XRP

62.8% Of XRP Realized Cap Held By New Investors: Sign Of Fragility?

Published

3 weeks agoon

By

admin

On-chain data shows a large portion of the XRP Realized Cap is in the hands of investors who got in during the last six months. Here’s what this could mean for the asset.

XRP Investors Younger Than Six Months Have Significantly Increased Realized Cap Share

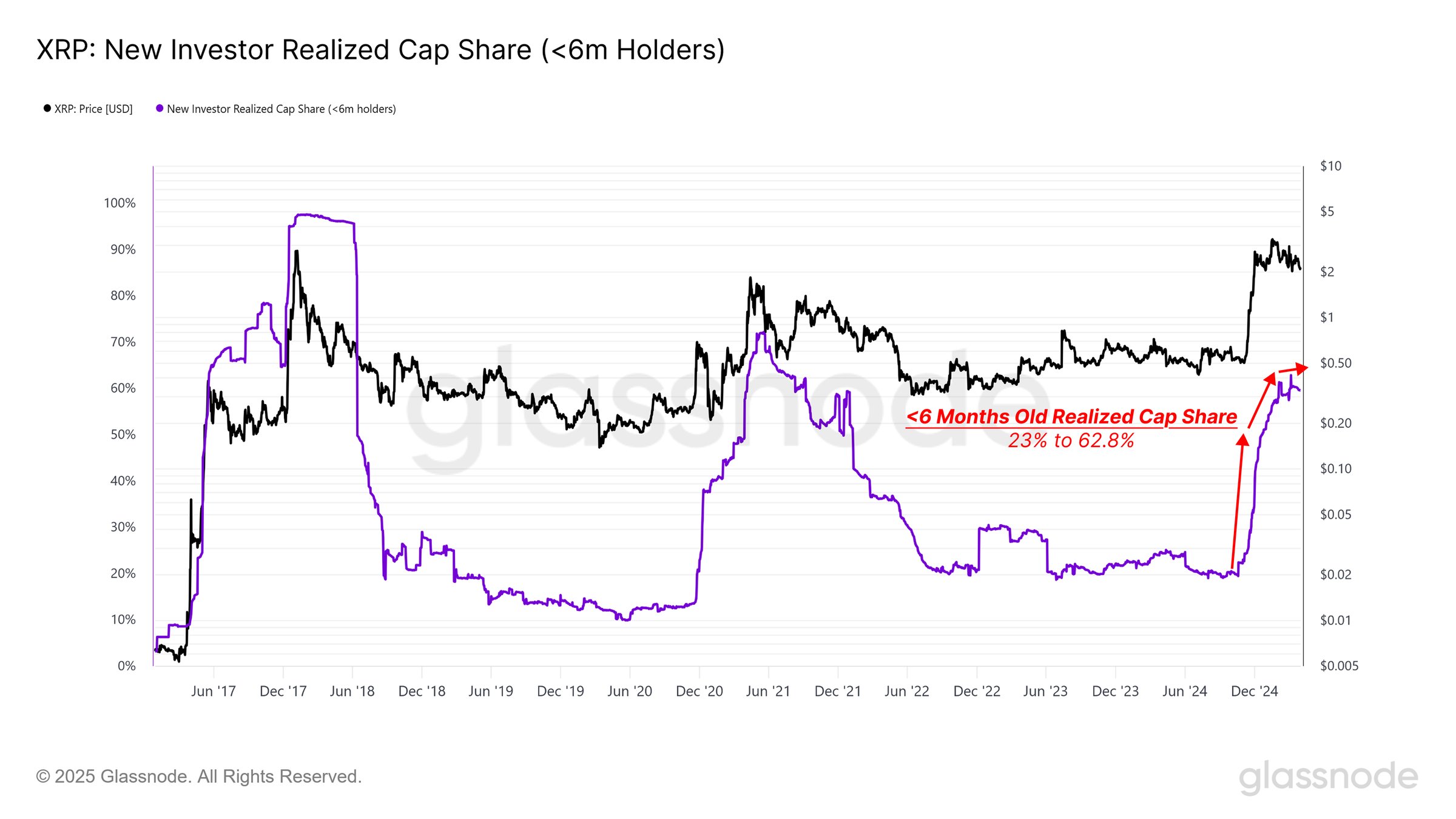

In a new post on X, the on-chain analytics firm Glassnode has discussed how the Realized Cap of XRP has changed recently. The “Realized Cap” here refers to an indicator that, in short, keeps track of the total amount of capital that the holders of the asset as a whole have invested into it.

Changes in this metric, therefore, correspond to inflows and outflows that the cryptocurrency is observing. Below is the chart shared by the analytics firm that shows the trend in the Realized Cap for XRP over the last few years.

As displayed in the above graph, the XRP Realized Cap has shot up during the past few months, implying that a large amount of capital has flown into the cryptocurrency. More specifically, the asset has seen the metric double from around $30.1 billion to $64.2 billion.

In the same chart, Glassnode has also attached the data of the indicator for the young investor age groups. It would appear that the capital held by cohorts like 1-month to 3 months and 3 months to 6 months has spiked recently, which makes sense considering the growth in the aggregated Realized Cap has come during these windows.

According to the analytics firm, this short-term capital spike is a sign of retail-led momentum. The momentum appears to have cooled off, however, as the metric has no longer been growing as sharply recently.

A consequence of all the fresh capital inflows is that XRP has seen a shakeup in investor dominance. As another chart shared by Glassnode shows, the new investors, comprising all the age bands under 6 months, have witnessed their Realized Cap share blow up.

Prior to the new inflows, this cohort controlled just 23% of the cryptocurrency’s Realized Cap, but today that value has grown to 62.8%. This means that 62.8% of the entire capital invested into the coin has come at price levels of the last six months.

Given that XRP is currently trading under the prices that it has been at for most of this window, a lot of these holders would be underwater. “This rapid concentration in new holders reflects strong retail involvement – but also raises the risk of fragility, as many hold elevated cost bases,” notes the analytics firm.

From the chart, it’s apparent that these are the same conditions that led to a top during the last two bull markets. With inflows slowing down as the price declines, it’s possible that the same pattern may once again be forming for XRP.

XRP Price

With a plunge of more than 8% in the last 24 hours, XRP has retraced its latest recovery as its price has returned to $1.78.

Source link

You may like

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

24/7 Cryptocurrency News

Ripple President Monica Long Shares Big Updates For XRP Community

Published

3 days agoon

April 25, 2025By

admin

Ripple President Monica Long once again caught the XRP community’s attention with her comments about the latest developments. In a recent interview, Long highlighted the recent acquisition and other key insights about the blockchain firm and its products. Besides, she also predicted 2025 to be the best year for Ripple so far, which has further boosted market sentiment.

Notably, her comments come as CEO Brad Garlinhouse also lauded a recent update, signaling a stronger global push for the firm’s financial infrastructure.

Ripple President Monica Long On Hidden Road Deal

Ripple President Monica Long, in an interview with CNBC’s Arjun Kharpal, discussed the firm’s recent acquisition of Hidden Road. The blockchain firm, known for its prime brokerage services, will now play a vital role in enhancing Ripple’s core offerings—payments, custody, and asset tokenization.

Long emphasized that this move directly supports the blockchain firm’s long-standing goal of building robust financial infrastructure for enterprises. Besides, she noted Ripple’s global presence, saying they’ve built their network “brick by brick” with powerful liquidity tools and real-time settlement capabilities.

Meanwhile, she noted that the company now holds more than 60 regulatory licenses worldwide, giving it a solid advantage in delivering end-to-end financial services. Monica Long expressed particular excitement about integrating Hidden Road’s services with Ripple’s ecosystem.

She highlighted that combining prime brokerage, post-trade settlement via the XRP Ledger (XRPL), and Ripple’s institutional-grade custody can unlock major efficiencies. According to the Ripple President, these developments lay the groundwork for Ripple’s most successful year yet.

Besides, recent Ripple Director Craddock has highlighted the potential of the Hidden Road deal and explained the role of XRP Ledger (XRPL) in it.

Ripple CEO Sparks Optimism With Recent XRP Update

Monica Long underlined that Ripple’s strength lies in handling the full financial flow, from liquidity sourcing to last-mile payouts. XRP and the upcoming RLUSD stablecoin will remain central to this infrastructure. With Ripple’s growing stack of services, digital asset utility is expected to skyrocket. She also stated:

“2025 is shaping up to be the best year yet for Ripple.”

Amid the positive updates from Monica Long, Ripple CEO Brad Garlinghouse welcomed the CME Group’s move to introduce XRP Futures on May 19. He said the launch may be “overdue,” but stressed that it marks a major milestone for XRP’s market maturity. Lauding the update, Ripple CEO Garlinghouse said:

“This is an incredibly important and exciting step in the continued growth of the XRP market!”

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Ripple

XRP Price Slips After Rally — Bulls Still in Play or Fading Fast?

Published

4 days agoon

April 24, 2025By

admin

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Source link

Altcoins

XRP, Solana, DOGE and Others Among 72 Different ETF Applications Waiting for SEC Approval: Report

Published

4 days agoon

April 24, 2025By

admin

Crypto firms are now waiting to hear back on 72 active applications for new crypto-related exchange-traded funds (ETFs).

James Seyffart, an ETF analyst at Bloomberg Intelligence, compiled the list of submissions to the U.S. Securities and Exchange Commission (SEC).

ETFs awaiting approval include funds tied to Solana (SOL), XRP (XRP), Sui (SUI), Litecoin (LTC), Axelar (AXL) Hedera (HBAR), BNB, Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE), Polkadot (DOT), Aptos (APT), Chainlink (LINK), Pudgy Penguins (PENGU), Official Trump (TRUMP), Melania (MELANIA) and Bonk (BONK).

Other potential new ETFs are tied to a basket of currencies, and a few are based on Bitcoin (BTC) and/or Ethereum (ETH), assets that have already been approved for inclusion in other spot ETFs.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, predicts that BTC ETFs will remain dominant regardless of the number of altcoin funds that are approved.

“No Second Best? Bitcoin ETFs command 90% of all the crypto fund assets globally. While a TON of alt/meme coin ETFs are likely going to hit market this year, they will only make a minor dent, Bitcoin likely to retain at least 80-85% share long-term.”

The SEC greenlit the first spot market Bitcoin ETFs in January 2024, bringing in billions of dollars worth of inflows to the top digital asset by market cap, and the regulator subsequently approved Ethereum ETFs for trading last July.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Don White – Art Dreamer/Vladimir Sazonov

Source link

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: