Bitcoin ETF

Have Bitcoin ETFs Lived Up to the Hype?

Published

7 hours agoon

By

admin

The launch of Bitcoin ETFs in January 2024 was heralded as a groundbreaking moment for the market. Many expected these products to open the floodgates for institutional capital and catapult Bitcoin prices to new heights. But now, a year later, have Bitcoin ETFs delivered on their promise?

For a more in-depth look into this topic, check out a recent YouTube video here: Have Bitcoin ETFs Lived Up to Expectations?

A Strong Start

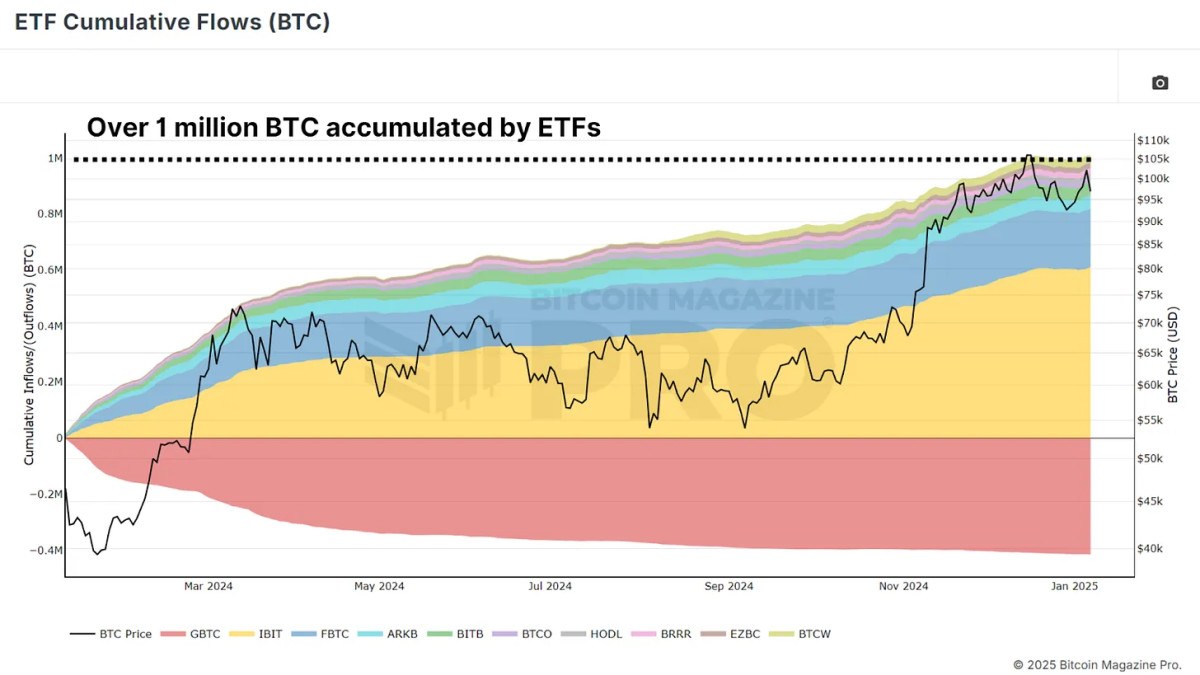

Since their launch, Bitcoin ETFs have accumulated over 1 million BTC, equivalent to approximately $40 billion in assets under management. Even when accounting for outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which saw withdrawals of over 400,000 BTC, the net inflows remain significant at about 540,000 BTC.

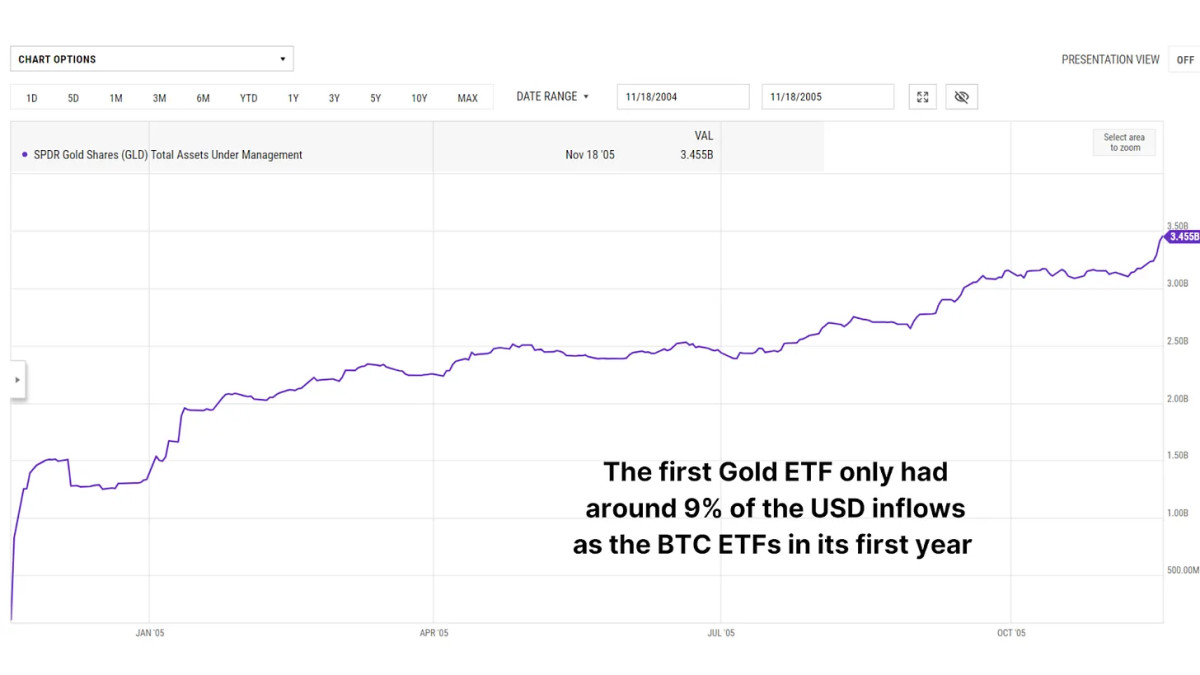

To put this into perspective, the scale of inflows far exceeds what we witnessed during the launch of the first gold ETFs in 2004. Gold ETFs garnered $3.45 billion in their first year, a fraction of Bitcoin ETFs’ $37.5 billion in inflows over the same period. This highlights the intense institutional interest in Bitcoin as a financial asset.

Bitcoin’s Year of Growth

Following the launch of Bitcoin ETFs, initial price movements were underwhelming, with Bitcoin briefly declining by nearly 20% in a “buy the rumor, sell the news” scenario. However, this bearish trend quickly reversed. Over the past year, Bitcoin prices have risen by approximately 120%, reaching new heights. For comparison, the first year following the launch of gold ETFs saw a modest 9% price increase for gold.

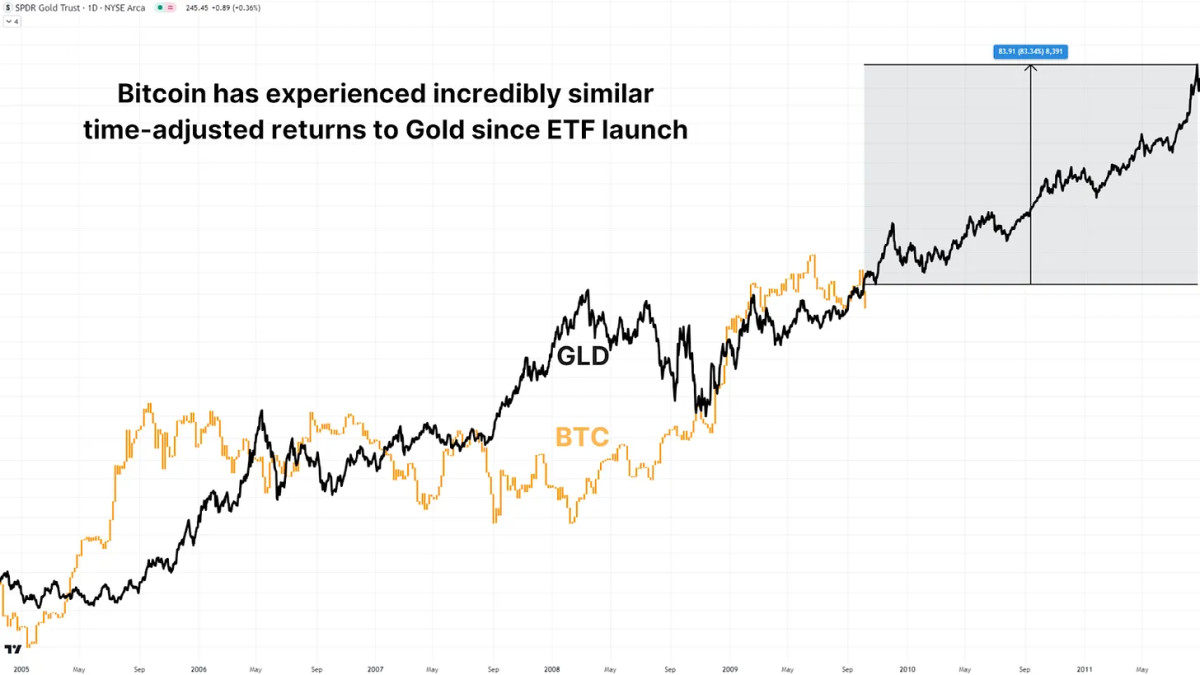

Following the Gold Fractal

When accounting for Bitcoin’s 24/7 trading schedule, which results in roughly 5.3 times more yearly trading hours than gold, a striking similarity emerges. By overlaying Bitcoin’s first year of ETF price action with gold’s historical data (adjusted for trading hours), we can see almost the same % returns. If Bitcoin continues to follow gold’s pattern, we could see an additional 83% price increase by mid-2025, potentially pushing Bitcoin’s price to around $188,000.

Institutional Strategy

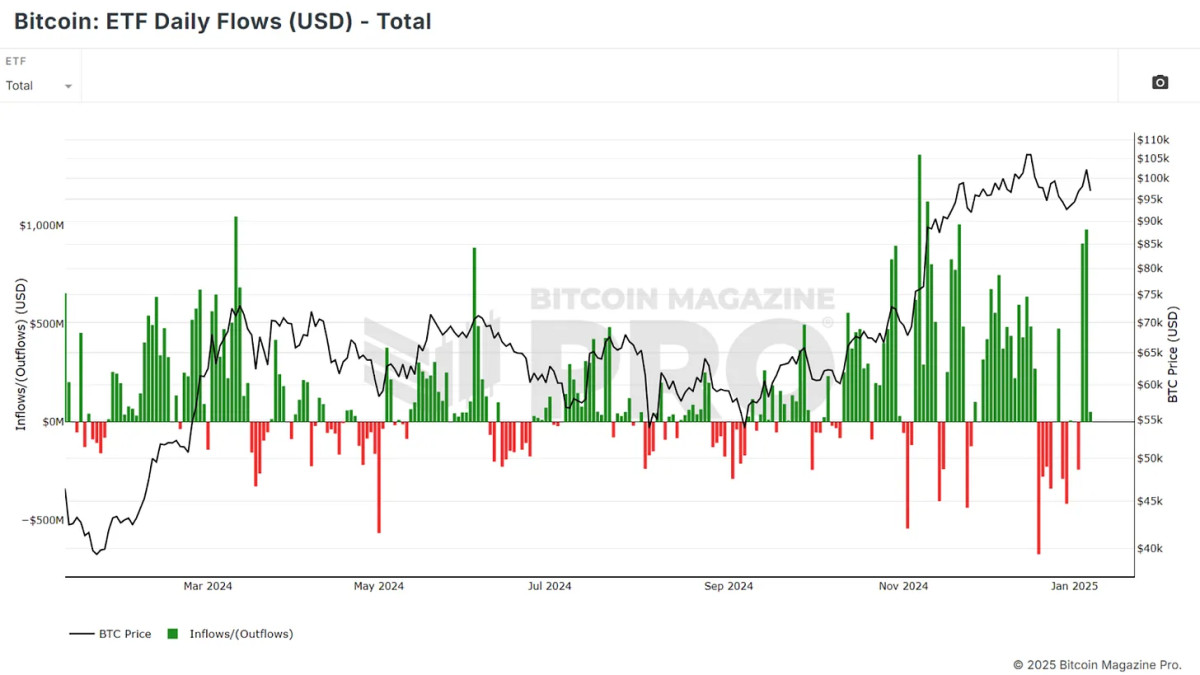

One intriguing insight from Bitcoin ETFs has been the relationship between fund inflows and price movements. A simple strategy of buying Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a traditional buy-and-hold approach. From January 2024 to today, this strategy has returned 130%, compared to ~100% for a buy-and-hold investor, an outperformance of nearly 10%.

For more information on this institutional inflow strategy, watch the following video:

Using ETF Data to Outperform Bitcoin [Must Watch]

Supply and Demand Dynamics

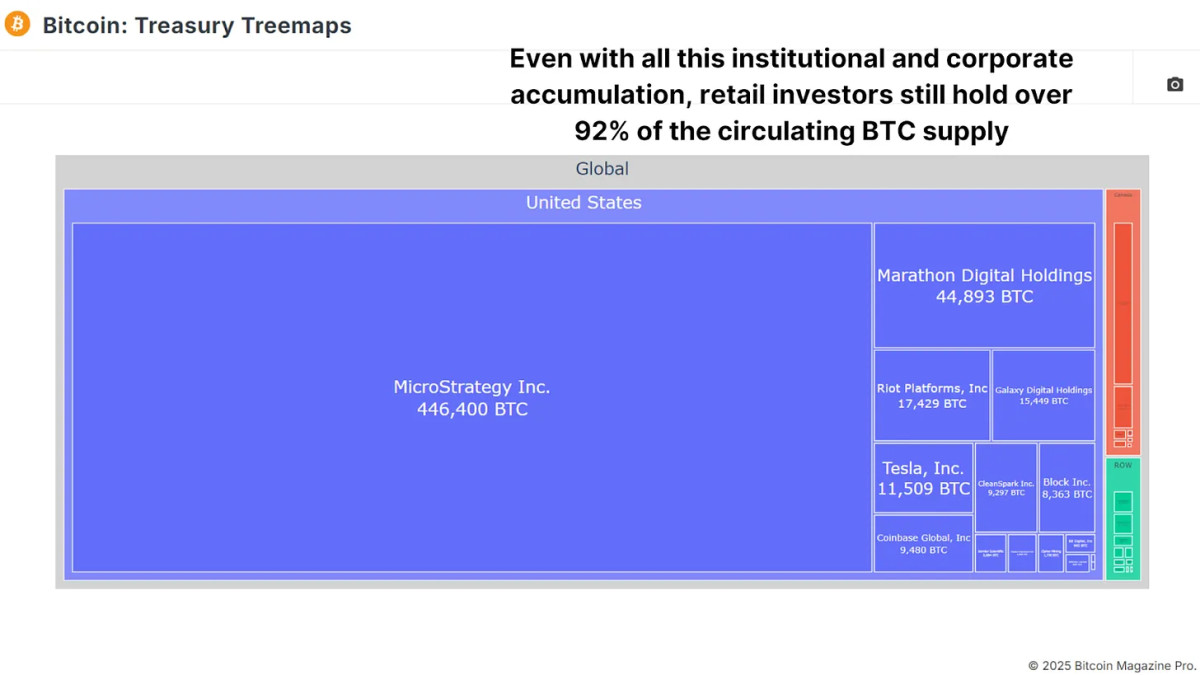

While Bitcoin ETFs have accumulated over 1 million BTC, this represents only a small fraction of Bitcoin’s total circulating supply of 19.8 million BTC. Corporations like MicroStrategy have also contributed to institutional adoption, collectively holding hundreds of thousands of BTC. Yet, the majority of Bitcoin remains in the hands of individual investors, ensuring that market dynamics are still driven by decentralized supply and demand.

Conclusion

One year in, Bitcoin ETFs have exceeded expectations. With billions in inflows, a significant impact on price appreciation, and increasing institutional adoption, they have solidified their role as a key driver of Bitcoin’s market narrative. While some early skeptics were disappointed by the lack of immediate explosive price action, the long-term outlook remains highly bullish.

The comparisons to gold ETFs provide a compelling roadmap for Bitcoin’s future. If the gold fractal holds true, we could be on the cusp of another major rally. Coupled with favorable macroeconomic conditions and growing institutional interest, Bitcoin’s future looks brighter than ever.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

XRP Price Eyes Breakout: Bullish Pennant Points Upward

Pieter Wuille and Gregory Maxwell Receive The Finney Freedom Prize

Kenya Prepares to Legalize Cryptocurrencies in Policy Shift: Report

Genius Group buys $5m more in Bitcoin, totaling treasury to $35m

Why This AI Agent Crypto AIXBT is Up 55% Today?

Apostas basquete Brasil

Bitcoin ETF

Bitcoin ETF inflows slump as BTC falls over 5% amid macroeconomic pressures

Published

3 days agoon

January 8, 2025By

admin

Spot Bitcoin exchange-traded funds experienced a sharp drop in inflows on Jan. 7 as Bitcoin fell 5%, driven by rising expectations of a more hawkish approach from the Federal Reserve.

Bitcoin, the world’s largest cryptocurrency, surged past $102,000 yesterday, sparking renewed optimism among investors anticipating a market rally ahead of President-elect Donald Trump’s upcoming inauguration.

However, the gains were short-lived as Bitcoin dropped by 5.7% within 24 hours, weighed down by rising U.S. bond yields and investor caution ahead of key economic updates, including the Federal Reserve’s meeting minutes and nonfarm payroll data.

The increase in bond yields has fueled expectations of a more hawkish stance from the Federal Reserve. Officials have already signaled plans for only two interest rate cuts in 2025, fewer than previously anticipated. Investors are now awaiting the Fed’s meeting minutes, set to be released on Wednesday, Jan. 8, for more clarity on policymakers’ deliberations.

Further pressure on Bitcoin came from a U.S. Labor Department report revealing job vacancies had climbed to a six-month high, driven by growing demand in the services sector.

It precedes the crucial nonfarm payroll report scheduled for Friday. A stronger-than-expected jobs report could solidify expectations of prolonged Fed tightening, as a resilient labor market may continue to fuel inflationary pressures.

Bitcoin ETF inflows plunge by 94%

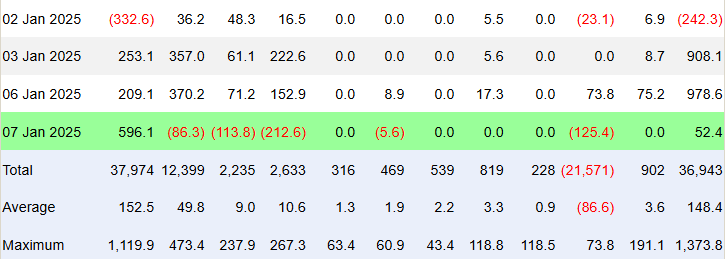

The falling Bitcoin price resulted in inflows of just $52.9 million across the 12 Bitcoin ETFs on Jan. 7, as expectations of a hawkish stance from the Federal Reserve dampened risk-on sentiment among investors. Notably, this figure represents a 94% drop compared to the $987 million inflows recorded the previous day.

According to data from SoSoValue, BlackRock’s IBIT was the only BTC ETF to record an inflow on Tuesday. The asset manager’s spot Bitcoin ETF drew in $596.11 million of inflows managing to offset the collective outflows seen from the other BTC ETFs.

ARK and 21Shares’s ARKB logged the highest outflows of the day with $212.55 million exiting the fund. Grayscale’s two Bitcoin ETFs tickered GBTC and BTC also contributed to the negative momentum with $125.45 million and $113.85 million outflows respectively.

Fidelity’s FBTC reported an outflow of $86.29 million while Franklin Templeton’s EZBC saw a more modest outflow of $5.58 million. The remaining BTC ETF saw “0” flows on the day.

Meanwhile, the daily trading volume for these investment products stood at $4.62 billion on Jan. 7 a jump from the $3.96 billion witnessed a day before.

AT press time Bitcoin (BTC) was exchanging hands at $96,145 per coin.

Source link

24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Published

3 days agoon

January 8, 2025By

admin

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after investors turned cautious with strong US JOLTS job openings and ISM Services PMI data.

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) purchased 6,078 BTC worth $208.7 on January 7, while miners only mined 450 new BTCs. IBIT recorded an inflow of $597.18 million, as per Trader T data.

This makes the third consecutive inflow into IBIT despite a major selloff in the crypto market. Notably, US Bitcoin ETF saw an inflow of $978.6 million on Monday, sparking optimism as the flagship crypto soared past the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million in outflow.

Grayscale’s GBTC also witnessed an outflow of $125.45 million. Flows were zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Whereas, other ETFs experienced varying degrees of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings increased by 259,000 to 8,098 million in November 2024, Also, ISM Services PMI came in higher than expected, which shows the resilience of the U.S. economy currently. This caused Bitcoin price to crash by more than 5%.

In fact, the US dollar index (DXY) holds its advance above 108.50 today, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year US Treasury yield increased to a 35-week high of 4.68%. The strong US economic data reduced expectations for further rate cuts by the Federal Reserve.

Whereas, BTC price continues to fall despite better performance by BlackRock Bitcoin ETF. The price currently trades at $96,259. The 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, the trading volume has decreased by 23% in the last 24 hours.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoin

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Published

6 days agoon

January 4, 2025By

admin

In a recent interview with FOX Business, Fred Thiel, CEO of Bitcoin (BTC) mining firm MARA Holdings, advocated an “invest and forget” strategy for retail investors looking to gain exposure to the world’s leading digital currency.

Thiel Cites Positive Historical Performance Of Bitcoin

BTC continues to trade within the mid-$90,000 range after a recent pullback from its all-time high (ATH) of $108,135. While crypto analysts keep a close eye on the flagship cryptocurrency’s price movements, major BTC holders appear less concerned about short-term fluctuations.

Related Reading

Citing Bitcoin’s historical performance, Thiel advised retail investors to adopt a long-term approach. He noted that Bitcoin has closed the year at a lower price only three times in its 14-year history, including during the peak of the COVID-19 pandemic. Thiel stated:

My recommendation, to my kids, for example, is they put just a little bit away every month in Bitcoin and forget about it. Over two, three, four years, it grows, and that’s what people do.

Thiel also emphasized BTC’s consistent growth, highlighting that it has appreciated annually by an average of 29% to 50%. However, BTC remains a high-risk asset, and risk-averse investors may shy away until the asset class achieves broader acceptance or gains official recognition from a major global economy.

For instance, the establishment of a US strategic Bitcoin reserve could solidify the cryptocurrency’s legitimacy as an asset and potentially spark a domino effect, encouraging other nations to follow suit. Thiel described such a reserve as a key catalyst for driving Bitcoin’s price to new highs in 2025.

Additionally, Thiel pointed to high institutional involvement through Bitcoin exchange-traded funds (ETFs) and favorable digital asset regulations under the Trump administration as other factors that could support BTC’s growth this year.

Although Thiel’s advice was aimed at retail investors, recent data suggests that many are already planning to increase their Bitcoin holdings. According to a poll conducted by MicroStrategy CEO Michael Saylor, over 75% of 65,164 respondents intend to end 2025 with more BTC than they started with.

The poll reflects growing enthusiasm among retail investors, buoyed by bullish developments in 2024 such as ETF approvals, the Bitcoin halving, and Trump’s election victory in November.

More Companies Adding BTC To Balance Sheet

Bitcoin adoption among corporations continues to grow. While MARA Holdings already holds BTC on its balance sheet, rival crypto mining company Hut 8 recently expanded its holdings to more than 10,000 BTC.

Related Reading

Other firms, such as Japan-based Metaplanet and Canada’s Rumble, joined the Bitcoin movement in 2024. Additionally, Bitcoin ETFs have accumulated over 1 million BTC in under a year since their launch.

However, skepticism remains. Japan’s Prime Minister recently expressed caution about the idea of establishing a strategic Bitcoin reserve, reflecting lingering doubts in some quarters. At press time, BTC trades at $97,229, up 0.7% in the past 24 hours.

Featured image from Unsplash, Chart from TradingView.com

Source link

XRP Price Eyes Breakout: Bullish Pennant Points Upward

Pieter Wuille and Gregory Maxwell Receive The Finney Freedom Prize

Kenya Prepares to Legalize Cryptocurrencies in Policy Shift: Report

Genius Group buys $5m more in Bitcoin, totaling treasury to $35m

Why This AI Agent Crypto AIXBT is Up 55% Today?

Have Bitcoin ETFs Lived Up to the Hype?

Apostas basquete Brasil

SAFE rallies 20% on Bithumb listing

Solana, XRP, Litecoin, HBAR in 2025 With New SEC Chair?

Bitcoin Supercycle Incoming Amid Changing Market Conditions, According to Alex Krüger – But There’s a Catch

K-pop giant Cube Entertainment’s CEO under fire for misleading crypto investment guarantees

How a Crypto Trader Turned a 90% Loss Into a $2.5M Win?

Solana whales rapidly accumulate this viral altcoin dubbed the ‘next XRP’

Polymarket’s Customer Data Sought by U.S. CFTC Subpoena of Coinbase, Source Says

BTC, ETH, XRP & Top Altcoins Bleed Ahead Of Key Jobs Data

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: