Bitcoin

The Case For A Future Valuation Of $1 Million

Published

5 months agoon

By

admin

Since November 5, the day President-elect Donald Trump secured another term in office, Bitcoin has experienced a remarkable uptrend, reaching a new all-time high of $93,300.

Since then, BTC has been trading within a narrow range between $89,000 and $92,000, positioning for a potential move toward the $100,000 milestone. This raises an intriguing question whether a price of $1 million per coin is feasible over the next decade.

A Long-Term Vision For Investors

Market expert VirtualBacon has conducted an in-depth analysis of these possibilities, delving into the numbers, trends, and catalysts that could propel Bitcoin to experience a surge of nearly 1,000% from its current price levels.

Within the current market cycle, the expert forecasts that Bitcoin could hit $200,000 in the next one to two years. However, he notes that while this milestone is significant, altcoins may offer higher returns at a greater risk, often crashing by 80% to 90% in bear markets.

In contrast to altcoins, which face increasing regulatory scrutiny, Bitcoin stands out as a safer long-term investment. VirtualBacon argues that Bitcoin’s potential is not just confined to the next few years but spans a decade or more.

Related Reading

To understand why Bitcoin’s price could reach $1 million, VirtualBacon asserts that investors need to consider its fundamental utility as a store of value. Bitcoin’s fixed supply of 21 million coins, its global accessibility, and its resistance to censorship and manipulation make it a compelling alternative to traditional financial assets.

The expert suggests that if Bitcoin is to become recognized as the digital gold of the 21st century, reaching a market capitalization that rivals gold’s estimated $13 trillion is not merely a theoretical possibility but “a logical outcome.”

Key drivers for this potential growth include increasing participation from asset managers, corporate treasuries, central banks, and wealthy individuals. Recent data indicates that Bitcoin ETFs have seen record inflows, with $1 billion invested last week, reflecting growing institutional confidence.

Additionally, discussions among corporations, such as Microsoft considering Bitcoin reserves, further enhance its strategic value. Wealthy individuals are also beginning to adopt Bitcoin as a standard portfolio allocation, with even a modest 1% investment becoming commonplace among billionaires.

What Does Bitcoin Need To Reach $1 Million?

For Bitcoin to reach the $1 million mark, two critical factors must be analyzed: global wealth growth and portfolio allocation. VirtualBacon notes that in 2022, total global wealth was estimated at $454 trillion, and projections suggest this could grow to $750 trillion by 2034.

Currently, gold holds approximately 3.9% of global wealth, while Bitcoin is at a mere 0.35%. If Bitcoin’s allocation in global portfolios rose to just 3%, still significantly below gold’s share, its market cap could soar to $20 trillion, pushing the price to $1 million per coin.

Historically, gold’s market cap saw significant growth following the launch of exchange-traded funds in 2004, with its portfolio allocation increasing from 1.67% to 4.74% over the next decade.

Related Reading

If Bitcoin follows a similar trajectory, its allocation could rise from 0.35% to 1.05% or more, translating to a market cap of approximately $7.92 trillion, equating to about $395,000 per Bitcoin. Therefore, reaching $1 million doesn’t require Bitcoin to surpass gold; it must capture about 57% of gold’s projected market cap by 2034.

With gold representing 4.7% of global portfolios compared to Bitcoin’s 0.35%, a modest increase in Bitcoin’s share of global wealth to 3%—just 60% of gold’s allocation—could “easily” result in a $20 trillion market cap and a $1 million price point.

At the time of writing, BTC is trading at $92,240, up 7% every week.

Featured image from DALL-E, chart from TradingView.com

Source link

You may like

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Altcoins

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

Published

39 minutes agoon

April 17, 2025By

admin

A widely followed crypto analyst says one Solana (SOL) competitor may be gearing up for a breakout.

In a new thread, crypto trader Michaël van de Poppe tells his 783,000 followers on the social media platform X that Sei (SEI) may increase more than 100% its current value if it breaks through a key resistance level.

“SEI starts to show momentum. The Bitcoin pair has a strong bullish divergence on the higher timeframes and the USD pair faces a crucial resistance. Breaking through $0.20 opens up a continuation towards $0.30-$0.35.”

SEI is trading for $0.17 at time of writing, down 2.4% in the last 24 hours.

Next up, the analyst says that Bitcoin (BTC) is in a consolidation phase that may lead to an explosive move to the upside.

“Bitcoin is stuck in the final range. Another test of $87,000 and we’ll likely break upwards to the rally of a new all-time high.”

Bitcoin is trading for $83,800 at time of writing, flat on the day.

Lastly, the analyst says that Ethereum (ETH) may be kicking off an uptrend if the price of gold peaks, based on ETH’s historic inverse correlation with the precious metal.

“A good start of the week, as ETH is +4% against Bitcoin. The ultimate question whether it will sustain or not, last months it has been giving back the returns in the days after. What to monitor? Gold peaking or not. If that’s the case, then we’ll see more strength on ETH.”

The analyst also says that ETH’s Relative Strength Index (RSI) indicator is flashing bullish, having entered oversold territory.

The RSI is a momentum oscillator used to determine whether an asset is oversold or overbought. The RSI’s values range from zero to 100. A level between 70 and 100 indicates that an asset is overbought. The 0 to 30 level range indicates that an asset is oversold.

“It’s been a bear market for 1,225 days for ETH, as, in this period, gold did a 2x. The lowest RSI on the weekly candle for ETH as well.”

ETH is trading for $1,589 at time of writing, down 2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Published

5 hours agoon

April 16, 2025By

admin

A modest bitcoin rally to a possible challenge of the $86,000 level quickly reversed during U.S. afternoon trading hours on Wednesday as Federal Reserve Chairman Jerome Powell warned on the effects of President Trump’s tariff regime.

“The level of the tariff increases announced so far is significantly larger than anticipated,” said Powell in a speech. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

In other words, stagflation — a throwback to a sizable portion of the 1970s when the U.S. experienced weak economic activity alongside double-digit inflation.

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” continued Powell.

The price of bitcoin (BTC) fell about 2.5% in the minutes following the Powell remarks, now trading at $83,700, down 1.5% over the past 24 hours.

U.S. stocks, which had been trying to mount a comeback from opening declines, also were hit, the Nasdaq slumping 3.4% to a session low.

Powell also mentioned that as crypto is becoming more mainstream, there’s a need for a legal framework for stablecoins. He said that banking regulation around crypto will likely be “partially relaxed.”

The U.S. Senate Banking Committee cleared a bill to regulate stablecoin issuers in March, marking the first committee approval and a significant step closer to law in the U.S.

Hawkish Fed weighs on crypto and BTC

“Powell came out extremely hawkish,” Quinn Thompson, chief investment officer of hedge fund Lekker Capital, said in a Telegram message. It’s notable that Powell downplayed last week’s market turmoil characterizing it as “orderly market functioning,” he added.

“I would have at least expected him to give a nod to the elevated volatility and ruptures forming in the treasury market but he did not do that,” Thompson said.

Powell’s tone suggests that investors should temper their expectations for rate cuts in the upcoming meetings, said Thompson, which could weigh on risk assets including crypto.

“It appears a May cut is firmly off the table barring Fed intervention for bad reasons and I wouldn’t say June is a lock either,” concluded Thompson. “The bull case for crypto and bitcoin specifically is liquidity and policymaker intervention. Both of those seemed very far off based, so it’s difficult for me to paint a constructive picture in the immediate term.”

UPDATE (April 16, 18:40 UTC): Adds additional comments made by Chair Powell about stablecoins. Adds analyst comment.

Source link

Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Published

7 hours agoon

April 16, 2025By

admin

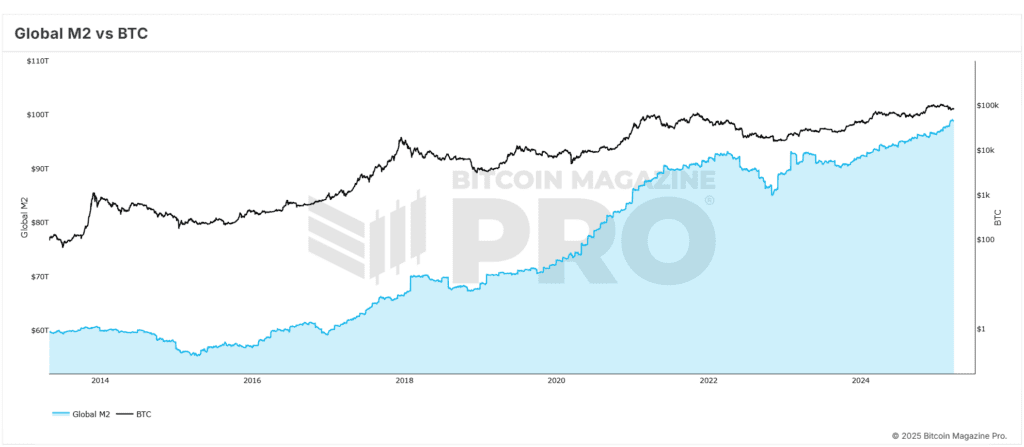

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

Bitcoin Price and Global Liquidity: A High-Impact Correlation

Crosby highlights a remarkable and consistent correlation—often exceeding 84%—between Bitcoin price and global M2 liquidity levels. As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay. Historical data supports the observation of a 56–60 day lag between monetary expansion and Bitcoin price increases.

This insight has recently proven accurate, as Bitcoin price rebounded from lows of $75,000 to above $85,000. This trend closely aligns with the forecasted recovery that Crosby and his team had outlined based on macro indicators, validating the strength and reliability of the correlation driving Bitcoin price upward.

Why the 2-Month Delay Impacts Bitcoin Price

The two-month delay in market response is a critical observation for understanding Bitcoin price movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets like BTC. Instead, there is an incubation period, typically around two months, during which liquidity filters through financial systems and begins to influence Bitcoin price.

Crosby has optimized this correlation through various backtests, adjusting timeframes and offsets. Their findings indicate that a 60-day delay yields the most predictive accuracy across both short-term (1-year) and extended (4-year) historical Bitcoin price action. This lag provides a strategic advantage to investors who monitor macro trends to anticipate Bitcoin price surges.

S&P 500 and Its Influence on Bitcoin Price Trends

Adding further credibility to the thesis, Crosby extends his analysis to traditional equity markets. The S&P 500 exhibits an even stronger all-time correlation of approximately 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driver not just for Bitcoin price, but also for broader risk-on asset classes.

By comparing liquidity trends with multiple indices, Crosby demonstrates that Bitcoin price is not an anomaly but part of a broader systemic pattern. When liquidity rises, equities and digital assets alike tend to benefit, making M2 supply an essential indicator for timing Bitcoin price movements.

Forecasting Bitcoin Price to $108,000 by June 2025

To build a forward-looking perspective, Crosby employs historical fractals from previous bull markets to project future Bitcoin price movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin price could retest and potentially surpass its all-time highs, targeting $108,000 by June 2025.

This optimistic projection for Bitcoin price hinges on the assumption that global liquidity continues its upward trajectory. The Federal Reserve’s recent statements suggest that further monetary stimulus could be deployed if market stability falters—another tailwind for Bitcoin price growth.

The Rate of Expansion Affects Bitcoin Price

While rising liquidity levels are significant, Crosby stresses the importance of monitoring the rate of liquidity expansion to predict Bitcoin price trends. The year-on-year M2 growth rate offers a more nuanced view of macroeconomic momentum. Although liquidity has generally increased, the pace of expansion had slowed temporarily before resuming an upward trend in recent months.

This trend is strikingly similar to conditions observed in early 2017, just before Bitcoin price entered an exponential growth phase. The parallels reinforce Crosby’s bullish outlook on Bitcoin price and emphasize the importance of dynamic, rather than static, macro analysis.

Final Thoughts: Preparing for the Next Bitcoin Price Phase

While potential risks such as a global recession or a significant equity market correction persist, current macro indicators point toward a favorable environment for Bitcoin price. Crosby’s data-driven approach offers investors a strategic lens to interpret and navigate the market.

For those looking to make informed decisions in a volatile environment, these insights provide actionable intelligence grounded in economic fundamentals to capitalize on Bitcoin price opportunities.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon