crypto Derivatives – Blockchain News, Opinion, TV and Jobs

OSEAN DAO Celebrates Company Registration Milestone and Announces an Upcoming 5 Million $OSEAN Airdrop – Blockchain News, Opinion, TV and Jobs

Ethereum Price Faces Rejection, Is This A Fresh Bearish Signal?

AI-Powered Layer 3 for Gaming powered by Arbitrum Orbit, built on Gelato RaaS – Blockchain News, Opinion, TV and Jobs

Aark Raises $6M Funding to Accelerate LRT Liquidity Integration for High Leverage Trading – Blockchain News, Opinion, TV and Jobs

MetaWin Announces Innovative TOKENIZED Tesla Cybertruck Contest on Ethereum’s Base Layer 2 Blockchain – Blockchain News, Opinion, TV and Jobs

New Meme Coin ICO Dogeverse Raises $6 Million After Completing Coinsult Audit – Blockchain News, Opinion, TV and Jobs

Altcoin Market Cap Set for 350% Explosion As Technical Setup Forms: Glassnode Founders

SeedHunter Marketing Module is live

Powered by Qualcomm, Aethir Unveils Game-Changing Aethir Edge Device to Unlock the Decentralized Edge Computing Future

Over 1,000 Builders, Partners, Investors and Enthusiasts Gather at Inaugural Global Event to Celebrate Sui – Blockchain News, Opinion, TV and Jobs

ceτi AI Acquires Big Energy Investments Inc. to Boost Its High-Performance Computing Capabilities in North America

Analyst Singles Out VeChain And XRP For Parabolic Surge, Here Are The Targets

Bitcoin Halving Successfully Completed, Fueling Expectations of Price Surge – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs