24/7 Cryptocurrency News

If XRP Lawsuit Ends, How High Could Ripple Price Go?

Published

6 days agoon

By

admin

The long-running XRP lawsuit has been on the investors’ radar this year, with a flurry of developments sparking market discussions. Besides, with pro-crypto Paul Atkins gearing up to replace the current US SEC Chair, Gary Gensler, the optimism further soars indicating a potential surge in Ripple price ahead. Besides, it also fueled speculations over a potential drop of the Ripple Vs SEC case, with the January 15 deadline approaching for the SEC to file an opening brief in the 2nd Circuit Court of Appeals.

What Happens if US SEC Drops The XRP Lawsuit?

The XRP lawsuit is one of the long-running cases in the crypto space and has gained notable traction from investors lately. However, with Donald Trump’s election win in November, the market sentiment remained high over a potential pro-crypto regulatory environment in the US.

In addition, it also fueled speculations about whether the incoming US SEC chair Paul Atkins would dismiss the Ripple vs SEC case ahead. Notably, the current US SEC Chair, Gary Gensler, whom many deem an anti-crypto regulatory, will leave his position in January. In addition, Trump’s inauguration on January 20 has further bolstered market sentiment.

Now, as the crypto-friendly Paul Atkins is set to replace Gensler, the market sentiment remained positive over a potential drop in the Ripple case. Notably, pro-XRP lawyers like Bill Morgan, Jeremy Hogan, Fred Rispoli, and others, have also indicated a potential dismissal of the legal case under the incoming US SEC chair.

On the other hand, the January 15 deadline for the US SEC to file its opening brief in the 2nd Circuit Court of Appeals is also approaching. Simultaneously, Ripple CTO Stuart Alderoty also called for an end to the ongoing XRP lawsuit, which has further fueled speculations in the market. This has also sparked discussions over its potential impact on Ripple price, with many anticipating a robust rally ahead.

Will Ripple’s Native Crypto Price Rally?

The market sentiment towards Ripple’s native crypto remained high, as evidenced by its robust rally recently. However, the rally has recently faded with the investors taking a pause amid the holiday mood. XRP price today was down nearly 6% and exchanged hands at $2.06, with its trading volume soaring 78% to $4.43 billion. However, CoinGlass data showed that XRP Futures Open Interest rose about 2%, indicating a bullish sentiment ahead for the crypto.

Despite the recent dip, a flurry of experts expect a potential rebound ahead for Ripple price, especially with optimism soaring over a potential dismissal of the XRP lawsuit. For context, popular market expert EGRAG CRYPTO recently predicted the crypto to hit $6 by March 2025. On the other hand, he further said that the crypto is likely to hit between $13 and $27 in this bull cycle, reflecting his growing confidence in the crypto.

However, the investors are keeping close track of the Ripple price, with the recent market volatility in focus. A recent XRP price analysis also hinted that the crypto could crash to $1 ahead before continuing its another run towards the north. Besides, if the US SEC, under Chair Gary Gensler, files its opening brief before the January 15 deadline, it could further weigh on the traders’ sentiment, which in turn could impact its price.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

24/7 Cryptocurrency News

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Published

3 hours agoon

January 4, 2025By

admin

RLUSD, the stablecoin floated by American blockchain payments firm Ripple Labs is growing at a fast pace, currently flipping its core rivals in 24 hour trading volume. Despite the stablecoin’s young age, it has printed a sustained growth track to beat Paypal’s PYUSD and Circle’s EURC tokens. This milestone comes despite Ripple USD showcasing a much smaller market capitalization than the duo.

RLUSD Stablecoin and the Performance Metrics

Per data from CoinMarketCap, the Ripple stablecoin boasts a self-reported market cap of $53.1 million. Atop this, the stablecoin saw its trading volume jump by 1,566% in 24 hours to $607.58 million.

This unexpected boost contrasts sharply with Paypal’s PYUSD with a $491.72 million capitalization and a 24 hour volume of $19.74 million. Also, Circle’s EURC, a MiCA-compliant token with market cap of $82.38 million and $10.55 million volume.

While it remains unclear the reasons for the RLUSD stablecoin growth, uptickthe current outlook positions it as the 3rd most traded token after Tether (USDT) and Circle’s USDC.

A related growth is seen across the board for Ripple coin per data insights from XPMarkets. At the moment, the token has a total user of 7,600, up from the 1000 it recorded 24 hours after Ripple launched the stablecoin in December, 2024.

With the RLUSD stablecoin’s growth trend, it is now the 13th largest asset on the XRP Ledger by market capitalization.

The token’s growth also hinges on its expansion on top trading platforms globally. As reported earlier by Coingape, it launched on Bullish on Christmas Eve after it made its global debut on Uphold and Bitso. These listings helped boost its liquidity and accessibility by users.

Ripple, XRP Ledger and RWA Agenda

Beyond its direct role in facilitating payments, Ripple Labs has a bigger plan for the RLUSD stablecoin. The firm is making ambitious move in the Real World Tokenization (RWA) world through its partnership with Archax.

Ultimately, the firm hopes to integrate the stablecoin as a primary liquidity layer in driving this use case. The firm recently launched its first tokenized money market fund on XRP Ledger lately, establishing its foothold in this industry.

Ripple executives have reiterated how the stablecoin, XRP Ledger and XRP will form a complementary bond across its product suite. The liquidity boost of the stablecoin might account for the latest rally in the price of XRP as reported earlier by Coingape.

As of writing, the coin was changing hands for $2.432, up by 2.6% in the past 24 hours. In an earlier XRP price analysis, the coin is projected to hit Should the broad Ripple plans work out, analysts are projecting a potential push to $3.5.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Analyst Reveals Two Levels To Watch Before FLOKI Price Hits ATH

Published

9 hours agoon

January 4, 2025By

admin

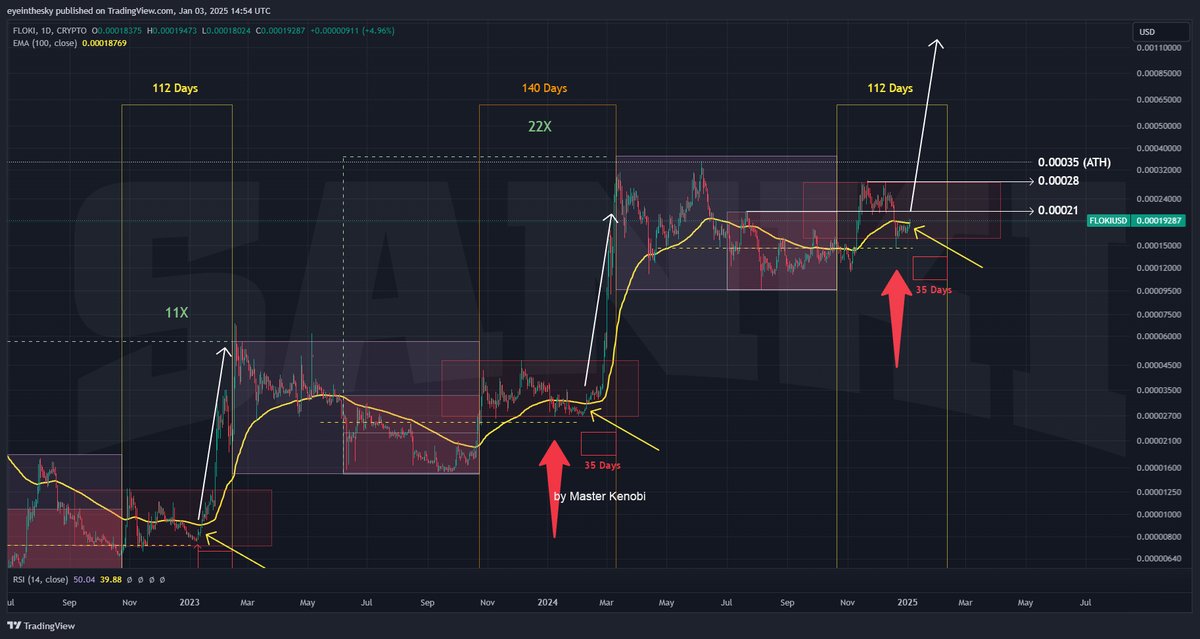

Crypto analyst Master Kenobi has revealed two levels to watch out for before the FLOKI price hits a new all-time high (ATH). The analyst also revealed the timeline for when the top meme coin could reach these price targets.

Two Levels To Watch Before FLOKI Price Hits ATH

In an X post, Master Kenobi revealed $0.00021 and $0.00028 as two levels to watch before the FLOKI price hits its current ATH of $0.00035 and enters price discovery. He added that he believes that the top meme coin will hit these price levels this month.

The analyst’s accompanying chart showed that FLOKI could rally to as high as $0.0011 as it rallies to a new ATH. A rally to this price level represents a gain of around 478% for the meme coin.

Master Kenobi also recently provided a bullish outlook for the FLOKI price. The crypto analyst mentioned that the crypto was on the verge of a massive breakout that could send its price to around $0.00080.

In a recent X post, he again reaffirmed that the meme coin was on the verge of a price breakout. Master Kenobi suggested that FLOKI could soon breakout from the two-weeks rectangle.

More Bullish Outlook For The Top Meme Coin

Other crypto analysts have provided a bullish outlook for the FLOKI price. One of them is World Of Charts. In an X post, the crypto analyst noted that the meme coin has recorded a 2x price increase from its last breakout.

He added that FLOKI is now bouncing again from the horizontal support area and approaching the bullish flag trendline. In line with this, World Of Charts predicted that the meme coin could record another 2x price increase in the coming days.

Crypto analyst Poseidon noted that the FLOKI price has recorded 300 days of consolidation. He remarked that this consolidation phase should end with an expansion to the upside.

From a fundamentals perspective, FLOKI also has a bullish outlook. As CoinGape reported, the meme coin’s ETP could go live in the first quarter of this year. This fund will attract institutional inflows into the coin’s ecosystem and possibly contribute to future price rallies.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Recession Fears Erupt Amid Bullish Crypto Market Sentiment, What’s Next

Published

12 hours agoon

January 4, 2025By

admin

With the Bitcoin price sliding below $100k, the crypto market sentiments drifted away from the ‘Greed.’ However, the outlook can get even worse, as the recent market finding hints at the possibility of a global economic recession, which could create a major crash for all financial markets. Let us discuss the analysts’ recent findings on the recession and its impact on the crypto industry.

Bullish Crypto Market Sentiment at Risk With New Recession Prediction

An on-chain analytics firm, Bravos Research has brought investors’ attention to a rare but historically significant event. According to the firm, the yield curve has just un-inverted, and the last three times it happened, it led to economic downturns. Overall, these findings highlight the possibility of the upcoming recession, as the short-term bond yield has dropped below the long-term yield before reverting. Interestingly, this is the widely popular and accurate indicator of economic recession, which predicted the Great Depression of 1929, the dot-com crash in the 2000s, and the financial crisis 2008.

Now, the yield curve has been inverted ever since early 2023 but has finally been un-inverted, concerning the investors and their sentiments. However, there are minor changes that could delay the recession. The Bravos Research findings revealed that there is un-inversion but the 10-year yield rose, which has not happened in the previous cycles. Additionally, the GDP growth and unemployment hikes in the previous recession align with the falling yield. However, that is not the case in the present situation. The rise in 10 year-yield shows resilience in economic fundamentals.

Eventually, this divergence disturbs the recession prediction, but it does not completely change that. The recession’s possibility could still continue and affect the Bitcoin and the market despite the rise of unemployment rates and the steepening of the yield curve.

How Will the Crypto Market React?

Although the crypto market often moves against the traditional market, the recession and similar macroeconomic events could also break the performance of digital assets. As all the financial markets rely on capital inflow, a recession can impact investors’ risk-taking sentiments. Meanwhile, the interest rate goes up, which prevents borrowing to invest. However, historical records also show that compared to the traditional market, recovery in most cases is faster in terms of crypto sentiments. Regardless, Bitcoin and the rest of the top cryptos have not witnessed a major recession. This is why an accurate market behavior prediction is hard to conclude.

For now, analysts believe that increasing bond yield could trigger volatility in most financial markets, whose impact will be seen in crypto market sentiments as well. However, as the reports hint, if the recession is delayed, it could present further opportunities for strategic accumulation.

What Investor Should Do Next?

The crypto market depends on hundreds of factors and could occasionally bring high volatility. The recession period will bring a similar outcome but on a higher level. For situations like this, crypto analysts have often suggested working with a diversified crypto portfolio and implementing risk management tactics. More importantly, investors should look for a long-term growth outlook and invest in utility-based tokens like Bitcoin. The Rich Dad and Poor Dad, Robert Kiyosaki, say, buy and forget. Interestingly, Kiyosaki confirmed a global market crash but called that a buying opportunity rather than a threat.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

Sui soars by over 1,300% from its lowest level in 2023

Game On: The Hottest Upcoming Gaming Token Airdrops on Ethereum, TON and Beyond

Analyst Reveals Two Levels To Watch Before FLOKI Price Hits ATH

A strong utility coin with potential to compete with Cosmos & Solana

Recession Fears Erupt Amid Bullish Crypto Market Sentiment, What’s Next

Edith Yeung Sees Big Things to Come for Crypto in Hong Kong

This crypto could make up for missing early Bitcoin, Ethereum, and Solana

Last Minute Opening Brief By Outgoing Gary Gensler

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

✓ Share: