Bitcoin

Ethereum outpaces Bitcoin in daily net flows for spot ETFs

Published

1 month agoon

By

admin

Ethereum spot ETFs mark a historic milestone with a $332.92 million daily inflow, surpassing Bitcoin ETFs amid the ETH price surge.

The latest data from SoSoValue reveals that Ethereum (ETH) spot ETFs have recorded $332.92 million in daily net inflows as of Nov. 29, outpacing Bitcoin (BTC) spot ETFs’ $320.01 million for the first time since inception.

This development coincides with Ethereum’s price surge of over 3% in the last 24 hours, while Bitcoin showed minimal movement during the same period.

Ethereum ETF performance breakdown

The first spot Ethereum ETFs in the U.S. began trading on July 23. These ETFs, approved by the U.S. Securities and Exchange Commission, include products from well-known financial institutions like BlackRock, Fidelity and Grayscale, among others. They provide investors exposure to Ethereum’s price without needing to directly hold the cryptocurrency.

Here’s a look at how those ETFs are performing today:

- BlackRock’s iShares Ethereum Trust ETF, trading on NASDAQ, emerged as the top performer. It boasts $250.39 million in daily net inflow. The fund’s cumulative net inflow stands at $2.1 billion, with net assets of $2.5 billion.

- Grayscale Ethereum Mini Trust, listed on NYSE, recorded $3.39 million in daily inflows, contributing to its substantial cumulative net inflow of $420.15 million. The fund currently maintains a 0.35% ETH share with a market price of $33.84.

- Fidelity Ethereum Fund, on the Cboe Exchange, secured $79.44 million in daily inflows, pushing its cumulative total to $824.23 million. The fund trades at $35.88 with a 0.22% ETH share.

Bitcoin ETFs maintain strong presence

Despite being overtaken in daily flows, Bitcoin spot ETFs demonstrate strong performance. BlackRock’s iShares Bitcoin Trust ETF recorded $137.49 million in daily net inflow. IBIT’s cumulative net inflow has reached $31.74 billion, commanding a 2.51% BTC share.

Fidelity Wise Origin Bitcoin Fund, or FBTC, followed with $106.46 million in daily inflow, while Bitwise Bitcoin ETF, or BITB, secured $26.54 million.

Notably, Grayscale Bitcoin Trust showed no daily inflow, maintaining its cumulative position at -$20.52 billion.

The total value traded for Ethereum ETFs reached $313.61 million, while Bitcoin ETFs recorded a higher volume of $2.51 billion. The cumulative total net inflow stands at $573.32 million for Ethereum ETFs and $30.70 billion for Bitcoin ETFs.

The first spot Bitcoin ETF was approved and launched in Canada by Purpose Investments. It began trading on the Toronto Stock Exchange (TSX) under the ticker BTCC on Feb. 18, 2021. This was a significant milestone, as it marked the world’s first-ever ETF directly holding Bitcoin.

In the U.S., however, the SEC has not yet approved a spot Bitcoin ETF as of November 2024. The U.S. market currently only has futures-based Bitcoin ETFs, which started with the ProShares Bitcoin Strategy ETF (BITO) in October 2021.

Source link

You may like

Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals

Is USDT Losing to RLUSD and USDC?

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple President Says 2025 Will Be a Big Year for Crypto, Predicts More Spot ETFs Will Be Launched – Here’s Why

Billionaire investor predicts 11,466% run for $0.175 token

Binance Leads Bitcoin and Ethereum Outflows in 2024

Bitcoin

Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals

Published

21 minutes agoon

January 10, 2025By

admin

The on-chain analytics firm Glassnode has revealed the level Bitcoin would have to rise to if it has to reach the historical top zone in this pricing model.

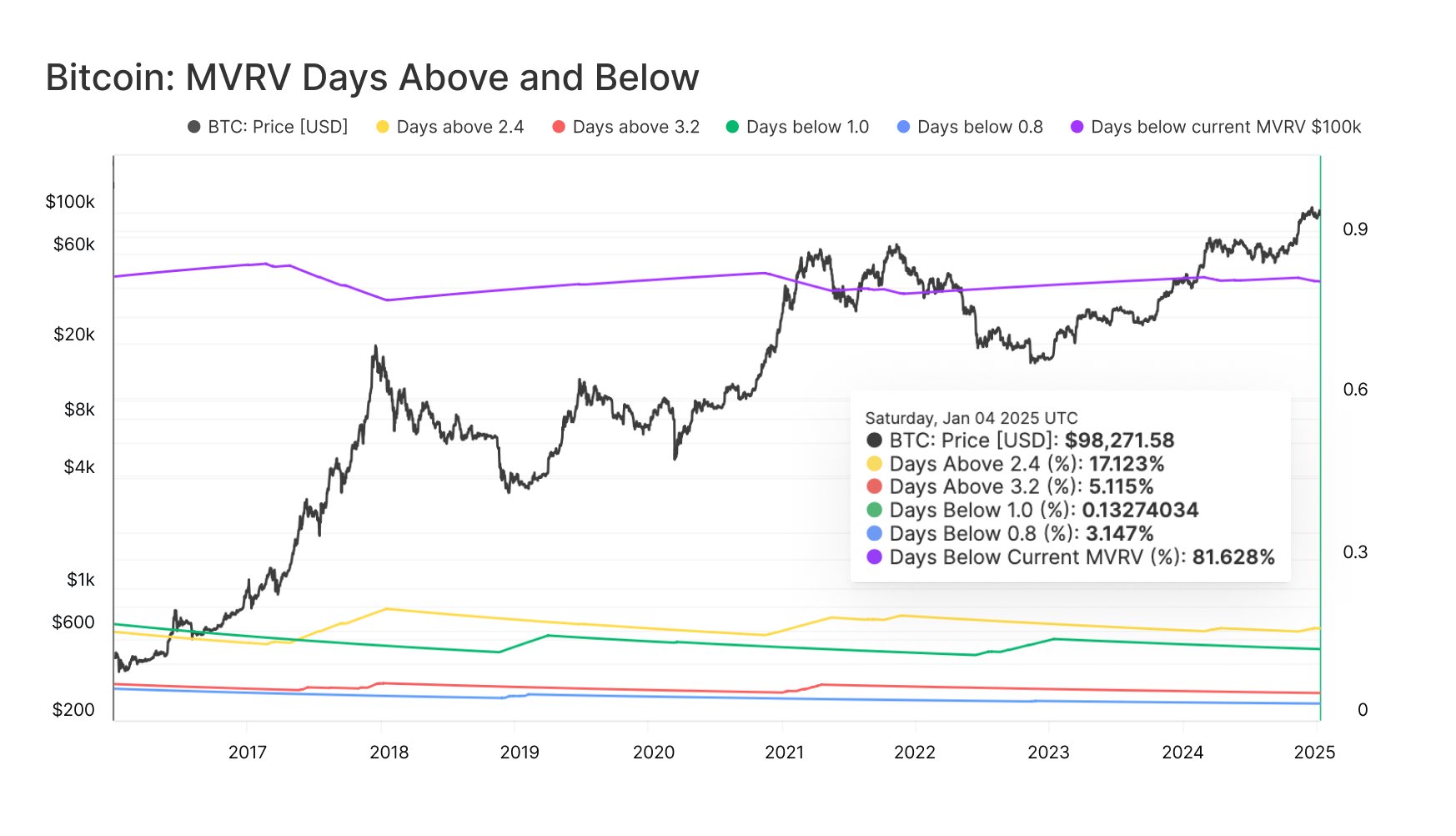

Bitcoin Hasn’t Surpassed Last MVRV Pricing Band Yet

In a new post on X, Glassnode has talked about the extreme euphoria threshold of the Bitcoin Market Value to Realized Value (MVRV) Pricing Bands. The MVRV Pricing Bands is a pricing model for the cryptocurrency that’s based on the MVRV Ratio.

Related Reading

The “MVRV Ratio” is a popular on-chain indicator that keeps track of how the value held by the Bitcoin investors (that is, the market cap) compares against the value that they initially put in (the realized cap). When the metric is greater than 1, the investors are holding more value than their initial investment, meaning that they are in a state of net profit. On the other hand, it being under the threshold suggests the market as a whole is underwater.

Historically, the holders being in too much profit has often signaled overheated conditions for Bitcoin, due to the fact that mass selloffs with the motive of profit-taking become probable in such conditions. Similarly, the dominance of loss has led to bottoms, as there aren’t many sellers left during these periods.

The MVRV Pricing Bands aim to capture this relationship. It defines certain price levels for the cryptocurrency that correspond to important levels in the MVRV Ratio.

Here is the chart for the model shared by Glassnode that shows the trend in these Bitcoin pricing bands over the last several years:

From the graph, it’s visible that the 0.8 pricing band, which is where the MVRV Ratio assumes a value equal to 0.8, has been around where bear market bottoms have formed for the asset. Right now, BTC is far above this level, situated at $33,100. The coin’s price is also at a significant distance from the 1.0 level of $41,300, which corresponds to the cost basis of the average address or investor on the network.

The pricing bands that BTC is currently trading under are the 2.4 and 3.2 levels, located at $99,300 and $132,400, respectively. The former of these has historically served as a signal that the bull market is getting heated.

Related Reading

BTC can stay inside this zone for a while, but once the market cap surpasses the 3.2 level, it becomes very likely that some type of top is going to be hit soon.

The chart below illustrates just how rare it is for the asset to trade in the region above 3.2:

“BTC price has historically spent only ~5% of trading days above the 3.2 MVRV level,” notes the analytics firm. “This highlights how rare such peaks are and reinforces why it’s often considered an “extreme euphoria” zone.”

So far, Bitcoin hasn’t been able to surpass this line in the current cycle. If the past bull markets are anything to go by, the top would only occur above this level, which would imply more room still left for the asset to run in the current cycle. It only remains to be seen, though, whether the pattern would actually hold this time or not.

BTC Price

At the time of writing, Bitcoin is trading at around $93,400, down more than 3% over the last seven days.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Source link

24/7 Cryptocurrency News

Binance Leads Bitcoin and Ethereum Outflows in 2024

Published

6 hours agoon

January 9, 2025By

admin

Binance Exchange is in the spotlight as the trading platform that dominated Bitcoin (BTC) and Ethereum (ETH) outflows in the past year. According to CryptoQuant analyst Crazzyblockk, the trading platform set a new benchmark for exchange activity.

The Binance Bitcoin and Ethereum Outflow Dominance

According to Crazzyblockk, crypto exchange Binance processed nearly 2 million Bitcoin and Ethereum outflow transactions in December 2024. Since 2018, the exchange has consistently led the market per Bitcoin and Ethereum outflow transaction counts.

Binance Dominates Bitcoin and Ethereum Outflows in 2024

“In the last month of 2024, Binance processed nearly 2 million BTC and ETH outflow transactions, setting a new benchmark for exchange activity.” – By @Crazzyblockk

More details 👇https://t.co/2O2s440FYz pic.twitter.com/zYG0BasQcg

— CryptoQuant.com (@cryptoquant_com) January 9, 2025

Despite the shift in the U.S. market per the emergence of crypto-based exchange-traded funds, CryptoQuant noted that Binance maintained its dominance. The trading firm led its rivals to process the highest monthly BTC and ETH outflow trades.

The analyst pointed out that the December 2 million outflow transaction count shows Binance’s deep liquidity. The record presents the exchange with robust infrastructure and a defined role as a core gateway for crypto trading withdrawals.

Binance achieved this milestone despite the impact of the departure of Changpeng ‘CZ’ Zhao as the CEO in 2023

Exchanges Supporting Crypto Market

While Binance ranked as the biggest per Bitcoin and Ethereum outflow processing, exchanges generally played a vital role in the crypto market’s evolution last year.

Coinbase exchange, for instance, played a vital role as a major custodian for Bitcoin and Ethereum ETF issuers. Beyond its role in the institutional market, Coinbase also played a key role in offering retail products through new token listings. Coingape reported recently that Coinbase listed MOG Coin, Moo Deng, and other retail-focused tokens.

Rivals like Binance have also stepped up their listing game to match support for other evolving assets beyond BTC and ETH.

Market Predictions For 2025 – Bitcoin and Ethereum In Focus

Bitcoin and Ethereum influence the market with a combined dominance of at least 68.8%. While CryptoQuant did not predict what outflow trends might accompany the assets this year, industry leaders gave some forecasts about both coins and their ecosystems.

Bitwise, for instance, predicted that Bitcoin and Ethereum prices would hit a new all-time high (ATH) this year. Specifically, Bitwise said BTC would hit $200,000 and Ethereum would hit $7,000 this year.

Meanwhile, BTC has recorded multiple ATHs this bull cycle fueled by demand from Binance and other platforms. However, Ethereum has yet to break a similar record. Other asset managers like Galaxy Digital also issued optimistic forecasts for BTC and ETH this year.

Ultimately, the belief is that due to their dominance and correlation with altcoins, a growth in their price might create a ripple effect for other digital assets.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals

Is USDT Losing to RLUSD and USDC?

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple President Says 2025 Will Be a Big Year for Crypto, Predicts More Spot ETFs Will Be Launched – Here’s Why

Billionaire investor predicts 11,466% run for $0.175 token

Binance Leads Bitcoin and Ethereum Outflows in 2024

The Future Of Home Bitcoin Mining Is Bright

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

Using Mining To Create More Fully Validating Bitcoin Users

Mastercard brings p2p aliases for crypto transfers in UAE, Kazakhstan: report

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: