Price analysis

3 TON Charts Signaling a Major Toncoin Price Rally This November

Published

4 months agoon

By

admin

The cryptocurrency market is gearing up for a massive bull run amid positive anticipation of the U.S. presidential election result. The bullish scenario could be suitable for high-performing assets like TON to replenish the recovery momentum. Here are three bullish charts hinting at a prolonged uptrend for the Toncoin price.

By the press time, TON price traders at $4.7 with an intraday loss of 3.3%. According to CoinGecko Data, the ToncoToncoin’set cap is $11.9 Billion, while the 24-hour trading volume is $234.4 Million.

3 Key Charts Indicating a Major Toncoin Price Rally This November

TON has shown signs of resilience and investor confidence despite recent market corrections. Below, we explore three critical charts that indicate a potential major rally for Toncoin price in November.

Whale Accumulation and Exchange Outflows Signal Potential Toncoin Price Rally

According to Santiment data, the percentage of TON supply held by top addresses has surged steadily from 23.7% to 27.5% in the last three months. This trend often suggests increased confidence among major investors in the assetasset’s-term potential. Historically, whale accumulation has led to price bottom formation and a precursor for a sustained uptrend.

Moreover, the TON supply on exchange has dropped drastically from 2.54 Million to 1.68 Million in the last two months. Such a supply shift often precedes a rally, as reduced exchange availability can create upward pressure on the price when demand rises.

Plunge in MVRV Ratio Hints at Potential TON Market Rebound

Amid the recent market correction, the 30-day Market Value to Realized Value (MVRV) ratio has plunged to -6.6%. The MVRV ratio is a metric that compares an asset’s capitalization to its realized capitalization, offering insights into whether the asset is overvalued or undervalued.

Generally, a negative value indicates that short-term buyers are at a loss and could capitulate if the correction is prolonged. Such exit for speculative traders often attracts long-term buyers in the market and drives a market recovery.

TON Price Analysis Signals Breakout from 4-Month Correction

Over the past four months, the Toncoin price has witnessed a steady correction from $8.17 to $4.7, registering a loss of 42%. The daily chart displays this correction with a downsloping trendline offering dynamic resistance to TON.

As the crypto market anticipates a bullish outlook around the upcoming U.S. presidential election, the Toncoin price shifted its bearish trajectory sideways. With sustained buying, the crypto buyers could drive an 8.5% surge to challenge the dynamic resistance. A potential breakout from this resistance could accelerate the bullish momentum and push the asset 74% to $8.2.

On the contrary, if sellers defend the overhead trendline, the current correction could be extended for November.

Frequently Asked Questions (FAQs)

The anticipation of a market-wide bull run surrounding the U.S. presidential election has fueled positive sentiment for high-performing assets like Toncoin

This decline implies reduced sell-side liquidity and can lead to upward price pressure when demand rises, often signaling the potential for a price rally

The charts highlight key bullish signals, including whale accumulation, reduced exchange supply, and technical resistance nearing a breakout, all pointing toward a potential rally for Toncoin this month.

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Price analysis

Traders eye $2.80 Rally As Ripple Files New Trademark

Published

22 hours agoon

March 17, 2025By

admin

XRP price has tumbled 8% over the weekend, hitting $2.3 at press time on March 16. As Ripple advances its legal battle and files new trademarks, how will XRP markets react in the week ahead?

Ripple (XRP) Tumbles 8% to End 4-Day Winning Streak

Ripple (XRP) emerged as one of the top-performing assets last week, fueled by renewed optimism in Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC).

On Thursday, FOX analysts reported that the SEC is considering classifying XRP as a commodity as part of ongoing settlement negotiations to conclude the long-running case against Ripple. The SEC is reportedly using Ethereum’s current regulatory treatment as a benchmark in its deliberations.

If this reclassification materialises, it could significantly enhance XRP’s prospects for ETF approval and potential inclusion in a strategic crypto reserve. However, after four consecutive days of green candles for Ripple price, driven by the SEC reclassification speculations, another major regulatory headline appears to have cut the XRP price rally short.

Why Is XRP Price Going Down Today?

After a four-day winning streak fueled by speculation that the SEC may classify XRP as a commodity, another major SEC announcement appears to have halted the rally.

On Friday, March 14, the SEC announced its decision to pause the approval process for altcoin ETFs, triggering a downturn in the prices of top altcoins over the weekend, particularly those with ETF filings in progress.

This development partly explains why XRP’s price has now plunged 8%, dropping from its Friday peak of $2.49 to $2.29 as of March 16.

Derivatives Market Analysis Flashing Early Rebound Signals

Despite the recent price dip, XRP’s derivatives market metrics indicate that bullish sentiment may still be in play. First, the latest Coinglass data shows, XRP’s trading volume has increased by 12.11%, reaching $6.05 billion. This suggests that despite the price pullback, there is still significant market activity.

Also, the 24-hour liquidation data (Rekt) stands at $11.58 million, with $8.98 million in long positions and $2.60 million in short positions. This suggests that while longs took losses amid the weekend drop, short sellers are now at risk of a squeeze if the price stabilizes.

XRP’s open interest has dropped by 6.70% to $3.14 billion, indicating that leveraged positions are unwinding. This could signal the end of the current correction, setting the stage for a fresh uptrend if demand picks up.

With strong derivatives volume and long positions outweighing shorts, the market appears to be positioning for a rebound. If broader sentiment improves and regulatory fears subside, XRP could regain momentum in the coming days.

3 Key Events XRP Traders Must Watch in the Week Ahead

XRP’s correction phase appears temporary, with derivatives market indicators pointing to sustained bullish momentum. Here are key factors influencing price movements this week:

1. Ripple Files Trademark for New Crypto Wallet Application

According to recent media posts, Ripple has reportedly filed for a trademark under the name “RIPPLE CUSTODY,” which hints at a potential new product focused on crypto storage solutions.

This development could drive fresh investor interest in the week ahead. For optimistic market watchers, Ripple is now in pole position to leverage international partnerships, and friendlier regulators to ship fresh innovative products that had been hampered during years of long litigation.

2. U.S. Federal Reserve Decision on February 19

The upcoming Fed meeting will play a crucial role in shaping broader market sentiment. Any hints of dovish monetary policy could spark increased risk appetite, potentially benefiting XRP and other digital assets.

3. SEC Pauses Altcoin ETF Approvals, but Market Watches for Further Developments

The SEC has temporarily halted decisions on altcoin ETF applications, but industry analysts expect continued discussions. Strategic investors will keenly watch out for Soundbites, and insights from key ETF sponsors in the coming weeks.

XRP Price Forecast: Bulls Eye $2.80 Rebound

XRP price forecast suggests a broader crypto market recovery is underway, setting the stage for XRP’s next move. The XRP/USDT daily chart presents a mix of consolidation and volatility, but key technical indicators hint at a potential rebound. The Keltner Channel (KC) midline at $2.35 is acting as immediate resistance, and a breakout above this level could open the door toward the upper KC band near $2.77.

The Relative Strength Index (RSI) at 47.49 sits in neutral territory, signaling neither overbought nor oversold conditions. However, its recent bounce from 40 suggests growing bullish momentum. A sustained RSI climb above 50 would reinforce the case for continued upside.

Despite the recent 8.38% dip in a single session, volume data shows a healthy recovery, with prior bullish days recording over 1.25 billion in volume—a sign that buyers remain engaged. If XRP can maintain support near $2.30, the bulls could regain control, driving prices toward $2.50 in the short term and $2.80 in extension.

On the flip side, failure to hold $2.30 could invite deeper retracements, potentially testing the lower KC band near $1.92. However, given XRP’s resilience in recent sessions, the momentum currently favors a bullish scenario

Frequently Asked Questions (FAQs)

XRP fell 8% after the SEC announced a pause on altcoin ETF approvals, triggering a broader market decline over the weekend.

Yes, derivatives data shows rising trading volume and bullish sentiment, suggesting a potential rebound if market conditions improve.

Ripple’s new trademark filing, the upcoming Fed decision, and further ETF regulatory developments are crucial factors for price movement.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

Published

1 day agoon

March 16, 2025By

admin

Bitcoin’s price briefly crossed the $85,000 mark on Sunday, March 16, marking an 11% rebound from last week’s bottom of $76,000. Bullish traders have been deploying significant leverage positions on BTC ahead of the upcoming US Federal Reserve rate decision slated for March 19.

Bitcoin (BTC) Attempts $85,000 Recovery as Sellers Continue to Hold

After reaching an all-time high of $109,071 in January, Trump’s inauguration ushered in a pullback phase witch Bitcoin (BTC) experiencing a sharp decline of nearly 30%, hitting a low of $76,000 last week.

This downturn has been attributed to various factors, including geopolitical tensions following President Trump’s intervention in early March and recent US trade tariff announcements.

However, positive indicators from the US Consumer Price Index (CPI) and Producer Price Index (PPI) reports published last week have spurred a recovery. On March 16, BTC price briefly crossed the $85,000 mark, reflecting an 11.1% gain from the previous week’s low of $76,000 recorded on Tuesday, March 12.

This suggests that investor sentiment has improved significantly since the CPI data release on Wednesday, March 13, with many opting to hold their positions in anticipation of upcoming macroeconomic announcements.

What Fed Rate Outcomes Could Drive BTC to $100K?

The upcoming Federal Reserve decision on interest rates is a critical event for Bitcoin investors.

Historically, lower interest rates have led to increased liquidity in financial markets, often benefiting risk assets ranging from stocks to cryptocurrencies.

The next Federal Open Market Committee (FOMC) decision expected by Wednesday, March 19.

If the Fed signals a rate pause or hints at imminent cuts, it could boost investor confidence, potentially driving Bitcoin’s price toward the $100,000 mark.

Conversely, a hawkish stance with rate hikes could tighten liquidity, posing challenges for Bitcoin’s upward momentum.

However, based on recent data from CME Group, a majority of market watchers have priced in a 99% chance of a rate pause.

If this scenario plays out as expected, BTC price could see some upside in the aftermath of the official rate announcement, as often historically seen after less hawkish Fed decisions.

Bulls Established $1.9 Billion Dominance in Bitcoin Derivative Market

Having digested inflation-easing signals in the US CPI and PPI reports, with market watchers nearly ruling out the chances of a rate cut as previously feared, the majority of Bitcoin traders have priced in the rate pause decision and positioned trades accordingly.

In the derivatives market, bullish sentiment is evident. Over the last 7 days, bull traders have mounted long leverage positions amounting to $4.9 billion, while short leverage positions stand at $3.8 billion, giving bulls a net dominance of $1.1 billion.

BTC Outlook for the Week Ahead

This substantial long positioning indicates strong market confidence in Bitcoin’s future appreciation. However, it’s essential to monitor these leveraged positions closely, as sudden market shifts could lead to liquidations, amplifying price movements.

Given the 11% BTC price rebound over the past week, the anticipated Fed rate pause may have already been priced in, and many traders could capitalize on the announcement to execute a sell-the-news strategy.

In this scenario, BTC could see another downturn below the $80,000 mark, especially with long traders currently holding over-leveraged positions.

Bitcoin Price Forecast: Recovery in Play, but $100K Remains a Tough Target

Bitcoin price forecast chart below is showing signs of more upside potential after rebounding 11% from the recent $76,000 low, to reach $83,175 at press time. The bullish case for BTC price action new week is supported by a number of technical indicators, but the path to $100,000 remains uncertain as key resistance levels and market sentiment present challenges.

First, the Elliott Wave count suggests Bitcoin has completed a corrective leg down, aligning with the 1.618 Fibonacci extension at $76,555.

A bounce from this level indicates potential for a relief rally, with immediate targets at the 0.382 Fibonacci retracement level of $89,085, followed by $92,956 (0.5 retracement) and a stronger resistance near $96,827 at the 0.618 level.

Additionally, the Parabolic SAR indicator, currently at $97,068, further reinforces this zone as a pivotal area where bullish momentum could face major resistance.

However, bearish risks remain prominent. The volume profile shows declining buy-side momentum, suggesting a lack of strong conviction among bulls.

More so, the BBP (Bear/Bull Power) indicator remains deeply negative at -10,559, signaling that downward pressure is still in play. If Bitcoin fails to reclaim $89,000 convincingly, it could trigger another sell-off toward the $76,000 support level, potentially exposing the market to further downside.

For the week ahead, Bitcoin’s price action hinges on reclaiming $89,000. A decisive close above this level could fuel a rally toward $97,000, but failure to break above could see BTC revisiting $80,000 or lower.

Frequently Asked Questions (FAQs)

If the Fed signals a rate pause or future cuts, Bitcoin could rally. However, strong resistance levels and profit-taking may slow momentum.

BTC must reclaim $89,000 to sustain an uptrend. Resistance sits at $92,956 and $96,827, while support remains at $80,000 and $76,000.

Bulls hold a $1.1 billion net dominance in derivatives, but over-leverage increases liquidation risks, potentially leading to sharp price swings.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

layer 1

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Published

1 day agoon

March 16, 2025By

admin

Cryptocurrency prices rose modestly during the weekend as investors embraced a risk-on sentiment following Friday’s surge in the US stock market.

Bitcoin (BTC) held steady above $84,000, while the market cap of all coins rose to over $2.8 trillion.

The crypto market will have two main catalysts this week: President Donald Trump’s tariffs and the Federal Reserve’s interest rate decisions. A sign of Trump easing his stand on tariffs and a more dovish Fed will be bullish for cryptocurrencies and other risky assets.

The top cryptocurrencies to watch this week will be Binance Coin (BNB), Cronos (CRO), and ZetaChain (ZETA).

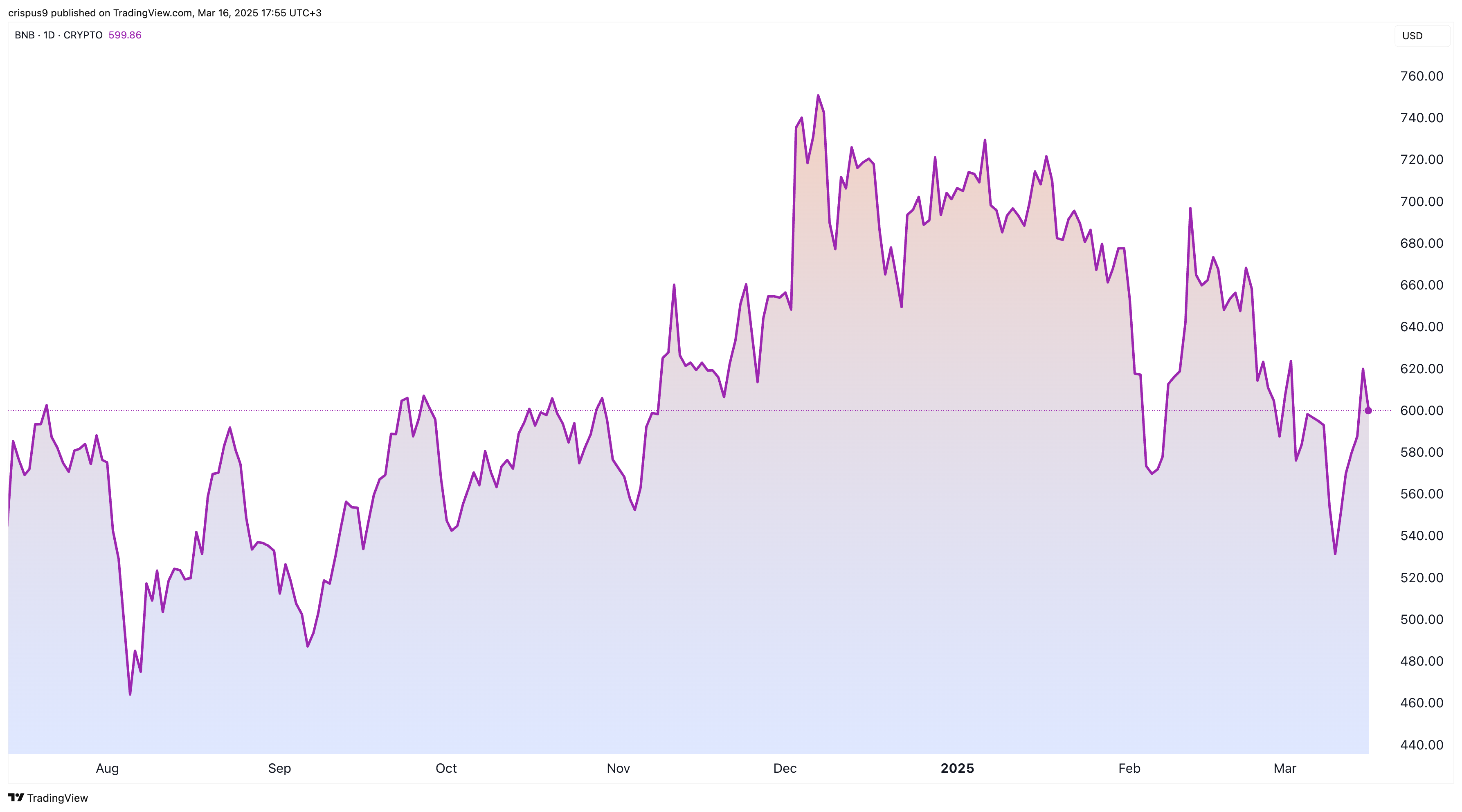

BNB

BNB price will be in the spotlight this week as the developers activate the Pascal hard fork on March 20. This is one of the three upgrades scheduled for the year’s first half. It is set to introduce newer features, including more Ethereum compatibility, native smart contract wallets, and more security.

The other two upgrades will improve BNB Chain’s speed and security. This is happening as the BSC Chain becomes one of the best alternatives to Ethereum (ETH) and Solana (SOL). Ethereum has higher fees and is slow, while the Solana network is highly associated with meme coins.

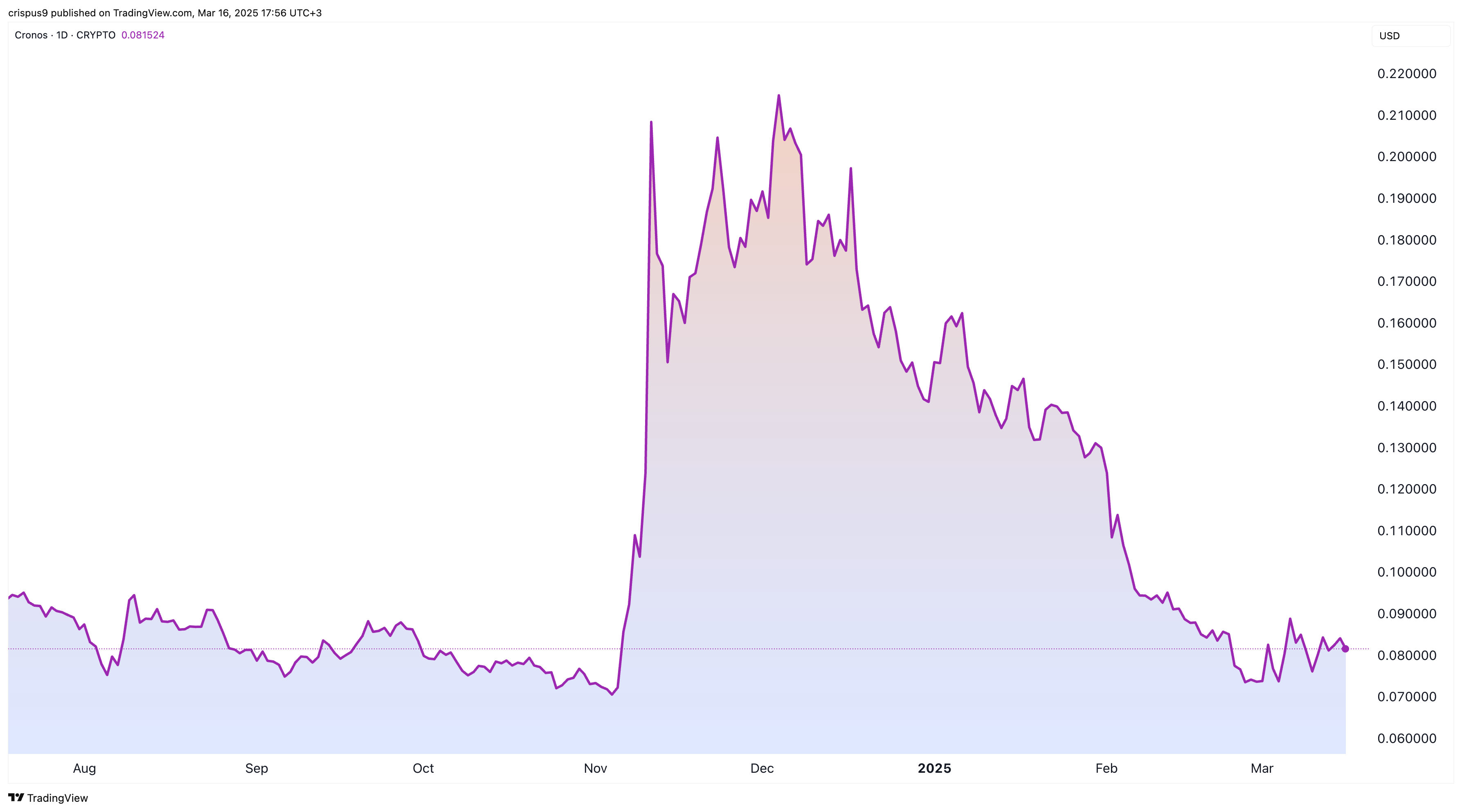

Cronos

A key Cronos vote will conclude on March 17. This crucial vote seeks to determine the creation of the Cronos Strategic Reserve. It aims to do that by undoing a 70 billion token burn that happened in 2021.

If the vote passes, Cronos will create 70 billion tokens and use them to create a reserve that will be used to support the ecosystem. Critics argue that creating these new tokens will dilute existing investors by adding to the supply.

Voting data shows that 45.8% of users have voted in support of the proposal, while 44.4% have rejected it. 9.27% have abstained. If the vote ends like this, the proposal will be rejected as the turnout is less than the quorum.

ZetaChain

ZetaChain is another top cryptocurrency to watch after its price crashed to a record low of $0.2070. It has dropped by over 92% from its all-time high, bringing its market cap to $151 million.

One reason for the ZETA price crash is that the total value locked in its ecosystem has crashed to $13 million from its all-time high of near $20 million.

The other reason is that Zetachain is highly dilutive as it has a circulating supply of 731 million against a total supply of 2.1 billion.

The network will unlock tokens worth over $6.6 million, representing 4.29% of the float this week. Cryptocurrencies are often highly volatile when there is a major unlock.

Source link

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: