Markets

George Soros’ Reflexivity Theory Explains Why Altcoins Swing Harder Than Bitcoin: Analyst

Published

2 months agoon

By

admin

Ever wonder why so-called altcoins appear more sensitive to macroeconomic data than Bitcoin?

According to Matt Mena, a crypto research strategist at the Swiss-based asset manager 21Shares, traders can look to George Soros, the American investor and philanthropist who famously broke the British pound back in 1992.

Soros began developing his theory of reflexivity in the 1950s, and while the trading concept has roots in traditional finance, Mena told Decrypt that it can be applied to crypto as well. Effectively, Soros’ theory of reflexivity centers on feedback loops among investors, where price movements influence their behavior, which in turn affects prices further.

When it comes to digital assets beyond Bitcoin, those with relatively smaller market caps like Ethereum and Solana are more speculative in nature, making them particularly susceptible to reflexive cycles, Mena said. As expectations of Fed rate cuts have driven markets over the past week-plus, indeed cryptocurrencies beyond Bitcoin have faced greater volatility.

“When macro data signals improving liquidity, such as the potential for Fed rate cuts, it often leads to increased risk-taking,” he said. “This inflow of capital into altcoins, driven by the expectation of higher returns, tends to magnify price movements.”

Following Wednesday’s inflation snapshot, which assuaged inflation concerns, Bitcoin price rose 3.8% from $96,800 to $100,500 over the course of around 12 hours. Meanwhile, Ethereum and Solana jumped 7.1% to $3,450 and 10.7% to $206, respectively.

By TradFi standards, Bitcoin is volatile. But the asset is more established than its crypto counterparts with greater institutional adoption, making it less susceptible to the reflexive trend, Mena said, adding that its reputation as “digital gold” provides somewhat of a buffer.

While Soros’ theory of reflexivity can help explain altcoins’ outsized swings, Tony Acuña-Rohter, the CEO of EDX Markets, an institution-only crypto exchange, told Decrypt that there are other factors that can cause chain reactions in the crypto market—such as liquidations.

Liquidations occur when an exchange forcibly closes a trader’s position, often due to insufficient funds to cover a leveraged position. By borrowing funds from an exchange, leverage trading allows traders to control a larger position, amplifying potential returns and losses.

When Bitcoin’s price fell to $92,000 in late December, plummeting from its record price of $108,000 just three days before, liquidations spiked. The pullback, which coincided with the Fed’s shifting outlook on rate cuts, sparked $1.4 billion in liquidations, according to CoinGlass.

What’s more, margin calls and stop orders can exacerbate price swings at the exchange level, Acuña-Rohter said, describing them as potentially potent risk management tools due to the overall structure of the crypto market, which is spread out across numerous exchanges.

“In crypto, [markets] are very fragmented,” he said. “Exaggerated movements can become even more exaggerated, not just from the macro factors, but these micro-like risk management tools.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Published

12 hours agoon

March 23, 2025By

admin

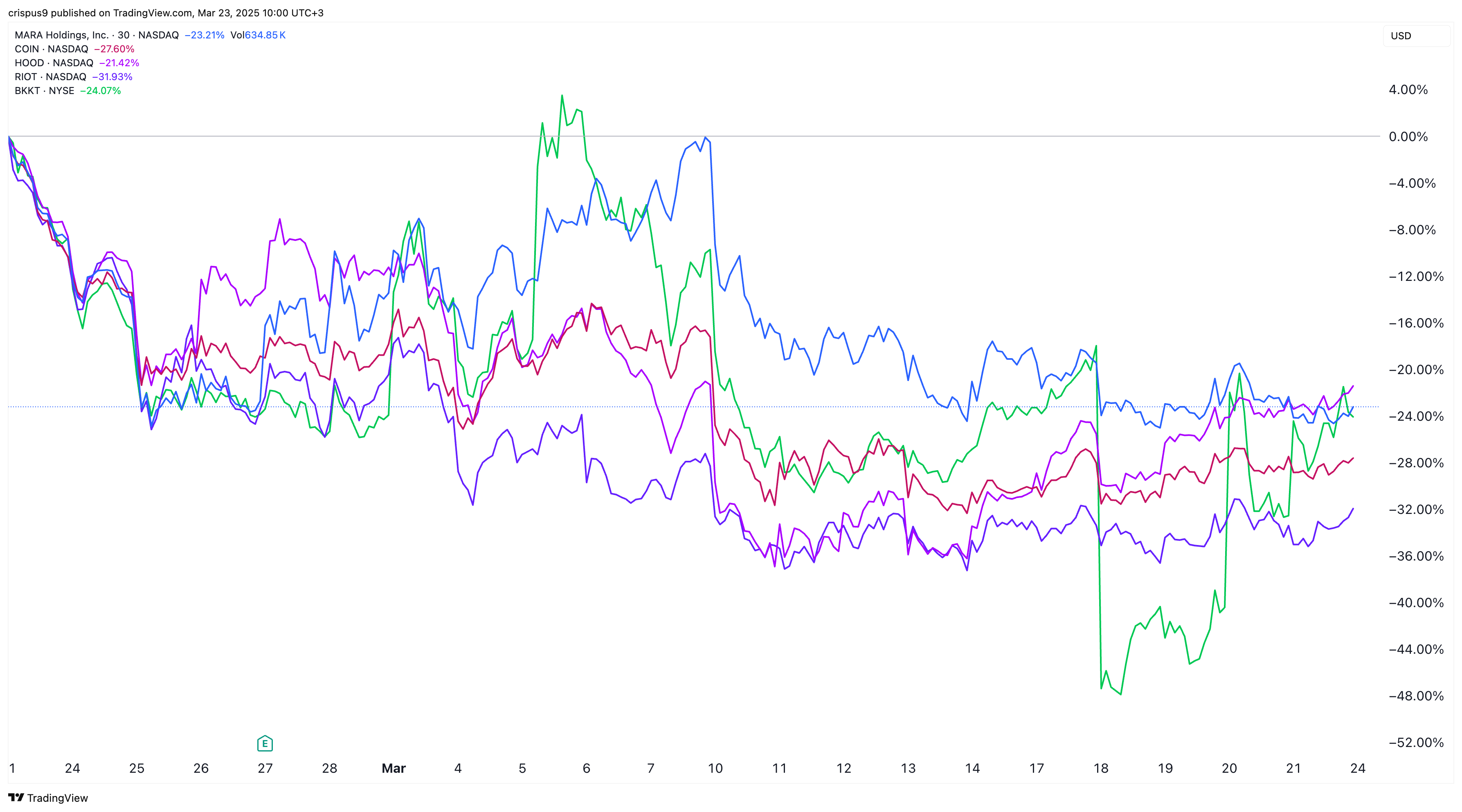

Crypto stocks are caught in a brutal free fall, mirroring the market-wide slump in Bitcoin and altcoins.

Coinbase, the biggest crypto exchange in the U.S., has crashed from nearly $350 per share in November to $190. This decline has brought its market cap from $86 billion to $48 billion—a $38 billion wipe out.

Michael Saylor’s Strategy, has also shed billions of dollars in value. Its market cap dipped from a high of $106 billion last year to $79 billion today. The company, formerly known as MicroStrategy, has continued to accumulate Bitcoin and now holds 499,226 Bitcoins in its balance sheet.

Robinhood stock crashed from $66.85 earlier this year to $45, erasing $18 billion in value. While Robinhood is known for providing retail trading, it has become a major player in the crypto market. It hopes to play a bigger role in the sector when it completes its BitStamp acquisition later this year.

Bitcoin (BTC) mining stocks have also plunged as the struggling BTC price hurts margins. Mara Holdings, formerly known as Marathon Digital, has lost over $4.6 billion in valuation. Other similar companies like Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf have also shed billions in valuation.

Bitcoin, altcoin prices plummet

These crypto stocks have dropped because of the ongoing decline of Bitcoin and other altcoins. According to CoinMarketCap, the market cap of all cryptocurrencies has dropped from over $3.7 trillion in 2024 to $2.7 trillion today.

Bitcoin has dropped from $109,300 in January to $85,000 at last check. Most altcoins have done worse. For example, Solana meme coins have shed over $18 billion in value as their combined market cap sank.

Crypto prices and crypto stocks have dropped despite the Trump administration’s pledge to be highly supportive of the sector via initiatives like a Strategic Bitcoin Reserve.

The Securities and Exchange Commission has also enacted some friendly policies and ended most of the lawsuits in the industry. It has ended lawsuits brought on companies like Coinbase, Ripple Labs, and Kraken.

Whether these crypto stocks bounce back remains to be seen. Crypto analysts have a mixed outlook on the industry. Some observers expect Bitcoin’s price to recover, with Standard Chartered predicting it will hit $500,000 over time.

Ki Young Ju, CryptoQuant’s founder, estimates that the crypto bull run has ended, noting that all indicators were bearish.

Source link

Bitcoin

Is Bitcoin Price Performance In 2025 Repeating 2017 Bull Cycle?

Published

24 hours agoon

March 23, 2025By

admin

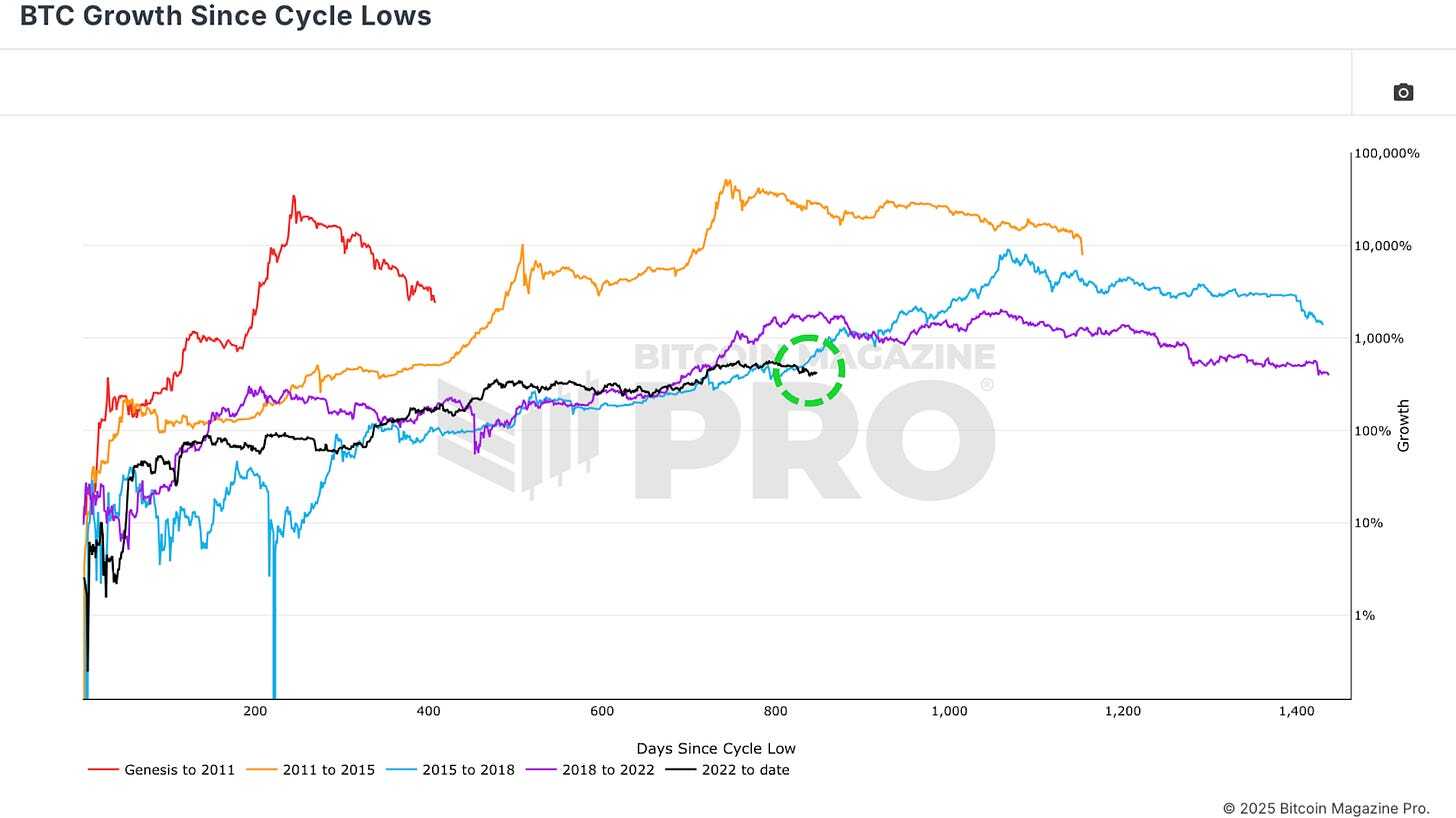

After reaching an all-time high above $100,000, the Bitcoin price has entered a multi-week downtrend. This correction has naturally raised questions about whether Bitcoin is still aligned with the 2017 bull cycle. Here we’ll analyze the data to assess how closely Bitcoin’s current price action correlates with previous bull markets, and what we can expect next for BTC.

Bitcoin Price Trends in 2025 vs. 2017 Bull Cycle

Bitcoin’s price trajectory since the cycle lows set during the 2022 bear market has shown remarkable similarities to the 2015–2017 cycle, the bull market that culminated in Bitcoin reaching $20,000 in December 2017. However, Bitcoin’s recent downtrend marks the first major divergence from the 2017 pattern. If Bitcoin were still tracking the 2017 cycle, it should have been rallying to new all-time highs over the past month, instead, Bitcoin has been moving sideways and declining, suggesting that the correlation may be weakening.

Despite the recent divergence, the historical correlation between Bitcoin’s current cycle and the 2017 cycle remains surprisingly high. The correlation between the current cycle and the 2015–2017 cycle was around 92% earlier this year. The recent price divergence has reduced the correlation slightly to 91%, still an extremely high figure for financial markets.

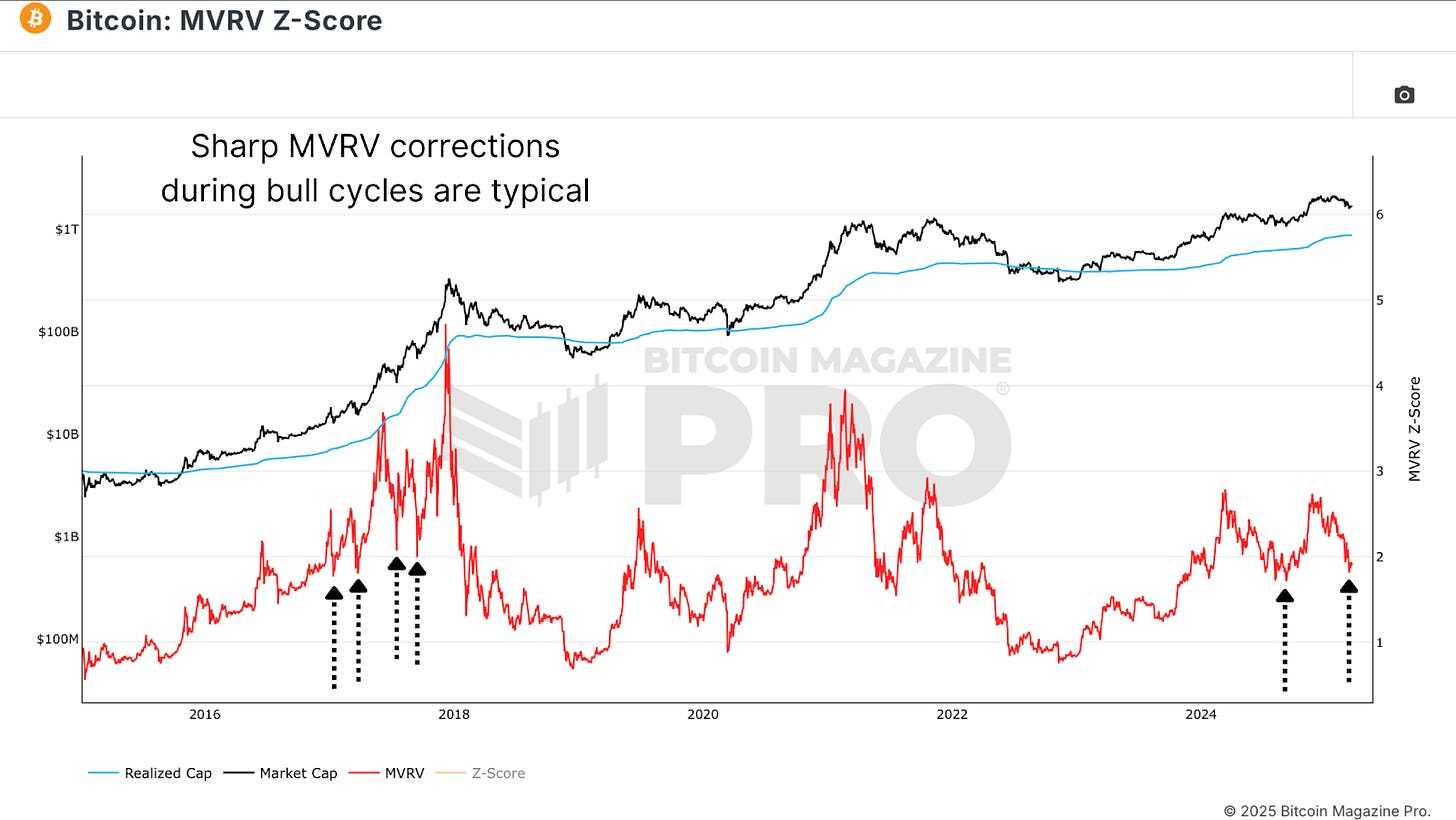

How Bitcoin Market Behavior Echoes 2017 Cycle Patterns

The MVRV Ratio is a key indicator of investor behavior. It measures the relationship between Bitcoin’s current market price and the average cost basis of all BTC held on the network. When the MVRV ratio rises sharply, it indicates that investors are sitting on significant unrealized profits, a condition that often precedes market tops. When the ratio declines toward the realized price, it signals that Bitcoin is trading close to the average acquisition price of investors, often marking a bottoming phase.

The recent decline in the MVRV ratio reflects Bitcoin’s correction from all-time highs, however, the MVRV ratio remains structurally similar to the 2017 cycle with an early bull market rally, followed by multiple sharp corrections, and as such, the correlation remains at 80%.

Bitcoin Price Correlation with 2017 Bull Cycle Data

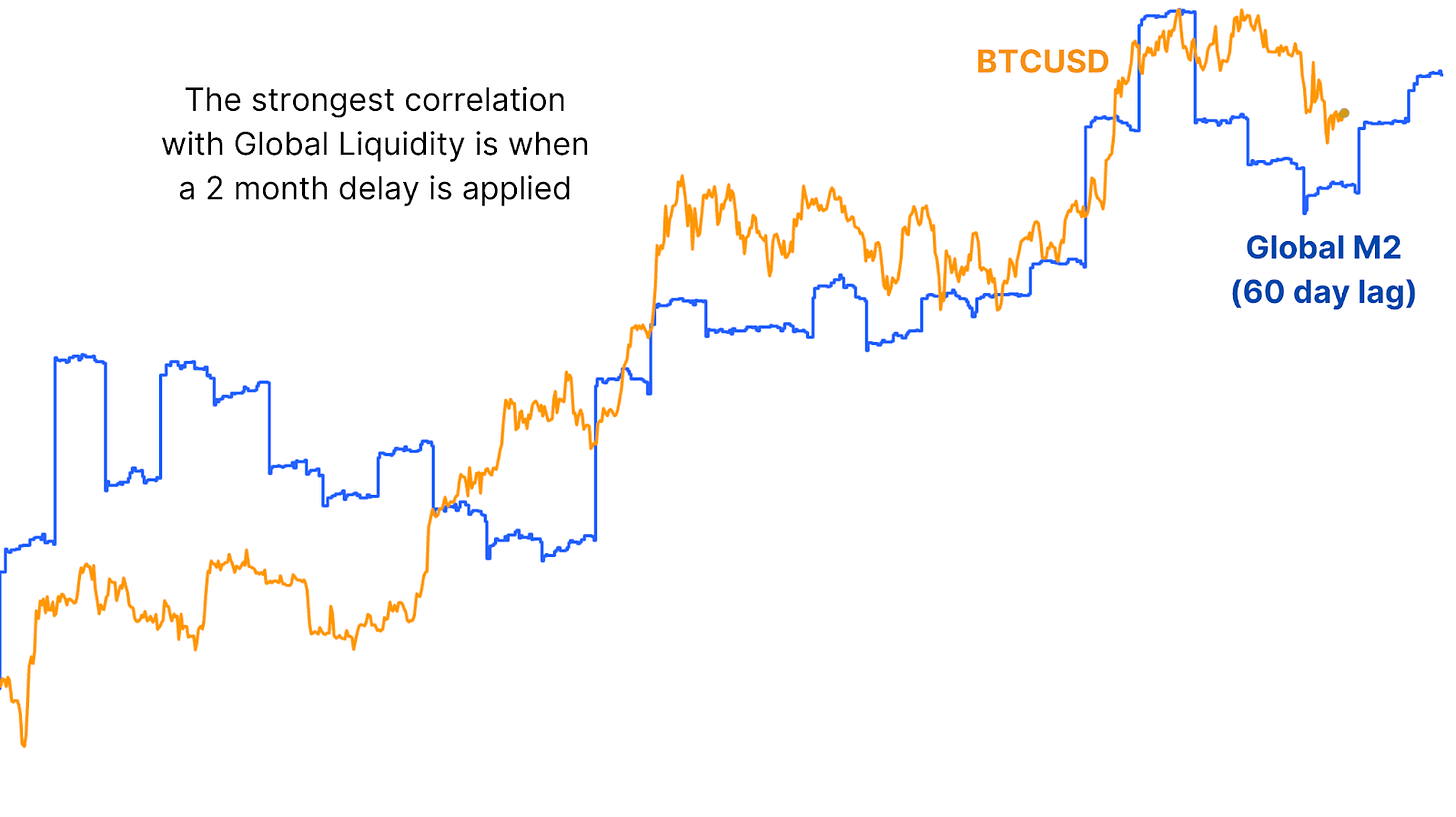

One possible explanation for the recent divergence is the influence of data lag. For example, Bitcoin’s price action has shown a strong correlation with Global Liquidity, the total supply of money in major economies; however, historical analysis shows that changes in liquidity often take around 2 months to reflect in Bitcoin’s price action.

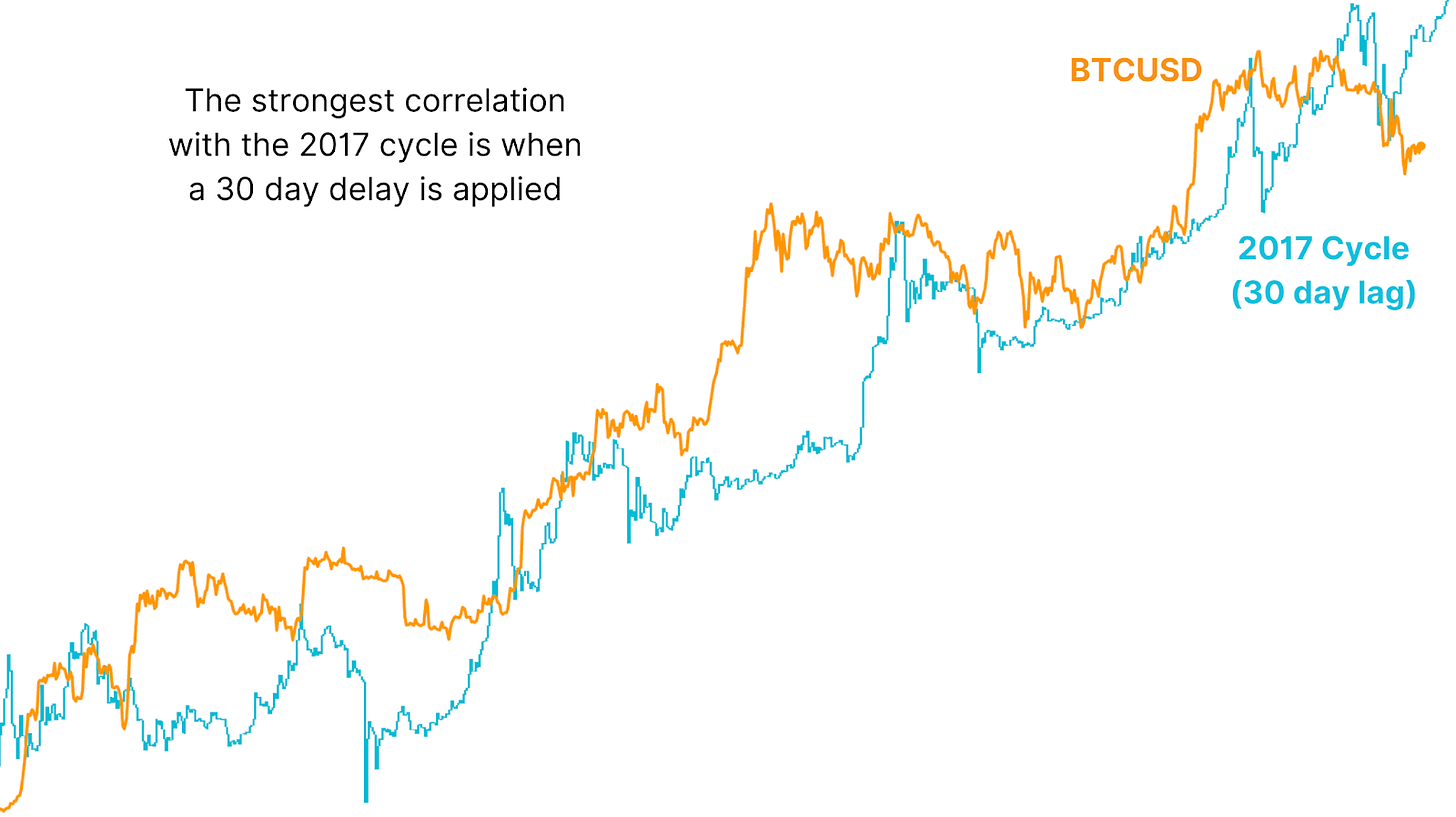

By applying a 30-day lag to Bitcoin’s price action relative to the 2017 cycle, the correlation increases to 93%, which would be the highest recorded correlation between the two cycles. The lag-adjusted pattern suggests that Bitcoin could soon resume the 2017 trajectory, implying that a major rally could be on the horizon.

What 2017 Bull Cycle Signals Mean for Bitcoin Price Today

History may not repeat itself, but it often rhymes. Bitcoin’s current cycle may not deliver 2017-style exponential gains, but the underlying market psychology remains strikingly similar. If Bitcoin resumes its correlation with the lagging 2017 cycle, the historical precedent suggests that Bitcoin could soon recover from the current correction, and a sharp upward move could follow.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Markets

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Published

1 day agoon

March 22, 2025By

admin

It was another up-and-down week for Bitcoin, after news from the central bank sent the biggest cryptocurrency up, then back down again. And we’ve basically landed right back where we started.

Right now, Bitcoin’s price now stands at $84,150 per coin after not budging over a seven-day period, according to CoinGecko data. It’s up 0.2% on the day, but totally flat on the week.

The asset jumped briefly after Federal Reserve Chair Jerome Powell told reporters Wednesday that everything was under control and that President Trump’s tariffs would have a “transitory” effect on inflation.

Bitcoin had been dipping—just like stocks—whenever President Trump abruptly announced tariffs over the past month. But investors seemed to like the news from Powell.

ETF action

American Bitcoin investors had been fast cashing out of Bitcoin ETFs earlier this month, but that all changed this week, Farside Investors data shows.

Every day this week, money has flooded back into the new vehicles, with over half a billion entering the funds by Wednesday. About $734 million worth of funds reentered Bitcoin ETFs this week as investor sentiment has changed as speculators expect interest rates to lower this year.

Note that the positive sentiment hasn’t extended to all crypto ETFs, as Ethereum funds are collectively nursing a now 13-day losing streak (including Friday’s fresh data)—even as Bitcoin funds show green over the last six days.

Choppy waters here to stay

Still, investors could still be in for a bumpy ride as data shows that Bitcoin’s volatility is at a six-month high due, as worries about the U.S. economy and geopolitical tensions push people to adopt a more “risk-off” mindset.

Amberdata Director of Derivatives Greg Magadini told Decrypt that volatility—in the short-term, at least—was likely here to stay.

SEC continues to clean up ‘mess’

And the U.S. Securities and Exchange Commission, which said it would put right the previous administration’s “mess” by being clearer on rules for the digital asset industry, made a statement that applies to Bitcoin mining: proof-of-work mining operations do not need to register their actions as they “do not involve the offer and sale of securities.”

According to the regulator, as a miner’s “expectation to receive rewards is not derived from any third party’s managerial or entrepreneurial efforts upon which the network’s success depends,” the activity does not come under the SEC’s jurisdiction.

Under crypto-friendly President Donald Trump, the regulator appears to be adopting a more relaxed approach to the space, and and has already scrapped a number of lawsuits and investigations targeting firms in the space.

BlackRock talks Bitcoin

Meanwhile, BlackRock—the world’s biggest asset manager—has tried to clear the air about Bitcoin… again. In an interview with CNBC‘s Squawk Box, the firm’s Digital Asset Head Robert Mitchnick said that calling the biggest cryptocurrency by market cap a “risk-on” asset was not exactly accurate.

“What we’ve seen lately seems to be self-fulfilling and actually a self-inflicted wound by some of the research and commentary that the industry does, leaning into this idea of it as a risk-on asset at times,” Mitchnick said.

BlackRock’s iShares Bitcoin Trust has been one of the most successful BTC ETFs since its launch last January. Is the Wall Street giant trying to get more clients for its fund?

Edited by Andrew Hayward

Source link

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

Jupiter Price Action Signals Breakdown—$0.41 Target In Play

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x