Bitcoin

Which Should You Choose? – Blockchain News, Opinion, TV and Jobs

Published

1 year agoon

By

admin

Cryptocurrency loans are on the rise. In fact, Raconteur found they’re fast becoming a genuine alternative to borrowing money from banks. This development isn’t surprising: many worldwide already buy, trade, and sell crypto. After all, crypto is still a currency despite being digital. If you’re new to crypto loans and deciding between this and personal loans, keep reading to find out which is the best option for you.

Crypto loans

Cryptocurrencies are assets similar to cars, houses, or stocks. As such, they can serve as collateral for loans. A crypto loan works by using your crypto holdings as collateral in return for liquidity from a lender. One popular crypto lending platform is Celsius Network—which hit $4 billion in loan origination in 2019. You can use your crypto loan at your discretion. This loan type allows you to manage your crypto assets. It also allows the lender to take action—like acquiring your assets—if you miss payments.

There are two types of crypto loans: centralized finance (CeFi) and decentralized finance (DeFi). In CeFi, the lender controls your crypto for the repayment period. Meanwhile, DeFi uses smart contracts to guarantee your obedience to the requirements.

Qualifications

You must own any crypto accepted by the lender of your choice. The most common are Bitcoin and Ethereum. You will also be asked for identification and proof of crypto assets.

Risks

Because crypto is digital, your assets are at risk of cybercrime and security breaches. The World Economic Forum explains crypto regulation in multiple countries thus focuses on improving investor and consumer protection. Such regulations allow for better transparency and authorization of transactions, including loans. However, these efforts to protect crypto consumers are still in their early stages, so it’s vital that you research crypto lending platforms before availing of their services.

Personal Loans

Personal loans can be acquired through a bank, credit union, or financial lender. The most common type of personal loan is unsecured, often used to finance big purchases like vacations. You’re not required to put up collateral, so the lender won’t get your assets if you fail to pay. Still, you may face consequences like additional fees and even lawsuits. On the other hand, secured loans require collateral like a car or house. Non-payment will lead to a loss of collateral and a lower credit score, affecting your chances of securing future loans. Secured loans are often utilized for mortgages or auto loans.

Qualifications

Anyone on the credit spectrum can get a personal loan. If you want higher chances of approval and a lower interest rate, Sound Dollar notes that applying for a personal loan requires a good credit profile. This involves having a credit score of 670 or higher, which displays your responsibility to pay on time. To improve your score, frequently pay bills on time and avoid maxing your credit limit. You will also need proof of income or employment to ensure repayment.

Risks

Because you can get personal loans from financial lenders, they may not follow the same privacy rules as banks and credit unions. Thus, your personal and financial data might be used or stolen without notice.

Which should you choose?

Choose a crypto loan if you have a low credit score and crypto assets you’re willing to risk. Crypto lenders are not banks, so they will also have lower interest rates. If you have a high credit score and collateral you can’t risk, go for a personal loan. The only thing you’re up against is time. Both loans have risks and responsibilities, so be cautious of what you’re putting at stake and always pay your dues on schedule.

If you liked this article, keep browsing Blockchain News for more.

Source link

You may like

Analyst Says XRP Price Will Reach $100, But This Needs To Happen First

Zircuit Staking Soars Past $2B TVL In Only 2 Months – Blockchain News, Opinion, TV and Jobs

The Most ‘Vertical’ Leg for Altcoins Since 2021 Is Now on Deck, Says Crypto Analyst – Here’s His Outlook

How To Become A Crypto Millionaire With Dogecoin (DOGE), ETFSwap (ETFS), And Ondo Finance (ONDO) – Blockchain News, Opinion, TV and Jobs

Akash (AKT) Leads Crypto Top 100 With 46% Rise: Here’s Why

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

altcoin markets

The Most ‘Vertical’ Leg for Altcoins Since 2021 Is Now on Deck, Says Crypto Analyst – Here’s His Outlook

Published

7 hours agoon

April 23, 2024By

admin

A popular crypto analyst says technical indicators are suggesting that the altcoin market is gearing up for a massive breakout.

Pseudonymous analyst TechDev tells his 446,400 followers on the social media platform X that the altcoin market cap structure may be repeating a historic bullish pattern.

“Altcoin accumulation. The most vertical leg since 2021 appears on deck.”

Looking at his charts, the analyst suggests that the crypto market cap, excluding the top 10 digital assets, is repeating a pattern seen during the 2016 and 2021 market cycles when it broke out, retraced and then surged to a new top.

The analyst also suggests that the altcoin market cap’s logarithmic moving average divergence (LMACD) indicator is flashing a breakout trend. The LMACD indicator is designed to reveal changes in an asset’s trend, strength and momentum.

Says TechDev,

“Altcoins are ready. The market is not.”

Next up, the analyst also says that Bitcoin (BTC) appears on the two-month chart to be halfway through its current cycle based on historic precedence and the Bollinger bands, a price volatility gauge. The upper and lower bands widen when volatility declines while the bands contract when volatility is about to explode.

Says TechDev,

“BTC: looks about halfway there.”

Bitcoin is trading for $67,059 at time of writing, up nearly 3.6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

Published

15 hours agoon

April 23, 2024By

admin

A popular trader known for several accurate crypto market calls is outlining his Bitcoin forecast after the BTC halving last week.

The pseudonymous analyst known as Dave the Wave shares a chart with his 147,000 followers on the social media platform X that indicates Bitcoin could reach $169,500 in the last quarter of 2024.

According to Dave the Wave, Bitcoin has consistently printed diminishing returns after every bull market since 2012. For the current cycle, the trader expects BTC to generate gains of over 626% from the bottom – a significant reduction from the 1,275% gains witnessed during the 2020 cycle.

“The near only constant is reduced return.”

At time of writing, Bitcoin is trading for $66,938, up over 3.5% in the past day.

Dave the Wave analyzes Bitcoin’s possible path forward using the logarithmic growth curve (LGC), an investing model that aims to forecast BTC’s market cycle highs and lows while filtering out short-term volatility.

The analyst explains that Bitcoin hitting a fresh all-time high before the halving is not so out of the ordinary. According to Dave the Wave, the halving marks the midpoint of a bull market and he expects BTC to ignite a steep rally from this point toward the top of his LGC model.

“A lot is being made of the current Bitcoin halving being at the highest price as compared to previously.

But this is not so significant when you see that previous halvings were all pushing previous all-time highs…. with halving prices within the last month’s spike of the previous ‘cycle’ highs…

The takeaway from this thread of charts is that halvings have all been, more or less, recoveries of price… and marking something of a midway point toward the peaks.

Also, that the initial peak last time should be considered the macro top [momentum-wise] even though a nominal higher price was seen on the second peak.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Published

19 hours agoon

April 23, 2024By

admin

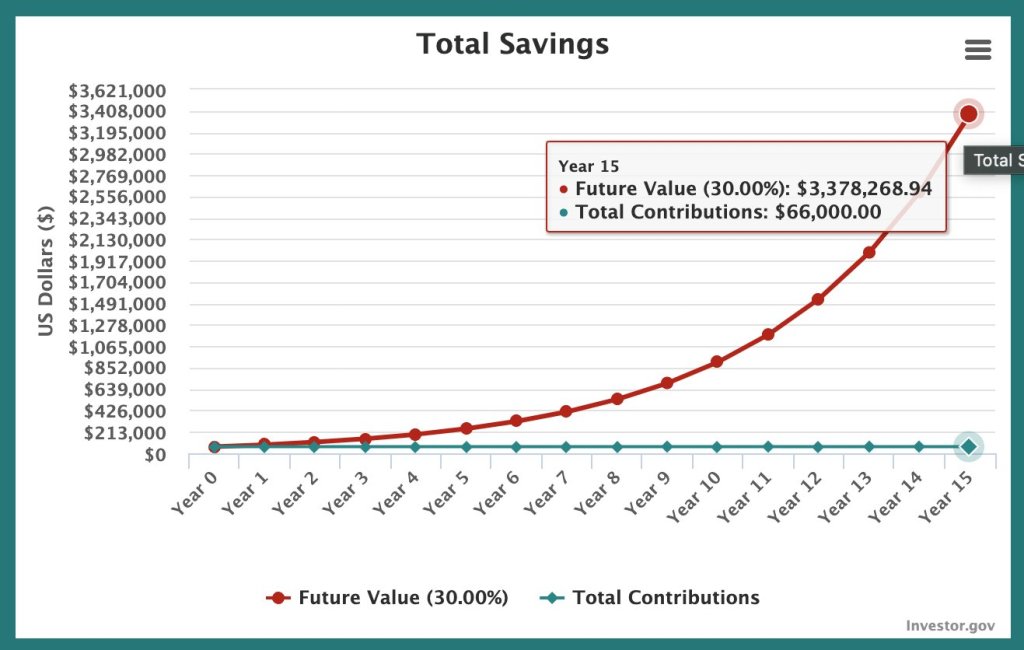

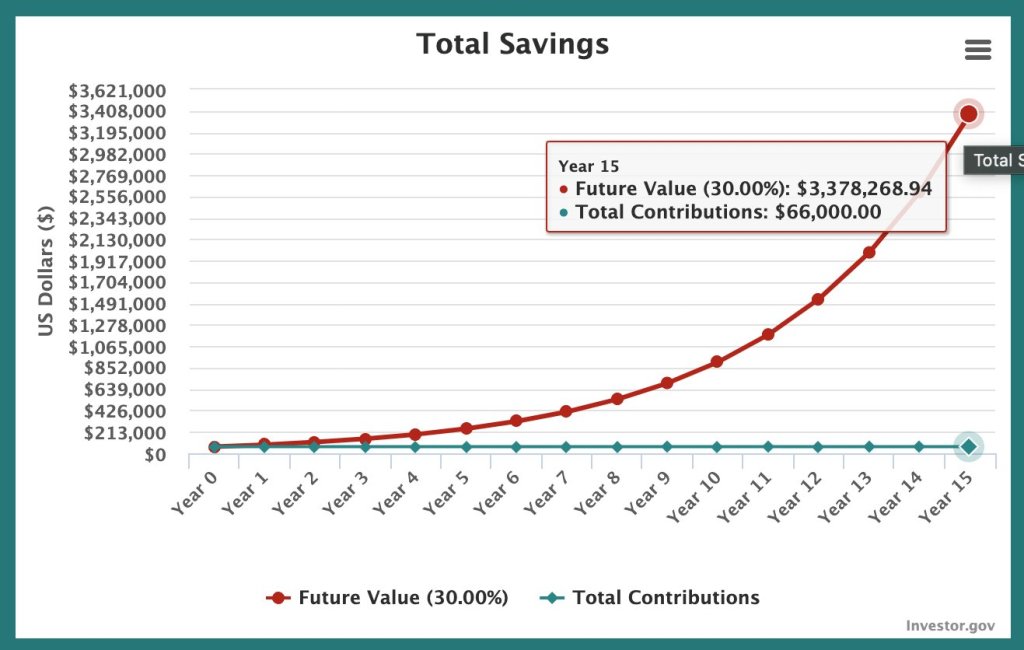

A recent analysis paints a rosy picture of Bitcoin’s future, even with a conservative growth projection. Taking to X, Michael Sullivan predicts that the world’s most valuable coin could reach a staggering $245,000 within just five years if it maintains a mere 30% compound annual growth rate (CAGR).

Bitcoin Projections: From Conservative To Exponential Growth

The analysis explores various growth possibilities for Bitcoin. Assuming the coin’s growth rate significantly contracts in the coming years, growing at just 30% CAGR, Sullivan projects the coin to reach $245,000 by 2029.

A decade later, it will be at $909,000; by 2039, each coin in circulation will be trading at a whopping $3.37 million. If, however, the CAGR rises to 40%, Bitcoin would be worth $10.3 million in 15 years and $1.9 million in 10 years.

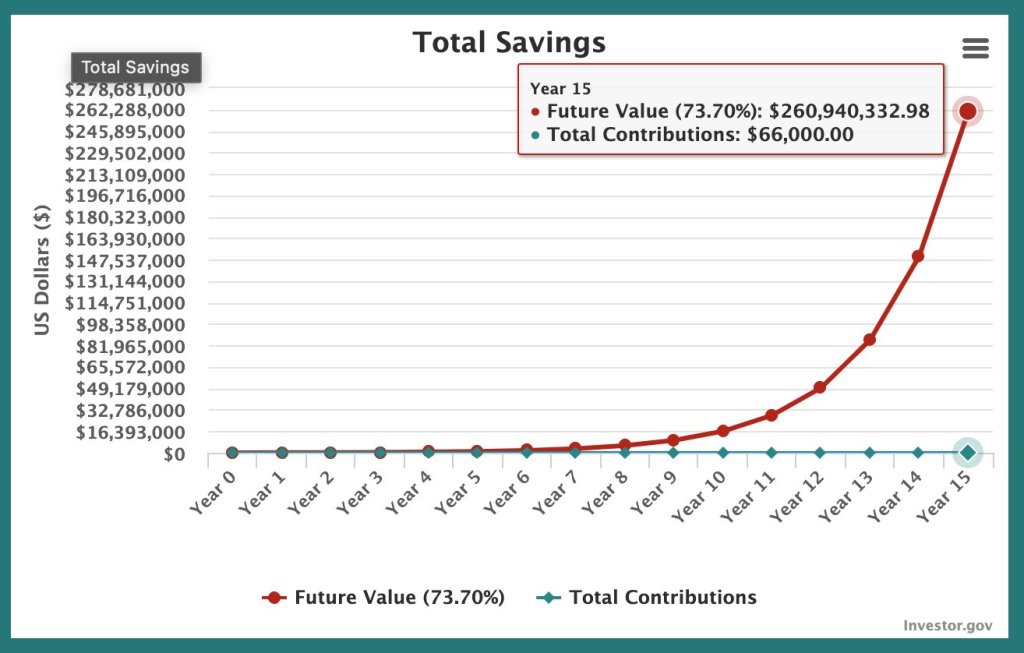

Still, even at these mega valuations, Bitcoin has been soaring at unprecedented rates, outperforming all traditional finance assets since launching. To demonstrate, Bitcoin registered a CAGR of 73.7% over the past four years.

Therefore, if this trend continues, Sullivan says BTC will smash above the $1 million level a year after halving in 2028. However, half a decade later, each coin will change hands at over $16.5 million.

A look back at Bitcoin’s history makes it clear that the coin has been on a tear. Following this historical trend and making projections for the future, BTC could be far more valuable in the next five or ten years.

There Are No Guarantees, Crypto Is Dynamic

While these projections are undoubtedly exciting for Bitcoin holders, it’s crucial to remember that they are just projections. The crypto market, just like any other tradable asset, doesn’t move in straight lines.

As an illustration, after peaking at nearly $70,000 in 2021, prices crashed to as low as $15,600 the following year. In 2017, BTC rose to around $20,000 before tanking to below $4,000 a year later in 2018. This volatility and the dynamic market, influenced by new circumstances, don’t guarantee these lofty projections.

Nonetheless, analysts remain optimistic of what lies ahead, especially after the historic Halving event on April 20. As traditional finance players join in, finding exposure in BTC through spot exchange-traded funds (ETFs), prices might rise, even breaking above the all-time highs of around $74,000.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst Says XRP Price Will Reach $100, But This Needs To Happen First

Zircuit Staking Soars Past $2B TVL In Only 2 Months – Blockchain News, Opinion, TV and Jobs

The Most ‘Vertical’ Leg for Altcoins Since 2021 Is Now on Deck, Says Crypto Analyst – Here’s His Outlook

How To Become A Crypto Millionaire With Dogecoin (DOGE), ETFSwap (ETFS), And Ondo Finance (ONDO) – Blockchain News, Opinion, TV and Jobs

Akash (AKT) Leads Crypto Top 100 With 46% Rise: Here’s Why

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Analyst Says Dogecoin and Two Altcoins Flying Under the Radar Flashing Bullish Signal – Here’s His Outlook

Shiba Inu Whales Move Over 3.19 Trillion SHIB, Where Are They Headed?

Giant Whale With $405,190,000 in Ethereum Starts Withdrawing ETH From Binance: On-Chain Data

BC.GAME Secures New Curacao LOK License, Enhancing Legal Compliance and Global Reach – Blockchain News, Opinion, TV and Jobs

Sui Overflow Hackathon Funding Pool Balloons to $1,000,000 as New Sponsors Join – Blockchain News, Opinion, TV and Jobs

XRP Price Scenarios Ahead Of Ripple-SEC Case Update: Analyst

Bitcoin Will Shatter $16 Trillion Market Cap of Gold, Says SkyBridge Capital’s Anthony Scaramucci – Here’s How

Bitcoin Price Approaches Breakout, Can BTC Pump Above $66K?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday