Blockchain

Digital banking giant Revolut joins Pyth Network

Published

1 day agoon

By

admin

Revolut, the U.K.-based digital banking giant, is the latest company to join the Pyth Network as a data publisher.

The partnership between the Financial Conduct Authority regulated neobank and Pyth Network (PYTH) means Revolut will now contribute its price data to the blockchain-based oracle network, benefiting the growing decentralized finance ecosystem.

Revolut’s integration with Pyth comes as the gap between traditional finance and DeFi continues to narrow.

This trend has gained traction amid the increasing adoption of blockchain technology across financial technology and related ecosystems. The Pyth Network’s oracle solution plays a key role in this evolution as the platform seeks to expand alongside industry giant Chainlink (LINK). Both oracle networks aim to provide web3 users and institutions with enhanced transparency and reliability.

Mike Cahill, chief executive officer of Duoro Labs and a contributor to the Pyth Network, highlighted the growing recognition of digital assets and DeFi within traditional finance.

“Pyth’s collaboration with Revolut is part of a larger trend we’re seeing, where traditional banking institutions, trusted by millions of customers globally, are recognizing the value of decentralized finance and digital assets. Together, we are driving the future of finance, where transparent and reliable data empowers the next generation of financial applications,” he noted.

As a data publisher on Pyth Network, Revolut will contribute to Pyth’s price feeds, enhancing the security and reliability of decentralized applications. In turn, Pyth will leverage Revolut’s market expertise to provide accurate and dependable price feeds to dApps. For Revolut, the partnership marks a significant step in expanding its presence in the web3 space.

Launched in 2015, Revolut has grown to over 45 million users and offers its services in 200 countries. Meanwhile, the Pyth Network continues to expand, with more than 120 data providers, over 590 price feeds, and integration across 450 dApps.

Source link

You may like

The Future Of Home Bitcoin Mining Is Bright

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

AI

‘Hype Cycle’ To Last Another Four Months for This Altcoin Sector, According to Real Vision Analyst Jamie Coutts

Published

2 days agoon

January 7, 2025By

admin

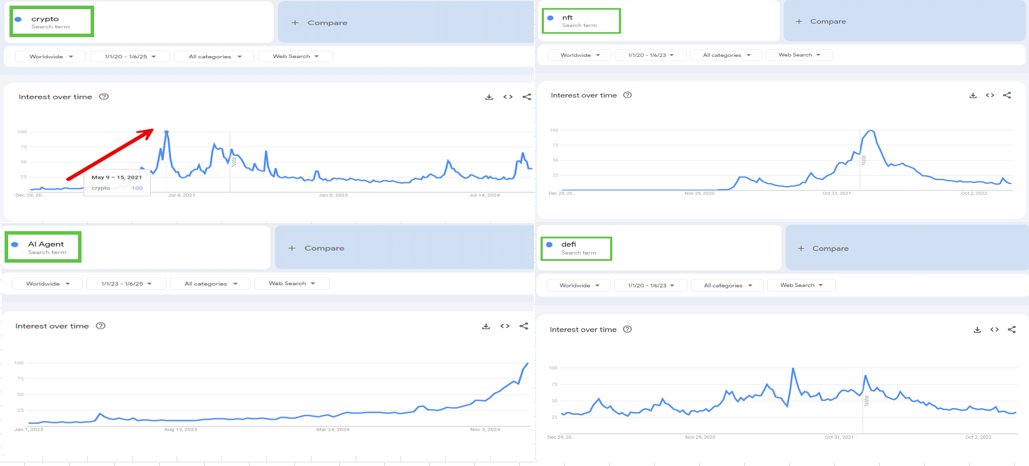

Real Vision’s chief digital assets analyst Jamie Coutts says that a nascent but soaring crypto sector could continue its upward trend for a few more months.

Coutts tells his 32,100 followers on the social media platform X that he thinks crypto artificial intelligence (AI) agents will continue to perform well in the coming months.

Crypto AI agents are protocols built to autonomously perform tasks on behalf of users such as interacting with blockchains and decentralized finance (DeFi) platforms, trading and managing portfolios.

Says Coutts,

“The last big crypto hype cycle was from November 2020 to May 2021, around six months. Subsectors like DeFi, NFTs (non-fungible tokens) around six-12 months.

Interest in AI agents in crypto took off in November 2024. Based on history, this trend is expected to last at least another four months, but probably longer.

AI agents are not like the others – they unlock potential for every established and new use case.”

The Real Vision analyst, however, says that crypto AI agents could face a severe correction after reaching the cycle top.

“There will be many scams (tread carefully/position size), and as with every hype cycle, the dump will be massive, but I suspect this move still has a way to go.”

According to the cryptocurrency data aggregator CoinGecko, some of the AI-focused crypto projects that rank among the top 100 digital assets by market cap include Artificial Superintelligence Alliance (FET), Virtuals Protocol (VIRTUAL) and ai16z (AI16Z).

Artificial Superintelligence Alliance is a me ging of various decentralized AI platforms whose goal is to speed up the advancement of decentralized Artificial General Intelligence (AGI) and Artificial Superintelligence (ASI).

Virtuals Protocol is a platform that aims to enable the co-ownership of AI agents.

Meanwhile, the ai16z crypto project is designed to leverage AI-driven insights to direct investments in blockchain projects.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Blockchain

Steem Dollars spike 106%, highlighting resurgent interest

Published

5 days agoon

January 5, 2025By

admin

Steem Dollars, the stablecoin native to the Steem blockchain, has seen a remarkable price surge of over 106%, drawing fresh attention to the decentralized content and rewards platform.

Originally created in 2016 by blockchain entrepreneur Ned Scott and BitShares founder Dan Larimer, Steem Dollars (SBD) were designed to provide stability in the volatile world of cryptocurrency while powering a unique ecosystem of social media and content creation.

Its market cap currently hovers just above $47.5 million.

The coin’s recent rally highlights renewed interest in the Steem ecosystem, where Steem Dollars play a central role. Pegged to the U.S. dollar, the coin offers a relatively stable cryptocurrency option — integral to the platform’s reward system.

Additionally, Steem – like most cryptocurrencies – can also be used to make digital peer-to-peer payments.

Users earn SBD for publishing and curating content on platforms like Steemit, a New York-based startup that touts itself as a decentralized alternative to traditional social media networks.

Why Steem Dollars matter

SBD provides liquidity for transactions within the Steem blockchain and can be used to earn interest as part of a decentralized savings account. It is also convertible to other cryptocurrencies or fiat.

Additionally, Steem Dollars can be traded for STEEM tokens or Steem Power, the latter increasing influence and voting weight on the platform.

The sharp price increase, however, raises questions about its stability. While the token is intended to maintain a value close to 1 USD, its market-driven price has occasionally deviated from this peg.

The current surge might reflect speculative trading rather than organic growth in the ecosystem, but it nonetheless underscores the enduring relevance of Steem Dollars in the blockchain space.

Looking ahead

As SBD continues to climb, analysts and community members will be watching closely to see if this momentum translates into lasting growth for the Steem ecosystem.

Whether the surge is a fleeting speculative event or the start of a broader renaissance, one thing is clear: Steem Dollars are once again making waves in the cryptocurrency world.

Several platforms integrate stablecoins into reward ecosystems to incentivize user participation and provide stability. Examples include Hive Dollar on the Hive blockchain, offering rewards for content creators, and DAI from MakerDAO, widely used in DeFi for staking and liquidity rewards.

Binance USD (BUSD) and USDC are commonly utilized in platforms like PancakeSwap and PoolTogether for similar purposes. Curve Finance employs stablecoins like DAI and USDT in liquidity pools, while sUSD from Synthetix powers synthetic asset trading and staking rewards.

Social media platforms like Roll and Rally also incorporate stablecoins to reward creators. These ecosystems highlight the versatility of stablecoins in reducing volatility and fostering user engagement.

Source link

Blockchain

Blockchain groups challenge new broker reporting rule

Published

2 weeks agoon

December 28, 2024By

admin

Three prominent blockchain advocacy organizations filed a lawsuit challenging the Internal Revenue Service’s new broker reporting requirements.

The organizations argue that the rules could severely impact the U.S. digital asset sector, particularly decentralized finance (DeFi).

The Blockchain Association, DeFi Education Fund, and Texas Blockchain Council jointly filed the legal challenge in the U.S. District Court for the Northern District of Texas.

They contended that the IRS and Treasury Department’s final “broker” rulemaking exceeds their authority.

The lawsuit specifically targets the rule’s expansion of the “broker” definition to include providers of DeFi trading front-end services, despite these entities not directly facilitating transactions.

The Blockchain Association CEO Kristin Smith called the broker rule “unconstitutional,” alleging that the IRS is violating the Administrative Procedure Act.

Today we’re taking action, filing a lawsuit that argues today’s broker rulemaking violates the Administrative Procedure Act and is unconstitutional.

We stand with our nation’s innovators and will continue working to ensure the future of crypto – and DeFi – is here in the United… https://t.co/CwZWzjwT5O

— Kristin Smith (@KMSmithDC) December 28, 2024

According to the Blockchain Association’s Head of Legal, Marisa Coppel, this overreach “would push this entire, burgeoning technology offshore” while infringing on the privacy rights of individuals using decentralized technology.

DeFi Education Fund CEO Miller Whitehouse-Levine expressed strong disappointment in the timing and scope of the regulation. Miller called it “midnight rulemaking” that threatens financial innovation.

The organization emphasized DeFi’s potential to make financial services more accessible, efficient, and consumer-focused.

Texas Blockchain Council President Lee Bratcher highlighted the practical impossibility of compliance. He stated that many actors in the decentralized ecosystem simply cannot access the information now required by the IRS.

“This regulatory overreach risks driving critical development overseas, threatening US competitiveness in the digital economy,” Bratcher stated.

The legal challenge comes after numerous stakeholders warned during the public comment period about the potential negative impacts on the digital asset industry. Crypto.news had earlier reported that DeFi proponents had promised aggressive action against the IRS policies.

Source link

The Future Of Home Bitcoin Mining Is Bright

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

SHIB, PEPE to be replaced by this token, according to popular analyst

Dogecoin May Beat Bitcoin In Next 6 Months

Cardano (ADA) Price Prediction January 2025, 2026, 2030, 2040

Using Mining To Create More Fully Validating Bitcoin Users

Mastercard brings p2p aliases for crypto transfers in UAE, Kazakhstan: report

Bitcoin Should Be Much Higher Six Months From Now, According to Real Vision’s Jamie Coutts – Here’s Why

US CFTC Issues Subpoena to Coinbase In Polymarket Case, What’s Next?

Buying Greenland Would Be A Huge Boost to US Bitcoin Mining

AI suggests 3 top Solana alternatives to boost wallets this first quarter

BNB Price Rebound Possible: Can It Climb Back to $720?

Bitcoin Dips Below $95K, RUNE and INJ Drop 11%

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x