Bitcoin

You Should Not Wear This Bitcoin Shirt — Here's Why

Published

2 months agoon

By

admin

Everyone has their own unique sense of style, but if you are wearing Bitcoin merch like the shirt in the X post below out in public — you should probably stop doing so.

This Bitcoin shirt is cringe as fuck.

Have fun getting 7 dollar wrench attacked. pic.twitter.com/zRlT2CFrIg

— Breadman (@BTCBreadMan) January 11, 2025

I agree with this post in that this shirt is cringe as fuck and will only bring unwanted attention.

Most people don’t understand Bitcoin and the lingo adjacent to it. If you’re wearing this out in public, the majority of people are not even going to understand it and will move on with their day, completely forgetting about it. So if you’re wearing the shirt, you’re not really flexing as hard as you think.

But some who will see you wearing it will know what it means, and this may lead to bad consequences.

Wearing a shirt that broadcasts to everyone that you own a full bitcoin (or basically $100,000, at the time of writing, in the form of a bearer asset) will likely just put a target on your back.

Don’t believe me?

This past November, the CEO of the Canadian company WonderFi was kidnapped and held for ransom. And more recently, a Pakistani crypto trader was kidnapped and forced to pay $340,000 to the kidnappers from his Binance account.

I’m not trying to scare anyone, but these things can happen, and you should at least avoid putting yourself in such a situation.

These criminals may or may not know how Bitcoin works, and it’s probably worse if they don’t. Because they might think you have it all on one exchange, or that you have your private keys located in one place that is easy to obtain, therefore thinking you are probably an easy target. And if you tell them you physically cannot give up your coins, and they don’t believe you, things could get ugly quick.

I’m not saying to never talk to anyone about Bitcoin ever or to be 100% secretive about it — I mean, I’m a public figure in this space and have thought through how to best limit the chances of something bad like this happening to me. The security of your bitcoin is important, but also is your personal security. Luckily for me, I am an American and have my second amendment rights. Protecting my Bitcoin from a potential $5 wrench attack is a lot easier with a firearm.

Upgraded my bitcoin security today by buying a Glock 19

— Nikolaus (@nikcantmine) December 26, 2020

If you are a proud owner of one full bitcoin, it’s fine to celebrate it, as that is a feat that most people on the planet will never be able to achieve.

My advice to you, though, is to celebrate it in a way that is more private, like with no one more than your family and very close friends that you trust. You can post online on X or Reddit anonymously about it if you really want to have a deeper conversation about it or to get the dopamine from all the other anons congratulating you on the accomplishment.

Don’t tell people how much bitcoin you own, and definitely don’t wear shirts that disclose it. Just stay humble and stack more bitcoin.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Bitcoin Price Drops As President Trump Creates Strategic Crypto Reserve

Tokenized assets hit $50b, projected to reach $2T by 2030

President Trump Signs Executive Order to Establish Bitcoin Reserve, Crypto Stockpile

Binance Stablecoin Reserve ATH, Here’s Implication For Bitcoin

Crypto voters could swing New Jersey gubernatorial race

Mt. Gox Stirs The Market With $1 Billion Bitcoin Transfer

Bitcoin

Bitcoin Price Drops As President Trump Creates Strategic Crypto Reserve

Published

11 minutes agoon

March 7, 2025By

admin

President Trump just signed an executive order creating a strategic Bitcoin and crypto reserve, triggering a “sell the news” event and an abrupt $5,000 drop in the price of BTC.

BTC fell from $90,251 to $85,091 in less than an hour after Trump signed the order, which establishes a national Bitcoin and crypto stockpile by holding digital assets seized from criminal activities rather than auctioning them off as had been previous practice.

BTC has since recovered to $87,202 at time of publishing.

The move had been widely anticipated and confirmed the executive action will not actively push the US to purchase crypto assets.

White House artificial intelligence and crypto czar David Sacks released a statement on the signing.

“Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it will not cost taxpayers a dime.

It is estimated that the U.S. government owns about 200,000 bitcoin; however, there has never been a complete audit. The E.O. directs a full accounting of the federal government’s digital asset holdings.

The U.S. will not sell any bitcoin deposited into the Reserve. It will be kept as a store of value. The Reserve is like a digital Fort Knox for the cryptocurrency often called “digital gold.”

Premature sales of bitcoin have already cost U.S. taxpayers over $17 billion in lost value. Now the federal government will have a strategy to maximize the value of its holdings.

The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies have no incremental costs on American taxpayers.

IN ADDITION, the Executive Order establishes a U.S. Digital Asset Stockpile, consisting of digital assets other than bitcoin forfeited in criminal or civil proceedings.

The government will not acquire additional assets for the Stockpile beyond those obtained through forfeiture proceedings.

The purpose of the Stockpile is responsible stewardship of the government’s digital assets under the Treasury Department.

PROMISES MADE, PROMISES KEPT

President Trump promised to create a Strategic Bitcoin Reserve and Digital Asset Stockpile. Those promises have been kept.

This Executive Order underscores President Trump’s commitment to making the U.S. the “crypto capital of the world.”

I want to thank the President for his leadership and vision in supporting this cutting-edge technology and for his rapid execution in supporting the digital asset industry. His administration is truly moving at ‘tech speed.’

I also want to thank the President’s Working Group on Digital Asset Markets — especially Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick — for their help and support in getting this done. Finally Bo Hines played a critical role as Executive Director of our Working Group.”

Bitcoin’s price move has partially retraced a major jump triggered in large part by Trump’s pro-crypto stance.

After Trump first announced the strategic Bitcoin reserve during his campaign and won the election on November 5th, BTC surged from around $65,000 to a peak of $108,268 on December 17th.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/jovan vitanovski/Panuwatccn

Source link

24/7 Cryptocurrency News

Binance Stablecoin Reserve ATH, Here’s Implication For Bitcoin

Published

2 hours agoon

March 7, 2025By

admin

There are signs of growing optimism in the market as the stablecoin reserve on the Binance exchange has jumped to a new all-time high (ATH). According to CryptoQuant analyst Darkfrost, this increase in the Binance stablecoin reserve marks a good omen for a positive market rebound. With volatility swaying the market in recent times, it remains to be seen what direction Bitcoin and altcoins will take moving forward.

Binance Stablecoin Reserve and Market Shift

Per the CryptoQuant data, the ERC-20 stablecoin on Binance has surpassed the $31.3 billion threshold. Darkfrost noted that a bump in the Binance stablecoin reserve often indicates positive momentum.

The CryptoQuant analyst attributed the massive Binance stablecoin inflow to two major reasons. These include channeling liquidity into the top crypto trading exchange in preparation for potential market entry. According to Darkfrost, this trend reflects confidence in the market and the exchange.

Beyond the influence of third-party investors, Binance could also be consolidating its stablecoin reserve amid a boost in market demand. The stablecoin reserve, per the chart shared by Darkfrost, has been on an upward trend since July 2024. The previous peak recorded onchain came around December 2022.

Binance Stablecoin Implication for Bitcoin

As the CryptoQuant analyst noted, periods of positive shift in the asset’s reserve often come with a massive push in the price of Bitcoin.

“Historically, periods of rising stablecoin reserves on Binance have often coincided with, or even preceded, an increase in BTC prices and a broader upswing in the crypto market,” Darkfrost said in his note.

The market has been quite unstable in the past few weeks, with volatility defining the order. At the time of writing, Bitcoin was changing hands for $90,511.91, up marginally by 0.18% in 24 hours.

Bitcoin price entered a risky zone earlier as Crypto Czar David Sacks blamed the Biden administration for selling BTC too early. This Bitcoin sentiment and uncertainty around the forthcoming White House Digital Asset Summit fuels market drawdown.

Market Dynamics and Trends to Watch

While the Binance exchange has enjoyed dominance in trading volume, including the stablecoin market, the trend is set to change. Based on the Markets In Crypto Asset (MiCA) legislation, the exchange has set March 31 to delist non-MiCA compliant tokens.

Some ERC-20 tokens, including USDT and EURI, will stop trading on the exchange. This might impact the exchange’s growing stablecoin reserve, which may, in turn, impact the broader market dynamics, as Darkfrost teased.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Arkham

Mt. Gox Stirs The Market With $1 Billion Bitcoin Transfer

Published

6 hours agoon

March 6, 2025By

admin

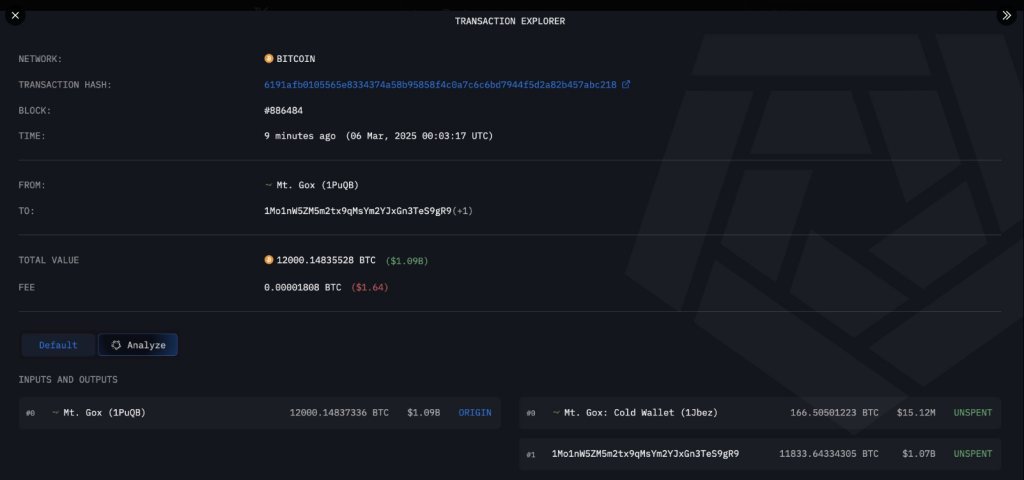

Bitcoin took center stage again as Mt. Gox moved 12,000 BTC, valued at over $1 billion, to an unknown wallet. This occurs at a time when Bitcoin is trading at approximately $92,000, a level that has caused market volatility. The actions of the defunct exchange have sparked debate regarding whether this movement indicates imminent creditor repayments or something else entirely.

Related Reading

Large Bitcoin Transfer Raises Eyebrows

Mt. Gox collapsed in 2014 following a major attack, and for years it has been in the process of reimbursing debtors. Regarding the trade, the movement of 12,000 BTC represents among the most important events in recent history. While some people think it may be a big step toward the much-needed repayments, others worry about the possible market pressure a big sell-off could generate.

On March 6, Arkham Intelligence reported that a Mt. Gox-linked wallet, “1PuQB,” moved 12,000 BTC, with 11,834 BTC (over $1 billion) sent to an unidentified wallet, “1Mo1n,” and 166.5 BTC ($15 million) transferred to Mt. Gox’s cold wallet, “1Jbez.”

ARKHAM ALERT: MT GOX MOVING $1B $BTC pic.twitter.com/VpIkHdJQkl

— Arkham (@arkham) March 6, 2025

This marks the first major transaction since January, when smaller amounts were shuffled between its cold wallets. Mt. Gox-linked wallets still hold approximately 36,080 BTC, valued at $3.26 billion, according to Arkham.

Such a large volume of Bitcoin movement historically has caused market volatility to rise. Investors are closely monitoring the possible sale in great numbers or redistribution of these monies to creditors. Although the recent surge in Bitcoin shows strong buying demand, this latest movement – if its a sell – could trigger a price dip,

Bitcoin Price Remains Stable At Or Above $90,000

Bitcoin is strong and is currently trading at about $91,680 despite the uncertainty. The market’s lackluster reaction to the transfer thus far may suggest that investors are “cool” about the most recent activity from the now-defunct exchange. Similar huge transactions have previously resulted in brief declines, but the price of Bitcoin has continued to rise.

Creditors Await Further Updates

Mt. Gox’s creditors have been waiting years for their money to come back. Payback has been slow and marked by delays. Although this most recent transaction shows that development is happening, it is still unknown when or how the creditors will get their Bitcoin.

Many hope that restitution will be handled smoothly so that it minimizes disturbance of the market. However, until official announcements are made, speculation will continue. The crypto community remains watchful for any updates that might clarify the exchange’s next steps.

Related Reading

What Next For Bitcoin

Meanwhile, any information regarding Mt. Gox’s forthcoming actions could potentially influence the coin’s short-term price action. Investors and analysts will be monitoring the transferred BTC for indications of heavy selling activity.

Featured image from Gemini Imagen, chart from TradingView

Source link

Bitcoin Price Drops As President Trump Creates Strategic Crypto Reserve

Tokenized assets hit $50b, projected to reach $2T by 2030

President Trump Signs Executive Order to Establish Bitcoin Reserve, Crypto Stockpile

Binance Stablecoin Reserve ATH, Here’s Implication For Bitcoin

Texas Surges in U.S. States’ Race to Put Public Funds Into Crypto, Bitcoin (BTC)

Crypto voters could swing New Jersey gubernatorial race

Mt. Gox Stirs The Market With $1 Billion Bitcoin Transfer

Texas Strategic Bitcoin Reserve Bill Passes The Senate

President Nayib Bukele Says El Salvador Will Continue Accumulating Bitcoin Despite IMF Pushback

step by step guide by a16zcrypto

What is a Strategic Bitcoin Reserve? How Nation States Could Hold BTC

How High Can Pi Network Price Get if Bitcoin Rises to $200k?

CORZ Shares Drop 15% Pre-Market as MSFT Cuts CoreWeave Commitments

Cointelegraph Bitcoin & Ethereum Blockchain News

XRP Bulls Set Their Sights On $222—Can It Happen?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: