XRP

A Look At Historical Price Alignments

Published

5 days agoon

By

admin

In a technical analysis shared by crypto analyst Bobby A (@Bobby_1111888) on X, the analyst projects that XRP will potentially reach the $15 mark in this bull run, contingent upon historical price movement patterns aligning. The analysis delves into XRP’s past market cycles, applying percentage-based extrapolations and chart pattern assessments to forecast future price trajectories.

Is A XRP Price Of $15 Realistic?

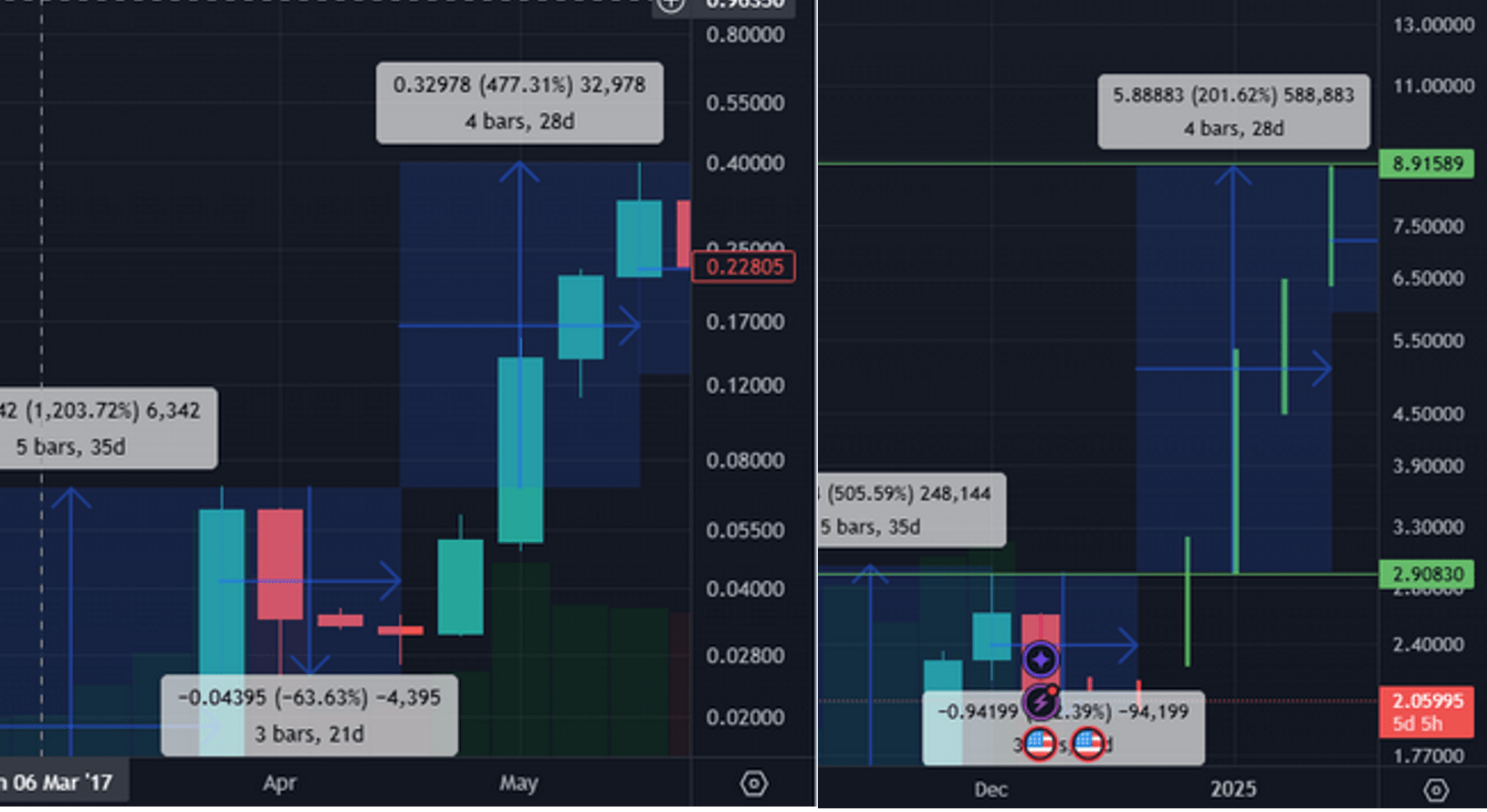

Bobby A’s analysis juxtaposes XRP’s performance during its 2017 market cycle against its current 2024 trajectory. From the range-high breakout in 2017, marked by a horizontal black dashed line on the chart, XRP experienced an initial appreciation of 629%.

In comparison, the asset has appreciated approximately 331% since its range-high breakout in 2024. Extending further back, from the December 2014 high to the May 2017 peak—approaching the 4.236 Fibonacci extension—XRP saw a staggering 1,330% increase.

Related Reading

Applying the principle of reducing percentage point increases by half, as observed from the initial surge in 2017, Bobby A posits that XRP’s next impulse could result in a 665% increase. This calculation positions XRP at an approximate $15.00 near the 4.236 Fibonacci extension level.

“XRP appears to be cutting its percentage point increases in half compared to its 2017 market cycle. If XRP cuts its next impulse in half from a percentage point increase perspective, as it did with this first one, it would put the asset’s price at roughly ~$15.00 near its 4.236 extension after a possible 665% increase,” Bobby A elaborates.

Notably, the analyst also notices a developing bull flag pattern, a continuation pattern that typically signals the potential for further upward movement. This bull flag is targeting the upper boundary of XRP’s macro parallel channel, estimated around the $10.50 price level. “The current bull flag the asset is forming targets the top of its macro parallel channel near $10.50,” Bobby A notes.

Related Reading

Another analyst, bassii (@cryptobassii), responded with a contrasting viewpoint centered on fractal analysis. Bassii posits that the ongoing run may be curtailed by 42%, projecting XRP’s price to approach $9, followed by a significant downturn.

He elaborates on the fractal patterns, stating, “This run seems to be cut to 42%, would get us close to $9, then a big drop. But you’re missing the last part of the 2017 run, IF (big if) that happens, and we keep same %, we get around $30 after months of accumulation.”

Or Even $35?

Bassii referred to a previous analysis of himself where he emphasized the similarities between the 2024 run and the 2017 cycle. Notably, both periods exhibit five weeks of consecutive green candles, albeit with differing magnitudes—approximately 500% in 2024 compared to 1,200% in 2017.

He points out, “2017: 5 weeks of green candles at ~1,200% ^, followed by 3 weeks of red candles down 63%. 2024: Also, 5 weeks of green candles at ~500% up (~1/2 of 2017’s run), followed by… (so far) 1 week of red candles by how much? You guessed it… 30% down.” The subsequent correction phases also mirror each other, with XRP experiencing a 30% decline in 2024 compared to a 63% drop in 2017, each roughly halved in magnitude.

Based on this, Bassii outlines potential future movements based on historical patterns, suggesting that if XRP continues to follow these fractal patterns without significant breakdowns, it could accumulate over several months and potentially ascend to $30 by September 2025.

Responding to Bassii’s analysis, Bobby A expresses cautious optimism, stating, “Yeah but I’m not sure that the last impulse will come. The next one I’m much more confident in.” Bassii complements this by highlighting the importance of adhering to fractal patterns and real-time chart developments, adding, “I think it will depend on how closely we follow the fractals and what the chart tells us during this upcoming run. So far it’s followed very very closely. The weekly candles for the last 8 weeks have followed beat by beat. I’m not a moon boy, I know how crazy $30-35 sounds. But if we’re still tracking the 2017 run.”

At press time, XRP traded at $2.1581.

Featured image created with DALL.E, chart from TradingView.com

Source link

You may like

These Are His Next Buys

UAE’s Bitcoin mining firm Phoenix Group expands in US ahead of Nasdaq listing: report

Shiba Inu Community Unveils TREAT Token Launch Date, Here’s When

Bithumb Meta Rebrands to Bithumb Partners for Investors

Trader Forecasts Q1 Surges for Ethereum (ETH), Says ‘Mega Pump’ Incoming for One Crypto Sector

Bitcoin Nears $100K, SPX and FIL Rise 12%

24/7 Cryptocurrency News

Bitcoin Nears $100K, SPX and FIL Rise 12%

Published

5 hours agoon

January 6, 2025By

admin

Crypto market today looks bullish as Bitcoin crossed the $99,000 mark and is trying to touch $100,000 again after a two-week bearish trend. SPX6900 (SPX) and Filecoin (FIL) became the top gainers for today, with a 12% surge in price. Major altcoins also showed a positive trend, with most of the top 10 coins in green.

The global crypto market is also up by 1%, reaching $3.49 trillion. However, the trading volume has decreased by a minor 2%, standing at $83 billion. The Fear and Greed Index now shows a reading of 60, indicating that greed has overtaken fear in the market sentiment.

Crypto Market Today: Bitcoin Eyes $100K as Major Altcoins Show Positive Momentum

Crypto prices today showed a strong upward momentum, with Bitcoin (BTC) eyeing the $100K mark. Major altcoins, including Ethereum (ETH), XRP, and Solana (SOL), each gained around 1% in the last 24 hours. Meanwhile, Bitcoin miner Marathon Digital Holdings (MARA) lent 16% of its reserves, driven by rising interest in BTC lending.

Bitcoin Price Today

Bitcoin price today was trading at $99,100, marking a 1% increase in the last 24 hours. Its 24-hour low and high were $97,314 and $99,265, respectively. The market cap stands at $1.96 trillion, with a trading volume of $24 billion. As per SoSo Value data, BTC ETF recorded a weekly inflow of $244 million, reflecting growing institutional interest.

Ethereum Price Today

Crypto market today showed Ethereum (ETH) price trading at $3,668, reflecting a 1% increase in the last 24 hours. Its 24-hour low and high were $3,595 and $3,682, respectively. Ethereum’s market cap stands at $441 billion, with a trading volume of $15 billion.

XRP Price Today

XRP price today was trading at $2.40, showing an approximate 1% increase in the last 24 hours. Its 24-hour low and high were $2.33 and $2.43, respectively. Ripple CEO Brad Garlinghouse highlighted the positive impact that Donald Trump’s victory has had on the company’s operations.

Solana Price Today

SOL price was up by 1% today, trading at $216. Its 24-hour low and high were $211 and $218, respectively.

Top Crypto Gainers Prices Today

SPX6900

SPX price was up by 12% in the last 24 hours, trading at $1.48. In the past week, it surged by 63%. Its 24-hour low and high were $1.27 and $1.56, respectively. Crypto market today reflects SPX’s market cap of $1.38 billion and trading volume of $94 million.

Filecoin

FIL price was up by 12% and is among the top gainers for today, trading at $6.23. Its 24-hour low and high were $5.52 and $6.28, respectively. The market cap stands at $3.86 billion, with a trading volume of $424 million.

Besides this, Movement (MOVE), Injective (INJ), and Artificial Superintelligence Alliance (FET) also gained 8 to 10% in the last 24 hours. Crypto market today highlights that FET token could reach $3 amid its token burn plan.

Top Crypto Losers Prices Today

Virtual Protocol

VIRTUAL price was down by approximately 7%, making it the worst performer for today. It was trading at $4.10, with a 24-hour low and high of $3.96 and $4.40, respectively.

Hyperliquid

HYPE price was down by 3% in the last 24 hours, trading at $24.81. Its 24-hour low and high were $24.06 and $25.63, respectively. The market cap stands at $8.27 billion, with a trading volume of $90 million.

Other than that, BONK, WIF, and BEAM also declined by 3% to 4% in the last 24 hours. Crypto market today reflects a mixed trend, with some tokens facing sell-offs despite positive momentum in major cryptocurrencies.

Besides this, the hourly chart also looks bullish, with Bitcoin price and major altcoins turning green in the last hour. Fartcoin gained 5% in the past hour, indicating short-term positive momentum in the crypto market today.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple RLUSD Stablecoin Flips PYUSD and EURC

Published

1 day agoon

January 4, 2025By

admin

RLUSD, the stablecoin floated by American blockchain payments firm Ripple Labs is growing at a fast pace, currently flipping its core rivals in 24 hour trading volume. Despite the stablecoin’s young age, it has printed a sustained growth track to beat Paypal’s PYUSD and Circle’s EURC tokens. This milestone comes despite Ripple USD showcasing a much smaller market capitalization than the duo.

RLUSD Stablecoin and the Performance Metrics

Per data from CoinMarketCap, the Ripple stablecoin boasts a self-reported market cap of $53.1 million. Atop this, the stablecoin saw its trading volume jump by 1,566% in 24 hours to $607.58 million.

This unexpected boost contrasts sharply with Paypal’s PYUSD with a $491.72 million capitalization and a 24 hour volume of $19.74 million. Also, Circle’s EURC, a MiCA-compliant token with market cap of $82.38 million and $10.55 million volume.

While it remains unclear the reasons for the RLUSD stablecoin growth, uptickthe current outlook positions it as the 3rd most traded token after Tether (USDT) and Circle’s USDC.

A related growth is seen across the board for Ripple coin per data insights from XPMarkets. At the moment, the token has a total user of 7,600, up from the 1000 it recorded 24 hours after Ripple launched the stablecoin in December, 2024.

With the RLUSD stablecoin’s growth trend, it is now the 13th largest asset on the XRP Ledger by market capitalization.

The token’s growth also hinges on its expansion on top trading platforms globally. As reported earlier by Coingape, it launched on Bullish on Christmas Eve after it made its global debut on Uphold and Bitso. These listings helped boost its liquidity and accessibility by users.

Ripple, XRP Ledger and RWA Agenda

Beyond its direct role in facilitating payments, Ripple Labs has a bigger plan for the RLUSD stablecoin. The firm is making ambitious move in the Real World Tokenization (RWA) world through its partnership with Archax.

Ultimately, the firm hopes to integrate the stablecoin as a primary liquidity layer in driving this use case. The firm recently launched its first tokenized money market fund on XRP Ledger lately, establishing its foothold in this industry.

Ripple executives have reiterated how the stablecoin, XRP Ledger and XRP will form a complementary bond across its product suite. The liquidity boost of the stablecoin might account for the latest rally in the price of XRP as reported earlier by Coingape.

As of writing, the coin was changing hands for $2.432, up by 2.6% in the past 24 hours. In an earlier XRP price analysis, the coin is projected to hit Should the broad Ripple plans work out, analysts are projecting a potential push to $3.5.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Last Minute Opening Brief By Outgoing Gary Gensler

Published

2 days agoon

January 4, 2025By

admin

The Ripple vs SEC lawsuit is in focus again as deliberations began on filing an opening brief before the January 15 deadline. Latest developments indicate that outgoing SEC Chair Gary Gensler is preparing for last-minute filing related to appeals before pro-crypto Paul Atkins takes over.

Some believe Gensler with SEC’s chief litigation counsel Jorge Tenreiro may create headwinds for Ripple, similar to former SEC Chairman Jay Clayton.

Last Minute Appeal in Ripple Vs SEC Lawsuit

The U.S. Securities and Exchange Commission (SEC) under Gary Gensler is likely deliberating to file its principal brief in the Ripple lawsuit. The 2nd Circuit Court of Appeals earlier extended the deadline to January 15 after a request by the securities agency.

Former SEC lawyers Marc Fagel and James Farrell cleared that the agency will continue its fight after an appeals-related opening brief in January. While the shift in the agency’s leadership may impact progress, but a decision to dismiss or withdraw the appeals in the lawsuit to affect the SEC more.

Besides, SEC’s chief litigation counsel Jorge Tenreiro, who has been deeply involved in Ripple lawsuit, to continue handling the case. It indicates that the legal battle may not shift drastically with a new SEC chair.

The regulator is set to present its arguments on secondary sales as Judge Analisa Torres’s ruling in Ripple Vs SEC lawsuit set didn’t exactly cleared the industry whether XRP is a security or commodity. This has further implications for Ripple and the crypto industry.

Notably, XRP was earlier referred to as “currency” by the U.S. DOJ and Treasury Dept’s FinCEN. And now, the SEC appealed the summary judgment on Ripple’s XRP sales through crypto exchanges, distribution to employees and others by the firm, and XRP sales by CEO Brad Garlinghouse and Executive Chairman Chris Larsen.

Pro-XRP Lawyers Expect End of Lawsuit Under Paul Atkins

Gensler to depart on Donald Trump’s inauguration day on January 20, setting the stage for Paul Atkins to take over SEC Chairman responsibilities. Pro-XRP lawyers Jeremy Hogan, Fred Rispoli, and Bill Morgan indicate high odds of resolution of the Ripple vs SEC lawsuit under pro-crypto Atkins.

Moreover, lawyers claimed Paul Atkins to work on providing clarity on crypto regulations, which remained unclear under Gensler. This could potentially lead to the end of Ripple lawsuit not otherwise. Ripple CLO Stuart Alderoty urged to “cleanse the lingering stain of Hinman from the agency” and restore trust in the agency.

Odds of XRP ETF and Price Rally Ahead

Ripple executives have earlier said that SEC continued its “failed arguments” in crypto cases as Gensler reaffirmed that crypto has no intrinsic value. Moreover, XRP ETF launch is more likely under Paul Atkins as the Trump administration is set to push for crypto regulations.

Attorney Jeremy Hogan predicts April or May as a likely timeline for the Ripple vs SEC lawsuit’s end. Moreover, he expects dismissal early, but “I’d say it’s possible but maybe unlikely.”

Analysts have been overall bullish on XRP price rally amid several developments including RLUSD launch. As per popular analyst Ali Martinez, XRP price is currently consolidating within massive massive bull pennant pattern. A pullback to $2.05 is possible unless the $2.73 resistance is broken. This could lead to a massive rally to $11.

XRP price is currently trading at $2.44, up 1% in the last 24 hours. However, trading volume remains low. Coinglass data indicates futures open interests climbed 7% over the last 24 hours.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

These Are His Next Buys

UAE’s Bitcoin mining firm Phoenix Group expands in US ahead of Nasdaq listing: report

Shiba Inu Community Unveils TREAT Token Launch Date, Here’s When

Bithumb Meta Rebrands to Bithumb Partners for Investors

Trader Forecasts Q1 Surges for Ethereum (ETH), Says ‘Mega Pump’ Incoming for One Crypto Sector

Bitcoin Nears $100K, SPX and FIL Rise 12%

Bitwise CEO predicts Trump administration to boost crypto mergers

Ethereum Price Targets $3,800 Rally as Bulls Mount $1B Leverage

This Week in Crypto Games: Hamster Kombat ‘HamsterVerse’, Telegram Game Airdrop Updates

The potential token to watch isn’t Solana or XRP

Bears aim at $2.20 Reversal as Profit-taking begins

ADA Gains 12%, Leading Index Higher

AIOZ Network pumps 32%, WOULD jumps double digits, while market shows minor movement

Brad Garlinghouse Highlights Donald Trump’s Effect On Ripple

top cryptocurrencies to watch this week

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

✓ Share: