Bitcoin 2025

2025 Bitcoin Outlook: Insights Backed by Metrics and Market Data

Published

4 months agoon

By

admin

As we step into 2025, it’s time to take a measured and analytical approach to what the year might hold for Bitcoin. Taking into account on-chain, market cycle, macroeconomic data, and more for confluence, we can go beyond pure speculation to paint a data-driven picture for the coming months.

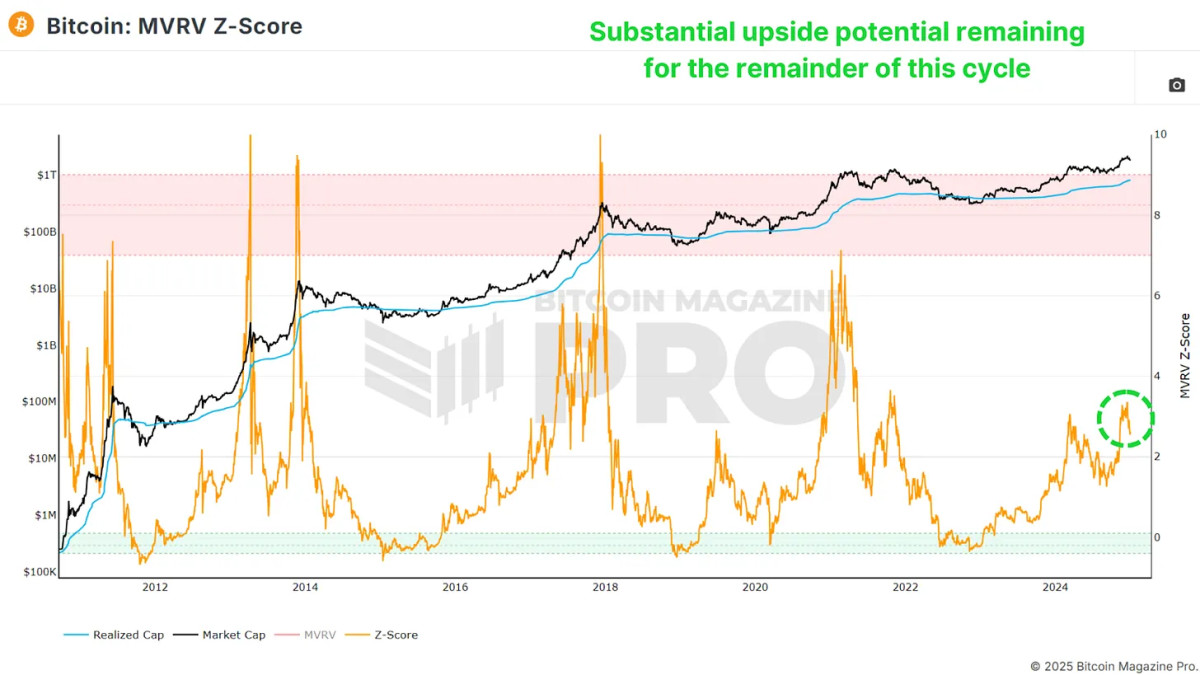

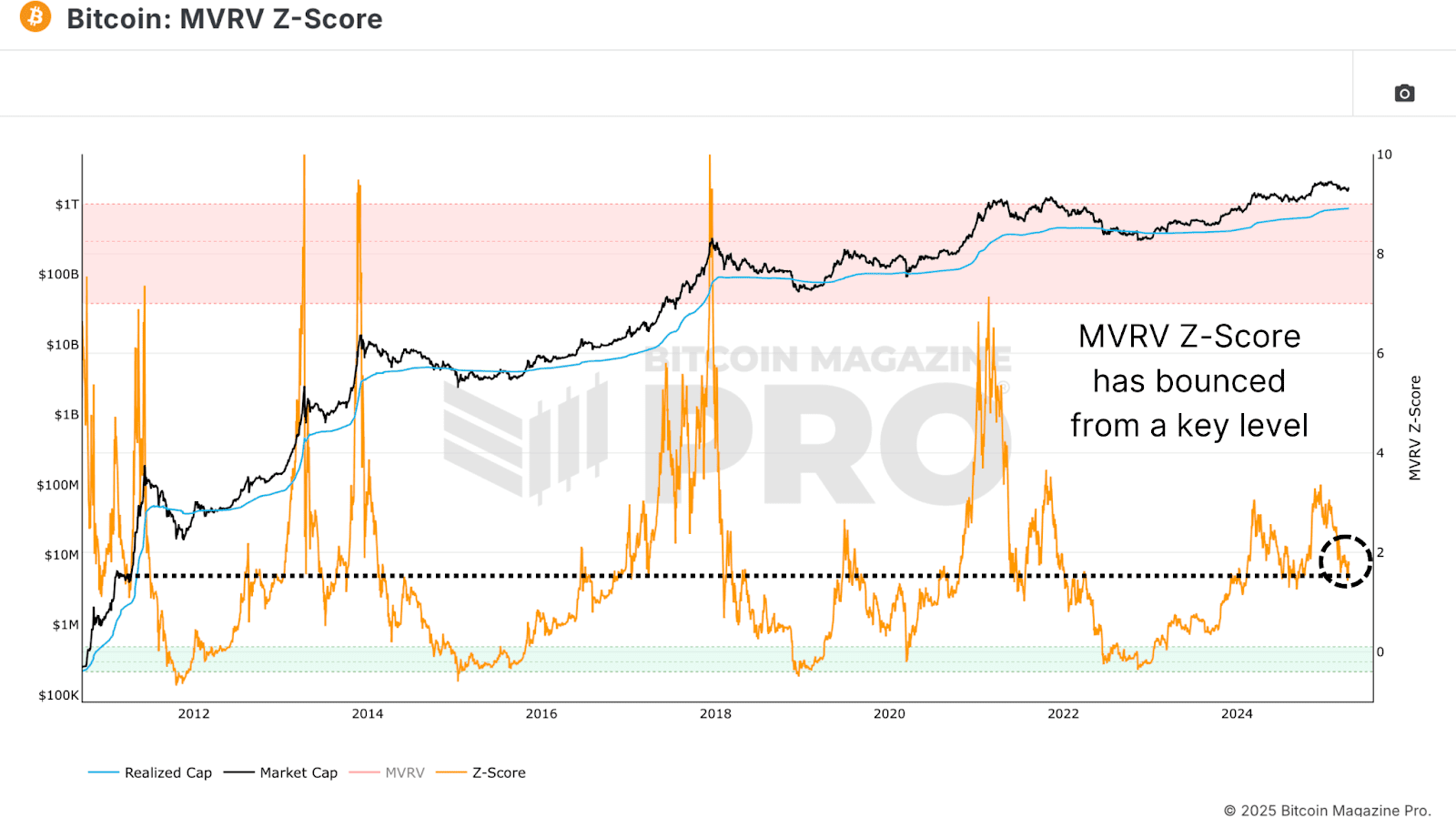

MVRV Z-Score: Plenty of Upside Potential

The MVRV Z-Score measures the ratio between Bitcoin’s realized price (the average acquisition price of all BTC on the network) and its market cap. Standardizing this ratio for volatility gives us the Z-Score, which historically provides a clear picture of market cycles.

Currently, the MVRV Z-Score suggests we still have significant upside potential. While previous cycles have seen the Z-Score reach values above 7, I believe anything above 6 indicates overextension, prompting a closer look at other metrics to identify a market peak. Presently, we’re hovering at levels comparable to May 2017—when Bitcoin was valued at only a few thousand dollars. Given the historical context, there’s room for multiple hundreds of percent in potential gains from current levels.

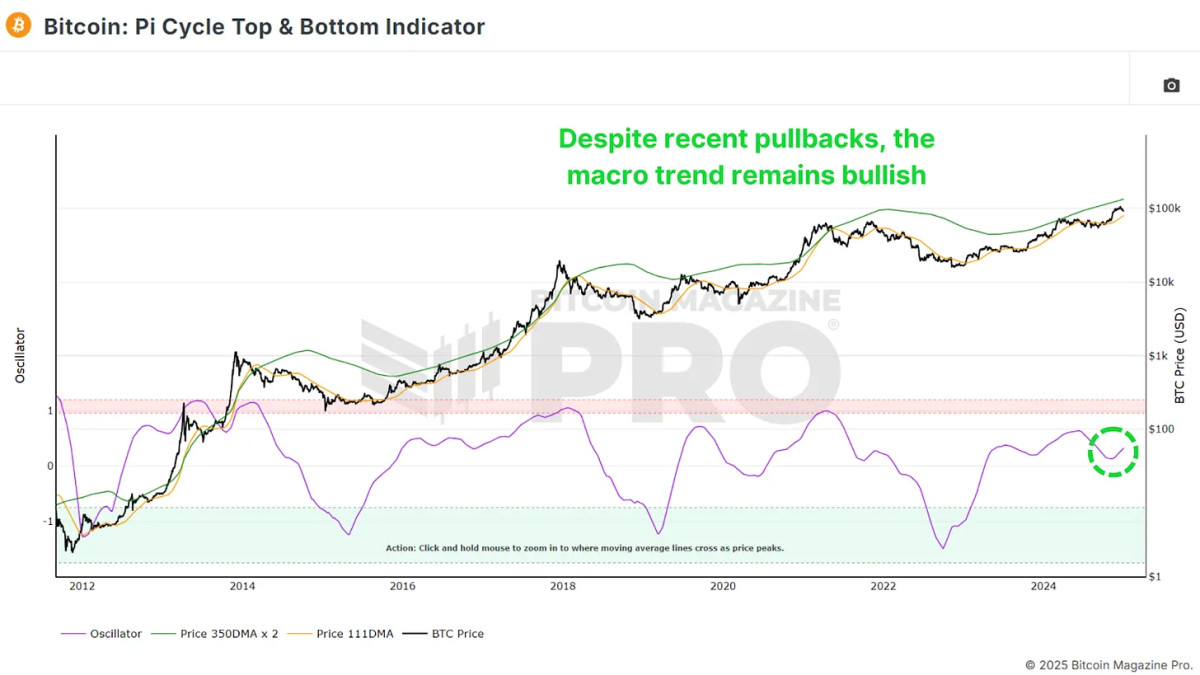

The Pi Cycle Oscillator: Bullish Momentum Resumes

Another essential metric is the Pi Cycle Top and Bottom indicator, which tracks the 111-day and 350-day moving averages (the latter multiplied by 2). Historically, when these averages cross, it often signals a Bitcoin price peak within days.

The distance between these two moving averages has started to trend upward again, suggesting renewed bullish momentum. While 2024 saw periods of sideways consolidation, the breakout we’re seeing now indicates that Bitcoin is entering a stronger growth phase, potentially lasting several months.

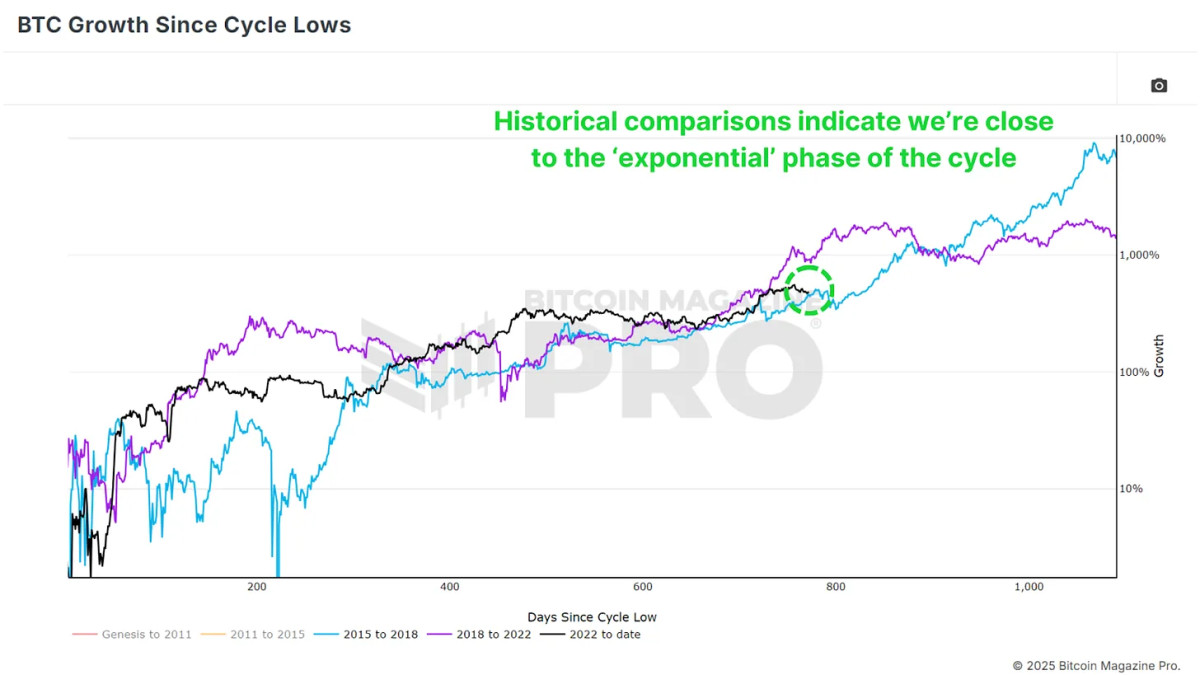

The Exponential Phase of the Cycle

Looking at Bitcoin’s historical price action, cycles often feature a “post-halving cooldown” lasting 6–12 months before entering an exponential growth phase. Based on previous cycles, we’re nearing this breakout point. While diminishing returns are expected compared to earlier cycles, we could still see substantial gains.

For context, breaking the previous all-time high of $20,000 in the 2020 cycle led to a peak near $70,000—a 3.5x increase. If we see even a conservative 2x or 3x from the last peak of $70,000, Bitcoin could realistically reach $140,000–$210,000 in this cycle.

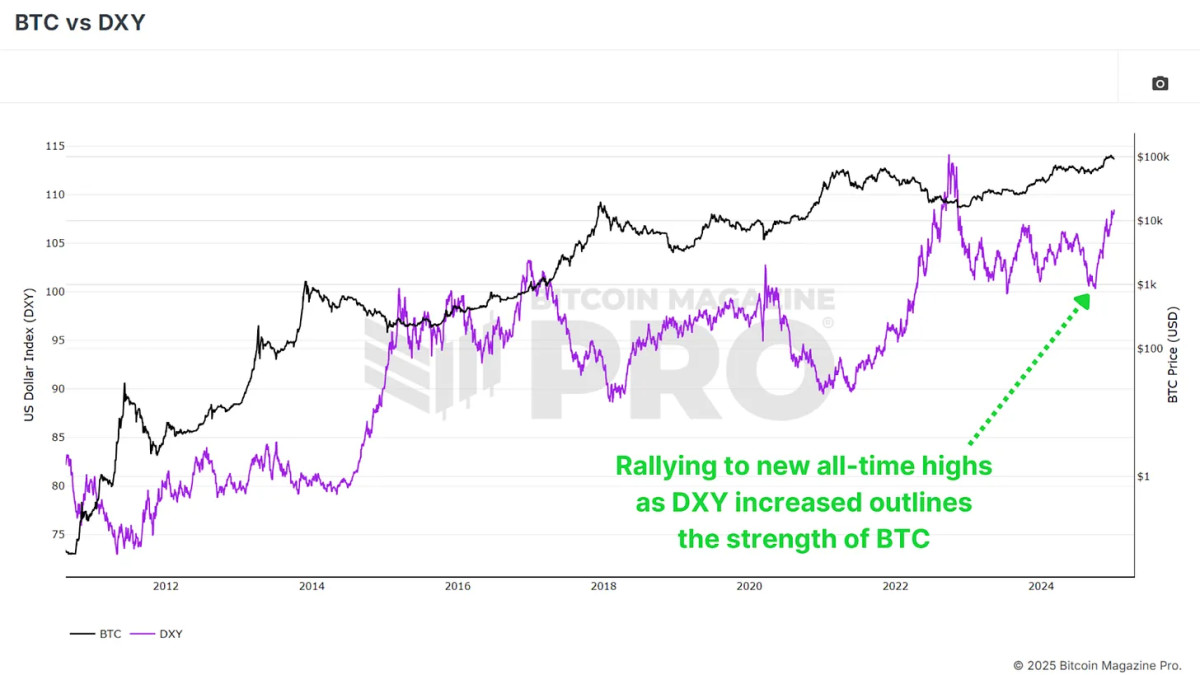

Macro Factors Supporting BTC in 2025

Despite headwinds in 2024, Bitcoin performed strongly, even in the face of a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY move inversely, so any reversal in the DXY’s strength could further fuel Bitcoin’s upside.

Other macroeconomic indicators, such as high-yield credit cycles and the global M2 money supply, suggest improving conditions for Bitcoin. The contraction in the money supply seen in 2024 is expected to reverse in 2025, setting the stage for an even more favorable environment.

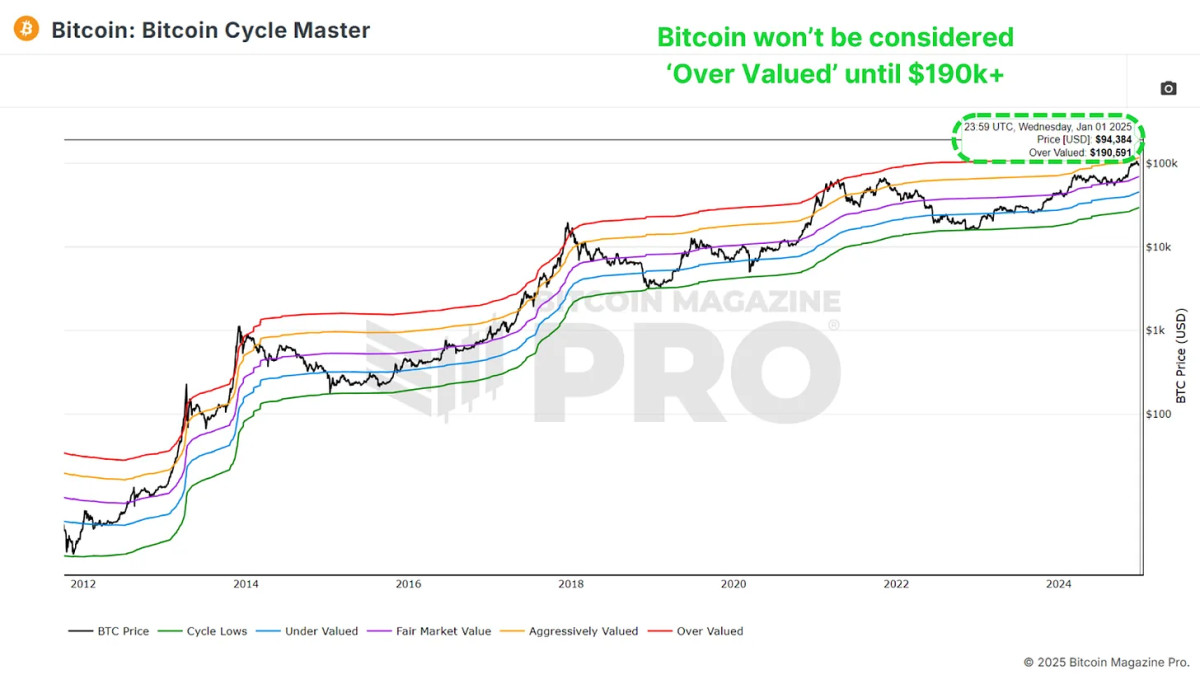

Cycle Master Chart: A Long Way to Go

The Bitcoin Cycle Master Chart, which aggregates multiple on-chain valuation metrics, shows that Bitcoin still has considerable room to grow before reaching overvaluation. The upper boundary, currently around $190,000, continues to rise, reinforcing the outlook for sustained upward momentum.

Conclusion

Currently, almost all data points are aligned for a bullish 2025. As always, past performance doesn’t guarantee future results, however the data strongly suggests that Bitcoin’s best days may still lie ahead, even after an incredibly positive 2024.

For a more in-depth look into this topic, check out a recent YouTube video here: Bitcoin 2025 – A Data Driven Outlook

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Bitcoin’s 2025 journey hasn’t delivered the explosive bull market surge many expected. After peaking above $100,000, the 2025 Bitcoin price retraced sharply to as low as $75,000, sparking debate among investors and analysts about where we stand in the Bitcoin cycle. In this analysis, we cut through the noise, leveraging on-chain indicators and macro data to determine if the Bitcoin bull market remains intact or if a deeper Bitcoin correction looms in Q3 2025. Key metrics like MVRV Z-Score, Value Days Destroyed (VDD), and Bitcoin capital flows provide critical insights into the market’s next move.

Is Bitcoin’s 2025 Pullback Healthy or Bull Cycle End?

A strong starting point for assessing the 2025 Bitcoin cycle is the MVRV Z-Score, a trusted on-chain indicator that compares market value to realized value. After hitting 3.36 at Bitcoin’s $100,000 peak, the MVRV Z-Score dropped to 1.43, aligning with the 2025 Bitcoin price decline from $100,000 to $75,000. This 30% Bitcoin correction may seem alarming, but recent data shows the MVRV Z-Score rebounding from its 2025 low of 1.43.

Historically, MVRV Z-Score levels around 1.43 have marked local bottoms, not tops, in prior Bitcoin bull markets (e.g., 2017 and 2021). These Bitcoin pullbacks often preceded resumed uptrends, suggesting the current correction aligns with healthy bull cycle dynamics. While investor confidence is shaken, this move fits historical patterns of Bitcoin market cycles.

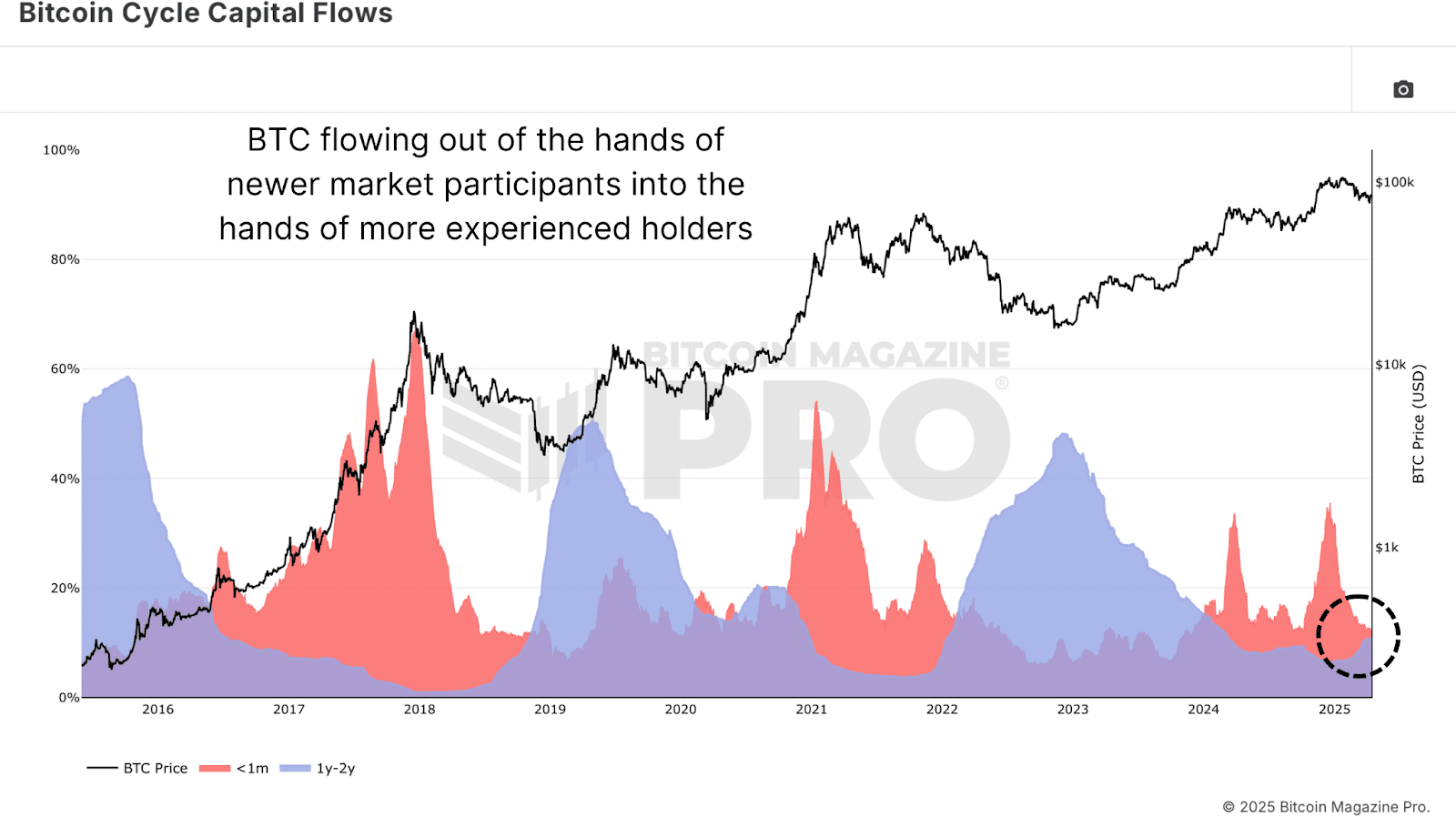

How Smart Money Shapes the 2025 Bitcoin Bull Market

The Value Days Destroyed (VDD) Multiple, another critical on-chain indicator, tracks the velocity of BTC transactions weighted by holding periods. Spikes in VDD signal profit-taking by experienced holders, while low levels indicate Bitcoin accumulation. Currently, VDD is in the “green zone,” mirroring levels seen in late bear markets or early bull market recoveries.

Following Bitcoin’s reversal from $100,000, the low VDD suggests the end of a profit-taking phase, with long-term holders accumulating in anticipation of higher 2025 Bitcoin prices. The Bitcoin Cycle Capital Flows chart further illuminates this trend, breaking down realized capital by coin age. Near the $106,000 peak, new market entrants (<1 month) drove a spike in activity, signaling FOMO-driven buying. Since the Bitcoin pullback, this group’s activity has cooled to levels typical of early-to-mid bull markets.

In contrast, the 1–2 year cohort—often macro-savvy Bitcoin investors—is increasing activity, accumulating at lower prices. This shift mirrors Bitcoin accumulation patterns from 2020 and 2021, where long-term holders bought during dips, setting the stage for bull cycle rallies.

Where Are We in the 2025 Bitcoin Market Cycle?

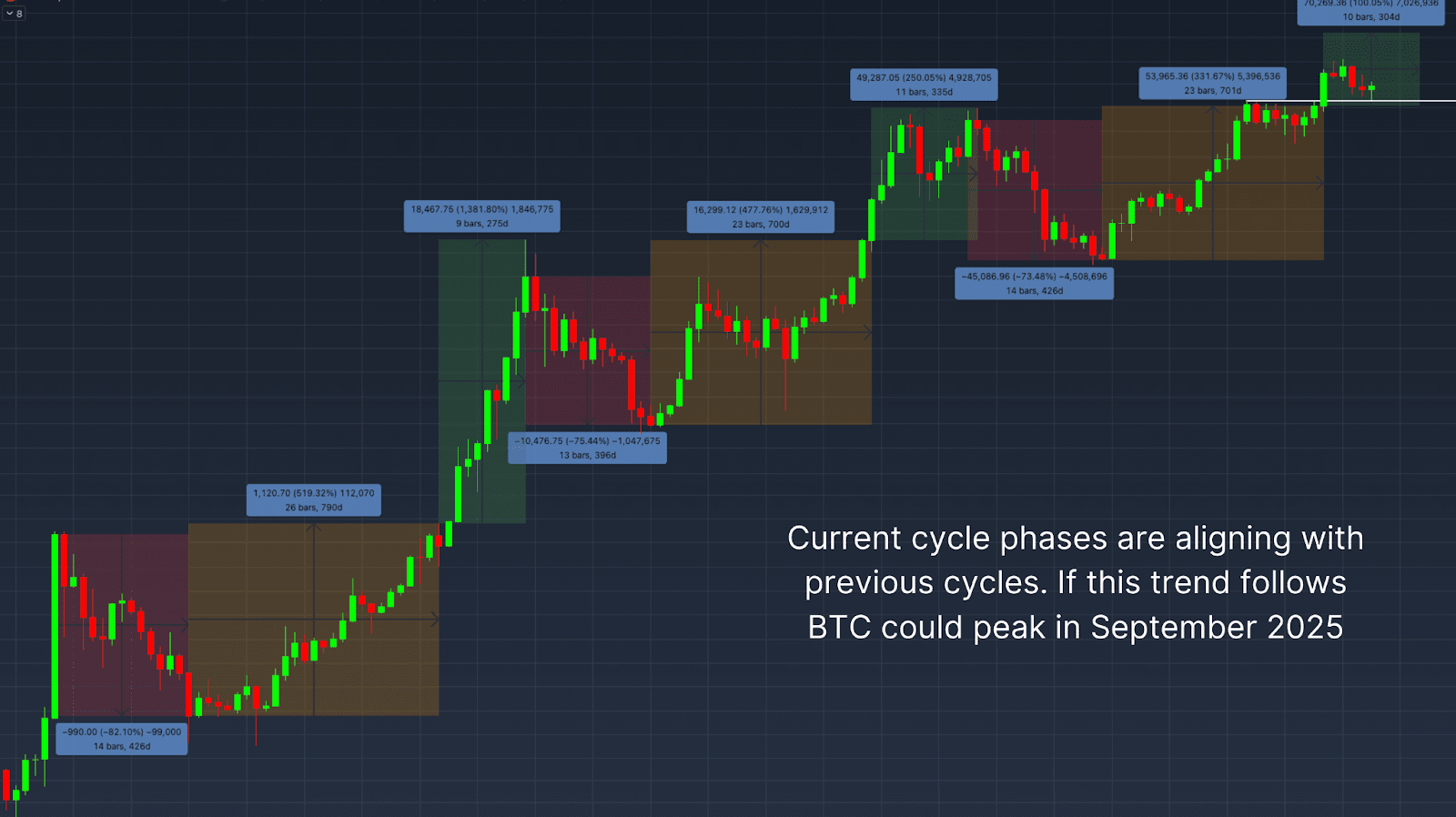

Zooming out, the Bitcoin market cycle can be divided into three phases:

- Bear phase: Deep Bitcoin corrections of 70–90%.

- Recovery phase: Reclaiming prior all-time highs.

- Bull/exponential phase: Parabolic Bitcoin price advances.

Past bear markets (2015, 2018) lasted 13–14 months, and the most recent Bitcoin bear market followed suit at 14 months. Recovery phases typically span 23–26 months, and the current 2025 Bitcoin cycle falls within this range. However, unlike past bull markets, Bitcoin’s breakout above previous highs was followed by a pullback rather than an immediate surge.

This Bitcoin pullback may signal a higher low, setting up the exponential phase of the 2025 bull market. Based on past cycles’ 9–11-month exponential phases, the Bitcoin price could peak around September 2025, assuming the bull cycle resumes.

Macro Risks Impacting Bitcoin Price in Q3 2025

Despite bullish on-chain indicators, macro headwinds pose risks to the 2025 Bitcoin price. The S&P 500 vs. Bitcoin Correlation chart shows Bitcoin remains tightly linked to U.S. equities. With fears of a global recession growing, weakness in traditional markets could cap Bitcoin’s near-term rally potential.

Monitoring these macro risks is crucial, as a deteriorating equity market could trigger a deeper Bitcoin correction in Q3 2025, even if on-chain data remains supportive.

Conclusion: Bitcoin’s Q3 2025 Outlook

Key on-chain indicators—MVRV Z-Score, Value Days Destroyed, and Bitcoin Cycle Capital Flows—point to healthy, cycle-consistent behavior and long-term holder accumulation in the 2025 Bitcoin cycle. While slower and uneven compared to past bull markets, the current cycle aligns with historical Bitcoin market cycle structures. If macro conditions stabilize, Bitcoin appears poised for another leg up, potentially peaking in Q3 or Q4 2025.

However, macro risks, including equity market volatility and recession fears, remain critical to watch. For a deeper dive, check out this YouTube video: Where We Are In This Bitcoin Cycle.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

It’s happening! Everything we’ve fought for and more; Ross Ulbricht is free and he is coming to Bitcoin 2025! Bring your “Free Ross Day One” t-shirts to Vegas because he will be in attendance at the conference for the first time as a free man, in less than two months.

“Freedom is the emancipation from the arbitrary rule of other men.” —Mortimer Adler

Freedom means a lot to us bitcoiners, so when Silk Road founder Ross Ulbricht, a freedom fighter and a Bitcoin pioneer, was given two life sentences + 40 years with no option for parole, hearts and hopes sank.

All around the world we have advocated and fought for Ross’ freedom. From petitions to t-shirts, he was all in our hearts. Ross represents us in our bravest of times in our adversity, in our fight to do what is right even when it may seem wrong.

After years of fighting, shouting, challenging, and campaigning, Trump made a promise that if he were re-elected he would pardon Ross. The question whether it would actually happen hung in the air for months. Then, on January 21st, 2025, Trump made true on his promise and it’s fair to say that it caused some commotion. Among the cheers and smiles, this moment showed us how far we have come, but is there still further to go from here?

The Bitcoin conference has always rallied the “Free Ross” movement. He’s not only one of us, but he is someone who has helped make bitcoin what it is today. We stood by Ross, and we couldn’t be more happy for him to come home.

Are you ready to create a united front that makes a future we are proud to see? Then get your tickets now for The Bitcoin Conference.

Source link

Bitcoin

Bitcoin 2025 Conference Brings Back Highly Anticipated Legal Education Program

Published

1 month agoon

March 14, 2025By

admin

BTC Inc., a leading provider of Bitcoin-related news and events, has announced the return of its Continuing Legal Education (CLE) program at The Bitcoin 2025 Conference in Las Vegas, Nevada. Scheduled for May 27th at the Venetian Expo Hall, this premier program provides legal and financial professionals with the opportunity to stay informed about the ever-evolving regulatory landscape surrounding Bitcoin.

Following a highly successful debut at Bitcoin 2024, where attorneys, startup founders, corporate legal teams, and policymakers praised the program for tackling crucial legal topics, the 2025 CLE session will continue to deliver valuable insights into the legal and regulatory frameworks shaping Bitcoin’s future.

The 2025 CLE program will offer four (4) hours of credit, pending approval from the Nevada Board of Continuing Legal Education. Participants will also receive certificates of completion for submission to states not pre-accredited for CLE or CPE credits.

Designed for industry professionals, in-house counsel, CFOs, CPAs/MTAs, startup founders, and C-suite executives, the program will address key legal, regulatory, and business considerations in the Bitcoin industry. Expert-led sessions will include:

- Trump Administration’s Bitcoin Policies – A deep dive into the Strategic Bitcoin Reserve, stablecoin regulations, and shifts in market structure.

- Bitcoin in Public Company Treasuries – Examining the legal frameworks for power agreements and transactions in regulated and deregulated markets.

- Bitcoin & the Courts: Operation Choke Point and Beyond – Analyzing legal battles shaping financial access, banking restrictions, and regulatory overreach.

- Mining Contracts & Legal Risks – Exploring complexities in hosting agreements, procurement risks, and emerging regulatory considerations.

Participants can register through either the CLE & Industry Pass bundle or the CLE & VIP Whale Pass bundle. Attendees will be among 300+ sponsors and 5,000+ companies, many of whom are in the early stages of their legal and consulting needs. The 2025 CLE program registration and further details can be found here.

The Bitcoin Conference is also renowned for hosting top-tier international Bitcoin events like Bitcoin Asia, Bitcoin Amsterdam, and Bitcoin MENA, and continues to be the premier destination for thought leadership and innovation in the Bitcoin space.

Disclaimer: Bitcoin Magazine is wholly owned by BTC Media, LLC, which also owns and operates the world’s largest Bitcoin conference, The Bitcoin Conference.

Source link

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje