Bitcoin

Bitcoin rebound and head to $100,000 target again

Published

1 month agoon

By

admin

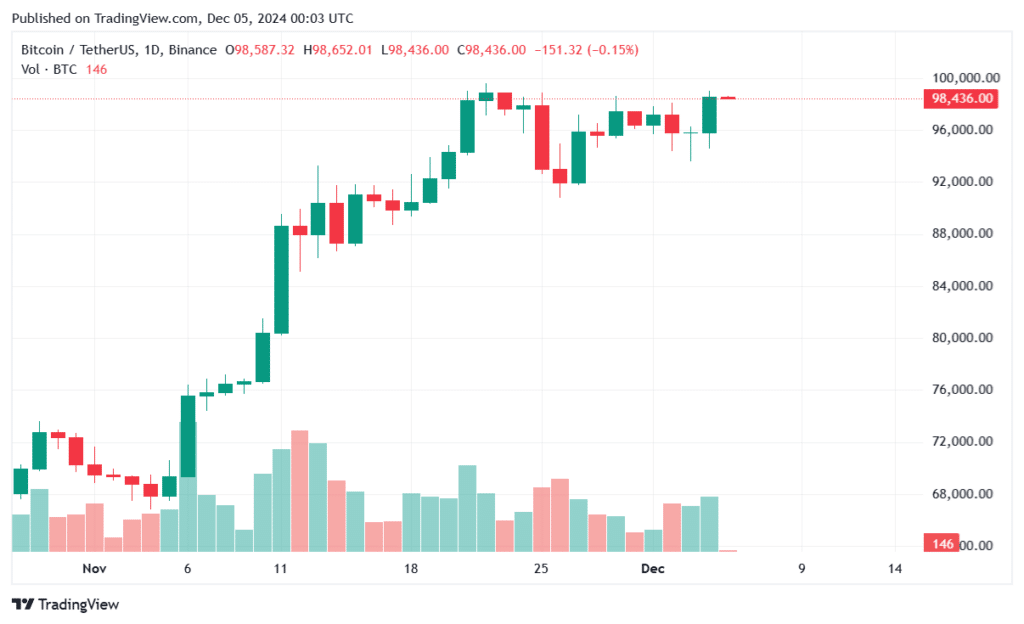

Bitcoin has rebounded to $98,000 today after dropping to its weekly lowest point, and several sentiments have made it back to head the $100,000 target price.

Bitcoin (BTC), the world’s largest cryptocurrency in the world by market capitalization, rose around 3% to $98,436 in the past week after dropping under the weekly average to $93,913 on Tuesday.

The South Korean martial law has brought a sentiment and dropped to its lowest record, but the token rebounded a few hours later after President Yoon Suk Yeol ended the order.

Trump nominated one-time Securities and Exchange Commission (SEC) Commissioner Paul Atkins to head the institutions, bringing a positive sentiment to the market. Ripple’s Brad Garlinghouse and Congressman Tom Emmer even support these nominations due to his stance as pro-crypto

Fed Chairman Jerome Powell’s acknowledgement of Bitcoin as a rival to gold also gives a perspective that this digital asset was commonly known as a safe-have instrument asset class.

Ethereum follows Bitcoin’s target movement

According to CoinMarketCap data on Dec. 05, Bitcoin dominance also showed a decrease of almost 5% to 54%, and this record was last seen this July. In comparison, Ethereum and other crypto recorded an increase to 12.9% and 32,6%, respectively, which indicates that Altcoins have room to grow.

Ethereum (ETH) increased by 5,21% to $3,813 in a day of trading. This largest blockchain token in the world is also heading to the next price target, which is $4,000, and possibly skyrocket to an all-time high of $4,891; the last time recorded was 3 years ago.

Although the other top cryptocurrencies have not performed yet, the crypto market cap in total is rising 1.87% to $3.58 trillion.

Source link

You may like

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

Bitcoin

Bitcoin Should Be Much Higher Six Months From Now, According to Real Vision’s Jamie Coutts – Here’s Why

Published

8 hours agoon

January 9, 2025By

admin

Real Vision’s chief digital assets analyst Jamie Coutts believes Bitcoin (BTC) will be at a significantly higher price six months from now.

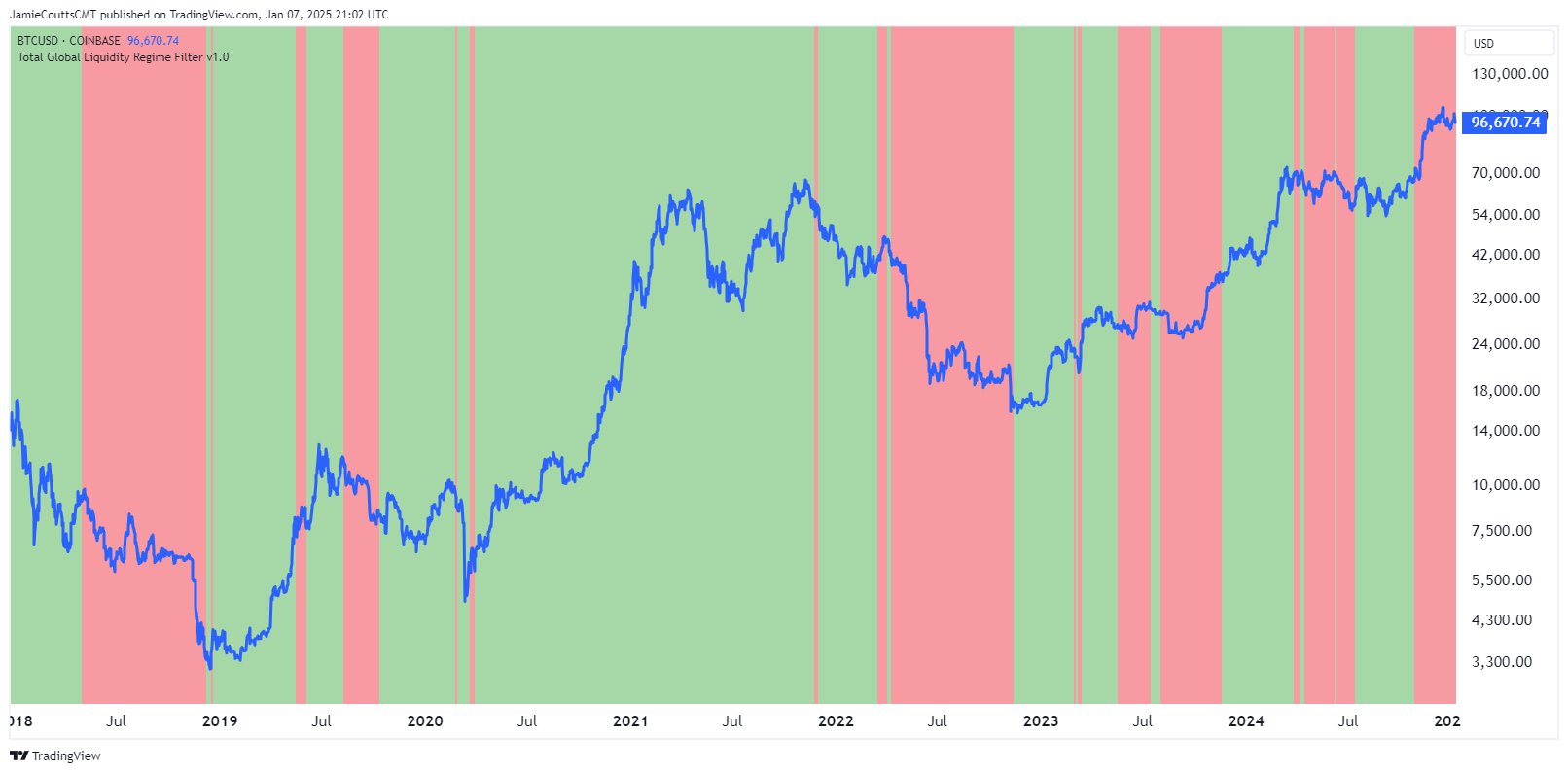

Coutts tells his 32,400 followers on the social media platform X that the Fed will likely make additional rate cuts in the near future that would inject more liquidity into the markets and cause Bitcoin to surge.

Coutts shares a chart showing the historical relationship between the global money supply (M2) metric and Bitcoin, suggesting an M2 increase would send BTC higher.

“With the strong dollar becoming a real problem, I expected Bitcoin to be in the $80,000 range by now. This speaks to the strength of the underlying bid and the market’s expectations that the Fed will have to act; otherwise, things will start breaking. Regardless of the sequence of events, more liquidity is coming, and Bitcoin should be much higher six months from now.”

Coutts also expects greater adoption of Bitcoin by the private wealth segment, which includes high-net-worth individuals and families, noting these entities “are less concerned than CT’s (crypto Twitter’s) daily obsession over liquidity ups and downs.”

Another one of Coutts’ predictions for the coming months is that the relatively new artificial intelligence (AI) agents crypto sector will continue an upward trend.

Crypto AI agents are protocols built to autonomously perform tasks on behalf of users such as interacting with blockchains and decentralized finance (DeFi) platforms, trading and managing portfolios.

Said Coutts,

“Interest in AI agents in crypto took off in November 2024. Based on history, this trend is expected to last at least another four months, but probably longer. AI agents are not like the others – they unlock potential for every established and new use case.”

Bitcoin is trading for $94,592 at time of writing, down 2.4% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

With bitcoin’s price dipping significantly below $100k again, the “buy the dip” cheerleaders are out in full force.

But I’m here to offer a different perspective: Don’t buy the dip.

Before I continue, let me please make it clear that nothing that I write in this Take is investment advice.

Why would I say such a thing? Is it that I hate bitcoin all of a sudden?

No.

I have other reasons for making such a statement.

The first is that I’m trying to keep you from becoming exit liquidity for people like this:

Don’t worry guys.

The retards are coming. pic.twitter.com/1YL8keRHYa

— Breadman (@BTCBreadMan) January 8, 2025

The second is that I like to buy bitcoin when it’s truly selling at a discount, not just when it appears to be selling at one.

Let me explain.

Right now, bitcoin is trading about 13% off of its all-time highs. While that may be a significant discount for an asset in the world of traditional finance, it’s hardly more than a daily fluctuation in the world of bitcoin.

In the four-year bitcoin cycles, bitcoin’s price tends to skyrocket during the years of and after its halving. And then the year that follows tends to be pretty terrible for bitcoin’s price. During that year, bitcoin’s price hits a low, which tends to be in the range of the prior cycle’s high.

That was a bit confusing, so let me give you an example.

In 2022, the last “pretty terrible” year, bitcoin’s price dropped to about $15,500, which was actually about $3,500 lower than bitcoin’s top from the previous cycle — $20,000.

If something comparable were to happen in 2026, we’d see bitcoin’s price at approximately $53k (23% below the previous cycle’s all-time high of $69k). Now, that would be a significant discount and a dip worth buying.

I don’t share this perspective to dissuade you from continuing with something like a dollar-cost averaging bitcoin investment strategy (one of the best strategies out there for the average retail investor). Instead, I share it because if a loved one came to me and asked me if now was a good time to buy bitcoin, I’d say “not really.”

I try to maximize the financial upside (in fiat terms) of investing in bitcoin as much as possible for those who ask me about investing in it — especially those who are new to it. And while I could maybe help someone trade in and out of a bitcoin position in the next year or so, I don’t like to do this, as I encourage people to buy and hold bitcoin for the long haul.

But, Frank, the U.S. might announce a Strategic Bitcoin Reserve and other nations may follow suit! And look at all the companies buying bitcoin for their treasuries!

Yes, these things are happening, and so are things like Bhutan selling bitcoin and so have things like Germany selling bitcoin and Tesla selling bitcoin.

Up until now, all bitcoin price cycles have been similar. So, while it looks like we have another year of bitcoin price upside in store for us, I think we drop far lower than this current price level when the tables turn.

And that’s when I’ll be proactively buying.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

Using Mining To Create More Fully Validating Bitcoin Users

Mastercard brings p2p aliases for crypto transfers in UAE, Kazakhstan: report

Bitcoin Should Be Much Higher Six Months From Now, According to Real Vision’s Jamie Coutts – Here’s Why

US CFTC Issues Subpoena to Coinbase In Polymarket Case, What’s Next?

Buying Greenland Would Be A Huge Boost to US Bitcoin Mining

AI suggests 3 top Solana alternatives to boost wallets this first quarter

BNB Price Rebound Possible: Can It Climb Back to $720?

Bitcoin Dips Below $95K, RUNE and INJ Drop 11%

Don't Buy The Bitcoin Dip

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x