Bitcoin

CME Gap Threatens Bitcoin With Potential Drop To $77,000

Published

6 days agoon

By

admin

Some analysts raised their concerns that Bitcoin might experience a possible crash which will be driven by the Chicago Mercantile Exchange (CME) gap leading to a huge drop in its price.

Since Bitcoin needs to fill in the gap, crypto traders predict it might push the firstborn cryptocurrency near the critical CME gap, suggesting that its price could go as low as $77,000 per coin.

Related Reading

Bitcoin Could Slide To $77,000

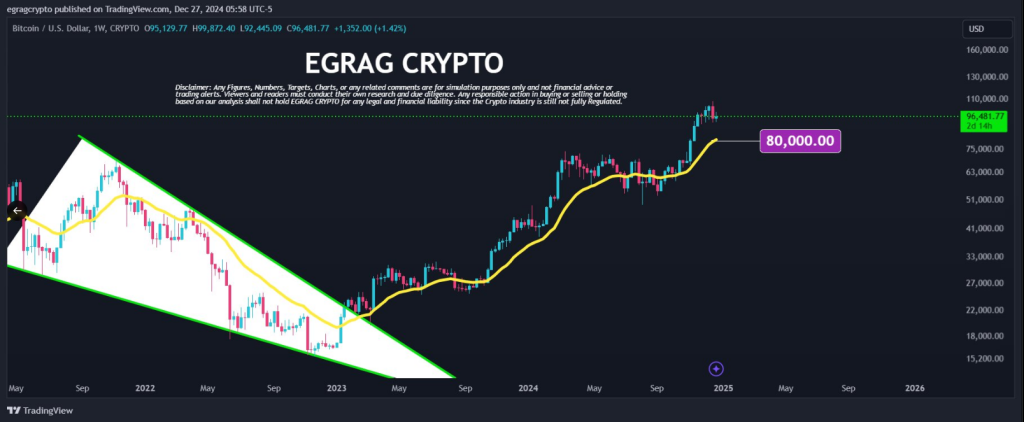

Crypto analyst Egrag Crypto suggested that the massive corrections that Bitcoin has been experiencing could cause the coin to plunge to the $77,000 mark.

Egrag added that since October 2022, the flagship cryptocurrency has been subjected to about seven considerable drops, adding, “The average drop across these events is approximately 23.53%.”

#BTC Drop – Average Dump & CME (70K-74K): How & Why?

1⃣Average Drop:

Since October 2022, #BTC has experienced nearly seven significant drops. Here are the percentage declines:1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%📊 The average drop across… pic.twitter.com/Vz6QiZlnzF

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

“From the current high of around 108,975, we’re looking at a potential drop to the lower end of the CME GAP (between 77K-80K). This represents a 25% decline, aligning well with the average drop observed during this cycle,” Egrag said in a post.

Egrag also noted that the current 21 Weekly EMA is around $80,000, suggesting that “another flash crash could be on the horizon.”

CME Gap At $80,000

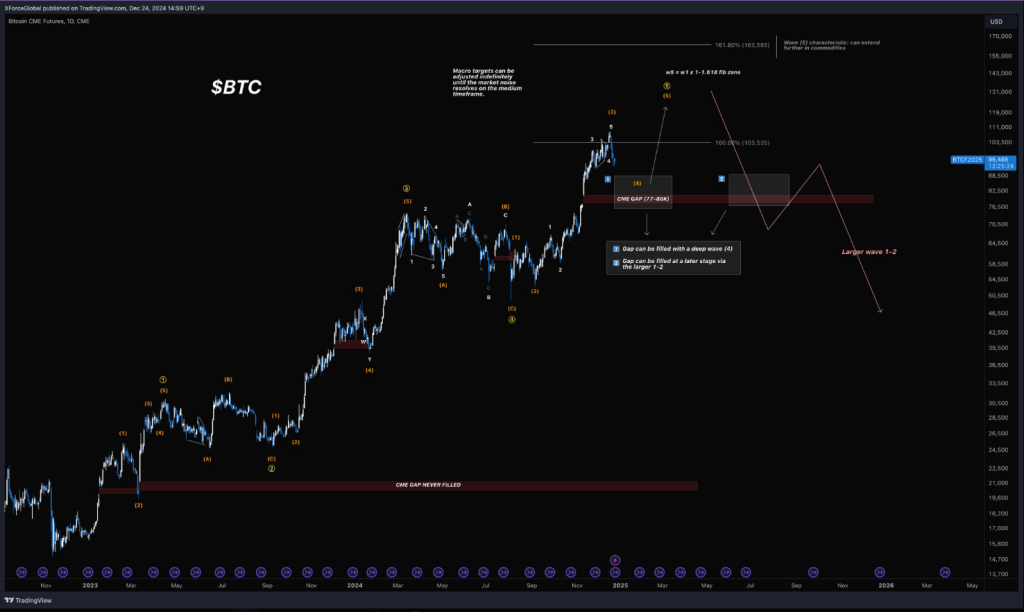

Another crypto analyst, XForceGlobal, reminded traders that “there’s a 1D CME gap at $80,000.”

XForceGlobal said that historically, 90% of daily CME gaps larger than have been eventually filled since 2018.

Just a friendly reminder: there’s a 1D CME gap at $80,000.

Statistically, since 2018, with the growing interest in gaps, 90% of 1-Day timeframe gaps larger than $1,000 have eventually been filled (ignore anything below the 1D timeframe).

The tricky part with CME gaps is… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

However, the crypto analyst noted that it is hard to predict the timing and method of filling CME gaps.

“The tricky part with CME gaps is that their timing and method of filling remain unpredictable,” XForceGlobal said in a post.

The crypto analyst sees possible scenarios to fill the CME gaps. In one scenario, XForceGlobal suggests it could be filed through a deep wave or wave-4 correction, bringing Bitcoin down to the $77,000 to $80,000 level.

In another scenario, XForceGlobal said it can be filled “at a later stage via the assumed 1-2 correction after we finally finish off this bull run’s impulse,” a scenario which might result in the BTC to plummet to $46,000.

Related Reading

A Market Dump In January?

Egrag believes that market makers might use the upcoming inauguration of President-elect Donald Trump to trigger selling pressure for Bitcoin, contributing to its imminent crash.

“Market makers are known for seizing opportunities during crises. Expect a market dump on Inauguration Day (January 20, 2025). This could be the perfect local top for a sell-off, likely leaving many newcomers in a panic,” the crypto analyst said.

Egrag outlined two scenarios that might unfold from the current market condition, suggesting that in one scenario, Bitcoin could pump to $120,000 and later experience a dump to the CME GAP before “resuming the bull run in 2025.”

In another possible scenario, the crypto analyst said that BTC could drop to the CME gap of $70,000 to $75,000 level before the resumption of the bull run.

Featured image from Pexels, chart from TradingView

Source link

You may like

Michael Saylor's Trump Meeting Is Turbo Bullish for Bitcoin

Create and launch a meme coin presale project in 2025

Jesse Pollak Reveals Efforts To Tokenize Coinbase COIN On Base

Trump-Backed Mike Johnson Re-Elected Speaker of the House

A Birthday Letter To Bitcoin

Ripple millionaire reveals shocking new altcoin pick for the 2025 bull run

America

Michael Saylor's Trump Meeting Is Turbo Bullish for Bitcoin

Published

16 minutes agoon

January 3, 2025By

admin

Last night, President-elect Donald Trump’s son, Eric Trump, posted a photo of himself at Mar-a-Lago with MicroStrategy Executive Chairman Michael Saylor with the caption, “Two friends, one passion: Bitcoin.”

This is so unbelievably bullish — let me explain.

For the last four years, under the Biden-Harris administration with total Democrat control, the U.S. government did their best to terrorize this industry and attack us. The overwhelming majority of the Democrat party did not support Bitcoin and followed Elizabeth Warren’s lead on demonizing the industry and its participants. They weaponized the justice system to arrest Bitcoiners, tried to tax our unrealized gains, stopped pro-Bitcoin legislation from being signed into law, de-banked industry participants via Operation Chokepoint 2.0, refused to support Bitcoin in any meaningful way, and so much more.

They were truly anti-Bitcoin. If Kamala Harris had won the presidential election, their reign of terror on Bitcoin would have continued for at least four more years. But now, the Democrats’ war on Bitcoin in America is finally coming to an end. And a new administration is coming in — and they love Bitcoin.

Donald Trump is not even officially in office yet, and his family is already inviting Michael Saylor to his estate in Mar-a-Lago to discuss Bitcoin further. This isn’t the first time he’s done something like this either, like in 2024 when Trump invited American Bitcoin mining giants there to learn more about the industry and what he needs to do to best support them.

It is important to note that just two weeks ago, Saylor said on Bloomberg that he would be open to advising Donald Trump on Bitcoin. And now with him being at Mar-a-Lago, I think it is safe to speculate that something big might be brewing here.

The Trumps understand Bitcoin and continue to show their support for the asset and industry. Eric Trump recently gave a great speech at the Bitcoin MENA Conference in Abu Dhabi, explaining the characteristics that make Bitcoin an invaluable asset while also sharing his family’s personal experience being de-banked, and how Bitcoin protects individuals from being cancelled. Donald Trump Jr. made an appearance at the Bitcoin 2024 Conference in, along with his father, and showed lots of support for this asset and industry.

Donald Trump has committed to releasing Bitcoiners (Ross Ulbricht) from prison, sign pro-Bitcoin legislation into law, work with the industry to help us thrive, end Operation Chokepoint 2.0, appointed an official Crypto Czar, said “Bitcoin and crypto will skyrocket like never before” under his administration, and so much more.

Even if you’re not a fan of Trump, you have to acknowledge and give him and his family credit for the good work they’re doing to make a regulatory friendly environment for this industry to thrive in. Imagine all this industry can accomplish over the next four years being supported by the President, allowing us the room to innovate and build without fear of being harassed and demonized by our own government. I would say the sky is the limit but it’s even better than that.

Four years is a long time, especially in this industry. Lots can happen during that time and I am incredibly bullish on the future of Bitcoin in America under this incoming Trump administration.

Michael Saylor: "Bitcoin is on the menu at Mar-a-Lago."

AMERICA IS EMBRACING #BITCOIN LIKE NEVER BEFORE 🇺🇸 pic.twitter.com/7c2NJG7Kzd

— Nikolaus Hoffman (@NikolausHoff) January 3, 2025

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Treasuries Primed To Double in 2025, According to InvestAnswers – Here’s What It Could Mean for BTC

Published

10 hours agoon

January 3, 2025By

admin

A closely followed crypto analyst is predicting that the number of corporations adopting a Bitcoin (BTC) treasury strategy will double in 2025.

In a new video update, the host of InvestAnswers tells his 553,000 YouTube subscribers that a doubling of Bitcoin treasuries could send the flagship crypto asset to an astronomical new all-time high.

“The beauty of Bitcoin is it’s hard and it’s driven by supply and demand. What happens if the supply dries up? What happens if the long-term holders are done selling? What happens if the miners, all their bags are being bought up? And what happens if more big players enter the market? This is what could drive the price absolutely bonkers…

We have seen tons of treasuries come in. We now have the new FASB (Financial Accounting Standards Board) rules, which make it even easier for more treasuries to come in. And the number of treasuries are going to double in 2025. That’s part of my 2025 prediction as well. That means where is all this Bitcoin going to come from? The only thing that can happen is the price will go up. That’s it.”

According to Bitcoin Magazine Pro, there are currently 33 publicly traded companies with Bitcoin treasuries, the largest one being MicroStrategy, which holds 444,262 BTC.

Bitcoin is trading for $96,754 at time of writing, up 2.4% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Analysts Highlight Investor Sentiment Shift As Bitcoin Approaches $98,000

Published

22 hours agoon

January 3, 2025By

admin

After weeks of consistent price correction, Bitcoin latest performance now appears to be demonstrating a rebound as the asset has earlier today reclaimed the $96,000 price mark now approaching the $98,000 level.

As Bitcoin approaches this key level, data shows that the top crypto has shown mixed signals across key market indicators, reflecting a subtle yet significant shift in investor sentiment.

Particularly, analysts have identified specific patterns in funding rates and premium metrics, which serve as vital tools for interpreting market sentiment and predicting potential price movements.

Bitcoin Current Funding Rates And What It Signals

A notable observation by CryptoQuant analyst Mignolet highlights how funding rate movements reflect retail investor sentiment. According to Mignolet analysis, funding rates, which represent the cost of holding long or short positions in perpetual futures contracts, are exhibiting nuanced movements.

Historically, during moments of strong resistance, funding rates tend to decline, signaling subdued sentiment and caution among investors.

In late October 2024, when Bitcoin was approaching its all-time high, funding rates showed similar behavior, reflecting investor hesitation despite rising prices. However, the current scenario presents a contrasting sentiment.

The analyst disclosed that while corrective price movements have emerged, investors are viewing these pullbacks as buying opportunities rather than reasons for fear or contraction.

This subtle psychological difference could influence market dynamics significantly, potentially paving the way for sustained upward momentum. Mignolet wrote:

Similar corrective candles have appeared, and from a technical perspective, this position might seem even more precarious. However, the sentiment is different. People now view this as an opportunity and believe it’s a reasonable position to buy. I believe this subtle difference in sentiment has the potential to produce very significant results.

Coinbase Premium Indicator Reaches Historic Low

Another key observation comes from the Coinbase Premium Indicator, a metric that measures the price difference between Bitcoin on Coinbase (a US-based exchange) and other global exchanges.

Coinbase Premium Index Hits a 12-Month Low!

“This drop not only signals a lack of institutional demand but also underscores the cautious sentiment among U.S. investors.” – By @burak_kesmeci

Read more

https://t.co/nIRWlciLwo pic.twitter.com/LYfKmNM7t5

— CryptoQuant.com (@cryptoquant_com) January 2, 2025

Recently, this premium dropped to its lowest level since January 2023, a period that marked a significant market bottom. Historically, when this premium turned negative during bullish phases, it often preceded a price rebound.

Analysts suggest that such negative sentiment from US investors often triggers strong buying pressure, which can reverse short-term downward trends and fuel long-term price gains.

Featured image created with DALL-E, Chart from TradingView

Source link

Michael Saylor's Trump Meeting Is Turbo Bullish for Bitcoin

Create and launch a meme coin presale project in 2025

Jesse Pollak Reveals Efforts To Tokenize Coinbase COIN On Base

Trump-Backed Mike Johnson Re-Elected Speaker of the House

A Birthday Letter To Bitcoin

Ripple millionaire reveals shocking new altcoin pick for the 2025 bull run

Solana Breaks Above Daily Downtrend – Analyst Expects New ATH Soon

Pro XRP Lawyer John Deaton Warns Users Against Crypto Scams

2025 Bitcoin Outlook: Insights Backed by Metrics and Market Data

Marathon Digital improves hash rate by 15%, mined 890 BTC in December

Bitcoin Treasuries Primed To Double in 2025, According to InvestAnswers – Here’s What It Could Mean for BTC

How This RWA Token Could Surpass Cardano (ADA) by 2025

Launch the next big cryptocurrency presale inspired by Dogecoin with Blocksync

Can Dogecoin Price Compete With New Memes Like Fartcoin & ai16z?

What Is AiXBT? The AI Influencer Taking Crypto by Storm

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

What is World Chain? Human-First New Blockchain Goes Live

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion2 months ago

Opinion2 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker