Blockchain

MyTopSportsbooks Journalist Investigates Profitability of Move-to-Earn Sneakers – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

A journalist has spent a month tracking his movements via a popular move-to-earn app to answer the question “Can you make money walking with NFTs?”. Ashton Miller, a journalist with MyTopSportsbooks, a website providing reviews of the best the best sports betting sites on the web, spent a month walking in non-fungible sneakers. The virtual shoes, represented in move-to-earn (M2E) app STEPN, award their “wearer” with cryptocurrency for every step they take.

Miller’s investigative journalism entailed using the STEPN app every day for a month and recording his progress and profitability. Along the way, he uncovered the M2E application’s mechanisms and tricks to keep players hooked.

In order to start earning cryptocurrency with STEPN, users must make an initial investment which they then aim to make back through walking or running. The STEPN app enables users to earn its native tokens, GST and GMT, by exercising after purchasing an NFT digital sneaker. Recovering this investment is made difficult by the game’s mechanics, which include fluctuations in the price of the token used to purchase the sneaker.

Another mechanism that can make it difficult to earn a return on investment, Miller discovered, is the way the game encourages players to spend the cryptocurrencies they earn. Users must repair their sneakers every time they “wear” them. They can also level their sneakers up in the hope of earning more cryptocurrencies in the future.

One key finding from the MyTopSportsbooks journalist’s investigation is that STEPN makes and adjusts the rules seemingly on a whim, with no accountability. App updates are frequent and often make recovering the initial investment even more difficult. Bugs frequently cost users cryptos, Miller found, with no means of holding STEPN responsible.

Source link

You may like

Bitcoin Price Restarts Decline, Can BTC Bulls Protect $60K?

Germany’s Largest Federal Bank To Offer Crypto Custody to Institutional Clients: Report

Increased Bitcoin ETF Adoption Propels BTC Dominance To Highest Level Since 2021

‘Lifetime Opportunity’ for Solana? Crypto Analyst Predicts Steep SOL Rally Following Marketwide Dip – Here’s His Target

Spot Bitcoin And Ethereum ETFs Approved In Hong Kong

Analyst Says One Memecoin Setting the Stage for Stronger Rally, Names Altcoin Presenting Opportunity After Dip

Altcoins

Over 540,000 New Crypto Assets Have Been Launched in First Four Months of 2024, According to CoinGecko

Published

2 days agoon

April 14, 2024By

admin

More than half a million altcoins have already been created between January and early April this year, according to crypto data aggregator CoinGecko.

Using data from its decentralized exchange (DEX) tracker GeckoTerminal, CoinGecko examined the number of cryptocurrencies from December 31st, 2021 to April 11th, 2024.

The result shows that 2.52 million cryptocurrencies have been launched to date, including transient memecoins and dead projects. The current number of crypto assets is also 5.7 times more than the 440,000 that existed at the end of 2021.

The period between January 1 and April 11th this year saw the rollout of 540,000 new tokens, equivalent to an average of 5,300 new tokens being launched every day in 2024. In comparison, 2022 recorded 720,000 new tokens and 2023, 830,000.

“Given that this is already more than half of the 0.83 million new tokens launched last year, 2024 is on track to surpass 2023 in the number of new tokens on-chain.”

CoinGecko says the memecoin season, which returned in late February this year, led to a record high of 195,735 new tokens launched in March 2024.

“This highlights the frenzy of memecoin activity as opportunistic participants launch derivatives of memecoins or themes that are already popular.

January and February 2024 also saw a large number of new tokens launched in each month, at 134,647 and 195,735 respectively. This perhaps suggests that on-chain speculative activity is on the rise regardless of broader rotations into memecoins.”

CoinGecko says future memecoin seasons may see a greater spike in new crypto assets because of the new tools that make token creation easier and the decreasing cost of on-chain trading.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/eliahinsomnia/WindAwake

Source link

Bitcoin

The Market Disruptor With 75% Uptrend, Outshining Top 100 Cryptos

Published

3 days agoon

April 13, 2024By

admin

Amid a widespread price correction affecting the majority of the top 100 cryptocurrencies, one digital asset has defied the trend, surging to impressive heights. Nervos Network, along with its native token CKB, has not only recorded significant gains but has also climbed to the 79th rank in the market, raising questions about the factors behind its surge.

Nervos Network Decoded

Nervos Network is a proof-of-work (PoW) Layer 1 (L1) blockchain designed to optimize application-specific Layer 2 chains. The network aims to establish its native asset, CKB, as a more sustainable store of value (SoV) compared to Bitcoin (BTC) while providing a more secure smart contract platform than Ethereum (ETH).

Bitcoin’s capped supply and decreasing block rewards raise concerns about long-term economic incentives for miners.

Notably, the Nervos Network tackles this issue by introducing a fixed annual secondary issuance of CKBs and the base supply, providing long-term incentives for miners.

Nervos Network also addresses the potential security risk associated with Ethereum. In Ethereum, the value of its native asset, ETH, is not directly linked to the value of Layer 2 apps built on top of it.

Nervos Network aims to mitigate this risk by ensuring that CKB is used for transaction fees and storage, creating a stronger economic relationship between the native asset and the overall network.

How Secondary Issuance And State Rent Drive Sustainability

Nervos utilizes a perpetual secondary issuance model to increase CKB’s SoV properties. This model incentivizes users to continuously lock up CKB in proportion to the size of their applications.

Furthermore, locked CKBs are subject to “state rent” through inflation, which automates state rent payments and ensures a sustainable economic model.

Nervos Network introduces a secondary market for chain space, enabling apps to unlock and sell CKBs without requiring relevant storage.

Investors can offset inflation by purchasing CKBs and depositing them into NervosDAO, a mechanism that receives a portion of the secondary issuance to counterbalance inflation. Interestingly, this resembles “treasury bonds” and offers potential investment opportunities.

Approaching ATH Amidst Bitcoin Integration Announcement

Having delved into the fundamentals, CKB has recently experienced a significant surge in value, breaking out of a long consolidation phase that lasted almost two years.

After trading in a range of $0.0024 to $0.0035, the cryptocurrency has broken through this price level since January 30th and has seen significant gains over the past few months.

Currently trading at $0.032, CKB is close to its all-time high (ATH) of $0.043, which was reached in March 2021. The token has seen notable price increases of 47%, 69%, 75%, and 14% over the past fourteen days, seven days, and 24 hours, respectively.

According to CoinGecko data, CKB has also seen a significant increase in trading volume, reaching $207 million in the last 24 hours, 9.7% from the previous day’s trading.

In addition, CKB’s market capitalization has increased significantly, nearly doubling from $740 million on April 2 to approximately $1.35 billion in just over a week.

The price spike can be attributed to the announcement that Nervos Network’s CKB token will join the Bitcoin network. The token’s introduction of smart contract functionality, along with its interoperability and modularity features scheduled for 2024, has created excitement among investors.

As Bitcoin approaches the Halving that has historically increased its value, Nervos Network is well-positioned to benefit from its strong ties to the largest cryptocurrency in the market.

With its continued bullish momentum and the predicted increase in BTC’s price, CKB may be poised to reach new all-time highs soon.

Featured image from iStock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoin

Polkadot Shines – Is Now The Time To Buy DOT Before $10?

Published

6 days agoon

April 10, 2024By

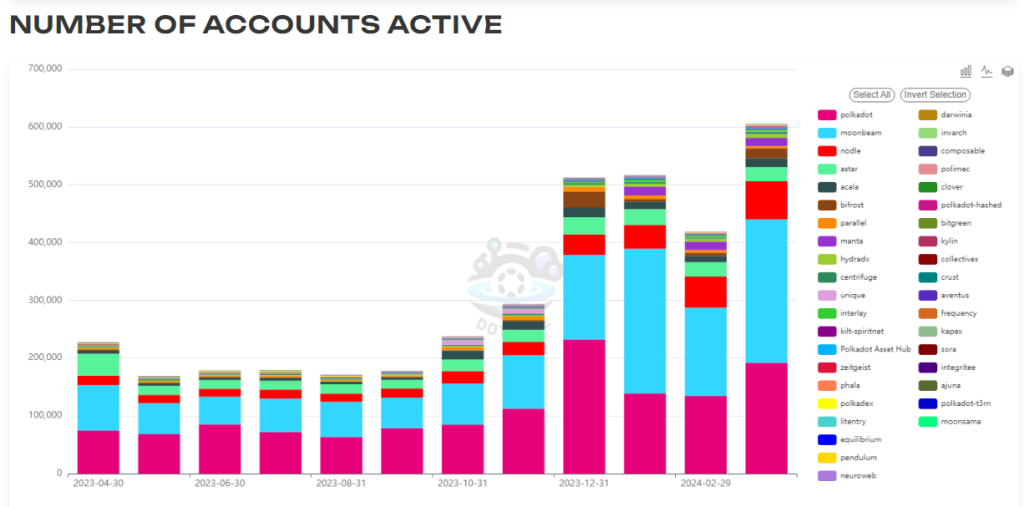

adminPolkadot, a blockchain platform designed for interoperability between different blockchains, is experiencing a surge in new users, but a disconnect between user growth and network activity is raising questions about its long-term viability.

Based on the latest figures, DOT tallied an all-time high in active wallets and unique accounts in March, surpassing 600,000 and 5.59 million, respectively. This suggests a growing interest in the platform, potentially driven by the thriving developer ecosystem on Polkadot’s parachains, specialized blockchains that connect to the main Polkadot chain. Moonbeam, a prominent parachain, played a particularly significant role, contributing the highest number of active addresses with nearly 250,000.

Source: Data

Polkadot Transactions Dip Despite Active User Growth

However, despite the influx of new users, the number of transactions on the Polkadot network hasn’t kept pace. While there was a modest increase in transactions compared to February, the current volume remains significantly lower than the peak recorded in December.

This inconsistency raises concerns about how actively users are engaging with the network. The possibility exists that users are holding or staking their DOT tokens instead of utilizing them for transactions on the platform.

Total crypto market cap is currently at $2.5 trillion. Chart: TradingView

Polkadot Price Seeks Stability After Recent Decline

The price of Polkadot’s native token, DOT, seems to be finding support around $9. This could indicate a period of consolidation after a decline from its previous highs above $11. While a price increase is typically seen as a positive sign, it’s important to consider it alongside actual network usage.

Source: Data

Is Polkadot Building Without Using?

The current situation with Polkadot presents a paradox. The platform is attracting new users, but they aren’t necessarily translating into active network participants. This could be due to several factors. Perhaps users are waiting for a specific application or service to be built on Polkadot before actively engaging. It’s also possible that technical limitations are hindering user activity.

Further analysis is needed to understand the reasons behind the lagging transactions. Examining the types of transactions occurring on the network could provide valuable insights. For instance, an increase in governance-related transactions might suggest a more engaged user base, even if overall transaction volume remains low.

Polkadot’s Future Hinges On Active Network Use

While the growth in active wallets and accounts is a positive sign for Polkadot, it’s crucial to convert this interest into actual network usage. The success of Moonbeam demonstrates the potential for a vibrant developer ecosystem on Polkadot. However, broader adoption across various use cases is necessary for the platform to reach its full potential.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin Price Restarts Decline, Can BTC Bulls Protect $60K?

Germany’s Largest Federal Bank To Offer Crypto Custody to Institutional Clients: Report

Increased Bitcoin ETF Adoption Propels BTC Dominance To Highest Level Since 2021

‘Lifetime Opportunity’ for Solana? Crypto Analyst Predicts Steep SOL Rally Following Marketwide Dip – Here’s His Target

Spot Bitcoin And Ethereum ETFs Approved In Hong Kong

Analyst Says One Memecoin Setting the Stage for Stronger Rally, Names Altcoin Presenting Opportunity After Dip

Dogwifhat To The Vet! Meme Coin Needs Medical Attention After Price Plunge — Analyst

JPMorgan Chase To Pay $250,000 for Defaming Former Employee As Regulator Orders Bank To Eliminate Series of Allegations

Bitcoin Bonanza Before The Halving? Analyst Sees Pre-Crash Buying Window

Over 540,000 New Crypto Assets Have Been Launched in First Four Months of 2024, According to CoinGecko

DOGE Price Set For Rebound? Whale Moves $26 Million In Dogecoin Off Robinhood

Binance Launchpool Rolls Out Staking and Trading Support for New Layer-1 Blockchain Project

Avalanche (AVAX) Downtrend Persists Amid Market Uncertainty

Dow Futures Drop, Bitcoin Price Plummets As Iran Launches Drones Toward Israel

US Hacker Handed Three-Year Prison Sentence for Looting $12,000,000+ in Crypto From Two Decentralized Exchanges

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Could Today’s CPI Data be Bullish? – Blockchain News, Opinion, TV and Jobs

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday