Bitcoin

Analysts Highlight Investor Sentiment Shift As Bitcoin Approaches $98,000

Published

3 months agoon

By

admin

After weeks of consistent price correction, Bitcoin latest performance now appears to be demonstrating a rebound as the asset has earlier today reclaimed the $96,000 price mark now approaching the $98,000 level.

As Bitcoin approaches this key level, data shows that the top crypto has shown mixed signals across key market indicators, reflecting a subtle yet significant shift in investor sentiment.

Particularly, analysts have identified specific patterns in funding rates and premium metrics, which serve as vital tools for interpreting market sentiment and predicting potential price movements.

Bitcoin Current Funding Rates And What It Signals

A notable observation by CryptoQuant analyst Mignolet highlights how funding rate movements reflect retail investor sentiment. According to Mignolet analysis, funding rates, which represent the cost of holding long or short positions in perpetual futures contracts, are exhibiting nuanced movements.

Historically, during moments of strong resistance, funding rates tend to decline, signaling subdued sentiment and caution among investors.

In late October 2024, when Bitcoin was approaching its all-time high, funding rates showed similar behavior, reflecting investor hesitation despite rising prices. However, the current scenario presents a contrasting sentiment.

The analyst disclosed that while corrective price movements have emerged, investors are viewing these pullbacks as buying opportunities rather than reasons for fear or contraction.

This subtle psychological difference could influence market dynamics significantly, potentially paving the way for sustained upward momentum. Mignolet wrote:

Similar corrective candles have appeared, and from a technical perspective, this position might seem even more precarious. However, the sentiment is different. People now view this as an opportunity and believe it’s a reasonable position to buy. I believe this subtle difference in sentiment has the potential to produce very significant results.

Coinbase Premium Indicator Reaches Historic Low

Another key observation comes from the Coinbase Premium Indicator, a metric that measures the price difference between Bitcoin on Coinbase (a US-based exchange) and other global exchanges.

Coinbase Premium Index Hits a 12-Month Low!

“This drop not only signals a lack of institutional demand but also underscores the cautious sentiment among U.S. investors.” – By @burak_kesmeci

Read more

https://t.co/nIRWlciLwo pic.twitter.com/LYfKmNM7t5

— CryptoQuant.com (@cryptoquant_com) January 2, 2025

Recently, this premium dropped to its lowest level since January 2023, a period that marked a significant market bottom. Historically, when this premium turned negative during bullish phases, it often preceded a price rebound.

Analysts suggest that such negative sentiment from US investors often triggers strong buying pressure, which can reverse short-term downward trends and fuel long-term price gains.

Featured image created with DALL-E, Chart from TradingView

Source link

You may like

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

Bitcoin

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Published

3 hours agoon

April 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

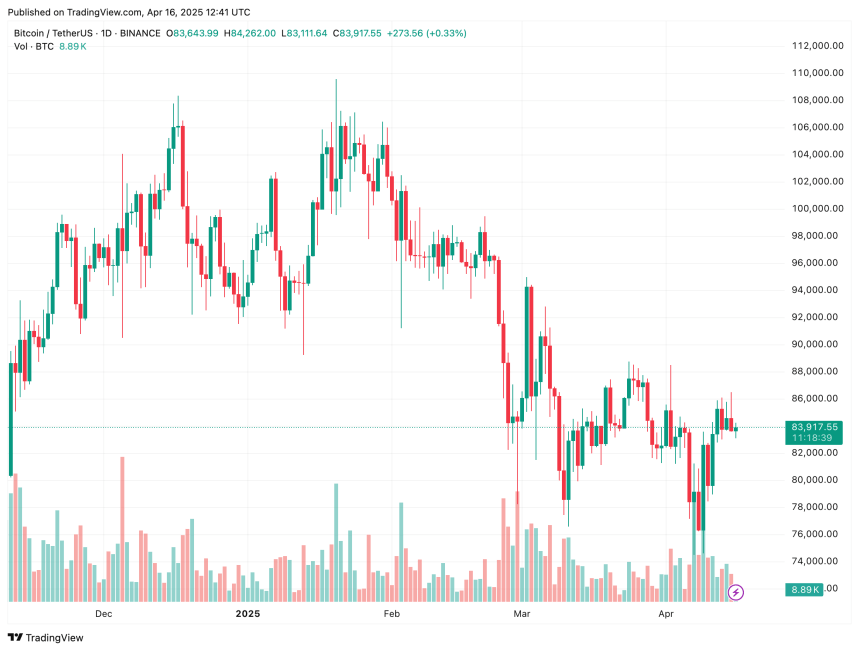

According to a recent CryptoQuant Quicktake post, while Bitcoin (BTC) has seen a steady rise in price from November 2024 to February 2025, sentiment in the cryptocurrency’s futures market has not shown a corresponding uptick.

Bitcoin Futures Sentiment Index Signals Caution

Bitcoin’s price surged from approximately $74,000 in November 2024 to a peak of $101,000 by early February 2025. However, following US President Donald Trump’s tariff announcements, risk-on assets – including BTC -have experienced a significant pullback.

Related Reading

After hitting a potential local bottom of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered some of its recent losses. The top digital asset is trading in the mid $80,000 range at the time of writing.

Despite this recovery, BTC’s futures sentiment has continued to decline since February. Even as the price holds near local highs, sentiment in the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it could indicate increasing caution or profit-taking behavior despite the ongoing bullish trend. The analyst commented:

This indicates a cooling interest or increased fear in the futures market, possibly due to macroeconomic uncertainty, regulatory concerns, or expected corrections.

A look at the BTC futures sentiment index shows a resistance zone around 0.8 and a support level near 0.2. The index is currently hovering around 0.4, pointing to a predominantly bearish sentiment across futures markets.

Similarly, Bitcoin’s average price has steadily declined from its early 2025 highs. It is now ranging between $70,000 and $80,000, signalling possible market indecision amid heightened tariff tensions.

According to abramchart, if futures sentiment remains low, BTC could face extended price consolidation or even downward pressure in the near term. However, any emerging bullish catalyst could quickly shift the sentiment and renew upward momentum.

Is BTC Close To A Momentum Shift?

Some analysts believe Bitcoin may be nearing a breakout. After consolidating in the mid-$80,000s for several weeks, on-chain metrics suggest BTC may be undervalued at current levels. Indicators such as BTC exchange reserves and the Stablecoin Supply Ratio support this view.

Related Reading

In addition, momentum indicators like Bitcoin’s weekly Relative Strength Index have begun to break out of a long-standing downward trendline – raising hopes for a potential bullish rally back toward $100,000.

However, several risks still remain. The recent appearance of a ‘death cross’ on BTC’s price chart – combined with persistent macroeconomic concerns related to trade tariffs – could still weigh heavily on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Bitcoin

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Published

3 hours agoon

April 17, 2025By

admin

In yet another milestone for Bitcoin adoption in Latin America, the Panama City Council has voted to approve the acceptance of Bitcoin and other digital currencies for municipal services, making it the first public institution in the country to do so.

The news was announced by Panama City Mayor Mayer Mizrachi on X (formerly Twitter), who stated:

“Panama City council has just voted in favor of becoming the first public institution of government to accept payments in Crypto. Citizens will now be able to pay taxes, fees, tickets and permits entirely in crypto starting with BTC, ETH, USDC, USDT.”

This decision sets Panama City on a more progressive path, enabling residents to interact with their local government using Bitcoin for everyday transactions. Mizrachi also explained how this was achieved without the need for new legislation, a hurdle that had stalled previous efforts.

“Prior administrations tried to push a bill in the senate to make this possible, but we found a simple way to do it without new legislation. Legally, public institutions must receive funds in $, so we partner with a bank who will take care of the transaction—receiving in crypto and convert on spot to $. This allows for the free flow of crypto in the entire economy and entire government.”

The Panama City Mayor’s Office further confirmed the news on its official social media channels, saying:

“We will soon become the first public institution in the country to allow payment for municipal services in cryptocurrency, through an authorized bank that will be responsible for converting the proceeds into dollars for the Mayor’s Office.”

Muy pronto nos convertiremos en la primera institución pública del país en permitir el pago de servicios municipales en criptomonedas, a través de un banco autorizado que se encargará de transformar los ingresos en dólares para la Alcaldía.

pic.twitter.com/wccxO1agfR

— Alcaldía de Panamá (@Panamaalcaldia) April 15, 2025

Mayor Mizrachi also revealed that the agreement with the banking partner will be finalized next week: “Deal’s being signed next week at the Blockchain conf in Panama. Look out for signing of the deal next week.” Published on By A widely followed crypto analyst says one Solana (SOL) competitor may be gearing up for a breakout. In a new thread, crypto trader Michaël van de Poppe tells his 783,000 followers on the social media platform X that Sei (SEI) may increase more than 100% its current value if it breaks through a key resistance level. “SEI starts to show momentum. The Bitcoin pair has a strong bullish divergence on the higher timeframes and the USD pair faces a crucial resistance. Breaking through $0.20 opens up a continuation towards $0.30-$0.35.” SEI is trading for $0.17 at time of writing, down 2.4% in the last 24 hours. Next up, the analyst says that Bitcoin (BTC) is in a consolidation phase that may lead to an explosive move to the upside. “Bitcoin is stuck in the final range. Another test of $87,000 and we’ll likely break upwards to the rally of a new all-time high.” Bitcoin is trading for $83,800 at time of writing, flat on the day. Lastly, the analyst says that Ethereum (ETH) may be kicking off an uptrend if the price of gold peaks, based on ETH’s historic inverse correlation with the precious metal. “A good start of the week, as ETH is +4% against Bitcoin. The ultimate question whether it will sustain or not, last months it has been giving back the returns in the days after. What to monitor? Gold peaking or not. If that’s the case, then we’ll see more strength on ETH.” The analyst also says that ETH’s Relative Strength Index (RSI) indicator is flashing bullish, having entered oversold territory. The RSI is a momentum oscillator used to determine whether an asset is oversold or overbought. The RSI’s values range from zero to 100. A level between 70 and 100 indicates that an asset is overbought. The 0 to 30 level range indicates that an asset is oversold. “It’s been a bear market for 1,225 days for ETH, as, in this period, gold did a 2x. The lowest RSI on the weekly candle for ETH as well.” ETH is trading for $1,589 at time of writing, down 2% in the last 24 hours. Follow us on X, Facebook and Telegram   Generated Image: Midjourney Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025 Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist Aptos Leverages Chainlink To Enhance Scalability and Data Access Bitcoin Could Rally to $80,000 on the Eve of US Elections Crypto’s Big Trump Gamble Is Risky Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje 3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Source link Altcoins

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Source link Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending