24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Published

1 day agoon

By

admin

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after investors turned cautious with strong US JOLTS job openings and ISM Services PMI data.

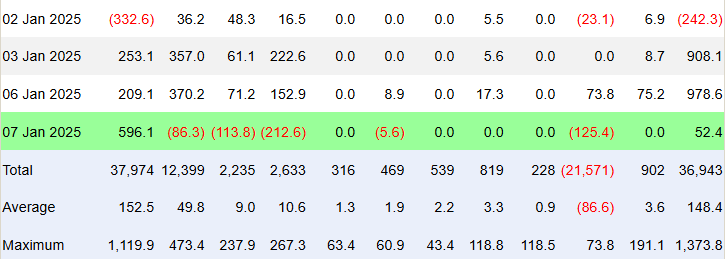

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) purchased 6,078 BTC worth $208.7 on January 7, while miners only mined 450 new BTCs. IBIT recorded an inflow of $597.18 million, as per Trader T data.

This makes the third consecutive inflow into IBIT despite a major selloff in the crypto market. Notably, US Bitcoin ETF saw an inflow of $978.6 million on Monday, sparking optimism as the flagship crypto soared past the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million in outflow.

Grayscale’s GBTC also witnessed an outflow of $125.45 million. Flows were zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Whereas, other ETFs experienced varying degrees of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings increased by 259,000 to 8,098 million in November 2024, Also, ISM Services PMI came in higher than expected, which shows the resilience of the U.S. economy currently. This caused Bitcoin price to crash by more than 5%.

In fact, the US dollar index (DXY) holds its advance above 108.50 today, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year US Treasury yield increased to a 35-week high of 4.68%. The strong US economic data reduced expectations for further rate cuts by the Federal Reserve.

Whereas, BTC price continues to fall despite better performance by BlackRock Bitcoin ETF. The price currently trades at $96,259. The 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, the trading volume has decreased by 23% in the last 24 hours.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

Using Mining To Create More Fully Validating Bitcoin Users

Mastercard brings p2p aliases for crypto transfers in UAE, Kazakhstan: report

Bitcoin Should Be Much Higher Six Months From Now, According to Real Vision’s Jamie Coutts – Here’s Why

24/7 Cryptocurrency News

US CFTC Issues Subpoena to Coinbase In Polymarket Case, What’s Next?

Published

7 hours agoon

January 9, 2025By

admin

The U.S. Commodity Futures Trading Commission (CFTC) has issued a fresh subpoena to crypto exchange Coinbase just days ahead of President Joe Biden leaving office. This comes as part of the US CFTC’s ongoing investigation into betting markets Polymarket thereby requiring Coinbase to provide specific information regarding customers involved in the case.

US CFTC Seeks Coinbase Customers

Under the outgoing Biden administration, the CFTC has cracked a whip issuing a subpoena to crypto exchange Coinbase in the Polymarket lawsuit.

After receiving an email for the same from the exchange, Eric, co-author of Ethereum’s EIP-1559, shared this information in the public domain. “The dems crypto pivot truly was something else!” he wrote.

The exchange informed its customers through email that it may be required to share account-related information with the US CFTC. However, the company noted that no action is required from customers at this time.

Biden’s CFTC is subpoenaing customer info from @coinbase in their case against @Polymarket pic.twitter.com/YlCdUPwHs7

— eric.eth (@econoar) January 8, 2025

Crypto Exchange Need to Comply Soon

The action comes with a deadline, unless Coinbase receives a motion to dismiss or other legal documentation by the close of business on January 15, 2025, the company will be required to comply.

The announcement comes just ahead of the CFTC chair Rostin Behnam stepping down before President-elect Donald Trump takes oath on January 20. The Trump transition team has reviewed at least six potential candidates to lead the US CFTC, aligning with the president-elect’s pledge to establish a more crypto-friendly regulatory framework.

Polymarket And Its Regulatory Scrutiny

Polymarket, a decentralized prediction market platform, gained huge popularity during the US Presidential Elections in 2024 drawing attention from regulators like the US CFTC. The regulator demanded limiting the operation of the prediction market while labeling them as gambling platforms.

Unlike the promises by Vice President Kamala Harris of a crypto pivot, the Democrats have continued with the crypto crackdown even in their last days in office. Coinbase and the CFTC have yet to comment publicly on the matter, but the subpoena marks another pivotal moment in the intersection of U.S. regulatory oversight and the cryptocurrency industry.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Bitcoin Dips Below $95K, RUNE and INJ Drop 11%

Published

11 hours agoon

January 9, 2025By

admin

Crypto market today remains in bearish territory as Bitcoin dipped below the $95K mark. Major altcoins followed the downtrend, with several tokens trading in the red. THORChain (RUNE) and Injective (INJ) became the worst performers, both dropping 11% from their daily highs.

The global crypto market today fell by approximately 2%, bringing the total market cap to $3.33 trillion. However, trading volume showed a slight increase of 4% over the last 24 hours, reaching $168 billion. Let’s take a closer look at the top cryptocurrencies by market cap and their current prices.

Crypto Market Today: BTC, ETH, SOL Drop in Bearish Trend

The crypto market today saw a continued bearish trend, with Bitcoin (BTC) down 3%, Ethereum (ETH) falling 2%, and Solana (SOL) dropping 2.5%. Despite the downturn, a positive sign emerged as Bitcoin whales began accumulating BTC once again.

Bitcoin Market Today: BTC Drops 3%, ETF Outflows Continue

Bitcoin price was trading at $94,390, reflecting a 3% drop in the last 24 hours. The 24-hour low and high for BTC stood at $92,559 and $96,666, respectively.

As per SoSo Value data, BTC ETFs witnessed an outflow of $458 million. Fidelity led the sell-off, offloading $258 million worth of Bitcoin. Ark and 21Shares also sold $148 million in Bitcoin, while data from BlackRock’s ETF remains anticipated.

Ethereum Market Today: ETH Price Down 1.5%, ETF Outflows Surge

Ethereum price was down by 1.5%, currently trading at $3,325. The 24-hour low and high for ETH were recorded at $3,210 and $3,387, respectively.

ETH ETFs saw an outflow of $159 million in the past 24 hours, with Fidelity contributing $147 million to the sell-off. The ongoing bearish sentiment continues to impact the crypto market today, reflecting declining prices and significant fund outflows from major institutions.

XRP Market Today: Only Gainer Among Top 10 Coins

XRP price stood out as the only coin in the top 10 to register a gain, rising by 0.40% in the last 24 hours. It was trading at $2.351, with a 24-hour low of $2.214 and a high of $2.396. Additionally, Ripple’s stablecoin RLUSD has been listed on the Bitstamp exchange, adding more utility to the XRP ecosystem.

Solana Market Today: SOL Price Drops 2%

Solana (SOL) price was down by approximately 2%, currently trading at $195.45. Its 24-hour low and high were recorded at $189 and $199, respectively.

Crypto Market Gainers Today

XDC Network

XDC price was up by 7%, now trading at $0.0973. Its 24-hour low and high were $0.087 and $0.0975, respectively. With a market cap of $1.45 billion and a trading volume of $59.35 million, XDC stands out amidst the crypto market today’s overall downturn.

Monero

XMR has been the 2nd top gainer for today, with its price trading at $196, reflecting a 4% increase. Its 24-hour low and high were recorded at $183 and $201, respectively. With a market cap of $3.61 billion and a trading volume of $86.49 million.

Hyperliquid (HYPE), GateToken (GT), and NEO token have also shown gains in the crypto market today, with each token up by 2% to 4% in the last 24 hours. Despite the broader market’s bearish trend, these tokens have managed to perform well.

Crypto Market Losers Today

THORChain

RUNE price was down by 11%, currently trading at $3.94. Its 24-hour low and high were recorded at $3.86 and $4.35, respectively, reflecting a significant decline in the crypto market today.

Injective

INJ price was down by 11% in the last 24 hours, trading at $21.60, with a 24-hour low of $20.54 and a high of $23.88. Despite the downward trend in the market, INJ price has been up by 11% in the last quarter and saw a 13% increase in the past week after the community passed a major governance proposal, amid growing market interest in AI coins.

WIF, MOVE, AIOZ, and SPX have also faced a decline of 7% to 9% in the last 24 hours. This adds to the overall bearish sentiment in the market.

Besides this, the hourly chart also shows a bearish sentiment in the crypto market, with Bitcoin down by 0.13% in the last 24 hours. Fartcoin dropped by 4% in the last hour, and major altcoins are also in the red, reflecting continued selling pressure across the market.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

FTX Breaks Silence On Backpack’s Alleged Acquisition Of The Defunct Exchange

Published

15 hours agoon

January 9, 2025By

admin

FTX issued a formal statement clarifying details surrounding Backpack entities’ claim of acquiring FTX EU Ltd. The clarification, released on January 8, 2025, addresses inaccuracies in Backpack’s January 7 press release, which suggested its involvement in asset recovery for former FTX EU customers.

FTX Highlights Inaccuracy in Backpack’s FTX EU Acquisition Statements

In a recent press release, FTX addressed statements made by Backpack entities regarding its purported acquisition of FTX EU. FTX stated that the January 7, 2025, Backpack announcement was made without FTX’s knowledge or involvement. According to the exchange, Backpack’s press release contain multiple inaccuracies that could mislead stakeholders.

FTX emphasized that 100% of FTX EU share capital is still owned by FTX Europe AG, a subsidiary of FTX. While there was an earlier agreement to sell FTX EU to former insiders of FTX Europe as part of a settlement, the U.S. Bankruptcy Court overseeing the Chapter 11 process has not approved any transfer. The defunct exchange also confirmed that it was unaware of any indirect sale of FTX EU shares to Backpack before this week.

Bankruptcy Court and Asset Recovery Process

In addition, the defunct exchange clarified that Backpack has no role in the U.S. Bankruptcy Court-approved process for returning funds to creditors, including FTX EU’s former customers. The company reiterated that only FTX EU holds responsibility for determining and returning funds owed to its customers. The court’s Chapter 11 plan does not authorize the organization to make distributions to any creditors or former customers.

The defunct exchange further stated that the amounts owed by FTX EU to its customers would be assessed solely by FTX EU following its sale, not by the exchange or the Bankruptcy Court. Therefore, the exchange disclaimed Backpack’s liability for repayments of EU customer funds.

Furthermore, the defunct exchange expressed concerns about the accuracy and completeness of the information presented in Backpack’s materials. The report urged stakeholders to rely only on official FTX communications.

Initial Distributions Under Bankruptcy Plan

The defunct exchange also provided an update on its U.S. Bankruptcy Court-approved Chapter 11 plan of reorganization. The defunct exchange plan became effective on January 3, 2025, with the initial distribution record date set for the same day. Distributions to convenience class claimants are expected within 60 days, subject to regulatory requirements.

Meanwhile, the exchange reaffirmed its commitment to adhering to the court’s processes and ensuring accurate communication with creditors.

These developments come in light of recent media speculation that US President Joe Biden might pardon Sam Bankman-Fried, the founder of the defunct FTX Exchange. Biden’s recent pardon of his son has sparked further rumors that SBF could get the same treatment.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

Using Mining To Create More Fully Validating Bitcoin Users

Mastercard brings p2p aliases for crypto transfers in UAE, Kazakhstan: report

Bitcoin Should Be Much Higher Six Months From Now, According to Real Vision’s Jamie Coutts – Here’s Why

US CFTC Issues Subpoena to Coinbase In Polymarket Case, What’s Next?

Buying Greenland Would Be A Huge Boost to US Bitcoin Mining

AI suggests 3 top Solana alternatives to boost wallets this first quarter

BNB Price Rebound Possible: Can It Climb Back to $720?

Bitcoin Dips Below $95K, RUNE and INJ Drop 11%

Don't Buy The Bitcoin Dip

ChatGPT’s top 5 crypto picks for the 2025 market surge

XRP Flashing Bullish Signal That Previously Triggered 470% Upside Burst, According to Analyst Ali Martinez

FTX Breaks Silence On Backpack’s Alleged Acquisition Of The Defunct Exchange

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: