24/7 Cryptocurrency News

Semler Scientific Achieves 99.3% BTC Yield Boosting Holdings To Over 2,300 BTC

Published

1 day agoon

By

admin

Semler Scientific, Inc., a medical technology company focused on combating chronic diseases, has expanded its Bitcoin holdings significantly. The company recently acquired 237 BTC, bringing its total reserves to 2,321 Bitcoin. This move reflects Semler’s ongoing strategy of increasing its cryptocurrency treasury to enhance shareholder value.

Semler Scientific Boosts Bitcoin Holdings to 2,321 BTC with 99.3% BTC Yield

In a recent statement, Semler Scientific confirmed acquiring 237 Bitcoin between December 16, 2024, and January 10, 2025. The acquisition was made at an average price of $98,267 per Bitcoin, including fees. These purchases added $23.3 million worth of Bitcoin to its reserves, which now total 2,321 BTC.

The company stated its total Bitcoin investment amounts to $191.9 million. Semler’s strategy focuses on using Bitcoin as a treasury asset to drive long-term growth and shareholder value.

Additionally, Semler Scientific funded its Bitcoin acquisitions through an at-the-market (ATM) offering and operational cash flow. As of January 10, 2025, the company had generated $121.8 million in gross proceeds under its ATM sales agreement with Cantor Fitzgerald.

The ATM program, which was expanded by $50 million in December 2024, enables the company to issue additional shares for strategic investments. This financing model underpins Semler Scientific’s continued ability to grow its Bitcoin holdings.

Interestingly, institutional Bitcoin adoption has risen with Michael Saylor’s MicroStrategy announcing another massive purchase of 2,530 BTC today, worth $243 million. This brings its total holdings to 450,000 BTC, acquired for $28.2 billion. Despite the move, MSTR stock declined after Bitcoin’s price dropped below key support levels.

Bitcoin Adoption and Key Performance Indicators

Since adopting its Bitcoin treasury strategy in July 2024, Semler Scientific has monitored its performance through a key performance indicator (KPI) known as BTC Yield. From July 2024 to January 2025, the company achieved a 99.3% BTC Yield, reflecting the effectiveness of its treasury management.

Bitcoin adoption remains integral to Semler Scientific’s financial strategy. The company has consistently emphasized its focus on increasing Bitcoin reserves.

Semler Scientific remains committed to its Bitcoin strategy, with plans to continue acquiring Bitcoin through proceeds from its ATM program and cash flow.

BTC Price Action

Meanwhile, Bitcoin’s 24-hour price action shows a 3.34% drop, falling from $94,820 to $91,700. Trading volume surged by 193.09%, reaching $58.6 billion, as the market cap stands at $1.81 trillion. BTC struggles to hold key support amid market volatility.

A recent report by CoinGape highlighted the reasons behind today’s drop in Bitcoin price. The decline is attributed to a strong jobs market diminishing hopes for rate cuts, technical exhaustion following Bitcoin’s rally to $100K, and profit-taking ahead of President-elect Donald Trump’s inauguration. Key support remains at $90,804.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

US SEC Delays Decision on Bitwise 10 Crypto Index Fund

AI Agent Tokens Skyrocket as Franklin Templeton Highlights ‘Significant Promise’

Syria Exploring The Embrace of Bitcoin

Hashed’s Simon Kim Says AI Has a ‘Black Box’ Problem

Expert who predicted Bitcoin’s 2017 surge says XYZVerse could be the next big thing

How Coinbase vs SEC Ruling Could Influence XRP Case

24/7 Cryptocurrency News

US SEC Delays Decision on Bitwise 10 Crypto Index Fund

Published

17 minutes agoon

January 14, 2025By

admin

The US Securities and Exchange Commission (SEC) has delayed its decision on whether or not it will approve the Bitwise 10 Crypto Index Fund. This decision comes just 6 days before Gary Gensler, the Chairman of the commission leaves the agency. Per the filing from the commission, this delay is not denial as it requires more time to consider the application.

The Bitwise 10 Crypto Index Fund Still Possible

According to the notice shared by the markets regulator, it chose to delay the approval or denial of this filing considering the key factors it has to consider. From the time the asset manager filed the Bitwise 10 Crypto Index Fund, the US SEC had an obligation by law to give its consideration within 45 days.

The markets regulator filed the decision to delay this proposed rule change three days before the January 17 deadline. Following this delay, the US SEC said it has now fixed at March 3, 2025 as the next tentative date to give its decision on the filing.

This is a breaking news, please check back for updates!!!

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

How Coinbase vs SEC Ruling Could Influence XRP Case

Published

8 hours agoon

January 14, 2025By

admin

After the Court of Appeals for the Third Circuit’s ruling partially in favor of Coinbase in its rulemaking petition lawsuit with the US Securities and Exchange Commission (SEC), lawyers tracking Ripple vs SEC lawsuit debate over precedent and clear crypto regulations.

The buzz is around another loss for SEC Chair Gary Gensler as another court states the US SEC’s actions in crypto-related lawsuits as “arbitrary and capricious.”

Pro-XRP Lawyers’ View on Implications for Ripple vs SEC Lawsuit

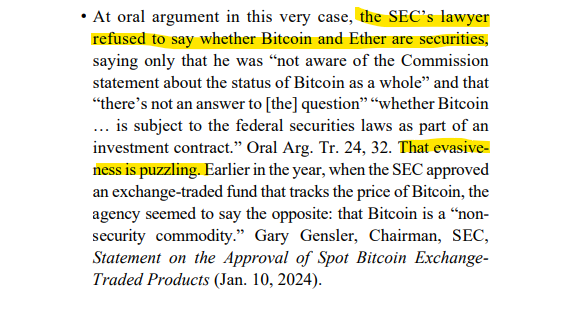

The United States Court of Appeals for the Third Circuit ruled that the SEC was unjustified in its denial of Coinbase’s rulemaking petition. Appellate court judges asked the regulator to provide a clear explanation of rules and guidelines that indicate digital assets are securities and with reasons.

Lawyer James Murphy, aka MetaLawMan, asserts the US SEC should hold off on any crypto rulemaking until the US Congress passes a market structure bill, clearing out the legal distinction between digital asset commodities and securities.

Lawyer Fred Rispoli reacted to Coinbase CLO Paul Grewal’s post “We just won our petition for a writ of mandamus at the Third Circuit.” Rispoli said Coinbase has lost almost every argument and the company’s only win was the court asked the SEC to provide sufficient reason for denying the petition.

However, he added that phenomenal concurrence by Judge Bibas is exactly what has appealed for in the 2nd Circuit Court. The statement focuses on how old rules from a century ago work for crypto. It reads:

“As I explain, its old regulations fit poorly with this new technology, and its enforcement strategy raises constitutional notice concerns.”

Fred Rispoli believes if the 2nd Circuit Court of Appeals decides to adopt this line of reasoning, then “SEC is done for good with crypto.” It means the court may also slam the SEC and may dismiss or extend the appeal as it reveals that the SEC failed to regulate in good faith.

Ex-SEC Lawyer’s Insights in Relation to XRP Case

Former SEC lawyer James Farrell revealed that the court ruled that any of the 3 rationales offered by the US SEC might suffice. These are “no need for rulemaking; want more info before rulemaking; or other resource priorities. But SEC had to pick 1 or more and spell out the why.”

He agreed that Judge Bibas’ concurrence was more supportive of the industry. However, the same judge also said “Some crypto assets are likewise nothing but creative schemes to evade securities regulations.”

Thus, the court hasn’t provided any clarity, which may depend on the SEC’s methodology used to classify some digital assets are securities.

Notably, lawyers agree that the ruling may apply in other courts if the majority panel of judges likes the reasoning in a sister court’s concurrence opinion.

Opening Brief in Ripple Vs SEC Lawsuit

The crypto industry and lawyers now await the U.S. SEC’s principal brief related to its appeals in SEC v Ripple lawsuit. It is scheduled to be filed by January 15. However, lawyers such as Jeremy Hogan and ex-SEC Marc Fagel believe pro-crypto Paul Atkins under the Trump administration may decide not to pursue the appeal further.

CoinGape has glanced at what could be expected from the opening brief by the U.S. SEC, as per Form C and outgoing SEC Chair Gary Gensler’s stance on crypto.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ancient8 (A8) Price Rockets 30% And Drift Token Up 7% Post Major Listing

Published

14 hours agoon

January 14, 2025By

admin

Bithumb, one of South Korea’s leading cryptocurrency exchanges, has listed Ancient8 (A8) and Drift (DRIFT) tokens on its platform. Following the announcement, A8 price surged by 30%, while the other token gained 7%, showcasing strong investor interest. The listings further reinforce the growing appeal of Web3 gaming and decentralized trading solutions among global investors.

Bithumb Announces Ancient8 and Drift Listing

On January 14, Bithumb announced the listing of Ancient8 and Drift tokens on its platform, adding them to the KRW pairs. Deposits and withdrawals opened within two hours of the announcement, while trading began at 5:00 PM.

A8 debuted at a base price of 429 won, supported on the Ethereum network, requiring 33 deposit confirmations. DRIFT was introduced at 1,605 won, operating on the Solana network, with 20 deposit confirmations. Both tokens are anticipated to attract significant trading activity due to their unique features and use cases.

The inclusion of these tokens highlights the exchange’s commitment to supporting innovative projects in the crypto ecosystem.

Bithumb Trading Rules and Restrictions

To ensure a secure trading environment, Bithumb has implemented temporary transaction restrictions for these new listings. Buying orders are restricted for the first five minutes after trading begins, while selling orders are limited during the same period, preventing prices from dropping below 10% or exceeding 100% of the base price.

Additionally, deposits and withdrawals are supported only through recognized networks. Deposits via unsupported networks will not be processed, and users are advised to double-check the address and network before initiating transactions.

A8 and DRIFT Crypto Tokens Performance

Following the listing announcement, Ancient8 (A8) price saw a 30% surge, with the price now trading at $0.3293. Its 24-hour low and high are $0.25 and $0.3756, respectively. It has a market cap of $76.74 million, and trading volume has increased by 265% after the announcement and is now at $6 million.

Similarly, DRIFT price was trading at $1.183, marking a 7% increase in the last 24 hours. The token rose over 140% in the last quarter. It has a market cap of $324 million and a trading volume of $88 million, which marks a whopping 365% increase in the last 24 hours. Crypto investor Da’G recently shared on X that the token is poised for a breakout, targeting $5 as its near-term goal.

Listings on major exchanges often lead to price spikes by increasing trader and investor access. As seen with Zircuit price surged 35% after the listing announcement on Bithumb platform listing.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

US SEC Delays Decision on Bitwise 10 Crypto Index Fund

AI Agent Tokens Skyrocket as Franklin Templeton Highlights ‘Significant Promise’

Syria Exploring The Embrace of Bitcoin

Hashed’s Simon Kim Says AI Has a ‘Black Box’ Problem

Expert who predicted Bitcoin’s 2017 surge says XYZVerse could be the next big thing

How Coinbase vs SEC Ruling Could Influence XRP Case

PEPE koers daalt ondanks toename whale interesse – wat gaat Pepe Coin doen?

BlackRock publishes 3 key takeaways to boost Bitcoin ETF adoption in 2025

One Factor Could Trigger ‘Larger’ Sell-Off in Cardano, Says Analyst Benjamin Cowen – Here’s His Outlook

Ancient8 (A8) Price Rockets 30% And Drift Token Up 7% Post Major Listing

US Tightens AI Chip Exports Restrictions Ahead of Trump’s Inauguration

ARKA NOEGO / NOAH’S ARK: On Solidarity and Bitcoin

Usual Protocol activates revenue switch amid redeem function debate

Sony’s Layer-2 Blockchain “Soneium” Goes Live

Senator Elizabeth Warren Questions Treasury Nominee Bessent

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: