Adoption

Why Hundreds of Companies Will Buy Bitcoin in 2025

Published

2 months agoon

By

admin

Matt Hougan, Chief Investment Officer (CIO) at Bitwise, has issued a bold prediction: hundreds of companies will buy Bitcoin as a treasury asset over the next 12 to 18 months. The shift, which Hougan describes as an “overlooked megatrend,” has the potential to significantly influence Bitcoin’s market trajectory.

MicroStrategy: The Torchbearer of Corporate Bitcoin Adoption

MicroStrategy, led by Michael Saylor, has become synonymous with corporate Bitcoin adoption. Though ranked only 220th globally by market capitalization, the company’s influence on the Bitcoin market is disproportionate. In 2024 alone, MicroStrategy acquired 257,000 BTC—exceeding the total Bitcoin mined that year (218,829 BTC).

The company’s ambitions show no signs of slowing. It recently announced plans to raise $42 billion for additional Bitcoin purchases, equivalent to 2.6 years’ worth of Bitcoin’s annual production at current rates.

Beyond MicroStrategy: A Growing Movement

MicroStrategy’s actions are just the tip of the iceberg. According to Hougan, 70 publicly traded companies already hold Bitcoin on their balance sheets. This list includes not only crypto-native firms like Coinbase and Marathon Digital but also mainstream giants like Tesla, Block, and Mercado Libre. Together, these firms—excluding MicroStrategy—own 141,302 BTC.

Private companies are also significant players. SpaceX, Block.one, and others collectively hold at least 368,043 BTC, based on data from BitcoinTreasuries.com. Hougan highlights that MicroStrategy’s share of the corporate Bitcoin market is already less than 50% and is likely to decline further as adoption grows.

What happens when larger companies, like Meta, which is currently considering a shareholder suggestion to add bitcoin to its balance sheet—20x the size of MicroStrategy start to emulate MicroStrategy’s strategy?

Why Corporate Bitcoin Adoption Is Poised to Accelerate

Two major barriers have historically constrained corporate adoption of Bitcoin: reputational risk and unfavorable accounting rules. Both have shifted dramatically in recent months:

1. Reduced Reputational Risk

Until recently, companies faced significant hurdles in adopting Bitcoin. CEOs and boards were concerned about shareholder lawsuits, regulatory scrutiny, and negative media coverage. However, as Bitcoin gains acceptance at institutional and governmental levels, these fears are dissipating. Post-election, Bitcoin has seen growing bipartisan support in Washington, making it increasingly “commonplace—and even popular—to own Bitcoin,” according to Hougan.

2. Favorable Accounting Changes

The Financial Accounting Standards Board (FASB) introduced a new guideline, ASU 2023-08, that fundamentally changes how Bitcoin is accounted for. Previously, companies were required to mark Bitcoin as an intangible asset, forcing them to write down its value during price declines but preventing upward adjustments when prices rose.

Under the new rule, Bitcoin can now be marked to market, allowing companies to recognize profits as its price appreciates. This change removes a significant disincentive and is expected to drive exponential growth in corporate Bitcoin holdings.

The “Why” Behind Corporate Bitcoin Adoption

Corporate motivations for holding Bitcoin mirror those of individual investors. Hougan outlines several reasons:

- Hedging Against Inflation: Bitcoin is viewed as a safeguard against currency debasement.

- Speculation: Some companies aim to boost stock prices through Bitcoin exposure.

- Cultural Signaling: Holding Bitcoin signals alignment with innovation and attracts a younger, tech-savvy customer base.

- Strategic Hunches: For many, Bitcoin ownership is a calculated gamble.

Hougan asserts that the motivations behind corporate adoption matter less than the magnitude of demand. “You just need to look at the numbers,” he writes. “Where does all this demand look like it’s going? And what would that mean for the market?”

A Megatrend That Could Redefine Markets

Hougan’s memo paints a bullish picture of Bitcoin’s future. If hundreds of companies follow MicroStrategy’s lead, the cumulative demand could drive Bitcoin’s price significantly higher in the coming year. With 70 companies already on board under less favorable conditions, the stage is set for an explosion in adoption.

This trend not only highlights Bitcoin’s evolving role as a treasury asset but also underscores its growing acceptance as a mainstream financial instrument. For mature investors, the implications are clear: the next 18 months could mark a pivotal period in Bitcoin’s journey from speculative asset to institutional cornerstone.

The Time to Buy Is Now

With reputational risks fading, accounting rules evolving, and demand accelerating, Bitcoin’s integration into corporate treasuries appears inevitable. Hougan’s analysis invites investors to consider the broader implications:

If corporations truly embrace Bitcoin at scale, what could that mean for the market’s future? For savvy investors, the answer might lie in acting sooner rather than later.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

Adoption

California Senator endorses Bitcoiner for seat on $500b pension fund board

Published

3 days agoon

March 12, 2025By

admin

California State Senator Ben Allen is eyeing further pro-crypto representation with an endorsement of Dom Bei for election to the board of California’s public pension fund.

Bei is the founder of Proof of Workforce, a Bitcoin (BTC) non-profit focused on promoting BTC adoption via educational initiatives targeting workers, unions and pension funds. He is in the race to join the California Public Employees’ Retirement System, CalPERS, as a board member.

Notably, CalPERS is the largest public pension fund in the United States with over $500 billion and serves more than 2 million public retirement system members. CalPERS manages the retirement assets of California’s police department, firefighters and teachers among others.

The pension fund also counts over 1.5 million individuals as members of its health program.

CalPERS board of trustees comprises 13 members. Endorsement from Sen. Allen could see Bei become the first bitcoin advocate to get elected.

“I’ve dedicated over a decade to championing workers and wage-earners. Now, I’m running for CalPERS Board of Trustees to protect our nation’s largest public pension, serving 2M+ participants,” Bei noted in a post on X.

The former firefighter previously served on the advisory board of the Santa Monica pension fund. His pro-bitcoin voice has seen him get support from across several players in the industry.

According to observers, election to CalPERS will be crucial to the overall push for BTC adoption across pensions and other public sector platforms. With his experience and as a Bitcoin holder, Bei could see the largest pension fund in the U.S. explore and potentially add the flagship digital asset to its holdings.

Other than Senator Allen, Bei has received endorsements from more than dozen state legislators. Santa Monica mayor Lana Negrete and California treasurer candidate Tony Vazquez have also talked up his chances. Meanwhile, Anthony Pompliano, founder and chief executive officer of Professional Capital Management, has also added his support.

In 2024, several pension and endowment funds disclosed exposure to Bitcoin, with this coming amid the rapid adoption that followed the Securities and Exchange Commission’s approval of the first spot BTC exchange-traded funds. They include state pension funds and multiple university endowment funds.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

One of the most intriguing aspects of crypto is its sense of anonymity. Bitcoin (BTC), for example, was created in 2008 by an unknown figure using the pseudonym Satoshi Nakamoto, and to this day, the true identity of its inventor remains unknown. The veil of anonymity has allowed users to create distinct identities through wallet addresses, adding an extra layer of privacy and discretion to transactions.

This concept of openness and universal access is one of the core promises of digital currencies, allowing anyone with internet access to engage, regardless of their financial history or background. However, even though the ethos of crypto promotes inclusivity, the reality hasn’t always reflected this.

The early days of crypto were defined by the archetype “crypto bros,” referring to a specific demographic of young, tech-savvy men who influenced the industry’s direction. Their influence extended to the design of projects, development of key protocols, and framing of the culture surrounding digital assets.

However, as the industry matured and evolved, efforts were made to reflect and include more female voices. This shift helped address the imbalance between gender representation, bringing new perspectives into the industry.

A 2024 study revealed that over 560 million cryptocurrency owners exist globally, with 61 percent identifying as male and 39 percent as female. This marks an increase from the previous year, when the global total was 420 million, with 37 percent of owners being female, signaling a positive shift.

In response to this trend, organizations have emerged to address crypto’s gender imbalances. Conferences and events once primarily targeted toward the male-dominated demographic have changed to allow women to step into the space and take the lead.

The Association for Women in Cryptocurrency, or AWC, for example, was founded in 2022 as a platform for women looking to enhance their knowledge and education in crypto. Led by Amanda Wick, AWC hosts various events, like webinars and in-person meetups, where women can learn from industry experts and connect with mentors who can guide them and help them discover new career opportunities.

Recently, Binance shared that it will offer global programs exclusively for women through its Binance Academy platform in honor of International Women’s Day. The events will be held across five continents at 11 venues to help women ease their way into the industry.

While women have made significant strides in the DeFi space, now accounting for 40 percent of Binance’s workforce, leadership positions have been predominantly held by men. Despite this, several women have established themselves as leaders in the space.

Perianne Boring, for instance, is the founder and CEO of the blockchain advocacy group The Digital Chamber, working alongside Congress and the government to promote and regulate blockchain technology. Her leadership role has made her an advocate for adopting blockchain technologies, as she has become a well-known voice in the space discussing the future of finance. In December, President Trump also considered Boring as a potential CFTC chair.

Another established female leader in the space is Joanna Liang, the founding partner of Jsquare, a tech-focused investment firm specializing in blockchain and web3. With a previous background as CIO at Digital Finance Group (DFG), a global Venture Capital firm focusing on crypto projects, Liang recently launched Jsquare’s latest fund, the Pioneer Fund. The fund has successfully raised $50 million in capital, making its first investment in the startup MinionLabs. The fund will focus on emerging technologies in the crypto space, including PayFi, real-world assets (RWAs), and consumer apps.

Laura Shin is also a prominent name in crypto and is recognized as one of the first mainstream media reporters to cover cryptocurrency full-time. She is the author of the book, ‘The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,’ and the host of the podcast Unchained. Laura has shared her expertise at events such as TEDx San Francisco and the International Monetary Fund.

Over the past 16 years, women have been instrumental in helping legitimize crypto assets throughout the financial landscape. Their contributions have spanned various sectors in the ecosystem, helping shift the narrative around crypto from a niche, speculative asset to a more widely recognized and accepted financial tool.

Source link

Adoption

Coinbase Rolled Out the Newest State of Crypto Report

Published

2 months agoon

January 24, 2025By

admin

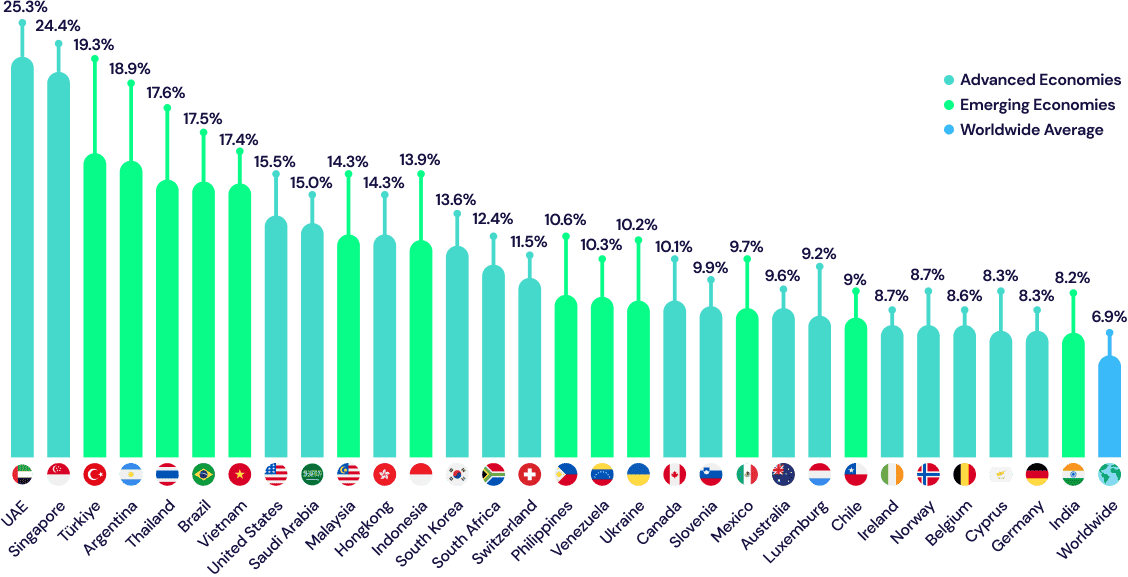

Coinbase rolled out the newest State of Crypto report. The study was conducted by Ipsos. It observes how crypto and blockchain technology are viewed in Argentina, Kenya, the Philippines, and Switzerland and how it impacts the lives of people in these countries.

For most of the part, the study is based on surveys with 4,000 adults (not specifying the age rates) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of Coinbase. The choice of countries aims to give an outlook of societies living in markedly different socioeconomic conditions in different parts of the world (none of these countries belong to the same continent, with the Philippines being an archipelago-based country).

The similarities between these countries are the mostly Christian populations and the government systems revolving around the republic model. Nevertheless, the countries have strikingly different areas, positions on the map, historical experiences, cultures, languages, climates, economic states, etc.

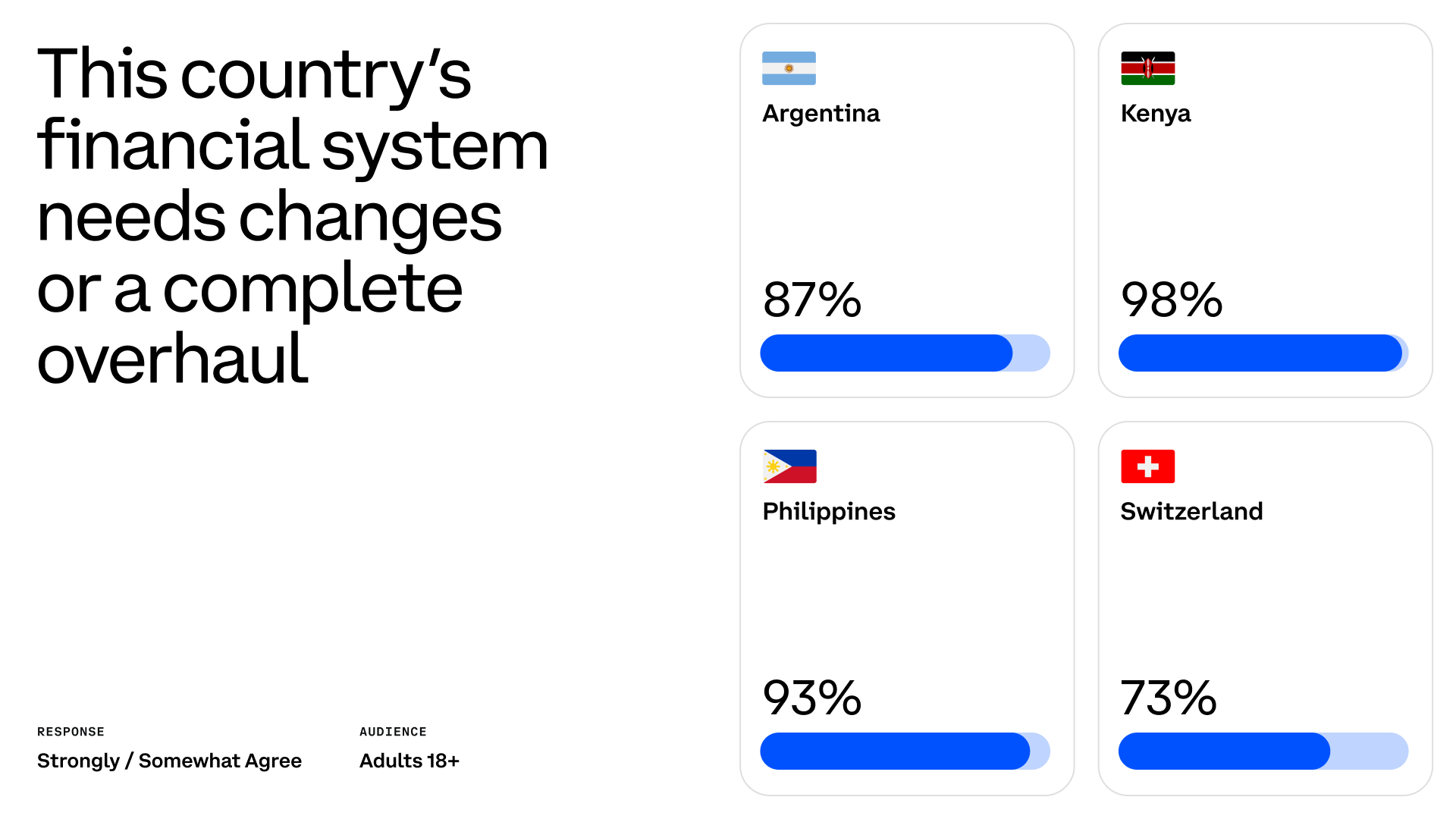

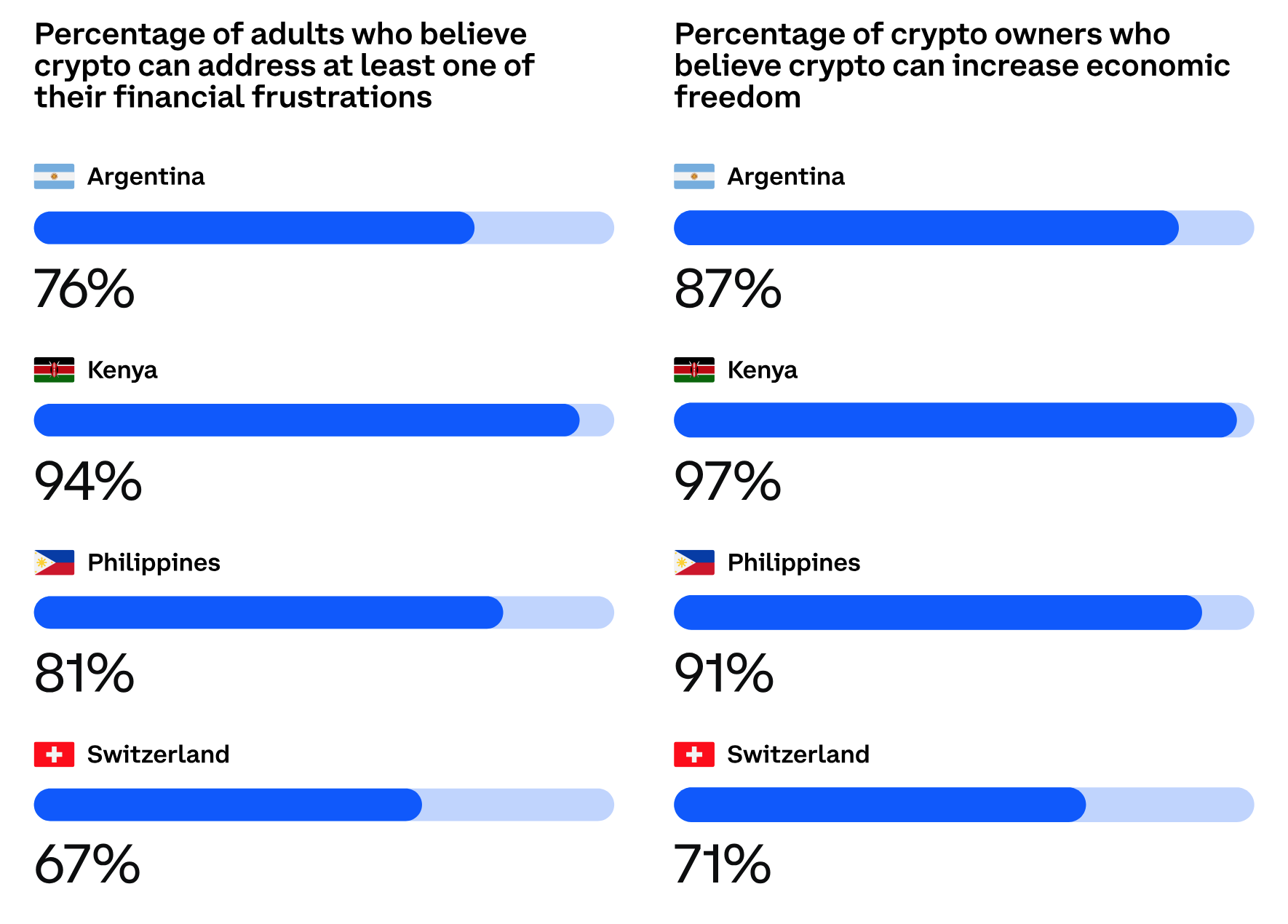

Coinbase, however, outlines another similarity between Argentina, Kenya, the Philippines, and Switzerland: according to the exchange team, the residents of these countries feel that the local financial systems need to be improved. More than that, generally, the polled residents see cryptocurrencies and blockchain as tools that may enhance their lives in terms of financial wealth and overall give more freedom and independence.

The state of economy in these countries

The report starts with the statistics demonstrating that in each country, less than a half of all respondents believe that the current financial direction in their country will make them live better than the previous generation. However, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

So it’s fair to say that in Kenya and Switzerland, people don’t approve of the current financial politics in contrast to the past years, while Argentina and the Philippines rather dislike both the current and the previous efforts, believing that nowadays things are a bit better than before. Respondents in all these countries agree that the local financial system should be changed or overhauled completely. They refer to the financial systems of their countries as “slow,” “expensive,” and “unstable.” They also cited a lack of innovation as one of the problems.

The study reveals four main concerns of the respondents named in the surveys: lack of fairness (discrimination), centralization, decreasing value of the national currency, and too much hard work to earn enough or save money.

The distribution of concerns varies from country to country, with Kenya and the Philippines being most critical towards centralization, discrimination, and wage slavery. Switzerland is least concerned about many of these issues while being cautious towards the government’s dependency on banks. Argentinians have the biggest trust issues with their financial institutions and a problem with saving money.

Crypto as a remedy

Most people polled by Ipsos for the study want to be in charge of their financial state and gain more freedom and control over their money. 7 in 10 respondents see cryptocurrency and blockchain as the way to achieve these goals. More than that, both crypto owners and those who don’t have crypto agree that digital currencies can help them gain more freedom and control over their wealth.

Switzerlanders are markedly less interested in crypto than respondents from other countries. However, over 70% of crypto owners in Switzerland believe that crypto offers them more control and freedom. Less than half of the surveyed Switzerlanders with no crypto believe that they need it.

Wider blockchain adoption is also viewed as a favorable factor that may improve the local financial systems and individual wealth. Most respondents believe that blockchain promotes innovation and facilitates control over individual finances. Respondents hope that blockchain will make the system faster and more accessible.

In all polls, Switzerland is presented with lower numbers. It reflects the lower expectations associated with Bitcoin and blockchain and the lower level of dissatisfaction with the financial status quo.

Looking into this study, you may notice a strong connection between the level of satisfaction with the country’s financial direction and the level of support for cryptocurrencies and blockchain. The residents of Switzerland and Argentina are less concerned with the current financial state of their countries, and they are less into crypto than Kenya and the Philippines. Probably, that’s one of the reasons why not only Kenya but Africa in general, where the population has little to no access to banking services but has smartphones, are usually seen as the driver of the mass adoption of cryptocurrency and blockchain-based solutions as the substitute of traditional banks.

Source link

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

BTC Regains $84K; ETH, XRP, SOL Pump

Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle

Sacks and his VC firm sold over $200M in crypto and stocks before WH role

Polkadot (DOT) Price Stability Fuels Hopes For Short-Term Recovery

Bitcoin Is A Strategic Asset, Not XRP

Bank of America Insider Helps Criminals and Illicit Businesses Launder Funds in Massive Global Conspiracy: US Department of Justice

U.S. government holds $16B in Bitcoin, eyes 1m BTC under new bill

Wales Man Loses Appeal to Dig Out Hard Drive Holding $676 Million in Bitcoin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x