Bitcoin

Will a Bitcoin ETF be Launched This Month? – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

By Marcus Sotiriou, Analyst at the publicly listed digital asset broker GlobalBlock .

Bitcoin has broken the $24,000 level again this morning and is now up 37% in 8 weeks. It seems clear that the first 4 rate hikes and a technical recession were priced into risk-on assets, as there was huge and persistent sell pressure in anticipation of the events/news.

Giants like BlackRock and Wells Fargo demonstrated their bullish stance on Bitcoin last week, with Wells Fargo saying cryptocurrencies have evolved into a valid portfolio option.

ARK Invest, a U.S. investment management firm with $50 billion of assets under management, has remained incredibly bullish on Bitcoin throughout this downtrend. ARK CEO, Cathie Wood, said last month she believes that Bitcoin mining will “turbocharge” solar and wind energy. ARK’s recent report showed that the U.S. was Bitcoin’s biggest buyer in July, and that a recovery path has been paved for Bitcoin as leverage is unwinding.

This month is particularly interesting for ARK, as the SEC has pushed its decision on ARK’s Bitcoin ETF application from July to August. If this ETF application is accepted by the SEC (which seems unlikely given the number of rejections so far) this would be a remarkable tailwind for Bitcoin.

There are some signs that can tell us whether it is likely that the SEC will approve an application soon. Firms usually update their proposals when they everything is set to launch. We can see that there is an Ark Invest filing for a Bitcoin futures ETF with an assigned ticker, and Valkyrie have updated its own ETF prospectus with a ticker. This gives us an indication that another Bitcoin Futures ETF may be approved soon.

Source link

You may like

How To Become A Crypto Millionaire With Dogecoin (DOGE), ETFSwap (ETFS), And Ondo Finance (ONDO) – Blockchain News, Opinion, TV and Jobs

Akash (AKT) Leads Crypto Top 100 With 46% Rise: Here’s Why

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Analyst Says Dogecoin and Two Altcoins Flying Under the Radar Flashing Bullish Signal – Here’s His Outlook

Shiba Inu Whales Move Over 3.19 Trillion SHIB, Where Are They Headed?

Bitcoin

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

Published

6 hours agoon

April 23, 2024By

admin

A popular trader known for several accurate crypto market calls is outlining his Bitcoin forecast after the BTC halving last week.

The pseudonymous analyst known as Dave the Wave shares a chart with his 147,000 followers on the social media platform X that indicates Bitcoin could reach $169,500 in the last quarter of 2024.

According to Dave the Wave, Bitcoin has consistently printed diminishing returns after every bull market since 2012. For the current cycle, the trader expects BTC to generate gains of over 626% from the bottom – a significant reduction from the 1,275% gains witnessed during the 2020 cycle.

“The near only constant is reduced return.”

At time of writing, Bitcoin is trading for $66,938, up over 3.5% in the past day.

Dave the Wave analyzes Bitcoin’s possible path forward using the logarithmic growth curve (LGC), an investing model that aims to forecast BTC’s market cycle highs and lows while filtering out short-term volatility.

The analyst explains that Bitcoin hitting a fresh all-time high before the halving is not so out of the ordinary. According to Dave the Wave, the halving marks the midpoint of a bull market and he expects BTC to ignite a steep rally from this point toward the top of his LGC model.

“A lot is being made of the current Bitcoin halving being at the highest price as compared to previously.

But this is not so significant when you see that previous halvings were all pushing previous all-time highs…. with halving prices within the last month’s spike of the previous ‘cycle’ highs…

The takeaway from this thread of charts is that halvings have all been, more or less, recoveries of price… and marking something of a midway point toward the peaks.

Also, that the initial peak last time should be considered the macro top [momentum-wise] even though a nominal higher price was seen on the second peak.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Published

10 hours agoon

April 23, 2024By

admin

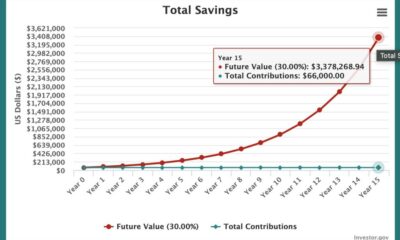

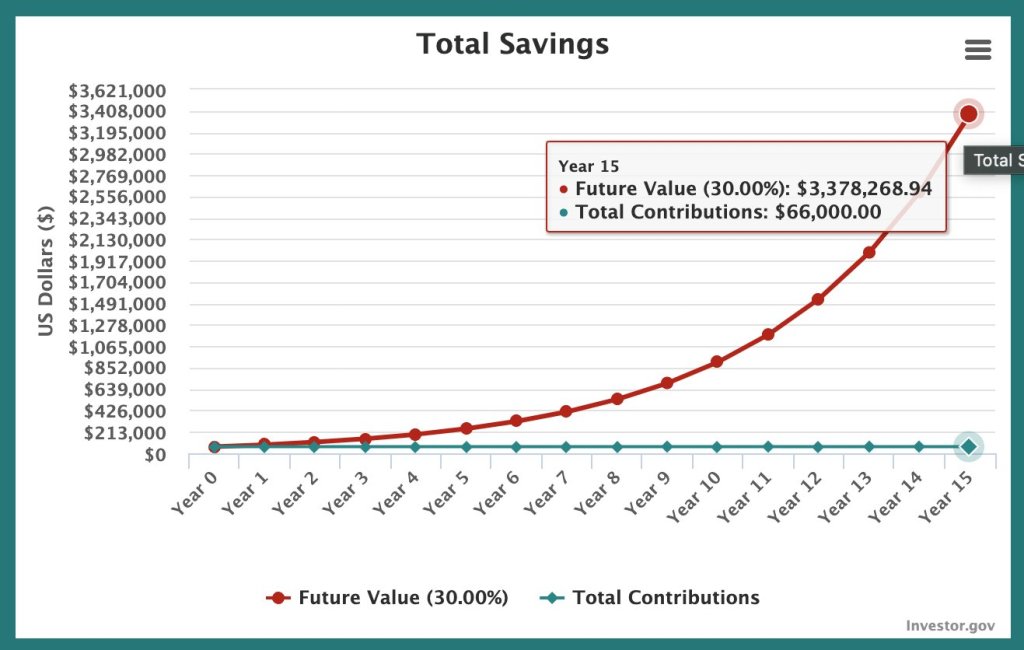

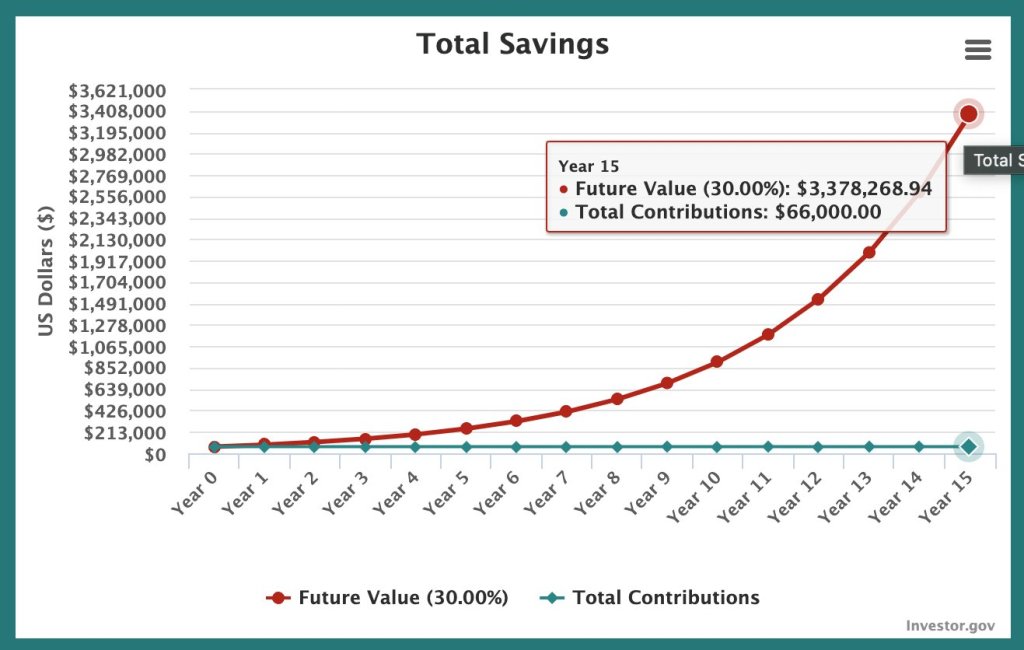

A recent analysis paints a rosy picture of Bitcoin’s future, even with a conservative growth projection. Taking to X, Michael Sullivan predicts that the world’s most valuable coin could reach a staggering $245,000 within just five years if it maintains a mere 30% compound annual growth rate (CAGR).

Bitcoin Projections: From Conservative To Exponential Growth

The analysis explores various growth possibilities for Bitcoin. Assuming the coin’s growth rate significantly contracts in the coming years, growing at just 30% CAGR, Sullivan projects the coin to reach $245,000 by 2029.

A decade later, it will be at $909,000; by 2039, each coin in circulation will be trading at a whopping $3.37 million. If, however, the CAGR rises to 40%, Bitcoin would be worth $10.3 million in 15 years and $1.9 million in 10 years.

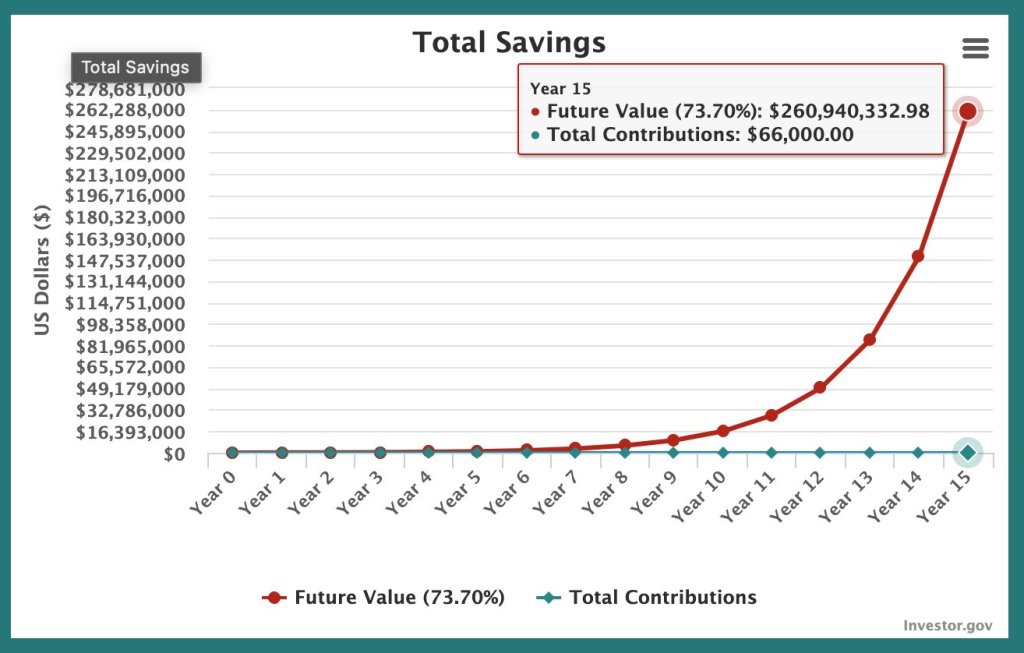

Still, even at these mega valuations, Bitcoin has been soaring at unprecedented rates, outperforming all traditional finance assets since launching. To demonstrate, Bitcoin registered a CAGR of 73.7% over the past four years.

Therefore, if this trend continues, Sullivan says BTC will smash above the $1 million level a year after halving in 2028. However, half a decade later, each coin will change hands at over $16.5 million.

A look back at Bitcoin’s history makes it clear that the coin has been on a tear. Following this historical trend and making projections for the future, BTC could be far more valuable in the next five or ten years.

There Are No Guarantees, Crypto Is Dynamic

While these projections are undoubtedly exciting for Bitcoin holders, it’s crucial to remember that they are just projections. The crypto market, just like any other tradable asset, doesn’t move in straight lines.

As an illustration, after peaking at nearly $70,000 in 2021, prices crashed to as low as $15,600 the following year. In 2017, BTC rose to around $20,000 before tanking to below $4,000 a year later in 2018. This volatility and the dynamic market, influenced by new circumstances, don’t guarantee these lofty projections.

Nonetheless, analysts remain optimistic of what lies ahead, especially after the historic Halving event on April 20. As traditional finance players join in, finding exposure in BTC through spot exchange-traded funds (ETFs), prices might rise, even breaking above the all-time highs of around $74,000.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Will Shatter $16 Trillion Market Cap of Gold, Says SkyBridge Capital’s Anthony Scaramucci – Here’s How

Published

1 day agoon

April 22, 2024By

admin

Seasoned hedge fund manager Anthony Scaramucci thinks that Bitcoin’s (BTC) market cap will ultimately eclipse the $16 trillion valuation of gold.

In a new CNBC interview, the SkyBridge Capital founder says Bitcoin is a superior asset that’s never been witnessed in the last 5,000 years of human history.

According to Scaramucci, Bitcoin still has ways to go before catching up to gold’s $16 trillion market capitalization but thinks the distance would decrease over time as regulators give their stamps of approval to BTC.

“I think what got me past being a skeptic is the notion that this is immutable, it’s decentralized in a way that makes it very powerful. The network itself is scaling.

And if you think about the way we treat money in our society over the last 5,000 years, Bitcoin checks all of the boxes. The only box it doesn’t check is central bank manipulation, which I think makes it way more powerful.

And so at a $1.4 trillion [market cap] could this trade to half the market capitalization of gold where gold is $16 trillion today? We believe it can. We actually think it’s going to go through the market capitalization of gold.

But if you’re making the point that the American owners in the ETF (exchange-traded fund) are not going to be enough to get it there, I disagree because over time the acceptance regulatorily is going to allow people to put it in their portfolio. A 1% position in these global portfolios takes it there.”

At time of writing, Bitcoin is trading at $66,587.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

How To Become A Crypto Millionaire With Dogecoin (DOGE), ETFSwap (ETFS), And Ondo Finance (ONDO) – Blockchain News, Opinion, TV and Jobs

Akash (AKT) Leads Crypto Top 100 With 46% Rise: Here’s Why

Trader That Called 2022 Bear Market Bottom Updates Bitcoin Forecast – Here’s His BTC Cycle Top Price Prediction

Conservative Projection Places Bitcoin At $245,000 In 5 Years

Analyst Says Dogecoin and Two Altcoins Flying Under the Radar Flashing Bullish Signal – Here’s His Outlook

Shiba Inu Whales Move Over 3.19 Trillion SHIB, Where Are They Headed?

Giant Whale With $405,190,000 in Ethereum Starts Withdrawing ETH From Binance: On-Chain Data

BC.GAME Secures New Curacao LOK License, Enhancing Legal Compliance and Global Reach – Blockchain News, Opinion, TV and Jobs

Sui Overflow Hackathon Funding Pool Balloons to $1,000,000 as New Sponsors Join – Blockchain News, Opinion, TV and Jobs

XRP Price Scenarios Ahead Of Ripple-SEC Case Update: Analyst

Bitcoin Will Shatter $16 Trillion Market Cap of Gold, Says SkyBridge Capital’s Anthony Scaramucci – Here’s How

Bitcoin Price Approaches Breakout, Can BTC Pump Above $66K?

‘Perfect Chart’ Shows 4,000,000,000 People Adopting Bitcoin and Crypto, Says Macro Guru Raoul Pal – Here’s the Timeline

Will Celestia (TIA) Hit $130? Analyst Makes Bold Prediction

Bitcoin Halving Successfully Completed, Fueling Expectations of Price Surge – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video1 year ago

Video1 year agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday