24/7 Cryptocurrency News

Coinbase Announces Support For Donald Trump’s TRUMP Meme Coin

Published

2 months agoon

By

admin

Coinbase cryptocurrency exchange has announced its decision to list the Donald Trump-themed cryptocurrency, TRUMP, on its platform. The token, which operates on the Solana blockchain, is categorized as an “Experimental” asset and will be available for trading in regions where Coinbase offers support.

This comes in the wake of the company’s decision to include meme coins in its list of offered currencies, even as experts continue to raise questions over the sustainability of such digital assets. To avoid a loss, users have been advised to send TRUMP tokens only through the Solana network.

Coinbase Announces Support For TRUMP Meme Coin

Coinbase has included the TRUMP meme coin, developed on the Solana network, in the “Experimental” asset category. These are often used with assets which have limited trading history or have high levels of price fluctuations.

In the official announcement made by Coinbase, it was stated that deposits, withdrawals, and trading for TRUMP will be available on Coinbase and Coinbase Exchange. However, the exchange admitted that transaction processing for Solana-based assets including TRUMP had been slowed down due to network congestion.

Coinbase has also shared the Solana network contract address for TRUMP token to avoid any suspicion. Users are encouraged to use the following address 6p6xgHyF7AeE6TZkSmFsko444wqoP15icUSqi2jfGiPN for all transactions to avoid loss of funds.

Market Activity and Reactions to TRUMP Token

Since its launch, the TRUMP token has attracted massive trading activity and large value transfers between wallets. According to Whale Alert, a blockchain tracking service, more than 1.6 million TRUMP tokens worth $67.4 million were transferred between two anonymous wallets.

Even though the token has a high trading volume, the market performance has been quite volatile having been listed by both Binance, and Robinhood. TRUMP was in the red by double digits following the introduction of a close competition meme coin called MELANIA. This led to criticism from key personalities in the financial and crypto industries, such as investor Mark Cuban, who doubted the token’s sustainability.

Balaji Srinivasan, a crypto enthusiast, called such tokens as TRUMP meme coins and pointed out the fact that they are very much risky. He said, “Every purchase order in such coins has an answer from a seller and this leads to price drop.” Srinivasan also stressed that the best coins are those with intrinsic value, despite the fact that some meme coins have gained communities.

Concerns Over Meme Coin Sustainability

Meme coins have faced scrutiny for their speculative nature and the potential risks they pose to late investors. The launch of TRUMP and similar tokens has reignited discussions about their long-term sustainability in the market especially with Donald Trump failing to mention crypto as top priority as he took office.

Skeptics have claimed that many meme coins rely on marketing and hype to draw investors, but such tokens may lack substantive use cases and sustainable value.

Edward Dowd, the founder of Phinance Technologies, called the TRUMP market drop a mistake that could have been avoided and questioned its sustainability. The recent swings in the prices of TRUMP and MELANIA have only compounded these fears, with more people urging retail investors to be more careful.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

24/7 Cryptocurrency News

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Published

5 hours agoon

March 25, 2025By

admin

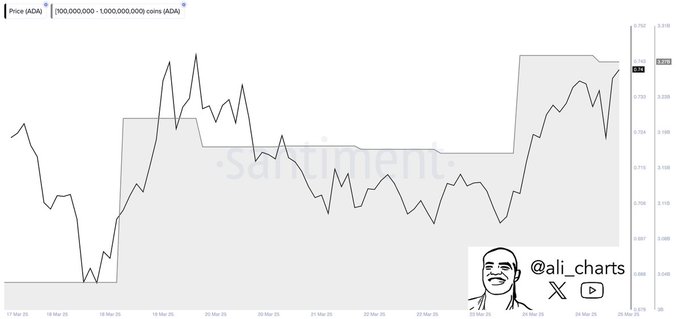

Cardano (ADA) continues to show signs of recovery, with whales significantly accumulating the token. Recently, whale addresses holding between 100 million and 1 billion ADA have purchased over 240 million ADA, worth approximately $175 million. This surge in whale activity suggests confidence in Cardano’s next performance, and the next key price target for ADA could be $0.85.

Whale Activity Supports ADA Price Recovery

Whales have been playing a significant role in the recent price movement of Cardano. In the last one week, the number of whale addresses is on a rise, and they have been accumulating ADA by buying it at higher volumes at a cheaper price. Such a move by the large investors means they have confidence in the asset in the long-run and an expectation of a change in trend, in this case a positive one.

The 240 million ADA purchased by whales serves as a strong indicator that large investors are positioning themselves for a future price increase.

Concurrently, based on the Mean Coin Age, long-term holders have not been selling the ADA tokens therefore they do not consider it a dump asset but rather a token with a massive rally potential. This could help contain the price support for ADA at higher levels and avoid sharp declines in the near term.

Cardano Price Struggles to Break Resistance

Nevertheless, the bullish indications from whale accumulation have been met with a pushback at $0.77 in price. In the previous weeks, ADA price has not managed to trade beyond this level, therefore, it cannot be considered a full recovery. Therefore, the $0.77 area represents the key level that will determine the formation of an uptrend since crossing a price higher than this level will unlock further buy signals.

There is a lack of consistent buying pressure in Cardano’s recent price action that hasn’t allowed ADA to break past significant resistance levels. However, the support from whales and long-term holders may help ADA price to avoid this situation. At press time, Cardano price was trading at $0.7476, a 1.20% rally from the intraday support of $0.7222.

If ADA price can cross above $0.77 then the next level of significant resistance may be $0.85 in order to pump for another round of higher price action.

Will ADA Price Soar To $5? Analyst Weighs In

Crypto analyst Javon Marks suggests that in accordance with the prior cycles it is possible to see the next move of ADA price towards the first level of the 1.272 Fibonacci extension, which in this case is $5.36. This target would signify over 6.8 times increase from the current position and more than 585% increase in the price rally.

In the shorter term, the 1.272 Fibonacci extension of the current base suggests a target of approximately $3.95. This target is in line with other past bullish runs that Cardano has exhibited where most of the movements occur after the formation of consolidation patterns.

Moreover, according to crypto analyst LLuciano_BTC, the Cardano price is showing signs of a bullish flag breakout after a period of consolidation. If the ADA price breaks above the descending resistance with strong volume, it could trigger a significant upside move, potentially toward $1.80.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Analyst Sets ‘Conservative’ XRP Price Target At $15, What’s Next?

Published

13 hours agoon

March 25, 2025By

admin

XRP price has traded near the flatline today, consolidating near the $2.4 mark, but experts remained bullish on the future trajectory of the coin. In a recent analysis, a top expert has set a “conservative” target of $15 for Ripple’s native asset, sparking market discussions. Besides, it also comes amid market optimism over a potential resolution in the Ripple Vs SEC case end, which has long dampened the broader market sentiment.

XRP Price Fails To Breakout Despite Market Optimism

XRP price was down about 0.7% today at $2.43 after touching a 24-hour high and low of $2.50 and $2.41, respectively. Notably, the crypto has been consolidating in this range over the past few weeks despite soaring market optimism over Ripple’s legal win.

For context, CEO Brad Garlinghouse recently shared key insights on the firm’s future. Besides, he also said that the US SEC would drop the Ripple Vs SEC case. This has caught the eyes of the market participants, but it appears that the news has failed to boost the prices. However, with soaring optimism, the market pundits anticipate a potential breakout ahead for the crypto.

Expert Eyes XRP Rally To $15

In a recent analysis shared on X, renowned expert EGRAG CRYPTO has set a “conservative” price target for XRP at $15. This prediction is part of a tiered target system, which also includes a “normal measurement” of $22, an “extended target” of $44, and a “personal target” of $27.

The conservative target of $15 suggests that the expert believes, based on the technical trends, that the XRP price has significant growth potential. Even in a more cautious market scenario, it can record a massive rally ahead.

In addition to the price targets, EGRAG CRYPTO also emphasized the importance of taking profits strategically. The expert advised investors to start taking profits rather than waiting for a single peak, citing the wisdom of securing profits to avoid potential losses.

A Closer Look Into The Future Potential

In response to a user’s inquiry about XRP price in the next bear market, EGRAG CRYPTO reassured investors that the price is unlikely to drop below $1. This prediction suggests that Ripple’s native asset has a strong foundation and is poised for long-term growth, even in the face of market volatility.

Echoing a similar sentiment, another expert Dark Defender also hinted towards a short-term rally ahead for the crypto. In a recent X post, Dark Defender said that XRP must breach the $2.75 level to continue its upward run ahead.

He also noted that it faces “little hassle” at $2.55 and strong support at $2.42. However, once $2.75 is breached, the Dark Defender said that Ripple’s coin will target the $5.85 in the near term. It also resembles the latest Ripple coin price analysis, which indicates a potential rally to $5 citing the recent market trends.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Is Ethena Price At Risk? Trump’s World Liberty Financial Sells 184K ENA Sparking Concerns

Published

21 hours agoon

March 25, 2025By

admin

Despite Ethena price extending weekly gains to over 7% this Tuesday, Donald Trump’s World Liberty Financial has rattled the crypto market with its ENA selloff spree. On-chain statistics indicated that Trump’s World Liberty sold a whopping 184,000 tokens intraday, reverberating a bearish sentiment among crypto traders and investors globally.

In the wake of massive token unlocks and a dump by a market maker previously, the synthetic dollar protocol built on Ethereum already remains subject to volatility. Now, market watchers bearishly speculate over the asset’s future trajectory due to rising selling pressure.

Is Ethena Price Bracing For Heat Amid Trump’s World Liberty’s Selloff?

Usual market sentiments remain highly negative in light of heightened selling pressure on cryptocurrencies. The latest data from Arkham Intelligence indicated that World Liberty Financial sold 184,000 ENA for $69K over the past day. This selloff chronicle sparked concerns over Ethena price action’s long-term prospects, underlining a spike in selling pressure and WLFI’s loss of interest in the asset amid broader trends.

Notably, the Trump family-backed firm purchased 11 tokens earlier, including the one mentioned above, via its WLFI sale funds. Intriguingly, since most of these assets were soon shifted to Coinbase Prime, the market had an unclear view of selloff transactions.

However, a part of ENA holdings was transferred to the ‘0x76a’ custodial wallet address. This wallet address shifted 180,000 tokens to the address ‘0x77a.’ Subsequently, this address then sold the amount received for WBTC, per the data.

Overall, this transactional process gained significant traction, whilst market watchers speculate whether further token selloffs are also incoming. The synthetic dollar protocol on Ethereum remains bearishly eyed by investors, attributed to this saga.

Factors Fueling More Heat For Ethena Price

Simultaneously, a couple of other aspects propel an unsure investor sentiment about future price movements. CoinGape reported that the market maker Amber Group recently offloaded $10 million ENA to Binance. The rising exchange supply solidified bearish market sentiments over the asset’s future potential.

On the other hand, recent ENA token unlocks have also ushered in price volatility. While March saw over 2 billion coins unlocked and added to the crypto’s supply, April comes as another hurdle. Reportedly, over 200 million coins are set to unlock on April 2 and 5 collectively. In turn, traders and investors remain cautious over future Ethena price movements.

It’s noteworthy that World Liberty Financial’s massive selloff potentially aligns with the past and looming unlocks in an effort to mitigate losses.

What’s Next?

As of press time, ENA price witnessed a nearly 1% jump in value, reaching $0.3989. The crypto hit a low and a peak of $0.3883 and $0.4098 intraday. Despite the selloffs and massive token unlocks, the weekly chart showed a 7% upswing, underling a resilient movement. However, the monthly chart showed a 10% slump, adding to speculations.

Crypto market traders are currently uncertain about the asset’s performance ahead as broader trends indicate that volatility looms, whilst the price chart shows resilience. Besides, Ethena price prediction by CoinGape shows that bears remain dominant, as per the 3-month bias indicator. Nevertheless, renowned market trader Byzantine General took to X, projecting an optimistic outlook for the synthetic dollar protocol crypto.

The trader revealed that the crypto’s funding rate isn’t negative anymore, suggesting a bullish movement looms. Further, ENA got heavily shorted primarily due to its massive token unlocks, but the heat has now cooled down, per the analyst. Nevertheless, despite positive reaffirmation by renowned traders, it remains vital to gauge in broader aspects that underscore volatility is possible.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Crypto holds on to Gains, US may reverse Biden BTC sales, Tesla leads bounce

Cardano price could surge to $2 as whale purchases rise

Bitcoin Cash (BCH) Falls 1.9%, Leading Index Lower

Analyst Sets ‘Conservative’ XRP Price Target At $15, What’s Next?

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: