Bitfinex

US Government To Release Half Its Bitcoin Intended for Trump’s Strategic Reserve

Published

8 hours agoon

By

admin

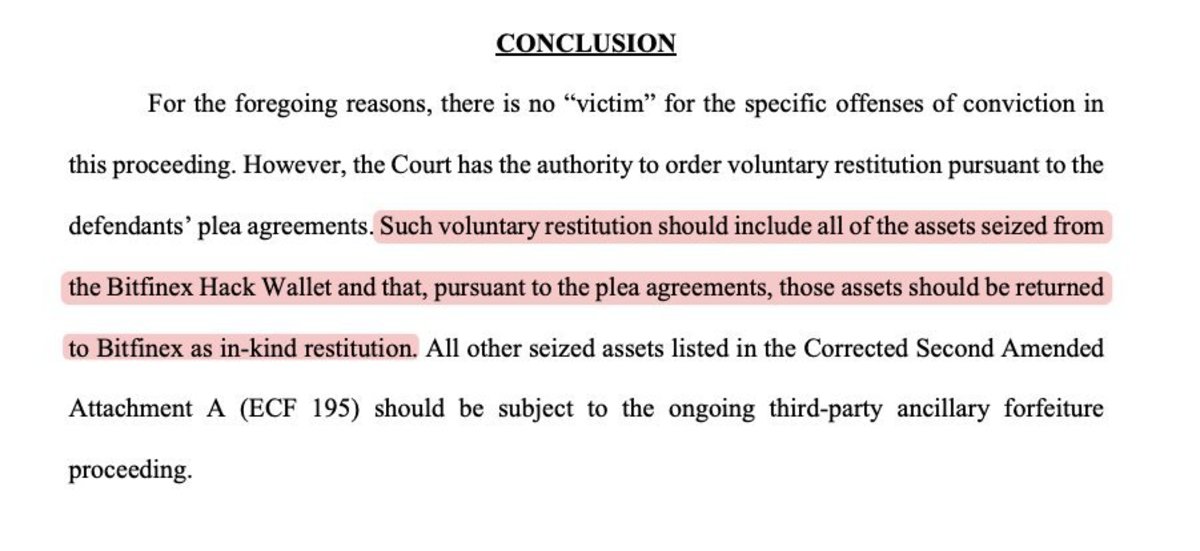

Earlier this morning, the U.S. government announced via a court document that stolen bitcoin from the Bitfinex hack in 2016 should be returned to the exchange in-kind. This bitcoin, as seen publicly on the blockchain via Arkham Intelligence, totals 94,643 BTC currently worth $9.4 billion at the time of writing.

Just five days before pro-Bitcoin Donald Trump is sworn into office for a second term, the U.S. government seems to be on the verge of sending a large chunk of U.S. held bitcoin back to Bitfinex. Last summer, at The Bitcoin 2024 Conference in Nashville, Donald Trump pledged to create a national strategic bitcoin stockpile using the bitcoin already held by the government obtained from hacks, seizures, etc. According to Arkham Intelligence data, the U.S. currently holds 198,109 bitcoin worth over $20.1 billion. If these coins are to be sent back to Bitfinex — that would cut Trump’s promised strategic reserve by 47.77% down to 103,466 BTC.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Magazine (@BitcoinMagazine) July 27, 2024

It makes me bullish that if the government is going to be acquiring mass amounts of bitcoin in the near future and over the long term, then I would want them to start from as close to 0 as possible, because that would require them to market buy more and push the price higher. The bitcoin should be returned in-kind, the court document stated, meaning those coins will not need to be sold for dollars, relieving any downward pressure on bitcoin’s price from that would be sale. Plus bitcoin getting returned to its rightful owner sounds like the right thing to do, and I’m sure Bitfinex will be thrilled to get their coins back.

However, if the U.S. government is going to be mass buying bitcoin for a strategic reserve, then Wyoming Senator Cynthia Lummis’ proposed legislation for that would need to be signed into law. As it stands from just Trump’s promise, he would just initially keep the seized bitcoin held on the government balance sheet as the strategic reserve, with the potential of acquiring more BTC by other methods, but made no hard promise on that. Senator Lummis’ proposed bill would see the United States buy 200,000 bitcoin per year, for 5 years, until it has accumulated a total of 1,000,000 bitcoin.

JUST IN: US Senator Cynthia Lummis outlines Strategic #Bitcoin Reserve plan: "purchase 200k BTC per year for five years. 1m BTC total." 🇺🇸 pic.twitter.com/57ofJhc8X0

— Bitcoin Magazine (@BitcoinMagazine) November 21, 2024

However this all plays out, the strategic bitcoin reserve will be bullish for the country and for Bitcoin in general. Obviously, Senator Lummis’ bill would be the far more bullish of the potential outcomes, because it would market buy back all the bitcoin it plans to give back to Bitfinex, and then 905,357 BTC more. That amount of sheer buying demand would most likely send the price of bitcoin skyrocketing, especially as other governments around the world start buying as well to keep up with our government’s purchases.

Even if Lummis’ bill does not come to fruition, and we only get the reserve that Trump promised, I believe that is still enough to make other governments FOMO into creating their own reserve as well.

There is only about 450 new bitcoin getting mined every day, and with institutional bitcoin purchases already outpacing the new supply of BTC mined this year, things could get really crazy, really fast. Buckle up.

JUST IN: Corporate demand for #Bitcoin is already outpacing new bitcoin supply this year 👀

Bullish 🚀 pic.twitter.com/PyKk9Aci93

— Bitcoin Magazine (@BitcoinMagazine) January 13, 2025

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Here’s why Litecoin price is pumping

Solana, Ripple’s XRP Jump as Donald Trump Reportedly Mulls ‘America-First’ Crypto Strategic Reserve, but Experts Suggest Otherwise

Dogecoin Price Stalls as Crypto Pros Abandon DOGE For This Altcoin

Le DOGE à 1,30 dollar ? Cela devrait propulser WEPE à la hausse

Analyst Says One Factor Could Be a Headwind for Bitcoin, Outlines ‘Line in the Sand’ BTC Must Overcome

Litecoin Price Jumps Double-Digits As ETF Speculation Ramps Up

Bitcoin

Major Victory For Bitfinex: DOJ Declares $9 Billion In Stolen Bitcoin Should Be Returned

Published

12 hours agoon

January 16, 2025By

admin

The US Department of Justice (DOJ) has stated that around $9 billion in Bitcoin, taken from the crypto exchange Bitfinex in a 2016 hacking incident, ought to be returned to the exchange.

This claim arises from a legal document submitted by the DOJ, which indicated that there are no recognizable victims in this specific case within the existing legal structure.

Bitfinex To Potentially Reclaim Stolen Bitcoin

The court documents, submitted on Tuesday, explain that the recovery of the stolen Bitcoin—specifically 94,643 BTC, along with amounts from various hard forks—should be returned to Bitfinex.

The DOJ argued that under the Mandatory Victim Restitution Act (MVRA), there is no legal basis to classify Bitfinex or its account holders as victims of the specific offenses for which the defendants were convicted.

The defendants, Ilya Lichtenstein and Heather Morgan, were convicted of Money Laundering Conspiracy, but crucially, they were not charged with the initial hack that resulted in the theft of the Bitcoin.

According to the DOJ, their subsequent actions did not directly cause the losses incurred by Bitfinex. The legal definition of a “victim” as stated in the MVRA requires a direct and proximate harm resulting from the commission of a specific offense, which in this case reportedly does not apply.

Legal Challenges In Crypto Asset Recovery

The DOJ’s filing emphasizes that, while no mandatory restitution can be ordered under the current convictions, the court retains the authority to grant voluntary restitution.

This means that, as part of their plea agreements, the defendants have agreed to return the stolen assets to Bitfinex. The restitution order proposed by the DOJ would encompass all funds recovered from the Bitfinex Hack Wallet.

While this ruling marks a potential financial windfall for Bitfinex, it also opens the door for further legal complexities. The government is in the process of a third-party ancillary forfeiture proceeding to address other seized assets linked to the defendants’ laundering activities.

These additional assets, which were involved in complex laundering schemes, may not be categorized as specific property lost by Bitfinex and its account holders.

The 2016 Bitfinex hack, one of the largest in cryptocurrency history, has had lasting repercussions, leading to ongoing debates about regulatory standards and victim restitution in the digital asset space.

As this situation develops, the parties involved in the case will be focused on the court’s ultimate ruling about the return of the seized Bitcoin and its impact on the future of cryptocurrency regulation and restitution methods for future cases.

The DOJ’s efforts aim not only to address the financial losses experienced by Bitfinex but also to clarify the legal ramifications related to digital asset theft.

At the time of writing, Bitcoin has managed to regain its bullish momentum with a 4% rise in the past 24 hours towards the $99,100 level.

Featured image from DALL-E, chart from TradingView.com

Source link

Bitfinex

Hackers apparently steal $20m from US government wallets

Published

3 months agoon

October 25, 2024By

admin

U.S. government crypto wallets may be compromised, as observers alerted the public to suspicious on-chain transactions.

According to Arkham, unknown hackers have possibly stolen $20 million in seized cryptocurrencies like Ethereum (ETH), Tether (USDT), and Circle USD Coin (USDC) from U.S. government-controlled addresses.

The developing story, corroborated by on-chain sleuth ZachXBT on Telegram, might even involve funds confiscated from the Bitfinex hackers. Arkham stated that address 0xc9E received seized assets from at least one wallet mentioned in the Bitfinex court case documents.

𝗨𝗣𝗗𝗔𝗧𝗘: 𝗨𝗦 𝗚𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁 𝗹𝗶𝗻𝗸𝗲𝗱 𝗮𝗱𝗱𝗿𝗲𝘀𝘀 𝗮𝗽𝗽𝗲𝗮𝗿𝘀 𝘁𝗼 𝗵𝗮𝘃𝗲 𝗯𝗲𝗲𝗻 𝗰𝗼𝗺𝗽𝗿𝗼𝗺𝗶𝘀𝗲𝗱 𝗳𝗼𝗿 $𝟮𝟬𝗠.

$20M in USDC, USDT, aUSDC and ETH has been suspiciously moved from a USG-linked address 0xc9E6E51C7dA9FF1198fdC5b3369EfeDA9b19C34c to… pic.twitter.com/UXn1atE1Wx

— Arkham (@ArkhamIntel) October 24, 2024

Bitfinex was hacked in 2016 by Ilya Lichtenstein and his rapper partner Heather Morgan, AKA Razzlekhan. The duo successfully stole about $8 billion in Bitcoin (BTC) from the crypto exchange. Nearly a decade later, federal prosecutors asked for a five-year sentence to be issued to Lichtenstein.

Transactions suggest the hackers started selling and laundering the funds after breaking into U.S. government wallets, Arkham said in its Oct. 24 post about the suspicious activity.

The funds were moved to wallet 0x348 which has begun selling the funds to ETH. We believe the attacker has already begun laundering the proceeds through suspicious addresses linked to a money laundering service.

Arkham

Before the blockchain analytics provider flagged the U.S. government transactions, Arkham noted that government wallets withdrew over $6.5 million in crypto from decentralized finance lender Aave. Etherscan data also showed that one U.S. government address paid up to $1,000 in Ethereum fees to move about $100,000 in cryptocurrencies.

This is a developing story.

Source link

Here’s why Litecoin price is pumping

Solana, Ripple’s XRP Jump as Donald Trump Reportedly Mulls ‘America-First’ Crypto Strategic Reserve, but Experts Suggest Otherwise

Dogecoin Price Stalls as Crypto Pros Abandon DOGE For This Altcoin

Le DOGE à 1,30 dollar ? Cela devrait propulser WEPE à la hausse

Analyst Says One Factor Could Be a Headwind for Bitcoin, Outlines ‘Line in the Sand’ BTC Must Overcome

US Government To Release Half Its Bitcoin Intended for Trump’s Strategic Reserve

Litecoin Price Jumps Double-Digits As ETF Speculation Ramps Up

Pump.fun meme coins “ponzi scheme” say Burwick Law founder

XRP’s Bull Momentum Strongest Since January 2018 as Futures Open Interest Hits Record High

Here’s Why Litecoin Price Is Up 18% Today?

Major Victory For Bitfinex: DOJ Declares $9 Billion In Stolen Bitcoin Should Be Returned

DeFi Altcoin Flashing Tier-One Setup and Could Ignite 56% Rally, According to Crypto Strategist

Bitcoin Miners, Economic Irrationality Can Be Fatal

VanEck Files New ‘Onchain Economy’ ETF to Target Crypto Infrastructure, Not Coins

VanEck seeks SEC approval for Onchain Economy ETF

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x