CoinDesk Indices

Building Bridges to the Mainstream

Published

15 hours agoon

By

admin

In today’s issue, Leo Mindyuk from MLTech provides a crypto outlook for 2025 and highlights key factors that could drive the adoption of these assets.

Then, Miguel Kudry from L1 Advisors shares his insights on the topic in Ask and Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

2025 Outlook for Crypto Adoption: Building Bridges to the Mainstream

The crypto industry is entering 2025 with a renewed sense of purpose. Over the past year, the sector has witnessed key developments that signal crypto’s increasing integration into traditional finance (TradFi) and broader adoption of crypto assets, especially bitcoin. However, the road ahead will test the resilience of this growing ecosystem. As we assess the outlook for 2025, several factors emerge as critical to shaping the adoption trajectory: regulatory clarity, institutional participation, and technological innovation.

1. Regulatory Clarity: Turning Uncertainty Into Institutional Guidelines

As I’ve briefly discussed on my CoinDesk podcast about election night results and the price action around it, regulatory clarity is emerging as a pivotal factor for crypto adoption. The market has already started pricing in the expectation that newly elected officials will bring long-awaited structure to the digital asset ecosystem. We will see some of those expectations starting to play out this year. Key areas where we are likely to see more clarity include:

a) Definition and classification of digital assets: The U.S. is expected to refine how digital assets are classified – whether as securities, commodities, or some combination. This clarity will directly impact how tokens are issued, traded, regulated, and taxed.

b) Stablecoins: These are likely to be a major focus for regulators due to their transformative real-world use cases and potential impact on financial stability.

c) Taxation of crypto transactions: Recent changes have already been made, and we will likely see clearer tax reporting requirements for digital assets, various associated activities, and various industry players.

Additional topics such as tokenization—including real-world assets—custodial and non-custodial wallets, regulated trading venues, decentralized finance (DeFi), anti-money laundering (AML) and know your customer (KYC) compliance, and consumer protections will also be actively discussed and potentially acted upon.

2. Institutional Participation: ETFs as a Catalyst

In 2024, crypto ETFs experienced explosive growth, with billions in net inflows and notable launches. With new products, crypto ETFs now represent a rapidly expanding financial market segment, attracting significant investor interest and outperforming traditional funds. We will likely see a variety of adjacent products.

For 2025, growing inflows and high volumes in BTC and ETH ETFs will likely continue to validate crypto as an asset class and streamline access for retail and institutional investors. This will open the path for other single-asset ETFs, multi-asset ETFs, and various adjacent ETFs (e.g., leveraged, inverse, market-timing, volatility). If regulatory clarity progresses fast enough, we may see the U.S.’s first crypto yield-generating ETFs (e.g., staking). These products could bring additional investor interest to the asset class and increase inflows into passive and active investment products.

3. Technological Innovation: The Convergence of Blockchain Scalability and AI

Technological advancements in 2025 will be driven by Layer-2 blockchain scalability and AI integration. Rollups, zero-knowledge proofs, and interoperability will enhance transaction efficiency and user experience for decentralized applications (dApps) and DeFi. Simultaneously, AI agents operating on decentralized networks will solve and optimize a variety of tasks and interact with users and each other. This synergy simplifies Web3 interactions and ensures secure, transparent execution of AI decisions on blockchain. Together, these innovations will lower barriers to entry, attract developers and users, and accelerate mainstream adoption, making 2025 a pivotal year for blockchain and AI convergence.

Summary

The outlook for crypto adoption in 2025 is overwhelmingly positive, but not without challenges. Regulatory clarity, institutional participation, and technological innovation will be the pillars of growth. The question isn’t whether crypto will gain mainstream acceptance—it’s how fast and in what form. As we approach this next phase, those who adapt to the evolving landscape will lead the charge in shaping the future.

Ask an Expert

Q. What were the most impactful developments in the crypto market over the past year, and how have they shaped crypto adoption?

The most significant development in crypto last year was the political shift, with President-elect Donald Trump making crypto a key part of his platform. Markets are only beginning to price in the impact of the Executive and Legislative branches, along with financial regulators, that not only refrained from fighting the crypto industry but also encouraged crypto innovation within the United States. Beyond bitcoin adoption and the potential establishment of a national strategic bitcoin reserve, the broader implications for financial markets are still unclear to many market participants. Some of the world’s largest financial institutions that were previously on the sidelines are now actively developing their crypto strategy in response to the new pro-crypto administration.

Q. How is the evolving regulatory landscape likely to impact crypto markets and institutional involvement in 2025?

The SEC’s regulation-by-enforcement approach has had a far-reaching impact on the crypto markets. A shift to a neutral – or even positive – stance means financial professionals and institutions will need to actively explore how to better serve their customers who are already engaged with crypto, particularly given its decisive role in the election. Additionally, they will need to adapt their offerings to remain competitive in a world where financial markets and assets increasingly operate on crypto rails. Financial advisors, in particular, now have more opportunities to serve their clients by incorporating crypto allocations and existing crypto portfolios into comprehensive financial planning and strategy.

Q. Given the macroeconomic climate, how should financial professionals think about integrating crypto into broader investment strategies in 2025?

The year 2025 will mark a pivotal shift for crypto, transitioning from merely being an asset class to becoming the infrastructure that underpins a growing portion of all asset classes. Put differently, with the adoption of crypto rails, financial professionals will be better equipped to respond to the macroeconomic climate, further accelerating the flywheel of asset tokenization, portfolio allocations, and broader adoption.

– Miguel Kudry, CEO, L1 Advisors

Keep Reading

- J.P. Morgan’s retail platform E-Trade is considering adding crypto trading.

- The SEC lawsuit against Coinbase has been paused and is moving to the second circuit.

- Czech National Bank opens up discussions around bitcoin as they consider reserve diversification options.

Source link

You may like

Solana whales rapidly accumulate this viral altcoin dubbed the ‘next XRP’

Polymarket’s Customer Data Sought by U.S. CFTC Subpoena of Coinbase, Source Says

BTC, ETH, XRP & Top Altcoins Bleed Ahead Of Key Jobs Data

Vitalik Buterin warns of AI risks while highlighting new opportunities

Senate Banking Committee Advances Plans for Crypto Subcommittee Vote

Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3594.2, up 1.8% (+64.6) since 4 p.m. ET on Thursday.

19 of 20 assets are trading higher.

Leaders: ADA (+12.0%) and ICP (+10.6%).

Laggards: BTC (-1.0%) and ETH (+0.6%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Source link

charts

CoinDesk 20 Performance Update: SOL Gains 7.5%, Leading Index Higher

Published

1 week agoon

January 3, 2025By

admin

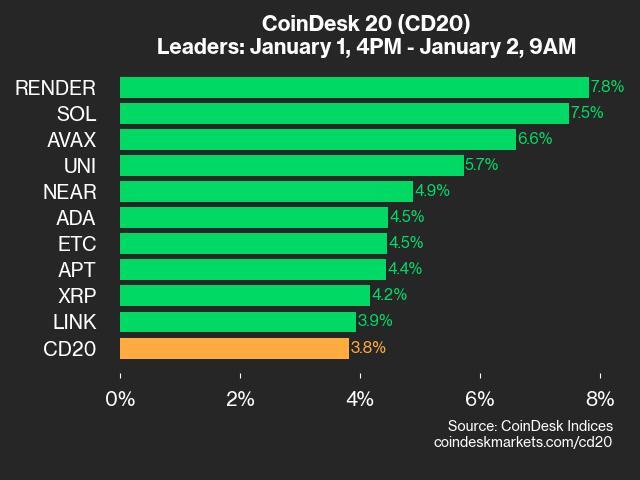

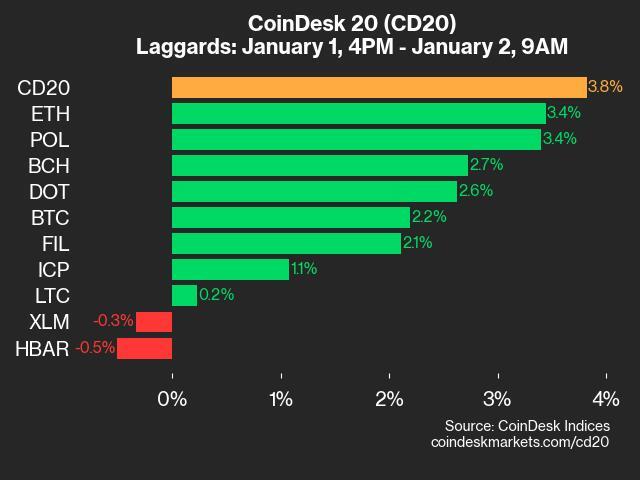

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3536.7, up 3.8% (+130.21) since 4 p.m. ET on Wednesday.

18 of 20 assets are trading higher.

Leaders: RENDER (+7.8%) and SOL (+7.5%).

Laggards: HBAR (-0.5%) and XLM (-0.3%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Source link

Centralized data networks, ones that are owned and/or managed by a single entity, have been structurally broken for years. Why? Single points of failure. If one entity (or even a few) has access to a database, then there is only one “point” to compromise in order to gain full access. This is a serious problem for networks holding sensitive data like customer information, government files, and financial records, and those with control of infrastructure like power grids.

Billions of digital records were stolen in 2024 alone, causing an estimated $10 trillion in damages! Notable breaches include nearly all of AT&T’s customer information and call logs, half of America’s personal health information, 700 million end-user records from companies using Snowflake, 10 billion unique passwords stored on RockYou24, and Social Security records for 300 million Americans.

Source: Statista, 2024

This is not just a private sector issue — governments and crucial national infrastructure also rely on centralized networks. Notable recent breaches include records on 22 million Americans stolen from the U.S. Office of Personnel Management, sensitive government communications from multiple U.S. federal agencies, personal biometric data on 1.1 billion Indian citizens, and the ongoing Chinese infiltration of several U.S. internet service providers.

Although hundreds of billions of dollars are spent each year on cyber security, data breaches are getting larger and happening more frequently. It’s become clear that incremental products cannot fix these network vulnerabilities — the infrastructure must be completely rearchitected.

Source: market.us, 2024

AI magnifies the issue

Recent advancements in generative AI have made it easier to automate everyday tasks and enhance work productivity. But the most useful and valuable AI applications require context, i.e. access to sensitive user health, financial, and personal information. Because these AI models also require massive computing power, they largely can’t run on consumer devices (computer, mobile), and instead must access public cloud networks, like AWS, to process more complex inference requests. Given the serious limitations inherent in centralized networks illustrated earlier, the inability to securely connect sensitive user data with cloud AI has become a significant hurdle for adoption.

Even Apple pointed this out during their announcement for Apple Intelligence earlier this year, stating the need to be able to enlist help from larger, more complex models in the cloud and how the traditional cloud model isn’t viable anymore.

They name three specific reasons:

- Privacy and security verification: Providers’ claims, like not logging user data, often lack transparency and enforcement. Service updates or infrastructure troubleshooting can inadvertently log sensitive data.

- Runtime lacks transparency: Providers rarely disclose software details, and users cannot verify if the service runs unmodified or detect changes, even with open-source tools.

- Single point of failure: Administrators require high-level access for maintenance, risking accidental data exposure or abuse by attackers targeting these privileged interfaces.

Fortunately, Web3 cloud platforms offer the perfect solution.

Blockchain-Orchestrated Confidential Cloud (BOCC)

BOCC networks are like AWS — except built completely on confidential hardware and governed by smart contracts. Though still early days, this infrastructure has been in development for years and is finally starting to onboard Web3 projects and Web2 enterprise customers. The best example of this architecture is Super Protocol, an off-chain enterprise-grade cloud platform managed completely by on-chain smart contracts and built on trustless execution environments (TEEs). These are secure hardware enclaves that keep code and data verifiably confidential and secure.

Source: Super Protocol

The implications of this technology address all of Apple’s concerns noted earlier:

- Privacy and security verification: With public smart contracts orchestrating the network, users can verify whether user data was transported and used as promised.

- Workload and program transparency: The network also verifies the work done within the confidential TEEs, cryptographically proving the correct hardware, data, and software were used, and that the output wasn’t tampered with. This information is also submitted on-chain for all to audit.

- Single point of failure: Network resources (data, software, hardware) are only accessible by the owner’s private key. Therefore, even if one user is compromised, only that user’s resources are at risk.

While cloud AI represents an enormous opportunity for Web3 to disrupt, BOCCs can be applied to any type of centralized data network (power grid, digital voting infrastructure, military IT, etc.), to provide superior and verifiable privacy and security, without sacrificing performance or latency. Our digital infrastructure has never been more vulnerable, but blockchain-orchestration can fix it.

Source link

Solana whales rapidly accumulate this viral altcoin dubbed the ‘next XRP’

Polymarket’s Customer Data Sought by U.S. CFTC Subpoena of Coinbase, Source Says

BTC, ETH, XRP & Top Altcoins Bleed Ahead Of Key Jobs Data

Vitalik Buterin warns of AI risks while highlighting new opportunities

Senate Banking Committee Advances Plans for Crypto Subcommittee Vote

Bitcoin Not Reached ‘Extreme Euphoria’ Phase Yet, Glassnode Reveals

Is USDT Losing to RLUSD and USDC?

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple President Says 2025 Will Be a Big Year for Crypto, Predicts More Spot ETFs Will Be Launched – Here’s Why

Billionaire investor predicts 11,466% run for $0.175 token

Binance Leads Bitcoin and Ethereum Outflows in 2024

The Future Of Home Bitcoin Mining Is Bright

Building Bridges to the Mainstream

Coinbase to add perpetual futures for AERO, BEAM and DRIFT

UK Court Denies James Howell’s Claim on £600M Bitcoin From Landfill

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x