Altcoin

Ethereum Faces Crucial Test As Funding Rates Decline And $3K Level Looms

Published

6 hours agoon

By

admin

Ethereum has undoubtedly been under pressure despite the recent bullish rally in the broader cryptocurrency market as it struggles to make any major upside move.

A recent analysis by ShayanBTC, a contributor to the CryptoQuant QuickTake platform, has shed light on key factors impacting Ethereum’s performance.

In a post titled “Ethereum Faces Crossroads: Funding Rates and $3K Support Key to Sustaining Bullish Momentum,” Shayan highlights the asset’s struggles to maintain its upward trajectory.

Funding Rates And The Importance Of The $3K Support Level

According to Shayan, Ethereum’s bullish momentum has been significantly challenged by fluctuations in Funding Rates, a key indicator of demand in the derivatives market.

While these rates initially rose during the recent rally in the crypto market, signaling growing confidence, there was a subsequent decline after Ethereum was rejected at the $4,000 resistance level suggesting reduced trader interest and commitment.

Notably, the spike in Funding Rates during the rally pointed to cautious optimism among traders. However, the sharp decline in these rates afterward highlights a waning demand for Ethereum in the derivatives market.

This shift raises concerns about the sustainability of the bullish trend, particularly in light of Ethereum’s inability to breach the $4,000 resistance.

The $3,000 support level has emerged as a pivotal threshold for Ethereum. Shayan emphasized that maintaining this level is crucial for stabilizing the market and potentially reigniting bullish momentum.

A failure to hold above $3,000 could trigger increased selling pressure, leading to a deeper market correction. The analyst wrote:

Overall, Ethereum’s outlook depends on reclaiming higher Funding Rates and defending $3K. These factors will determine whether the market resumes its uptrend or faces further corrections.

Ethereum Market Performance

Meanwhile, Ethereum has continued to demonstrate downward movements, especially as the broader market has recently turned bearish. Over the past week, Ethereum’s market value has dropped by 6.2% bringing its price below $3,500.

However, over the past day, there has been a slight uptick in ETH’s price as the asset records a 0.9% increase. This slight increase has pushed ETH’s price to hover above $3,200 at the time of writing marking a 33.9% decrease away from its all-time high of $4,878 recorded in November 2021.

Interestingly, despite the descent in ETH’s price in the past week, the asset’s daily trading volume has faced an opposite trend over the same period. Particularly, ETH’s daily trading volume has moved from $20 billion last Friday to now sitting at above $26 billion as of today.

Given the current trend in ETH, it is worth noting that this increase in trading volume may be a result of the surge in buying pressure and selling pressure ongoing in the Ethereum market.

Featured image created with DALL-E. Chart from TradingView

Source link

You may like

How 3 Consecutive Wins Made This Crypto Investor $9M in Profits?

Red-Hot DeFi Platform Usual Faces Backlash as Protocol Update Triggers Sell-Off

The DTX Exchange hybrid platform shocks the online trading space

US Bitcoin ETF Ends Week With $149.4M Outflow, Will It Impact BTC Rally?

Spot Bitcoin ETF Approval Was The Most Important Moment In 2024

Best Altcoins to Buy Now

With the crypto market cap well above $3 trillion, plenty of altcoins are showing some very promising price activity. So, what are the best altcoins to buy right now?

We’ve put together a shortlist of promising altcoin projects that have shown bullish price action over the last few weeks, as well as boasting strong use cases or price catalysts for the immediate future.

Let’s take a look at the best altcoins in January 2025.

What are the best altcoins to buy now?

Before we begin, it’s worth noting that nobody can tell you which assets you should or should not invest in.

What are your investment goals? What’s your risk appetite? It’s crucial to develop your own investment strategy, including profit targets and stop loss targets, before making any important financial decisions.

Yes, the following altcoins could potentially be a welcome addition to the right crypto portfolio once. However, the best altcoins to buy right now are really those coins that best suit your personal trading needs!

So make sure you have a clear idea of what you’re after when diving into the world of cryptocurrency altcoins.

1. Sui (SUI)

SUI, the native token for the Sui (SUI) L1 blockchain built to support dApp development, is a popular high-cap altcoin that has seen upward momentum in recent weeks.

Late last year, SUI was added to the list of assets traded by the Grayscale investment firm, boosting the coin’s profile and prestige within the industry. SUI rose 31% in the past month and 13% in the last week, now standing at #13 in the market cap rankings.

2. Bitget Token (BGB)

Bitget Token is seeing an excellent month with over 108% gains so far and 9% growth over the last 7 days. Bitget Token (BGB) benefits from its attachment to the heavy hitting Bitget Wallet project. The token also provides real-world utility within the Bitget ecosystem by offering discounted trading fees, early access to new proects, staking rewards, and free withdrawals.

All of the above have contributed to healthy demand for BGB token which looks to have bullish trading activity at the time of writing.

3. ai16z (AI16Z)

While we’re often loathe to include meme coins in lists like these, the Solana ecosystem meme coin ai16z gets a mention here for demonstrating strong upward momentum over the last month, capped off with a price correction in the past week.

ai16z (AI16Z) grew 120% this month before pulling back 26% in the past week, a formidable price drop that could signal that the price is consolidating for another rally. Of course, further research is needed to identify real-time price indicators that might suit your particular trading strategy. However, the confluence of a major increase followed by a lesser pullback certainly creates some of the conditions that can, in some cases, favor a bull run.

4. Tokenize Xchange (TKX)

One promising altcoin that may not be on everyone’s radar at the moment is the coin for the Tokenize Xchange crypto exchange based in Singapore. Tokenize Xchange (TKX) coin has risen 144% in the last month, with a 13% pullback in the last 7 days that potentially leaves room for another price increase.

The coin offers utility by providing discounted trading fees on the Tokenized Xchange platform. This is a tried and tested method for adding value to a crypto coin, as seen with the roaring success of Binance’s native BNB token.

5. Virtuals Protocol (VIRTUAL)

Virtuals Protocol is a blockchain-powered AI platform that allows users to release autonomous AI ‘agents pre-programmed to handle a variety of tasks. If this rings a bell, it’s because Virtuals Protocol (VIRTUAL) is establishing itself as a direct competitor to the immensely popular Fetch.AI project that is now collaborating with the government of Munich and making major waves in the crypto space.

Virtuals Protocol is targeting a fairly niche area of the blockchain industry with few competitors and a lot of potential value, and it’s likely that the hype over the coin’s potential is behind the recent 79% jump in value over the last month, despite a 29% pullback this week.

Choosing the best altcoins to buy

When evaluating the right altcoin to buy, there are a few things to consider. The health and reputation of a project and its staff is always important, and can be partially gauged by checking news stories and social media posts around the project.

Projects with anonymous staff, for example, are sometimes regarded with more caution due to the perceived risk of them acting in bad faith, while projects with staff that have a good track record in business might soothe some of those concerns for potential investors.

The use case and viability of a project, such as the intended purpose of its native cryptocurrency and blockchain network, should arguably be the deciding factor. Projects that have demonstrated a real-world use case are often seen as more viable than projects whose product is still theoretical.

Finally, the current and past price performance should come into play. Learning technical analysis is a skill that can pay dividends for financial investors. Price charts can reveal interesting price patterns and trends that can help inform an altcoin trading strategy for those looking for the best altcoins to invest in now.

FAQ

How can I choose the best altcoins to buy right now?

Checking the recent price performance of altcoins and finding altcoins that have seen upward price movement in recent days or weeks can be informative to many traders. Of course, everyone will have had the same idea!

So some traders prefer to find coins that have seen a recent price surge followed by a slight price correction, and then conduct further technical analysis to see if the coin is viable for their investment strategy. By doing this, you can find some promising candidates for your list of strong altcoins to buy today.

What’s the best altcoin to buy right now?

Nobody can tell you what the right altcoin for your personal crypto portfolio might be. However, this article has some suggested coins that might be worth researching in your own time to see if they could be a good fit for you and your investment strategy. See above for our list of top 5 altcoins to buy now.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

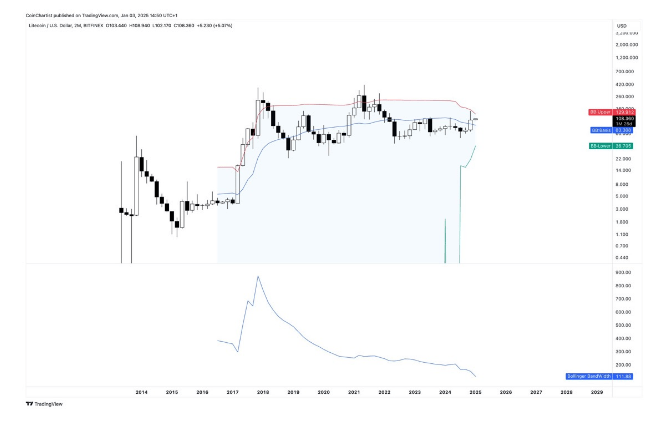

Litecoin (LTC) has been experiencing a significant decrease in volatility, with a crypto analyst highlighting an unusual tightening in its bi-monthly (2M) Bollinger Bands (BB). According to an analyst, Litecoin’s current technical setup points to strong potential for a parabolic breakout, with the $130 price mark emerging as a critical resistance zone.

Related Reading

Narrow Bollinger Bands To Trigger Litecoin Breakout

Prominent crypto analyst Tony Severino shared a price chart on X (formerly Twitter) showing Litecoin’s price action on a bi-monthly time frame, applying Bollinger Bands as a technical indicator to measure a cryptocurrency’s price volatility. The Bollinger Bands examine market volatility by plotting an upper and lower band around a Moving Average (MA), which acts as a basis line.

In Litecoin’s case, Severino has indicated that the cryptocurrency’s 2M Bollinger Band width is extremely narrow, underscoring a lack of or significantly decreased volatility. Historically, Bollinger Bands are known to expand during periods of high volatility and tighten at low volatility.

Severino’s Litecoin chart displays the upper Bollinger Band marked by the red line, the basis line by a blue line, and the lower band highlighted in the green area. The analyst disclosed that Litecoin’s candlesticks are currently positioned above the basis line at $83.3, indicating potential for bullish momentum.

If the price of Litecoin continues upwards and crosses the upper Bollinger band at approximately $130, Severino predicts that it could trigger heightened volatility and an explosive price breakout. Based on historical trends, an extremely narrow Bollinger Band often indicates a potential for a bullish trend reversal after a period of consolidation.

Severino’s analysis has pinpointed the upper BB at $130 as a crucial resistance area for Litecoin. A sustained break above this level on a high timeframe could pave the way for more gains, potentially pushing Litecoin significantly above its current market value of around $111.5.

According to CoinMarketCap, Litecoin has recorded modest gains, increasing by 6.14% in the past 24 hours. Over the past week, the prominent cryptocurrency has also experienced a higher increase of about 11.7% to its current level. To reach the critical resistance area at $130, Litecoin is required to rise by approximately 18% from its market price.

Litecoin Rally Predicted, Targets 38% Upside

According to crypto analyst Mike on X, Litecoin is preparing for a significant breakout to a new price high. He forecasts that the cryptocurrency will record a 38% price rally from the breakout point at $106 to reach a fresh bullish target of $146.67.

Looking at the analyst’s price chart, Litecoin appears to have broken the $102 resistance level and is approaching its next significant resistance at $122.77. The chart also highlights horizontal lines indicating critical resistance areas for Litecoin.

Related Reading

Mike has pinpointed a key support zone at $99.91 that could act as a safety net for Litecoin during a downtrend. Should Litecoin face a significant price drop below this support, the analyst points to the $86.97 and $74.43 price levels as the next potential support areas.

Featured image from Pexels, chart from TradingView

Source link

Altcoin

MARA CEO Advocates “Invest And Forget” Approach To Bitcoin, Citing Strong Historical Performance

Published

1 week agoon

January 4, 2025By

admin

In a recent interview with FOX Business, Fred Thiel, CEO of Bitcoin (BTC) mining firm MARA Holdings, advocated an “invest and forget” strategy for retail investors looking to gain exposure to the world’s leading digital currency.

Thiel Cites Positive Historical Performance Of Bitcoin

BTC continues to trade within the mid-$90,000 range after a recent pullback from its all-time high (ATH) of $108,135. While crypto analysts keep a close eye on the flagship cryptocurrency’s price movements, major BTC holders appear less concerned about short-term fluctuations.

Related Reading

Citing Bitcoin’s historical performance, Thiel advised retail investors to adopt a long-term approach. He noted that Bitcoin has closed the year at a lower price only three times in its 14-year history, including during the peak of the COVID-19 pandemic. Thiel stated:

My recommendation, to my kids, for example, is they put just a little bit away every month in Bitcoin and forget about it. Over two, three, four years, it grows, and that’s what people do.

Thiel also emphasized BTC’s consistent growth, highlighting that it has appreciated annually by an average of 29% to 50%. However, BTC remains a high-risk asset, and risk-averse investors may shy away until the asset class achieves broader acceptance or gains official recognition from a major global economy.

For instance, the establishment of a US strategic Bitcoin reserve could solidify the cryptocurrency’s legitimacy as an asset and potentially spark a domino effect, encouraging other nations to follow suit. Thiel described such a reserve as a key catalyst for driving Bitcoin’s price to new highs in 2025.

Additionally, Thiel pointed to high institutional involvement through Bitcoin exchange-traded funds (ETFs) and favorable digital asset regulations under the Trump administration as other factors that could support BTC’s growth this year.

Although Thiel’s advice was aimed at retail investors, recent data suggests that many are already planning to increase their Bitcoin holdings. According to a poll conducted by MicroStrategy CEO Michael Saylor, over 75% of 65,164 respondents intend to end 2025 with more BTC than they started with.

The poll reflects growing enthusiasm among retail investors, buoyed by bullish developments in 2024 such as ETF approvals, the Bitcoin halving, and Trump’s election victory in November.

More Companies Adding BTC To Balance Sheet

Bitcoin adoption among corporations continues to grow. While MARA Holdings already holds BTC on its balance sheet, rival crypto mining company Hut 8 recently expanded its holdings to more than 10,000 BTC.

Related Reading

Other firms, such as Japan-based Metaplanet and Canada’s Rumble, joined the Bitcoin movement in 2024. Additionally, Bitcoin ETFs have accumulated over 1 million BTC in under a year since their launch.

However, skepticism remains. Japan’s Prime Minister recently expressed caution about the idea of establishing a strategic Bitcoin reserve, reflecting lingering doubts in some quarters. At press time, BTC trades at $97,229, up 0.7% in the past 24 hours.

Featured image from Unsplash, Chart from TradingView.com

Source link

How 3 Consecutive Wins Made This Crypto Investor $9M in Profits?

Red-Hot DeFi Platform Usual Faces Backlash as Protocol Update Triggers Sell-Off

The DTX Exchange hybrid platform shocks the online trading space

US Bitcoin ETF Ends Week With $149.4M Outflow, Will It Impact BTC Rally?

Spot Bitcoin ETF Approval Was The Most Important Moment In 2024

Ethereum Faces Crucial Test As Funding Rates Decline And $3K Level Looms

Best Altcoins to Buy Now

Coinbase CLO Paul Grewal Calls Out FDIC Over Incomplete FOIA Responses

Privacy Shouldn't Be A Product, Stop Treating It Like One

Billionaires Pour ~$1,777,000,000 Into Three Assets in Major Portfolio Overhaul: Report

First Sitting U.S. President to HODL meme coins

Ethereum, Dogecoin, & XRP See Growth In HODLer Count

Why You May Want To Redeem Your Bitcoin From THORChain's Lending Service

Zuckerberg Knowingly Used Pirated Data to Train Meta AI, Authors Allege

Meme Index raises $2M in 2 weeks

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x