ETH Price

$175M Staking to spark $3,300 Breakout?

Published

2 months agoon

By

admin

Ethereum (ETH) price rebounded 4% to reach $3,220 on January 12, as the crypto market sell-off subsided. On-chain data shows investors making large deposits into ETH 2.0 staking contracts. Has ETH price formed a market bottom?

Ethereum (ETH) Price Gains 4% as Market Sell-off Wanes

Ethereum (ETH) experienced a volatile week, reflecting the broader crypto market dynamics. The recent turbulence was fueled by macroeconomic concerns and the ongoing effects of market-wide liquidations triggered earlier this month.

ETH price dropped by 10% between January 6 and January 9, falling from $3,150 to $2,835 as investors reacted to heightened uncertainty. The broader crypto sell-off was exacerbated by liquidity concerns, which intensified bearish sentiment across major altcoins.

However, Ethereum found support near the $2,850 mark on January 10, as selling pressure eased and on-chain activity indicated a shift in sentiment. Investors began making significant deposits into ETH 2.0 staking contracts, reflecting renewed confidence in the network’s long-term potential.

As of January 12, ETH has rebounded 4%, climbing back to $3,220. This recovery hints at the formation of a local bottom, with traders now closely monitoring key resistance levels and potential catalysts for further upward momentum.

Ethereum 2.0 Staking Inflows Surge By $175 Million in 3 Days

Ethereum’s rebound above $3,200 has fueled optimism that the cryptocurrency may consolidate within the $3,150–$3,400 range in the near term.

On-chain data reveals a considerable surge in Ethereum staking deposits, signaling growing confidence among long-term holders and network validators. According to the official data from the Beacon Chain, ETH staking inflows have seen a sharp uptick over since January 9, coinciding with the 4% price rebound.

As of January 9, the total staked value stood at 33.84 million ETH. Despite the broader market downturn that saw ETH dip below $3,200 earlier in the week, staking activity intensified. Over the past three days, investors staked an additional 53,000 ETH—valued at approximately $175 million at current prices— bringing the total staked to 33.89million ETH as of January 12.

This development offers two key insights into Ethereum’s short-term outlook. Firstly, increased staking cuts down short-term market supply, easing immediate sell-side pressure.

Secondly, the increased staking activity signals a shift in investor behavior. Rather than liquidate holdings during the recent market downturn, a significant cohort of ETH holders opted to lock their assets into staking contracts, leveraging passive rewards as a buffer against short-term price volatility.

While the broader crypto market sentiment remains cautious, Ethereum’s rising staking deposits, position the asset for a steady consolidation above the $3,200 mark in the coming days.

Etheruem Price Forecast: Bulls Set to Hold $3,200 Support

Ethereum price prediction paints an optimistic outlook, with staking deposits mopping up excess market supply from last week’s sell-off. From a technical standpoint, ETH is currently trading $3,271, consolidating near its lower Bollinger Band of $3,116, which offers immediate support.

The Bollinger Bands indicate low volatility as they tighten, signaling a potential breakout ahead, if market sentiment flips positive. However, trading volume remains subdued at 27.72K, and the ADX trending at 20.77, market sentiment remains largely cautious. In essence, weak breakout attempts may struggle to breach the $3,300 resistance.

A bullish scenario could materialize if ETH reclaims the $3,419 midline of the Bollinger Bands, with increased volume supporting the uptrend. Conversely, failure to hold $3,200 may see ETH test the critical $3,116 support level.

Frequently Asked Questions (FAQs)

Ethereum’s price rebounded due to eased selling pressure, renewed investor confidence, and a surge in ETH 2.0 staking deposits.

Staking deposits reduce market supply and indicate long-term investor confidence, supporting Ethereum’s price stability and upward momentum.

Ethereum faces resistance at $3,419, while $3,200 and $3,116 serve as critical support levels to monitor.

ibrahim

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Pi Network coin to $10? 4 catalysts that may make it possible

XRP Jumps as Ripple CEO Brad Garlinghouse Says SEC ‘Case Has Ended’

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

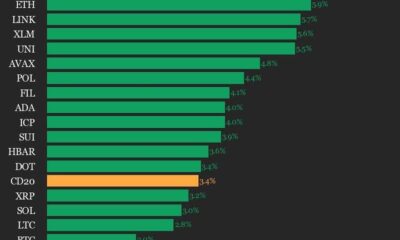

Index Rises 3.4% as All Assets Trade Higher

Sophisticated crypto address poisoning scams drain $1.2M in March

Ether (ETH) price declined by over 11.75% in the last 24 hours to around $1,900. At its intraday low, the cryptocurrency was trading for $1,755, its lowest price since October 2023.

ETH/USD four-hour price chart. Source: TradingView

Several factors appear to be contributing to ETH price losses, including:

US recession fears and its overall impact on risk-on markets.

Massive long liquidations in the crypto market.

Crypto loans backed by ETH as collateral facing liquidation risks.

Bearish technicals.

Ether price declines with risk-on assets

Ether’s ongoing price drop mirrors similar declines in the broader risk-on market due to unfavorable macroeconomic conditions.

Key points:

TOTAL crypto market cap vs. Nasdaq, Dow Jones, S&P 500, and US 10-year Treasury note yields four-hour chart. Source: TradingView

JPMorgan raised US recession risk to 40% for 2025, up from 30%, citing US President Donald Trump’s “extreme US policies” as a key risk factor.

Goldman Sachs also raised its 12-month recession probability to 20%, up from 15%.

Earlier in March, Trump imposed 25% tariffs on all goods from Mexico and Canada, and 10% tariffs on Chinese imports.

Canada and Mexico have announced intentions to impose retaliatory tariffs on US goods, escalating trade tensions and raising concerns about a potential trade war.

Meanwhile, China has already retaliated by increasing tariffs on multiple US products and imposing export controls and investment restrictions on 25 US firms.

These tariffs are expected to increase consumer prices and contribute to US inflation.

US recession fears are impacting Ethereum and the crypto sector, notably:

Ether, Bitcoin, and other top-ranking crypto assets have historically declined during periods of economic turbulences, e.g., the Covid-19 sell-off in March 2020.

As of March 11, the 52-week correlation between the crypto market and the US benchmark index, the S&P 500 index, was 0.69.

TOTAL crypto market cap and S&P 500’s 52-week correlation coefficient. Source: TradingView

A consistently positive correlation increases the odds of a crypto market decline if US stocks keep falling, especially as the trade war drags on further.

Bond traders see no need for a rate cut before June, with CME data showing 95% and 52.5% odds of a pause in the Fed’s March and May meetings, respectively.

Target rate probabilities for March’s Fed meeting. Source: CME

Bad DeFi loans increase Ether sell-off pressure

A $74 million DeFi loan on the Sky protocol, collateralized with $130 million in ETH, almost got liquidated after Ether price fell below the liquidation level just above $1,900.

As it happened:

The borrower added $34 million in ETH as collateral to avoid liquidation.

Withdrew $1.6 million in USDT from Binance, swapped it for DAI, and deposited into Maker.

Reduced debt to $73.1 million while ETH’s price continued to decline.

Liquidation level remained at $1,836 per ETH, closer to ETH’s current price above $1,900.

Nearly $353 million in debt is tied to such loans, risking liquidation if ETH’s price falls 20% from here.

Ethereum liquidation levels in DeFi. Source: DefiLlama

Long liquidations accelerate ETH downtrend

Ether’s tumble over the past 24 hours coincided with a wave of long liquidations that forced traders to exit their leveraged positions.

Key takeaways:

Over $240 million worth of ETH positions were wiped out in the last 24 hours, with long liquidations accounting for $196.27 million, or 82% of the total.

ETH total liquidation chart. Source: Coinglass

The sharp price drop triggered a cascade of forced sell-offs as traders betting on Ethereum’s price increase were liquidated.

When leveraged long positions fail to maintain margin requirements, exchanges automatically sell off their holdings to cover losses.

Such liquidations accelerate price declines, exacerbating the downturn.

The broader crypto market also experienced a sharp deleveraging event, with total liquidations reaching $897.26 million across assets.

Crypto market liquidations (24 hours). Source: TradingView

Ether eyes further decline toward $1,700

From a technical perspective, Ether’s price decline today is part of its prevailing inverse-cup-and-handle (IC&H) pattern.

Key points:

ETH/USD daily price chart. Source: TradingView

A temporary consolidation (handle) formed near $2,700, indicating a failed breakout attempt.

ETH broke below key support levels, confirming the IC&H breakdown, leading to more losses.

The measured move target from the pattern suggests a potential decline toward $1,700, aligning with the dotted support level.

The 50-day EMA ($2,600) and 200-day EMA ($2,929) remain far above, reinforcing bearish sentiment.

Key levels to watch:

ETH price is inside a descending channel pattern since late February.

As of March 11, the ETH/USD pair was rising after testing the channel’s lower trendline as support.

ETH/USD four-hour price chart. Source: TradingView

Such rebounds have taken prices toward the channel’s upper trendline in recent history.

If the fractal repeats, ETH’s next upside target could be around $2,000, aligning with the 0.236 Fibonacci retracement line.

A reversal from current price levels could have ETH test the IC&H downside target of $1,700.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Published on By Ethereum price once again faces strong selling pressure crashing under $2,000 earlier today, and opening the gates for another 75% drop to $1,250 levels. Over the last week, ETH has lost more than 16%, thereby extending its year-to-date losses to more than 37%, suggesting a strong bearish sentiment for the altcoin. On the other hand, the Ethereum ETF outflows have also surged last week, suggesting dropping institutional interest. The world’s largest altcoin Ethereum (ETH) has come under strong bearish grip eroding all of its gains following the US Presidential election in November 2024. Crypto analyst Ali Martinez highlighted that Ethereum is breaking down of a parallel channel, a technical pattern that suggests bearish price action ahead. If Ethereum price fails to hold this support, it can crash by another 75% all the way to $1,250 levels. Today’s ETH price drop comes amid the broader crypto market correction as market liquidations soar to more than $600 million as per the Coinglass data. Additionally, the ETH open interest has dropped by 2.67% to $19 billion, hinting bearish sentiment among futures traders. The Ethereum market faced significant turbulence yesterday, with over $230 million in long positions liquidated, according to crypto analyst Ali Martinez. The wave of liquidations has shaken out overleveraged traders, highlighting the current market volatility surrounding the altcoin. Furthermore, the institutional interest in Ethereum has been falling fast. During the last week, the total outflows from spot Ethereum ETFs surged over $120 million. Despite this fall, crypto market analysts continue to stay bullish for ETH expecting it to kickstart its recovery journey again. Despite the bearish onslaught over the past few weeks, market analysts continue to be bullish about an Ethereum price recovery in the coming days. Crypto analyst Ali Martinez reports that Ethereum’s largest whales have purchased 330,000 ETH in the past 48 hours, signaling strong accumulation by major holders. Additionally, over 600,000 ETH have been withdrawn from crypto exchanges in the last week, pointing to a potential shift toward long-term holding. These trends highlight growing confidence among large investors and reduced selling pressure on exchanges. For Ethereum momentum to shift on the upside, the bulls must reclaim $2,460 resistance. A massive 10.95 million investors hold ETH at these levels, and thus, investors need to break past this to trigger a rally to the upside. Crypto trader and analyst Crypto Patel has expressed bullish sentiment on Ethereum (ETH), emphasizing his strategy of buying during market dips. “Buying $ETH on every dip for $10k/ETH,” Patel shared. He believes that this is the last opportunity for accumulation before Ethereum’s next major price surge. Bhushan Akolkar Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills. Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss. Published on By Ethereum price surged 15%, climbing from $2,200 to $2,550 within a frenetic one-hour period on Sunday, March 2, after Trump confirmed ETH’s inclusion in the official Crypto Strategic Reserve. Ethereum price action came under intense scrutiny over the weekend as markets reacted to Trump’s official confirmation of the much-anticipated Crypto Strategic Reserve. Notably, Trump had initially omitted ETH from the list of altcoins to be included in the strategic reserve bucket of assets. The announcement, which came around noon in the U.S. trading session, had featured only SOL, ADA, and XRP, sparking concerns that ETH was excluded due to recent network update squabbles and changes in leadership. “And, obviously, BTC and ETH, as other valuable Cryptocurrencies, will be at the heart of the Reserve. I also love Bitcoin and Ethereum! – Donald Trump, via Truth Social, March 2, 2025 Within an hour, SOL, XRP, ADA, and Bitcoin prices all rose by double digits, while ETH remained rooted at the $2,200 level. However, nearly two hours after the initial announcement, Trump issued another post clarifying that both ETH and BTC were also included on the list of assets to be acquired by the United States Treasury. Following this clarification, ETH price promptly joined the rally. Within one hour of Trump’s second post, Ethereum surged 15%, moving from $2,200 to reclaim territory above the $2,550 level. Considering that XRP and Cardano have now recorded gains exceeding 20% at press time, ETH could potentially witness further upside, especially as U.S.-based investors holding ETH ETFs could mount major buy orders when markets reopen on Monday, March 3. Movements observed in the derivatives market show that some strategic traders deployed massive leverage on Sunday in hopes of booking amplified profits if the trading week begins on a positive note, as widely anticipated after Trump included ETH in the Crypto Strategic Reserve. Coinglass Liquidation Map data, which measures the real-time balance of leverage deployed on active long futures contracts against shorts, shows bulls established significant dominance on Sunday, hinting that the majority of traders are betting on further gains when markets reopen for the week. The ETH liquidation map chart above shows that bulls mounted a total of $1.14 billion at press time on Sunday, while short leverage has dwindled to just $333 million. This reflects that bulls now dominate the ETH market, with long leverage exceeding shorts by approximately 70%. Aligning with the trending news events, it appears short traders are opting to close out their positions early rather than risk bigger losses, as the current ETH price rally has the backing of the United States government. With the U.S. government set to begin the official process of purchasing ETH, BTC, SOL, and ADA, the current bullish setup in the derivatives market could persist. Unless another comparable bearish catalyst arises, ETH is poised to face weakened resistance levels as it approaches the $3,000 mark in the week ahead, as implied by the dwindling short positions in the derivatives market. Another key factor contributing to the positive swing in Ethereum’s market momentum was the leadership change announced by the Ethereum Foundation on Saturday, March 1. The Foundation appointed Hsiao-Wei Wang, a core researcher with seven years of experience, and Tomasz Stańczak, CEO of Nethermind, as co-Executive Directors. This leadership restructuring aims to enhance technical expertise and improve communication within the Ethereum ecosystem. Following recent controversies surrounding network updates, this leadership shuffle has lifted investor sentiment ahead of President Trump’s major announcement on Sunday. After intraday 15.72% gains, Ethereum price forecast charts continue to flash bullish signals for a potential rally towards $4,000 as March 2025 kicks off on a positive note. As seen below, the ETHUSDT 12-hour chart reveals a textbook falling wedge breakout, a historically strong reversal pattern. If confirmed by a decisive close above the upper trendline near $2,500, ETH price could advance further towards $3,000 mark, especially as the 70% bullish dominance in the derivatives market hints weaker resistance clusters at key price levels ahead. Typically, the falling wedge pattern projects a measured move equal to the height of the formation, with the current target signaling a potential ETH price rally toward $4,000 in the coming weeks. The strong bullish candle on the breakout signals robust buying interest, reinforced by increasing volume, confirming the validity of the trend reversal. The price currently hovers around $2,514, with the next key resistance zone near $2,800, which previously acted as a supply zone. If Ethereum clears this level, momentum could accelerate toward the $3,200-$3,400 range, aligning with the upper bound of historical resistance. A sustained move above this threshold would validate the full breakout target near $4,000. On the flip side, failure to hold above $2,500 could invite selling pressure, potentially retesting the former resistance-turned-support level at $2,300. A break below this threshold might invalidate the bullish setup, opening the door for a deeper pullback. However, given the strength of the breakout, Ethereum bulls appear poised for further gains in the near term. Ethereum soared 15% after Donald Trump confirmed its inclusion in the U.S. Crypto Strategic Reserve, boosting investor confidence. Ethereum could target $2,800 in the short term, with a breakout above this level potentially driving prices toward $4,000. ETH bulls control 80% of derivatives market leverage, signaling strong buying interest and reduced short positions, reinforcing bullish momentum. ibrahim Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss. Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025 Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist Aptos Leverages Chainlink To Enhance Scalability and Data Access Bitcoin Could Rally to $80,000 on the Eve of US Elections Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals Crypto’s Big Trump Gamble Is Risky Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Source link 24/7 Cryptocurrency News

Ethereum Price Crash to $1,250 Likely As ETH Loses Key Support

Will Ethereum Price Crash Further From Here?

Ethereum Liquidations Skyrocket

Will ETH Recover Anytime Soon?

Source link ETH Price

Falling Wedge Pattern Hints $4K Rally as Trump Confirms ETH, SOL, ADA, XRP for Crypto Reserve

Ethereum (ETH) Price Soars 15% as Trump Confirms ETH Inclusion in Crypto Reserve

Bulls Establish 80% Dominance in ETH Derivatives Market

Ethereum Foundation’s Leadership Shuffle also Lifted Market Sentiment

ETH Price Forecast: Falling Wedge Pattern Hints $4K Rally Ahead

Frequently Asked Questions (FAQs)

Source link

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Pi Network coin to $10? 4 catalysts that may make it possible

XRP Jumps as Ripple CEO Brad Garlinghouse Says SEC ‘Case Has Ended’

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Index Rises 3.4% as All Assets Trade Higher

Sophisticated crypto address poisoning scams drain $1.2M in March

Dogecoin Shark & Whale Population Rises—Price Turnaround Incoming?

ECB Prepping The Ground For Digital Euro Launch

One Indicator Could Soon Signal New Bitcoin Breakout, According to Crypto Analyst

BMT crypto soars nearly 30% a day after Binance listing

EOS Token Spikes 30% as Network Rebrands to ‘Vaulta’

Why Is Tron Price Up 7% Today?

Lessons from the Bybit Hack

North Dakota Senate passes crypto ATM bill limiting daily transactions to $2K

Ethereum To $4,000? Standard Chartered Lowers Expectations

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

✓ Share: