cryptocurrency

PitchBook predicts $18 billion in crypto VC funding for 2025

Published

6 days agoon

By

admin

PitchBook analyst Robert Le expects crypto VC funding to be “much much stronger” in 2025 compared to 2024.

“We’re going to see $18 billion or more in venture capital dollars that’s going to be invested into crypto,” Le told CNBC’s Jordan Smith. That’s a 50% increase from 2024, but still less than the roughly $30 billion “that was invested in 2021 and 2022,” he added.

2023 and 2024 recap

Le described 2023 as a challenging year for crypto funding due to the collapse of FTX, erosion of trust, and higher interest rates.

However, 2024 started strong with positive momentum driven by spot Bitcoin exchange-traded funds, or ETFs getting approved.

Despite a slowdown mid-year, “we’re probably going to end [2024] at somewhere between $11 [billion] and $12 billion of invested capital, which is still 10 to 20% more than 2023,” he said.

2025 Funding Expectations

Le’s projection of $18 billion or more in crypto VC funding is a 50% increase compared to 2024. Several factors bode well for the sector, he says. They include:

- Generalist investors are regaining interest, signaling potential large-scale investments.

- Crypto-native funds have significant dry powder but require generalist participation for substantial growth.

- Financial institutions will play a pivotal role by leveraging their trusted relationships with regulators.

Shifting focus

Le anticipates a shift in focus toward application-layer investments, moving beyond infrastructure projects. Examples include:

- Decentralized applications (dApps) targeting non-crypto users with better risk management.

- Use cases leveraging crypto infrastructure for non-crypto sectors such as mobility and energy data.

The analogy of AWS serving as a base for companies like Uber and Airbnb highlights the need for robust applications atop crypto infrastructure to realize its full potential, Le argues.

The benefit of ‘nothing’

Le emphasized the importance of regulatory clarity for the crypto industry’s growth. He expressed cautious optimism about the U.S. regulatory environment in 2025, noting:

- A shift in SEC leadership under the incoming Trump administration could result in fewer enforcement actions.

- Legislative progress, such as stablecoin bills or crypto-specific rules, would be beneficial but is not guaranteed.

- Even a lack of new regulatory actions could be an improvement over the past two years of uncertainty.

Le concluded that a stable regulatory environment, coupled with growing institutional involvement and application-focused investments, could set the stage for significant advancements in the crypto sector in 2025.

But even if the next presidential administration and incoming lawmakers “do nothing,” Le says, “that is already an improvement.”

For the full interview, see below.

Source link

You may like

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

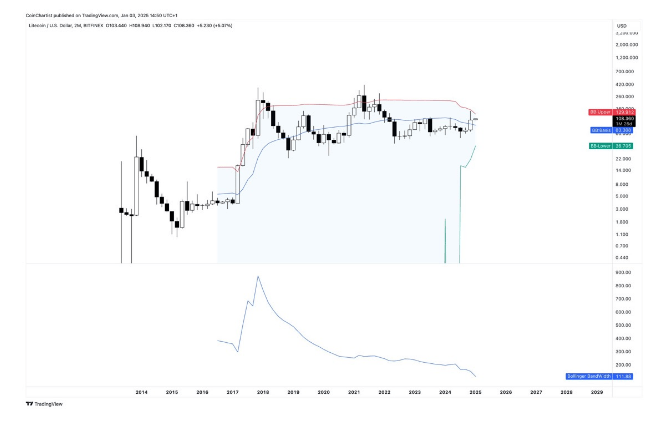

Litecoin (LTC) has been experiencing a significant decrease in volatility, with a crypto analyst highlighting an unusual tightening in its bi-monthly (2M) Bollinger Bands (BB). According to an analyst, Litecoin’s current technical setup points to strong potential for a parabolic breakout, with the $130 price mark emerging as a critical resistance zone.

Related Reading

Narrow Bollinger Bands To Trigger Litecoin Breakout

Prominent crypto analyst Tony Severino shared a price chart on X (formerly Twitter) showing Litecoin’s price action on a bi-monthly time frame, applying Bollinger Bands as a technical indicator to measure a cryptocurrency’s price volatility. The Bollinger Bands examine market volatility by plotting an upper and lower band around a Moving Average (MA), which acts as a basis line.

In Litecoin’s case, Severino has indicated that the cryptocurrency’s 2M Bollinger Band width is extremely narrow, underscoring a lack of or significantly decreased volatility. Historically, Bollinger Bands are known to expand during periods of high volatility and tighten at low volatility.

Severino’s Litecoin chart displays the upper Bollinger Band marked by the red line, the basis line by a blue line, and the lower band highlighted in the green area. The analyst disclosed that Litecoin’s candlesticks are currently positioned above the basis line at $83.3, indicating potential for bullish momentum.

If the price of Litecoin continues upwards and crosses the upper Bollinger band at approximately $130, Severino predicts that it could trigger heightened volatility and an explosive price breakout. Based on historical trends, an extremely narrow Bollinger Band often indicates a potential for a bullish trend reversal after a period of consolidation.

Severino’s analysis has pinpointed the upper BB at $130 as a crucial resistance area for Litecoin. A sustained break above this level on a high timeframe could pave the way for more gains, potentially pushing Litecoin significantly above its current market value of around $111.5.

According to CoinMarketCap, Litecoin has recorded modest gains, increasing by 6.14% in the past 24 hours. Over the past week, the prominent cryptocurrency has also experienced a higher increase of about 11.7% to its current level. To reach the critical resistance area at $130, Litecoin is required to rise by approximately 18% from its market price.

Litecoin Rally Predicted, Targets 38% Upside

According to crypto analyst Mike on X, Litecoin is preparing for a significant breakout to a new price high. He forecasts that the cryptocurrency will record a 38% price rally from the breakout point at $106 to reach a fresh bullish target of $146.67.

Looking at the analyst’s price chart, Litecoin appears to have broken the $102 resistance level and is approaching its next significant resistance at $122.77. The chart also highlights horizontal lines indicating critical resistance areas for Litecoin.

Related Reading

Mike has pinpointed a key support zone at $99.91 that could act as a safety net for Litecoin during a downtrend. Should Litecoin face a significant price drop below this support, the analyst points to the $86.97 and $74.43 price levels as the next potential support areas.

Featured image from Pexels, chart from TradingView

Source link

Altcoin

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Published

16 hours agoon

January 4, 2025By

admin

In a recent interview with FOX Business, Fred Thiel, CEO of Bitcoin (BTC) mining firm MARA Holdings, advocated an “invest and forget” strategy for retail investors looking to gain exposure to the world’s leading digital currency.

Thiel Cites Positive Historical Performance Of Bitcoin

BTC continues to trade within the mid-$90,000 range after a recent pullback from its all-time high (ATH) of $108,135. While crypto analysts keep a close eye on the flagship cryptocurrency’s price movements, major BTC holders appear less concerned about short-term fluctuations.

Related Reading

Citing Bitcoin’s historical performance, Thiel advised retail investors to adopt a long-term approach. He noted that Bitcoin has closed the year at a lower price only three times in its 14-year history, including during the peak of the COVID-19 pandemic. Thiel stated:

My recommendation, to my kids, for example, is they put just a little bit away every month in Bitcoin and forget about it. Over two, three, four years, it grows, and that’s what people do.

Thiel also emphasized BTC’s consistent growth, highlighting that it has appreciated annually by an average of 29% to 50%. However, BTC remains a high-risk asset, and risk-averse investors may shy away until the asset class achieves broader acceptance or gains official recognition from a major global economy.

For instance, the establishment of a US strategic Bitcoin reserve could solidify the cryptocurrency’s legitimacy as an asset and potentially spark a domino effect, encouraging other nations to follow suit. Thiel described such a reserve as a key catalyst for driving Bitcoin’s price to new highs in 2025.

Additionally, Thiel pointed to high institutional involvement through Bitcoin exchange-traded funds (ETFs) and favorable digital asset regulations under the Trump administration as other factors that could support BTC’s growth this year.

Although Thiel’s advice was aimed at retail investors, recent data suggests that many are already planning to increase their Bitcoin holdings. According to a poll conducted by MicroStrategy CEO Michael Saylor, over 75% of 65,164 respondents intend to end 2025 with more BTC than they started with.

The poll reflects growing enthusiasm among retail investors, buoyed by bullish developments in 2024 such as ETF approvals, the Bitcoin halving, and Trump’s election victory in November.

More Companies Adding BTC To Balance Sheet

Bitcoin adoption among corporations continues to grow. While MARA Holdings already holds BTC on its balance sheet, rival crypto mining company Hut 8 recently expanded its holdings to more than 10,000 BTC.

Related Reading

Other firms, such as Japan-based Metaplanet and Canada’s Rumble, joined the Bitcoin movement in 2024. Additionally, Bitcoin ETFs have accumulated over 1 million BTC in under a year since their launch.

However, skepticism remains. Japan’s Prime Minister recently expressed caution about the idea of establishing a strategic Bitcoin reserve, reflecting lingering doubts in some quarters. At press time, BTC trades at $97,229, up 0.7% in the past 24 hours.

Featured image from Unsplash, Chart from TradingView.com

Source link

cryptocurrency

DEGN launches NFTs linked to 1,690 new ‘physical money’ printers

Published

2 days agoon

January 2, 2025By

admin

DEGN has released a Solana-based NFT that can be redeemed for a physical minting device called the Airmoney DEGN Genesis Edition. The device functions as a DePIN hardware wallet, allowing users to trade directly and print their wealth.

According to its description on NFT marketplace Magic Eden, there are 1,690 numbered Airmoney DEGN Genesis Edition devices available for NFT buyers. Marketed as a “physical money printer,” the Airmoney DEGN enables users to trade, earn, and print physical money directly from the device.

“The crypto world needed a physical money printer, so we built one. DEGN Genesis Edition introduces 1690 numbered devices – each uniquely paired with a Solana NFT,” wrote DEGN.

Degn Device mint 9AM EST tomorrow (January 2th)

There is no raffle, FCFS

WL Mint open for 2 hours

Mint Price: 2.69 SOLAfter mint you will be able to fill out the shipping form on our website (where you want device shipped)

This is a physical device mint – NFT’s are… pic.twitter.com/oTKTmM07Tk

— Degn.com (@AirmoneyDegn) January 1, 2025

On its official X account, @AirmoneyDegn, the company announced that minting for the device will begin on Jan. 2 at 9:00 a.m. EST. Whitelisted wallets will have early access for the first two hours upon launch, with each buyer limited to five NFTs. However, the official release and worldwide shipping dates for the product remain unclear.

Users interested in purchasing the device can redeem it through the NFTs. After minting, buyers will be able to fill out a pre-order form on the official site. Based on the Solana (SOL) blockchain, the NFTs for the device cost 2.69 SOL or around $560.

DEGN claimed the device is backed leading crypto firms including ByBit, Berachain, Movement, and Hyperliquid. Promotional images depict the device as featuring two buttons labeled “long” and “short,” a screen displaying trading activity for various tokens, and a side knob.

Additionally, DEGN stated that holders of the Genesis Edition device will receive “lifetime node rewards” and participate in what it calls “the largest token distribution in DePIN history.” Hinting at a future token launch, DEGN promises device holders a 69% allocation of its future tokens.

“This isn’t just another hardware wallet; it’s a physical manifestation of crypto culture, built for the trenches, engineered for degens. Each device serves as your key to the future of decentralized physical infrastructure networks,” wrote DEGN.

Each buyer will receive a uniquely numbered device that provides access to DEGN’s on-chain marketplace. Users can also run decentralized nodes directly through the device and earn rewards.

Source link

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

Sui soars by over 1,300% from its lowest level in 2023

Game On: The Hottest Upcoming Gaming Token Airdrops on Ethereum, TON and Beyond

Analyst Reveals Two Levels To Watch Before FLOKI Price Hits ATH

A strong utility coin with potential to compete with Cosmos & Solana

Recession Fears Erupt Amid Bullish Crypto Market Sentiment, What’s Next

Edith Yeung Sees Big Things to Come for Crypto in Hong Kong

This crypto could make up for missing early Bitcoin, Ethereum, and Solana

Last Minute Opening Brief By Outgoing Gary Gensler

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker