24/7 Cryptocurrency News

SHIB Burn Rate Soars 1500% As Shiba Inu Price Eyes Rally To $0.001

Published

4 days agoon

By

admin

The renowned dog-themed meme token Shiba Inu captured noteworthy market attention on Friday, witnessing a remarkable surge in the SHIB burn rate. Notably, intraday burn statistics flagged a whopping 1500% uptick, primarily against the backdrop of over 30 million tokens destroyed. In turn, crypto market participants are now speculating whether Shiba Inu price could hit a $0.001 target this month.

SHIB Burn Rate Shoots Up 1500% Echoing Market Optimism

As per a recent X post by the community’s official tracker Shibburn, the SHIB burn rate was up 1550%, underscoring a massive hit to the circulating supply. Per the data shared, 33.01 million coins were burnt in the past 24 hours, aiding the burn rate uptick.

For context, the Shiba Inu token burn mechanism primarily focuses on permanently reducing the asset’s circulating supply. As a result, market participants anticipate a bullish impact on the top meme coin’s future movements, aligning with the law of supply and demand.

Simultaneously, weekly burn statistics indicated that 44.03 million tokens were taken out of the supply, adding to market optimism surrounding the asset. Also, recent ecosystem developments have further aided the leading dog-themed meme coin in retaining its bullish stance across the market.

CoinGape reported that the crypto’s lead developer, Shytoshi Kusama, recently confirmed the TREAT token launch. This chronicle, expected to support the broader ecosystem substantially, remains much awaited in the market. Simultaneously, the Shiba Inu price also remains extensively eyed by market watchers in anticipation of considerable gains in 2025, primarily in the wake of community advancements and constant SHIB burns.

Price To Hit $0.001 This Month?

SHIB price today showcased gains worth 2% intraday and is currently resting at $0.00002264. The meme coin’s 24-hour low and high were $0.00002198 and $0.00002294, respectively. Notably, the rising price trajectory aligns with the remarkable surge in the SHIB burn rate, as mentioned above.

Moreover, a recent Shiba Inu price analysis by CoinGape further rationalized a $0.001 price target for the token, looming for this month. Breaking through the critical resistance level of $0.000025 remains highly pivotal for the crypto. Besides, the broader ecosystem developments and rising adoption of Shibarium have further weighed the scales towards the bullish side of the coin. As the supply continues to shred in the interim, a $0.001 price target appears to be scalable ahead, as market experts also expect a bull cycle continuation in 2025.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

ReadyGamer announced as Virtual Protocol rides wave of investor confidence

Ripple CEO Brad Garlinghouse Calls $11B Valuation Outdated Amid XRP Price Surge

Dogecoin Jumps 20%, But Social Media Still Bearish: Green Signal For Rally?

Canada Can Elect The Next Bitcoin World Leader

Ethereum, XRP, Rollblock, Solana, Pepe, and Shiba Inu

Cardano Price Prediction Points To New ATH as Bullish Breakout Looms

24/7 Cryptocurrency News

Ripple CEO Brad Garlinghouse Calls $11B Valuation Outdated Amid XRP Price Surge

Published

3 hours agoon

January 7, 2025By

admin

Ripple CEO Brad Garlinghouse has declared that Ripple’s previous valuation of $11 billion is now “very outdated,” following a notable surge in XRP price and increased demand for Ripple’s blockchain solutions.

Speaking during a recent interview, Garlinghouse cited the company’s substantial holdings of XRP, now valued at over $100 billion, as a key factor altering Ripple’s valuation outlook.

Ripple CEO Brad Garlinghouse Calls $11B Valuation Outdated

According to Ripple CEO Brad Garlinghouse the company now has more than $100 billion worth of XRP tokens. This development changes the valuation proposition of the blockchain infrastructure company dramatically. The CEO noted that Ripple’s trading in private markets has been much cheaper to the net asset value of the company than other companies that are linked to cryptocurrencies such as MicroStrategy.

“The total value of the XRP we hold is now greater than $100 billion,” said Garlinghouse. He also compared Ripple’s valuation metrics with MicroStrategy noting that the latter trades at a premium to its assets. ”Ripple has been trading in the private markets at a discount while MicroStrategy has trading at 3x premium to its net asset value,” he said.

Ripple was last valued at $11 billion in early 2024 when the company bought back $300 million worth of shares. Nevertheless, Ripple CEO Brad Garlinghouse stated that such an estimate is no longer relevant to the current financial position of Ripple, thanks to the increasing XRP price and institutional adoption.

XRP Price Growth Attracts Attention Amid Market Trends

XRP price has also seen a significant rise in value, it has risen five times its value before the election periods in late 2024. Ripple’s token has had increased liquidity and trading volume, sometimes even outperforming Bitcoin, as per data from FalconX.

This upsurge is in line with other developments within the cryptocurrency market such as the high probability of a crypto ETF launch and debate on a U.S. based blockchain reserve. Crypto analyst Peter Brandt noted in his recent analysis of XRP’s technical chart that if the current bullish flag pattern would be fulfilled, XRP market cap may hit $500 billion.

Furthermore, the SuperTrend indicator has just turned bullish on the XRP 12-hour chart for the first time in several months. Analyst Ali Charts pointed out that “The last time the SuperTrend indicator changed direction to the bullish side, XRP rose by 470%.”

Ripple CEO Stance on Company Strategic Focus

Although XRP is gaining popularity in the market, Ripple’s main business is still centered on offering blockchain technologies to financial companies. In the interview, Ripple CEO Brad Garlinghouse restated his company’s focus on the B2B sector including banks, payment providers, and corporates, where Ripple is offering solutions like custody and cross-border payments.

Recently, Ripple announced that it would launch its stablecoin called Ripple USD (RLUSD) with the license from the New York Department of Financial Services (NYDFS). Garlinghouse stressed that the RLUSD will leverage XRP rather than replace it, increasing its liquidity, and opening more possibilities for the utilization of Ripple’s DEX and automated market maker (AMM) functionalities.

The acquisition of Switzerland-based custody firm Metaco which was completed about 18 months ago has also put Ripple in a vantage position to offer its institutional products. The CEO was upbeat on the increased demand of the company’s custody services especially from Tier 1 banks.

Changing Regulatory Environment Fuels Optimism

Ripple’s growth has been supported by changing perceptions in the legal environment. Garlinghouse claimed that the previous several months marked a ‘turning point’ due to the exit of SEC Chairman Gary Gensler and the chance for regulatory certainty under the new administration.

As a result of the recent changes in the US government’s stance with regard to cryptocurrency innovation, Ripple CEO Brad Garlinghouse said, “The winds have changed.”

Recently, he also stated that 95% of Ripple’s customers are outside the United States, but he expects the interest to return in the United States in the next few months.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Price Prediction Points To New ATH as Bullish Breakout Looms

Published

7 hours agoon

January 6, 2025By

admin

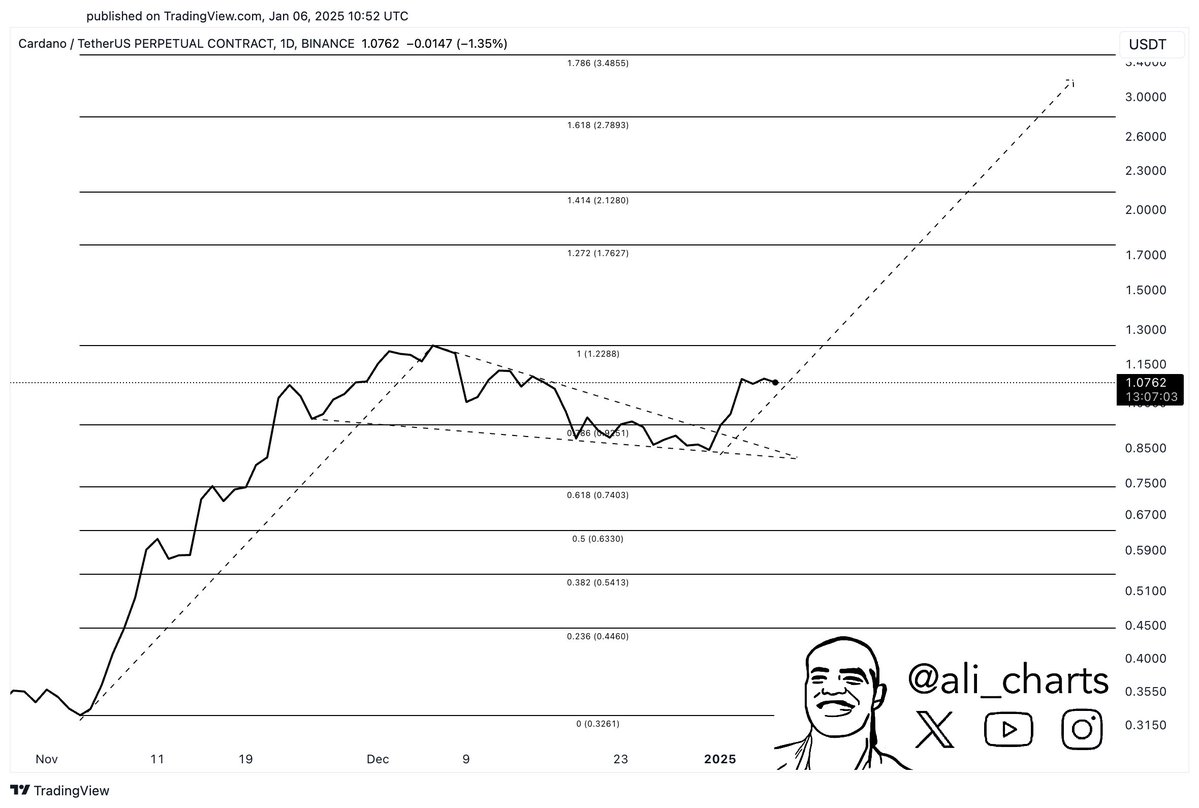

Cardano (ADA) price is showing strong signs of a potential breakout as it consolidates near $1.10, sparking optimism among traders. Ali Charts, a cryptocurrency analyst, has highlighted a bullish pennant formation on ADA’s price chart, suggesting an upward move could be on the horizon.

If this pattern plays out, Cardano price could target higher levels, with the possibility of reaching $1.40 in the short term and breaching the previous all time high of $3.10. The cryptocurrency has gained 28% since the start of 2025, supported by growing network activity and increased investor interest.

Cardano Price Prediction Points To New ATH

Cardano’s price is currently forming a bullish pennant, a technical pattern that often predicts a continuation of an uptrend. This pattern is characterized by a sharp price increase, followed by consolidation in a triangular shape.

The resistance level of the pennant is around $1.11, while the support lies near $1.10. If ADA breaks above the upper trendline, traders could expect the price to surge, with a target near $1.40. Ali Charts emphasized that the “Cardano breakout to $3 could be fast and smooth” if bullish momentum strengthens. This ADA price prediction aligns with an ealier analysis by Coingape pointing to a similar price breakout after the formation of an Elliott Wave.

Technical indicators also support this outlook. The Relative Strength Index (RSI) is at 67, reflecting strong buying activity, though it is approaching overbought levels. Meanwhile, the MACD (Moving Average Convergence Divergence) remains in bullish territory, suggesting continued upward pressure.

Rising Network Activity Boosts Investor Confidence

In addition to technical signals, Cardano’s network activity has been gaining momentum, which could further support its price action. According to data from DeFiLlama, the Total Value Locked (TVL) on the Cardano blockchain has surged to $595 million, marking a 33% increase since the start of the year.

The rise in TVL indicates growing interest in Cardano’s decentralized finance (DeFi) ecosystem, which is attracting both retail and institutional investors. Transaction volumes have also increased, with the metric reaching $10.64 million, signaling higher on-chain activity.

Moreover, the number of funded wallets on the Cardano network has grown significantly. Since December 19, over 10,000 new wallets have been added, bringing the total to 4.38 million. This influx of new investors is often seen as a positive indicator of market sentiment.

ADA Price Resistance Levels and Potential Targets

While Cardano price prediction is showing bullish momentum, it faces key resistance levels that must be breached to sustain its uptrend. The immediate resistance is at $1.20, as identified by Donchian Channels.

Breaking above this level could pave the way for a move toward $1.34, which corresponds to the 1.618 Fibonacci extension.

If ADA continues to attract buying pressure and breaks out of its current consolidation, it could eventually target higher price levels even as high as $7. However, failure to surpass $1.20 could lead to a pullback, with $1.00 serving as a critical support level. A breach below this support could expose Cardano to further declines, potentially testing $0.92.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ex-SEC Lawyer Affirms Settlement in XRP Lawsuit

Published

18 hours agoon

January 6, 2025By

admin

The Ripple SEC case is in debate again as the deadline for the U.S. Securities and Exchange Commission (SEC) to file its initial brief approaches. A former US SEC lawyer said the parties will likely settle as ruled earlier by Judge Analisa Torres. The incoming Donald Trump administration and SEC Chair Paul Atkins may decide to not pursue the appeal in XRP lawsuit.

Ex-SEC Lawyer Says Settlement in Ripple SEC Case Most Likely

Marc Fagel, a former SEC enforcement attorney, on January 6 posts explained to the crypto community that the government agency didn’t lose, but won in part and lost in part. This requires a settlement between parties as both Ripple and SEC appealed the part they lost.

“Because both parties appealed the part of the case they lost. So the penalty is on hold pending appeal,” he added. The court ordered Ripple to pay $125 million in penalty for $700 million in unregistered securities sales to institutional investors.

Marc Fagel asserts the odds of new SEC administration deciding not to pursue the appeal is higher, which will make parties settle Ripple SEC case on what the court ruled. However, he affirmed that the SEC under Gary Gensler will file appeal by January 15.

Pro-XRP Lawyer Expect May End Timeline for XRP Lawsuit

As reported first by CoinGape Media, lawyer Jeremy Hogan has predicted an April or May timeline for the end of the Ripple SEC case. He added that the decision may not come before that as it takes a lot of time to get reports, memos, requisite SEC meetings and others.

Today, he again commented that Paul Atkins will definitely drop the appeal and settle with Ripple to end XRP lawsuit in 2025.

I definitely think that’s the most likely scenario (with the Ripple case being a non-fraud/no investor’s harmed case). Like most of these things, it’s just the timing that is difficult to lock down – maybe April or May?

— Jeremy Hogan (@attorneyjeremy1) January 5, 2025

What’s Next Under Paul Atkins?

Experts and the crypto community believe the end of Ripple SEC case will boost the odds for XRP ETF approval. This may also trigger a rally in XRP price.

CEO Brad Garlinghouse in a post on Sunday criticized the SEC under Gary Gensler saying the actions “froze our business opportunities here at home for years.” He highlights that 75% of Ripple’s open job roles are now US-based and the company has signed new deals in the U.S. in the last six weeks.

“Team Trump is already jumpstarting innovation and job growth in the US with Scott Bessent, David Sacks, Paul Atkins and others at the helm, and they aren’t even in office yet! Say what you want, but the “Trump effect” is already making crypto great again.”

Meanwhile, analysts expect XRP price to see another rally to double-digit figures, similar to a 400% rally after Trump’s re-election.

In short-term, XRP price to consolidate at the current range for weeks and then rally towards a new all-time high, as per analyst CrediBULL Crypto. “Currently trading at around where I closed my last long. We’ve taken some liquidity above us into local supply. Currently eye-ing up the orange zone for another potential long trade,” he predicted.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ReadyGamer announced as Virtual Protocol rides wave of investor confidence

Ripple CEO Brad Garlinghouse Calls $11B Valuation Outdated Amid XRP Price Surge

Dogecoin Jumps 20%, But Social Media Still Bearish: Green Signal For Rally?

Canada Can Elect The Next Bitcoin World Leader

Ethereum, XRP, Rollblock, Solana, Pepe, and Shiba Inu

Cardano Price Prediction Points To New ATH as Bullish Breakout Looms

Coinbase (COIN) Stock Could Become Available on Base Chain, According to Creator Jesse Pollak

Anchors Are Evil! Bitcoin Core Is Destroying Bitcoin!

Tether, top crypto exchange to swap $1b USDT to Tron network

Top Altcoins to Buy in 2025 That Could Skyrocket in 60 Days

MicroStrategy Continues Weekly Bitcoin Buying Spree With Another $101 Million

New Pi Cycle Top Prediction Chart Identifies Bitcoin Price Market Peaks with Precision

SPX6900 price rockets to ATH: will SPX hit $2 soon?

Pepe Coin Price Set to Crash 30% As Top Holders Sell PEPE

MicroStrategy Buys a Further 1,020 Bitcoin

Telegram users can send gifts to friends, TON fails to pump

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Bitcoin3 months ago

Bitcoin3 months agoSEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

✓ Share: