Lookonchain

$227,000,000 Worth of OM Tokens Moved to Crypto Exchanges Prior to 90% Price Collapse of Mantra: On-Chain Data

Published

2 weeks agoon

By

admin

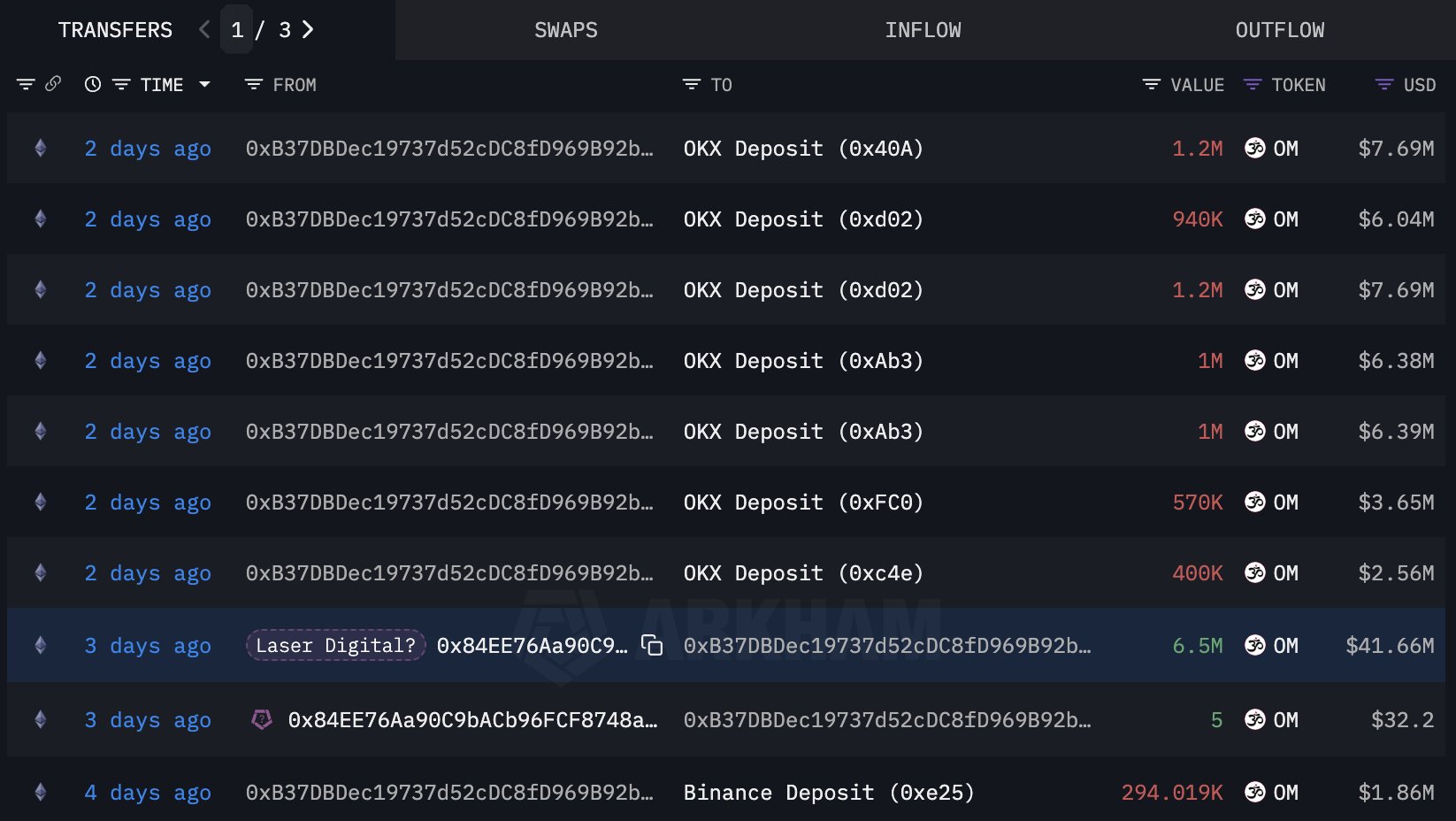

Blockchain intelligence platform Lookonchain says that tokens of the real-world asset (RWA) crypto project Mantra (OM) worth hundreds of millions of dollars were transferred to digital asset exchanges before a massive price crash.

Lookonchain says on the social media platform X that multiple wallets had sent millions of OM tokens to crypto exchanges prior to Mantra’s 90% price meltdown over the weekend.

Based on Lookonchain’s data, some of the exchanges that received the deposits include OKX and Binance.

“Who dropped the price of OM?

Before the OM crash(since Apr 7th), at least 17 wallets deposited 43.6 million OM($227 million at the time) into exchanges, 4.5% of the circulating supply.

According to Arkham’s tag, two of these addresses are linked to Laser Digital.

Laser Digital is a strategic investor in Mantra.”

On Sunday, Mantra witnessed a sudden price meltdown, dropping from a high of $6.35 to a low of $0.37 – a whopping decline of 94% in just one day. Simultaneously, its market cap plunged from $6.11 billion to $683.3 million.

Crypto asset management firm Laser Digital says that it is not involved in the price collapse of Mantra.

“We want to directly address recent speculation around Laser Digital’s involvement in the price action of OM (Mantra)… Assertions circulating on social media that link Laser to ‘investor selling’ are factually incorrect and misleading…

On-chain movements of OM linked to Laser wallets have been flagged publicly. We want to be absolutely clear: Laser has not deposited any OM tokens to OKX. The wallets being referenced to OKX are not Laser wallets.”

Meanwhile, Mantra CEO JP Mullin blames crypto exchanges for OM’s sudden price collapse, noting that the firms needlessly closed large positions during low-liquidity hours.

At time of writing, OM is trading for $0.595, down 32.5% in the past day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

Altcoins

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

Published

1 month agoon

March 25, 2025By

admin

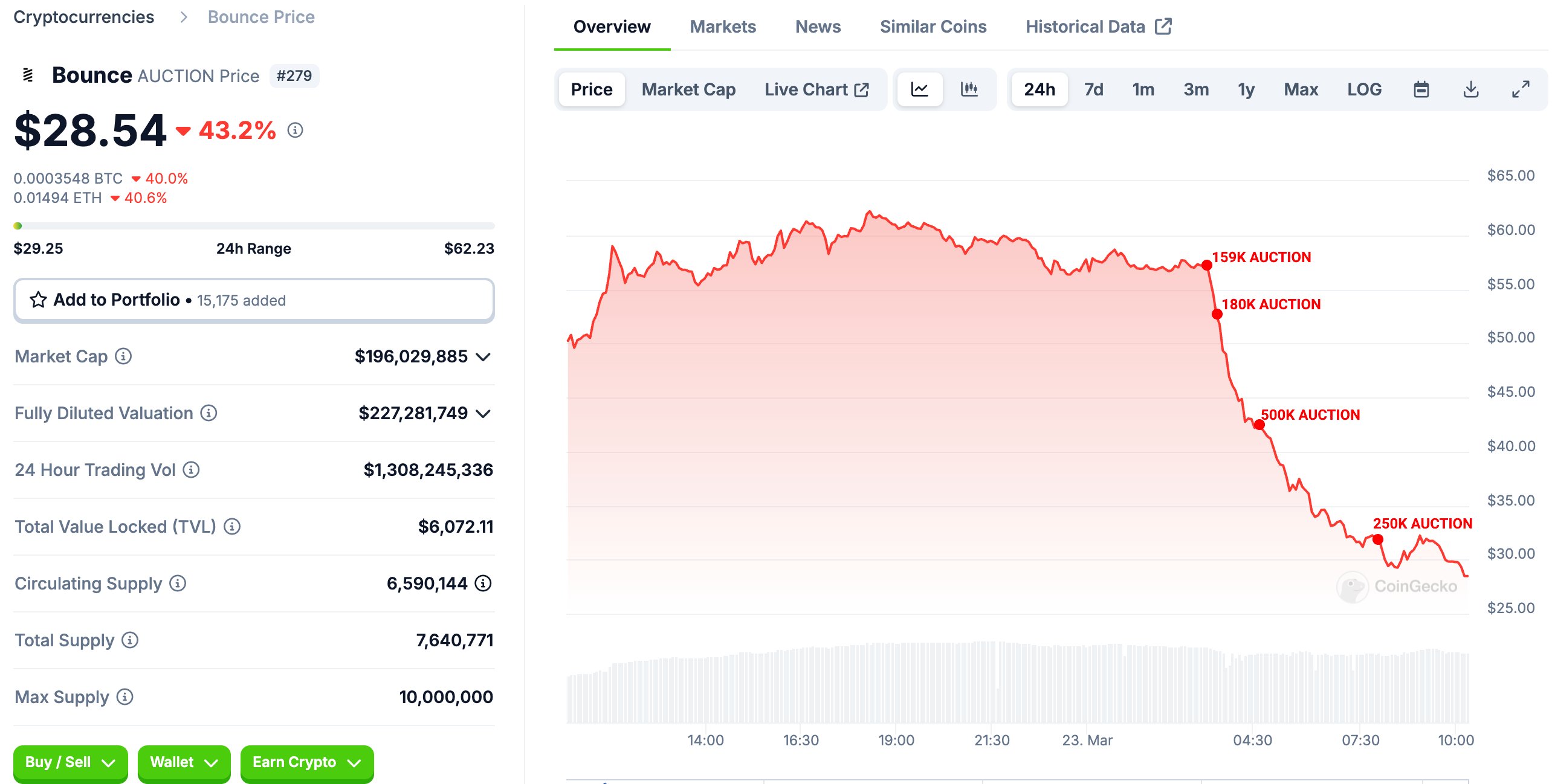

Deep-pocketed traders triggered a price crash over the weekend after depositing a huge chunk of an altcoin’s supply to digital asset exchanges.

According to blockchain tracking firm Lookonchain, whales in the Bounce (AUCTION) market have been greatly influencing the altcoin’s price action for the past week, causing massive swings in both directions.

Bounce Finance is a decentralized auction platform enabling auctions for various assets, such as physical assets tokenized on the blockchain and non-fungible tokens (NFTs).

AUCTION tokens are used for governance, staking, and fees for participating in auctions or creating NFTs on the platform.

Lookonchain says that in the last several days, whales sent over 14% of the circulating supply of AUCTION to Binance, the largest crypto exchange in the world by volume, and OKX. Those deposits presumably led to coins being sold on the open market, which ultimately caused prices to plummet.

Says Lookonchain,

“AUCTION Whales deposited 1.08 million AUCTION ($48.6 million, 14.26% of the total supply) into Binance and OKX again, causing the price to plummet by 50%.

Pay attention to price changes.”

At time of writing, AUCTION has not recovered, currently trading at $20.93 with a market cap of $137 million. AUCTION is ranked as the 363rd-largest crypto asset by market cap.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bybit

Bybit Ethereum (ETH) Reserves Steadily Recovering Following Massive Hack, According to CryptoQuant

Published

2 months agoon

February 24, 2025By

admin

Market intelligence platform CryptoQuant says that the Ethereum (ETH) reserves of Bybit are recuperating after the crypto exchange was hacked to the tune of $1.4 billion.

In a new thread on the social media platform X, Julio Moreno – CryptoQuant’s head of research – says that Bybit is seeing inflows worth over $390 million in ETH.

“Bybit’s ETH reserves are slowly recovering. The exchange has experienced positive net flows of 139,000 ETH since the hack.”

Previous reports indicate that the Singapore-based exchange suffered the biggest exploit in the digital assets industry when a bad actor took control of its ETH cold wallet, which stores keys offline.

According to recent data from the blockchain tracker Lookonchain, Bybit’s rapid recovery of ETH is being aided by other digital asset firms as well as crypto whales.

“Since being hacked, Bybit has received 145,879 ETH ($390 million) in loans and deposits. Whales withdrew 47,800 ETH ($127.56 million) from Binance to Bybit as loans.

Bitget transferred 40,000 ETH ($106 million) to Bybit as loans. Whale ‘0x3275’ transferred 20,000 ETH ($53.7 million) to Bybit as loans.

[The crypto exchange] MEXC transferred 12,652 stETH ($33.74 million) to Bybit as loans.

Whale ‘0xd7CF’” bought 15,427 ETH ($42.2 million) from CEXs (centralized exchanges) and DEXs (decentralized exchanges), then deposited it to Bybit.

A wallet suspected to be Fenbushi Capital deposited 10,000 ETH ($27 million) to Bybit.”

Furthermore, Lookonchain finds that Bybit itself purchased $197 million ETH via over-the-counter transactions.

Ethereum is trading for $2,808 at time of writing, a 1.5% increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

‘Giant Whale’ Accumulating Ethereum DeFi Altcoin, According to Lookonchain

Published

3 months agoon

February 10, 2025By

admin

A large entity is reportedly accumulating Uniswap’s native token UNI, according to blockchain tracking firm Lookonchain.

Citing data from on-chain “de-anonymizer” Arkham, Lookonchain reports that an unknown deep-pocketed investor has begun withdrawing UNI from Binance, the largest crypto exchange in the world.

“A giant whale is accumulating UNI!

This whale has withdrawn a total of 1.7 million UNI ($15.54 million) from Binance in the [past days].”

According to Arkham’s data, the whale also holds $15.8 million in Tether’s USDT in the same wallet which was created only about two weeks ago.

Uniswap is the second-largest decentralized exchange (DEX) in the world, according to CoinGecko, and UNI is its governance token. Uniswap is the top DEX operating on Ethereum (ETH).

At time of writing, UNI is trading for $9.22, up over 50% in the past year.

Lookonchain also reported two whales loading up on HYPE, the native token for the layer-1 DEX Hyperliquid.

“Whales are buying HYPE.

0xfD7A…Ea8d deposited 3 million USDC to Hyperliquid and bought 130,422 HYPE ($2.96 million).

0x3369….ADdF deposited 6.95 million USDC to Hyperliquid and bought 186,964 HYPE ($4.24 million).”

At time of writing, HYPE, which only launched just over two months ago, is trading for $23.52, up over 5% on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals