Altcoins

Top Crypto Assets For Q1 2025: Grayscale Reveals Best Altcoins

Published

5 days agoon

By

admin

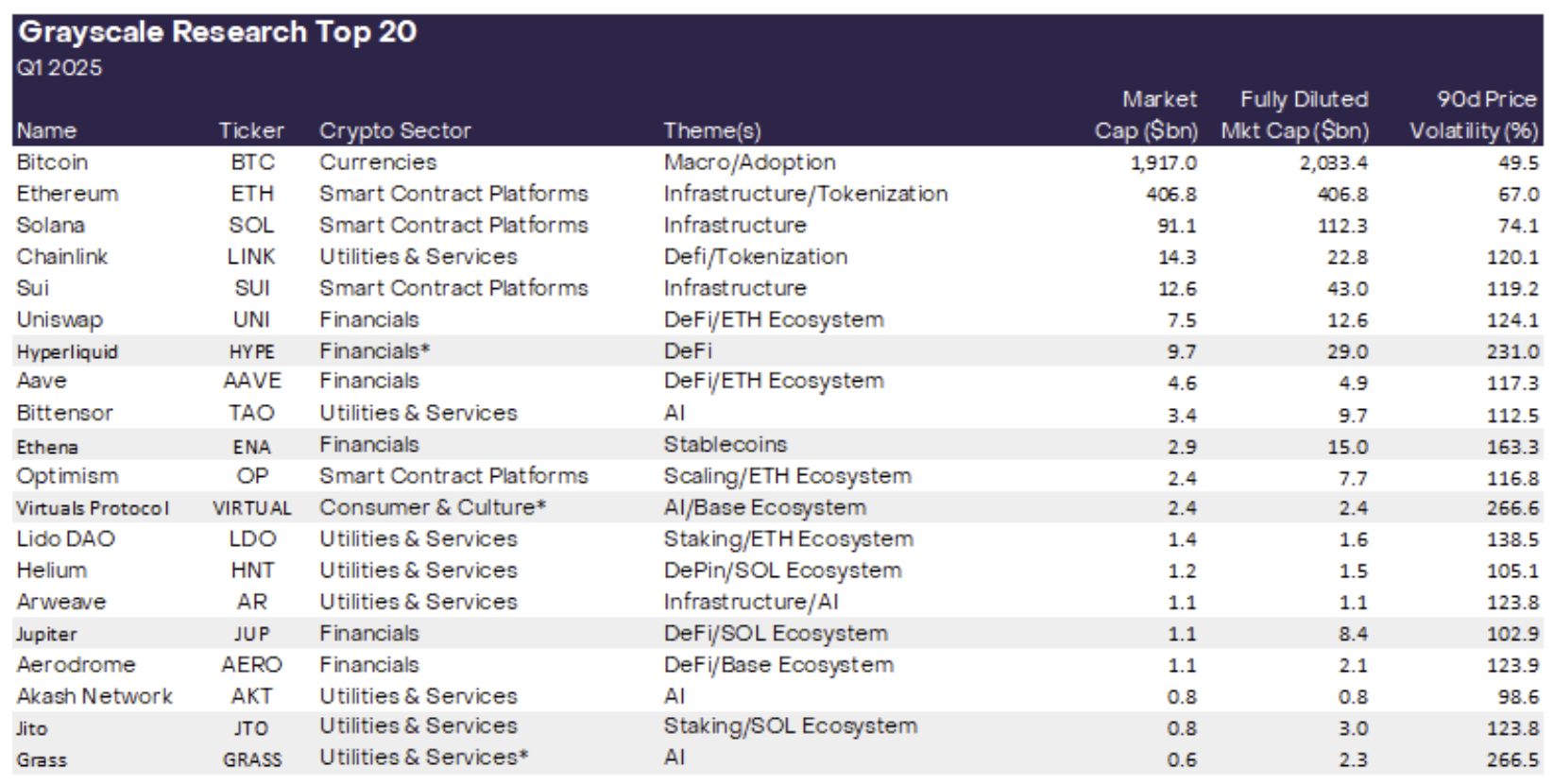

Grayscale Investments has published its quarterly review, unveiling its top 20 crypto assets for Q1 2025. Each quarter, the Grayscale Research team evaluates “hundreds of digital assets” to guide the rebalancing of the FTSE/Grayscale Crypto Sectors family of indexes.

In the words of the research note, “Our approach incorporates a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks.” The newest additions to the top 20 list are guided by three main market themes that Grayscale believes will shape the coming months: the US election and potential regulatory implications, rapid developments in decentralized AI, and the expanding Solana ecosystem.

Related Reading

While Bitcoin, Ethereum, Solana, Chainlink, Uniswap, SushiSwap, Aave, Bittensor, Optimism, Lido DAO, Helium, Arweave, Aerodrome and Akash Network remain on the the list, six new altcoins were added compared to the previous quarter. “We are adding the following six assets to our Top 20 list for Q1 2025,” the report states, emphasizing each project’s notable alignment with one or more of the aforementioned themes.

Best (New) Crypto Assets For Q1 2025

Hyperliquid (HYPE): A Layer 1 blockchain geared toward on-chain financial applications, Hyperliquid’s flagship product is a decentralized exchange (DEX) for perpetual futures. Built around a fully on-chain order book, HYPE seeks to capture the growing demand for advanced derivatives trading in a decentralized environment. Notably, HYPE has seen a meteoric rise over the past weeks, already claiming rank #19 on the list of the largest cryptocurrencies by market cap.

Ethena (ENA): Ethena protocol has introduced a novel stablecoin, USDe, backed by hedged positions in Bitcoin and Ether. As Grayscale explains, “Specifically, the protocol holds long positions in Bitcoin and Ether and short positions in perpetual futures contracts on the same assets.” A staked version of the token leverages the pricing differential between spot and futures markets, potentially offering a unique yield profile for participants.

Virtual Protocol (VIRTUAL): Operating on Base, an Ethereum Layer 2 network, Virtual Protocol enables the creation of AI agents designed to function autonomously. “These AI agents are designed to perform tasks autonomously, mimicking human decision-making,” Grayscale notes. The platform further allows for co-ownership of these agents via tokenization, bridging AI capabilities with blockchain infrastructure.

Related Reading

Jupiter (JUP): Jupiter has emerged as a leading DEX aggregator on Solana, recording the highest total value locked (TVL) among all Solana applications. With Solana’s user base broadening and speculation intensifying around memecoins and AI agent tokens, “we believe Jupiter is well positioned to capitalize on this growing market activity,” states the report.

Jito (JTO): Jito is a liquid staking protocol on Solana that has demonstrated strong adoption over the past year. Notably, Grayscale highlights the project’s substantial earnings: “Jito has experienced substantial growth in adoption over the past year and offers one of the best financial profiles in all of crypto, generating over $550mn in 2024 fee revenue.”

Grass (GRASS): Grass rewards users for sharing unused internet bandwidth via a Chrome extension. “This bandwidth is used to scrape online data, which is then sold to AI companies and developers for training machine learning models,” according to Grayscale. The project monetizes web scraping by redistributing rewards to users who contribute their idle bandwidth.

Furthermore, Grayscale notes that it continues to be “excited about themes from previous quarters such as Ethereum scaling solutions, tokenization, and decentralized physical infrastructure (DePIN).” Examples of these established themes include Optimism, Chainlink, and Helium, which remain in the Top 20 due to their alignment with scaling, tokenization, and DePIN use cases, respectively.

Notably, six assets—NEAR, Stacks, Maker CELO, UMA, and TON—have been rotated out of the Top 20 list this quarter. “Grayscale Research continues to see value in each of these projects, and they remain important elements of the crypto ecosystem. However, we believe the revised Top 20 list may offer more compelling risk-adjusted returns for the coming quarter,” Grayscale notes.

At press time, HYPE traded at $29.45.

Featured image created with DALL.E, chart from TradingView.com

Source link

You may like

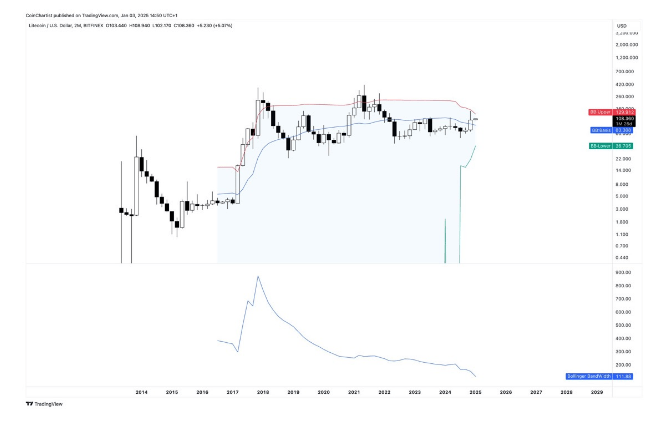

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

Litecoin (LTC) has been experiencing a significant decrease in volatility, with a crypto analyst highlighting an unusual tightening in its bi-monthly (2M) Bollinger Bands (BB). According to an analyst, Litecoin’s current technical setup points to strong potential for a parabolic breakout, with the $130 price mark emerging as a critical resistance zone.

Related Reading

Narrow Bollinger Bands To Trigger Litecoin Breakout

Prominent crypto analyst Tony Severino shared a price chart on X (formerly Twitter) showing Litecoin’s price action on a bi-monthly time frame, applying Bollinger Bands as a technical indicator to measure a cryptocurrency’s price volatility. The Bollinger Bands examine market volatility by plotting an upper and lower band around a Moving Average (MA), which acts as a basis line.

In Litecoin’s case, Severino has indicated that the cryptocurrency’s 2M Bollinger Band width is extremely narrow, underscoring a lack of or significantly decreased volatility. Historically, Bollinger Bands are known to expand during periods of high volatility and tighten at low volatility.

Severino’s Litecoin chart displays the upper Bollinger Band marked by the red line, the basis line by a blue line, and the lower band highlighted in the green area. The analyst disclosed that Litecoin’s candlesticks are currently positioned above the basis line at $83.3, indicating potential for bullish momentum.

If the price of Litecoin continues upwards and crosses the upper Bollinger band at approximately $130, Severino predicts that it could trigger heightened volatility and an explosive price breakout. Based on historical trends, an extremely narrow Bollinger Band often indicates a potential for a bullish trend reversal after a period of consolidation.

Severino’s analysis has pinpointed the upper BB at $130 as a crucial resistance area for Litecoin. A sustained break above this level on a high timeframe could pave the way for more gains, potentially pushing Litecoin significantly above its current market value of around $111.5.

According to CoinMarketCap, Litecoin has recorded modest gains, increasing by 6.14% in the past 24 hours. Over the past week, the prominent cryptocurrency has also experienced a higher increase of about 11.7% to its current level. To reach the critical resistance area at $130, Litecoin is required to rise by approximately 18% from its market price.

Litecoin Rally Predicted, Targets 38% Upside

According to crypto analyst Mike on X, Litecoin is preparing for a significant breakout to a new price high. He forecasts that the cryptocurrency will record a 38% price rally from the breakout point at $106 to reach a fresh bullish target of $146.67.

Looking at the analyst’s price chart, Litecoin appears to have broken the $102 resistance level and is approaching its next significant resistance at $122.77. The chart also highlights horizontal lines indicating critical resistance areas for Litecoin.

Related Reading

Mike has pinpointed a key support zone at $99.91 that could act as a safety net for Litecoin during a downtrend. Should Litecoin face a significant price drop below this support, the analyst points to the $86.97 and $74.43 price levels as the next potential support areas.

Featured image from Pexels, chart from TradingView

Source link

Altcoin Sherpa

Trader Warns Altcoin That’s Up 9,000%+ in Two Months Primed for a Pullback, Updates Outlook on Hyperliquid

Published

3 days agoon

January 2, 2025By

admin

Widely followed trader Altcoin Sherpa says that one artificial intelligence (AI)-focused crypto asset is about to present opportunities for bulls.

Altcoin Sherpa tells his 236,000 followers on the social media platform X that ZEREBRO, which bills itself as an AI system that autonomously creates and distributes content onto various platforms, may allow entries in the $0.40 range.

After a correction, the trader says that ZEREBRO will be “very strong” in the future.

“$0.50 is still resistance and I expect some sort of pullback between here and low $0.60s but I still think this is going to be a very strong one going forward. I have a solid bag of this. Team is full of shippers

I’d view the $0.40ish area as a decent entry.”

At time of writing, ZEREBRO is trading at $0.54, up 38% in the last 24 hours.

Altcoin Sherpa is also bullish on decentralized perpetuals exchange Hyperliquid (HYPE).

He says that those looking to position themselves long on HYPE can start to look at accumulating at current prices, with a potential target above the $50 level.

“HYPE DCA (dollar cost average) between 30-25 and feel good about it.

Also consider saving some $$ to buy lower in case it comes. low 20s would be a gift and I plan on adding plenty more if it comes.

still think it goes to $50+ before cycle end.”

At time of writing, HYPE is trading for $0.26.

With his eye on the memecoin sector, the trader says many of the big memes like MOODENG, CHILLGUY, or PNUT “all either send hard” from current prices or “fall off a cliff.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

With the new year approaching, some analysts forecasted a “very bullish” 2025 for Altcoins. The sector is expected to explode soon and kickstart the long-awaited “Altseason” after retesting a key support level.

Related Reading

Altcoins Retest Key Support Level

Amid the recent market’s performance, many Altcoins have struggled to record significant gains. However, several market watchers forecasted the start of the altcoin will come as soon as January 2025.

Fueled by the post-US election pump, the total crypto market capitalization, excluding Bitcoin and Ethereum, broke out on a three-year downtrend in mid-November, surpassing its yearly high of $788 billion. During this month’s rally, the sector surged to $1.1 trillion, its highest market cap since 2021.

Since then, Altcoins has struggled over the last two weeks, dropping nearly 26% as Bitcoin lost the $100,000 mark but remains above a key level despite the recent performance.

Crypto Jelle pointed out that the sector broke out and retested its “major trendline while destroying all leverage in the process.” The analyst highlighted that funding was “completely reset,” sentiment has been at its lowest, and the chart seems promising, adding he is “Very bullish for 2025.”

He also noted that Altcoins’ price action is “very similar” to Bitcoin’s first major pullback of 2021. Per the chart, the flagship crypto had a “strong rally, pullback, lower high, and chopping below the first low” before breaking out to new highs.

Based on this performance, Altcoins’ pullback is seemingly over, they “should start pushing back up soon if this keeps playing out the same.” Similarly, Michaël van de Poppe stated, “The correction is almost over, and the time for up only is on the horizon for Altcoins and Bitcoin. Expecting a lot to come.”

Altseason To Follow 2021’s Playbook?

Titan of Crypto asserted that Altcoins are set to explode soon, suggesting that “the grand finale is around the corner.” Per the analyst’s chart, Altcoins have been in a two-year cup and handle pattern, breaking out of the pattern’s upper line during the recent market highs.

According to the pattern, Altcoins, excluding ETH, could see a 200% to a market capitalization of $1.4 trillion, surpassing 2021’s high of $1.13 trillion. The analyst also pointed out that, ahead of its 2021 rally, the sector saw a similar performance.

In 2020, Altcoins broke out in November and saw a significant 30% drop in early December, followed by a four-week recovery. Then, they recorded a 143% surge in January 2021, which led to other three-monthly green candles before the first major retrace.

Related Reading

Similarly, they’ve experienced a 26% drop this December, currently being on the third week out of the expected four-week recovery period. To the analyst, “Early January could mark the start of an ‘up only’ season.”

Lastly, Titan of Crypto added that, during the last two cycles, Altcoins’ initial rally lasted between 140 and 175 days, suggesting that this cycle’s rally could hit a new high around April or May. If it were to follow the past cycles’ performance, it could see a first pump around Q2 2025 before peaking in Q4.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Litecoin Sees 2M Bollinger Bands Tighten

Top 4 altcoins to consider buying now: DOGE, Sui, XRP, RBLK

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

3 crypto projects with potential to turn $550 into $11000 in no time

2 Charts That Hint Shiba Inu Price Could Double Soon

Sui soars by over 1,300% from its lowest level in 2023

Game On: The Hottest Upcoming Gaming Token Airdrops on Ethereum, TON and Beyond

Analyst Reveals Two Levels To Watch Before FLOKI Price Hits ATH

A strong utility coin with potential to compete with Cosmos & Solana

Recession Fears Erupt Amid Bullish Crypto Market Sentiment, What’s Next

Edith Yeung Sees Big Things to Come for Crypto in Hong Kong

This crypto could make up for missing early Bitcoin, Ethereum, and Solana

Last Minute Opening Brief By Outgoing Gary Gensler

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker