Bitcoin

VanEck seeks SEC approval for Onchain Economy ETF

Published

8 hours agoon

By

admin

Will the SEC approve VanEck’s entry into the growing digital asset investment space?

On Jan. 15, 2025, asset management company VanEck filed an application with the U.S. Securities and Exchange Commission for the “Onchain Economy” exchange-traded fund. Matthew Sigel, VanEck’s head of digital assets research, disclosed the filing in a now-deleted social media post, revealing the company’s ambitious plans to invest in the rapidly growing digital transformation sector.

Deleted a post on an ETF filing.

Details coming soon— matthew sigel, recovering CFA (@matthew_sigel) January 15, 2025

The proposed ETF aims to allocate at least 80% of its assets to businesses and products within the digital asset ecosystem. These include software developers, mining firms, cryptocurrency exchanges, infrastructure providers, payment firms, and other crypto-focused companies collectively referred to as “Digital Transformation Companies.”

VanEck outlined a strategic selection process for these investments, emphasizing fundamental research, market trends, valuation, and each company’s role in the broader digital asset ecosystem. While the fund will not directly hold cryptocurrencies, it plans to invest in digital asset products such as commodity futures contracts.

VanEck’s application is part of a broader wave of activity in the ETF market, driven by speculation that the regulatory environment may become more favorable for cryptocurrencies under President Donald Trump’s administration. Bitwise Asset Management applied in November 2024 for its 10 Crypto Index Fund ETF, which tracks leading cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

In December last year, WisdomTree joined 21Shares, Canary Capital, and Bitwise in submitting applications for ETFs focused on specific digital assets like XRP (XRP). Grayscale Investments also petitioned the SEC to convert its existing Solana Trust into an ETF, while REX Financial launched the REX Crypto Equity Premium Income ETF, which employs a covered-call strategy to generate income from crypto-related stocks.

These developments reflect the financial sector’s growing interest in digital assets and the anticipation of regulatory clarity. As the SEC evaluates these applications, the industry is poised for a potential shift that could reshape institutional and retail access to cryptocurrency investments.

Source link

You may like

Here’s Why Litecoin Price Is Up 18% Today?

Major Victory For Bitfinex: DOJ Declares $9 Billion In Stolen Bitcoin Should Be Returned

DeFi Altcoin Flashing Tier-One Setup and Could Ignite 56% Rally, According to Crypto Strategist

Bitcoin Miners, Economic Irrationality Can Be Fatal

VanEck Files New ‘Onchain Economy’ ETF to Target Crypto Infrastructure, Not Coins

Sony Launches Blockchain to Controversy

Bitcoin

Major Victory For Bitfinex: DOJ Declares $9 Billion In Stolen Bitcoin Should Be Returned

Published

2 hours agoon

January 16, 2025By

admin

The US Department of Justice (DOJ) has stated that around $9 billion in Bitcoin, taken from the crypto exchange Bitfinex in a 2016 hacking incident, ought to be returned to the exchange.

This claim arises from a legal document submitted by the DOJ, which indicated that there are no recognizable victims in this specific case within the existing legal structure.

Bitfinex To Potentially Reclaim Stolen Bitcoin

The court documents, submitted on Tuesday, explain that the recovery of the stolen Bitcoin—specifically 94,643 BTC, along with amounts from various hard forks—should be returned to Bitfinex.

The DOJ argued that under the Mandatory Victim Restitution Act (MVRA), there is no legal basis to classify Bitfinex or its account holders as victims of the specific offenses for which the defendants were convicted.

The defendants, Ilya Lichtenstein and Heather Morgan, were convicted of Money Laundering Conspiracy, but crucially, they were not charged with the initial hack that resulted in the theft of the Bitcoin.

According to the DOJ, their subsequent actions did not directly cause the losses incurred by Bitfinex. The legal definition of a “victim” as stated in the MVRA requires a direct and proximate harm resulting from the commission of a specific offense, which in this case reportedly does not apply.

Legal Challenges In Crypto Asset Recovery

The DOJ’s filing emphasizes that, while no mandatory restitution can be ordered under the current convictions, the court retains the authority to grant voluntary restitution.

This means that, as part of their plea agreements, the defendants have agreed to return the stolen assets to Bitfinex. The restitution order proposed by the DOJ would encompass all funds recovered from the Bitfinex Hack Wallet.

While this ruling marks a potential financial windfall for Bitfinex, it also opens the door for further legal complexities. The government is in the process of a third-party ancillary forfeiture proceeding to address other seized assets linked to the defendants’ laundering activities.

These additional assets, which were involved in complex laundering schemes, may not be categorized as specific property lost by Bitfinex and its account holders.

The 2016 Bitfinex hack, one of the largest in cryptocurrency history, has had lasting repercussions, leading to ongoing debates about regulatory standards and victim restitution in the digital asset space.

As this situation develops, the parties involved in the case will be focused on the court’s ultimate ruling about the return of the seized Bitcoin and its impact on the future of cryptocurrency regulation and restitution methods for future cases.

The DOJ’s efforts aim not only to address the financial losses experienced by Bitfinex but also to clarify the legal ramifications related to digital asset theft.

At the time of writing, Bitcoin has managed to regain its bullish momentum with a 4% rise in the past 24 hours towards the $99,100 level.

Featured image from DALL-E, chart from TradingView.com

Source link

Bitcoin

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Published

10 hours agoon

January 15, 2025By

admin

After rocketing up to the highs of $108,000 in December 2024, Bitcoin now has fallen to about $96,000. This has led to renewed debate among analysts as to what this means for the leading cryptocurrency. Some think that it may all be a warning, but others, such as Fundstrat’s Tom Lee, are still bullish long-term.

Related Reading

$50,000 The Worst-Case Scenario?

Recently, Tom Lee shared his opinions with CNBC during an interview as a response to the fears regarding Bitcoin’s latest retreat. He stated that corrections up to $70,000 or even down to $50,000 can happen. Corrections of this type, he continued, have become extremely frequent throughout Bitcoin’s history; hence long-term investors must consider them opportunities and not as problems.

It was with the mention of $50,000 that eyebrows were raised, but Lee’s confidence in Bitcoin’s strength remains unbroken. He said these corrections often prepares the stage for even stronger price recoveries, especially in a market as dynamic as crypto.

A Bold Prediction Amid Uncertainty

Lee predicted that the price of Bitcoin might reach $200,000-$250,000 by the end of 2025, simply because he is convinced that this cryptocurrency will eventually serve as an economic hedge against instability and increase in adoption rates among institutional investors.

Lee also says the current price point of $90,000 will be an ideal entry point for anyone thinking long term. His reasoning is that Bitcoin’s underlying fundamentals remain strong, and the recent pullback hasn’t dented its broader growth narrative.

Inflation And Market Dynamics

Lee said that inflation fears are not yet critical, and temporary disruptions, such as natural disasters, can impact data. However, the cautious approach of the Federal Reserve to rate cuts gives room for optimism. A slower pace of inflation and strong earnings from major companies could boost risk assets, including Bitcoin, in the near term.

Related Reading

Investor Sentiment And What’s Next

After Lee’s comment, Bitcoin rebounded a little; it came back to about $96,400. The rebound shows that the market participants were comforted by his analysis.

The lesson for investors is obvious: volatility will probably interrupt Bitcoin’s road of development, but overall the long-term future seems bright. Forecasts for the market range from $50,000 to $250,000, thereby presenting both risk and possibility.

The balancing act between fear and optimism will ultimately shape Bitcoin’s trajectory in the months to come.

Featured image from Shutterstock, chart from TradingView

Source link

Bitcoin

Bitcoin DeFi Is Finding Product-market Fit With Runes

Published

22 hours agoon

January 15, 2025By

admin

Over the past year, the Bitcoin Renaissance has brought significant attention to BTCfi, or “Bitcoin DeFi” applications. Despite the hype, very few of these applications have delivered on their promises or managed to retain a meaningful number of “actual” users.

To put things into perspective, the leading lending platform for Bitcoin assets, Liquidium, allows users to borrow against their Runes, Ordinals, and BRC-20 assets. Where does the yield come from, you ask? Just like any other loan, borrowers pay an interest rate to lenders in exchange for their Bitcoin. Additionally, to ensure the security of the loans, they are always overcollateralized by the Bitcoin assets themselves.

How big is Bitcoin DeFi right now? It depends on your perspective.

In about 12 months, Liquidium has executed over 75,000 loans, representing more than $360 million in total loan volume, and paid over $6.3 million in native BTC interest to lenders.

For BTCfi to be considered “real,” I would argue that these numbers need to grow exponentially and become comparable to those on other chains such as Ethereum or Solana. (Although, I firmly believe that over time, comparisons will become irrelevant as all economic activity will ultimately settle on Bitcoin.)

That said, these achievements are impressive for a protocol that’s barely a year old, operating on a chain where even the slightest mention of DeFi often meets with extreme skepticism. For additional context, Liquidium is already outpacing altcoin competitors such as NFTfi, Arcade, and Sharky in volume.

Bitcoin is evolving in real time, without requiring changes to its base protocol — I’m here for it.

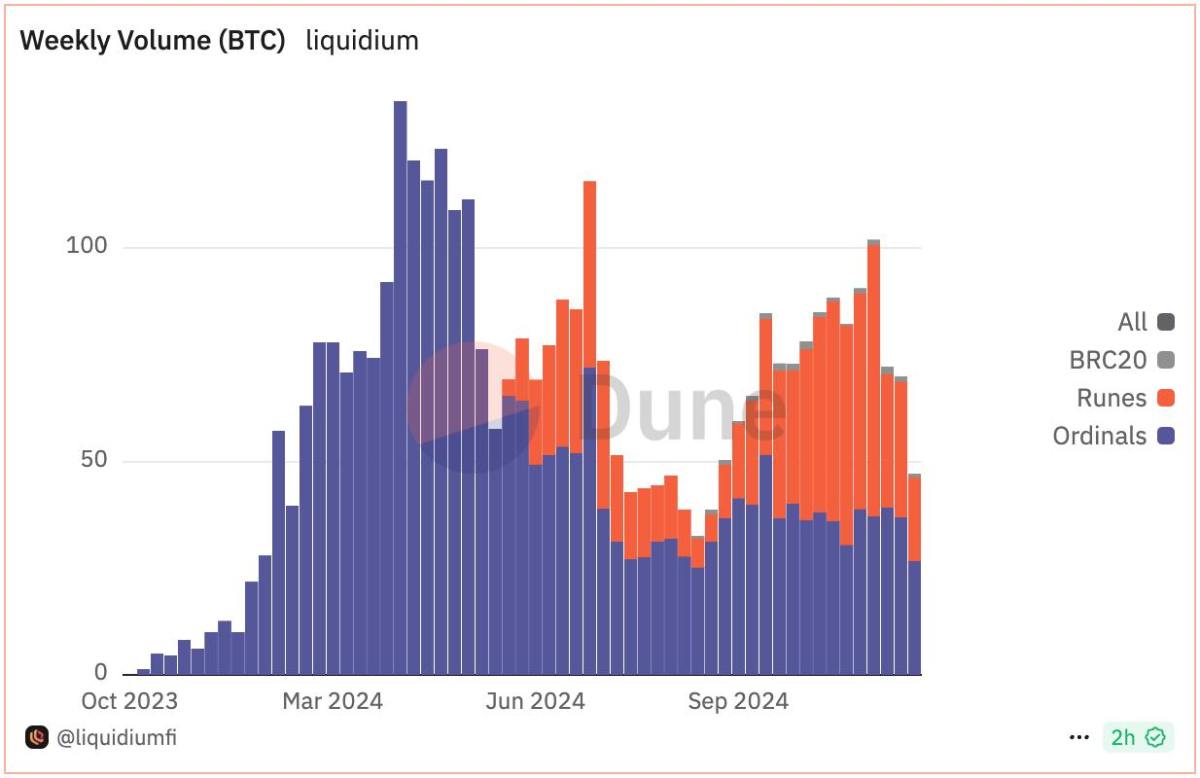

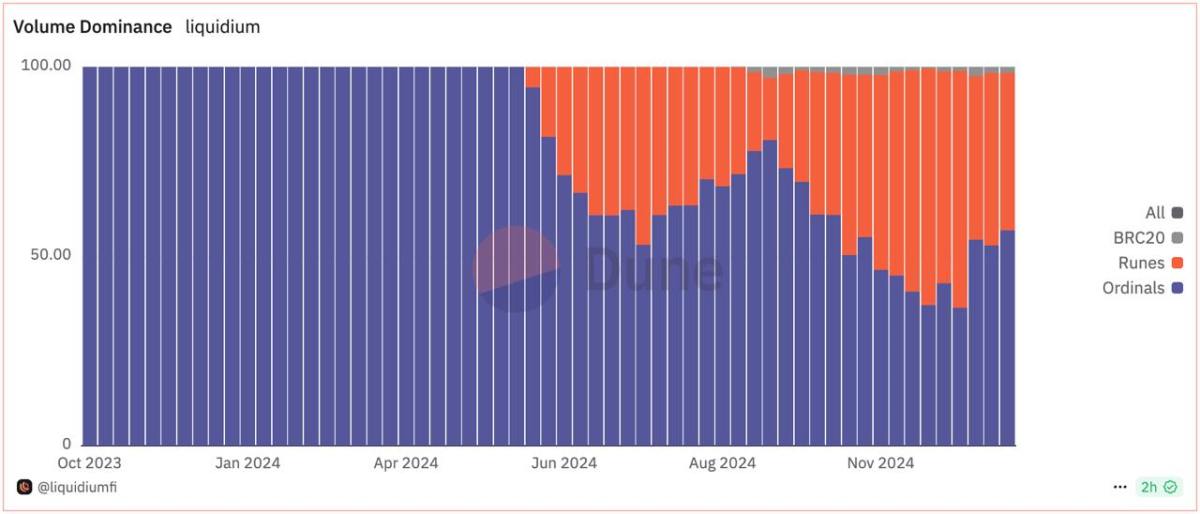

After a rocky start, Runes are now responsible for the majority of loans taken out on Liquidium, outpacing both Ordinals and BRC-20s. Runes is a significantly more efficient protocol that offers a lighter load on the Bitcoin blockchain and delivers a slightly improved user experience. The enhanced user experience provided by Runes not only simplifies the process for existing users, but also attracts a substantial number of new users that would be willing to interest on-chain in a more complex way. In contrast, BRC-20 struggled to acquire new users due to its complexity and less intuitive design. Having additional financial infrastructure like P2P loans is therefore marking a step forward in the usability and adoption of Runes, and potentially other Bitcoin backed assets down the line.

The volume of loans on Liquidium has consistently increased over the past year, with Runes now comprising the majority of activity on the platform.

Ok so Runes are now the dominant asset backing Bitcoin native loans, why should I care? Is this good for Bitcoin?

I would argue that, regardless of your personal opinion about Runes or the on-chain degen games happening right now, the fact that real people trust the Bitcoin blockchain to take out decentralized loans denominated in Bitcoin should make freedom lovers stand up and cheer.

We’re winning.

Bitcoiners have always asserted that no other blockchain can match Bitcoin’s security guarantees. Now, others are beginning to see this too, bringing new forms of economic activity on-chain. This is undeniably bullish.

Moreover, all transactions are natively secured on the Bitcoin blockchain—no wrapping, no bridging, just Bitcoin. We should encourage and support people who are building in this way.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Here’s Why Litecoin Price Is Up 18% Today?

Major Victory For Bitfinex: DOJ Declares $9 Billion In Stolen Bitcoin Should Be Returned

DeFi Altcoin Flashing Tier-One Setup and Could Ignite 56% Rally, According to Crypto Strategist

Bitcoin Miners, Economic Irrationality Can Be Fatal

VanEck Files New ‘Onchain Economy’ ETF to Target Crypto Infrastructure, Not Coins

VanEck seeks SEC approval for Onchain Economy ETF

Sony Launches Blockchain to Controversy

Justin Sun Breaks Silence on USDD Backing and Bold 20% Yield

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

How Should Bitcoiners View Quantum Computing?

US Judge Deems SEC’s Order To Deny Coinbase Rulemaking Petition ‘Arbitrary and Capricious’

Algorand retests key level amid 20% spike

Top 4 Coins That Can Challenge XLM’s “Stellar” Growth

Bitcoin Smashes $99,000 as Inflation Rises to 2.9% in December

Bitcoin DeFi Is Finding Product-market Fit With Runes

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x