Donald Trump

Gary Gensler Is Out at the SEC, and Crypto-Friendly Mark Uyeda Is In

Published

2 months agoon

By

adminCommissioner Mark Uyeda will take over running the U.S. Securities and Exchange Commission as the agency awaits the Senate confirmation on President Donald Trump’s pick for the permanent role, Paul Atkins.

Acting Chair Uyeda, who has been a clear supporter of relaxing the regulator’s pursuit of the crypto industry alongside fellow Republican Commissioner Hester Peirce, once served Atkins as a counsel at the agency. Atkins, who was formally nominated hours after Trump was sworn in on Monday, is a former commissioner who has developed ties to crypto in his Washington consulting business.

Uyeda has expressed his own strong views about the SEC’s role regarding digital assets. He’s routinely criticized the commission’s majority on moves to rein in crypto, such as the so-called Staff Accounting Bulletin 121 (SAB 121) that made it difficult for banks to maintain digital assets clients. He’s said he favors getting rid of it — a move that’s now within his authority.

The change of chairs hasn’t yet been officially announced at the agency, though the remaining commissioners — including Hester Peirce and Caroline Crenshaw — issued a joint statement on former Chair Gary Gensler’s exit.

“Although as Commissioners we approached policy issues from different perspectives, there was always dignity in our differences,” the commissioners said. “Chair Gensler has been committed to bipartisan engagement and a respectful exchange of ideas, which has helped facilitate our service to the American public.”

Gensler had previously announced he would resign at noon on Jan. 20 — the same time Trump was sworn into office.

Gensler had become the chief government antagonist for the crypto industry in recent years. He pursued enforcement cases, pushed controversial crypto accounting policy, favored tough rule proposals that threatened the industry’s business model and blocked — for a time — the establishment of spot crypto exchange traded funds (ETFs). On the latter point, a court ruling against the agency forced Gensler’s hand, and he eventually voted with the commission’s Republicans to clear the path for ETFs.

His agency argued in court that existing law was sufficient to categorize and regulate crypto assets. That stance was favored by some federal judges and opposed by others, and the central questions are still working its way through the courts.

Uyeda’s SEC, for however long his tenure lasts, is absent virtually all senior legal officials that worked under Gensler, including in the enforcement division and the general counsel’s office.

The acting chairman has the full authority of the office, but people in that position sometimes choose to defer to the incoming chair and wait on big decisions.

At the SEC’s sister agency, the Commodity Futures Trading Commission, Republican Commissioner Caroline Pham has been lifted to the acting chair role there, though Trump hasn’t yet named a permanent successor to the outgoing Democrat chair, Rostin Behnam.

Unlike the CFTC, which currently has a 2-2 split between the parties, the SEC’s Republicans outnumber the lone Democrat 2-1.

Source link

You may like

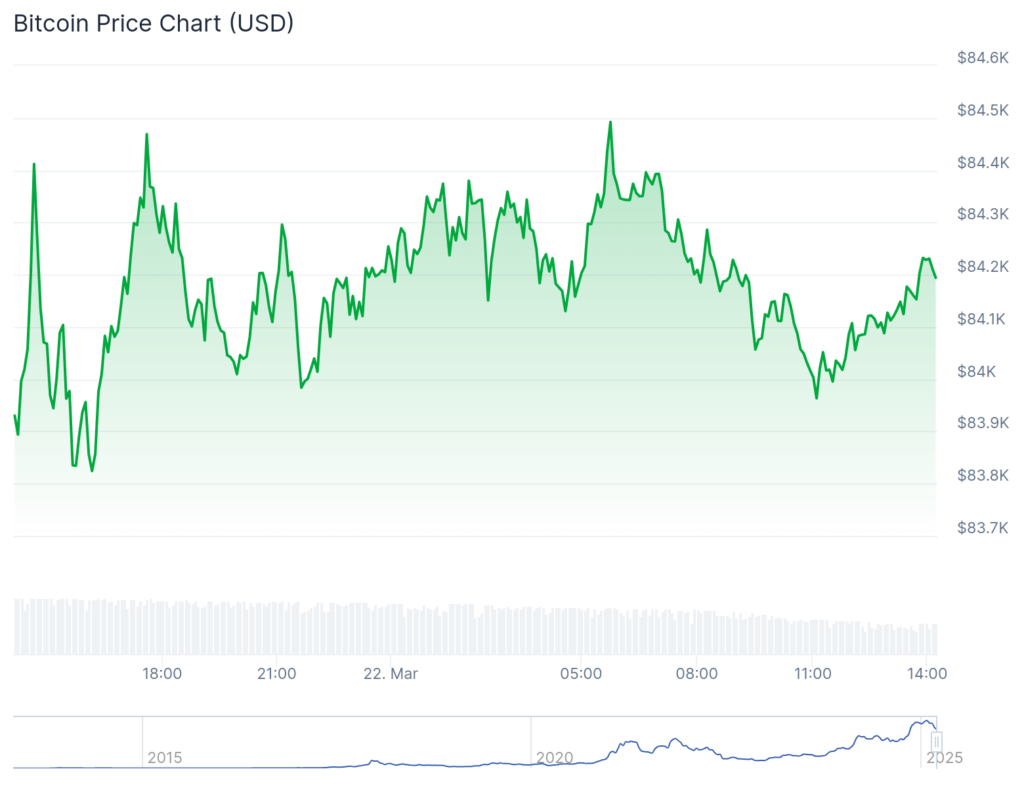

Altcoins have been attracting investor attention this weekend, with Bitcoin and Ethereum prices stagnating around $85,000 and $2,000, respectively, since Friday. Prominent crypto analysts have published data insights showing investors are increasingly rotating capital toward altcoins after recent U.S. macroeconomic updates.

Analysts Predict Altcoin Season as Fed Rate Pause Triggers Risk-On Appetite

The altcoin market had a rough start to March 2025 when U.S. President Donald Trump announced new tariffs on Canada and Mexico. However, the macroeconomic landscape has since improved. The Trump administration made adjustments to the tariffs, while U.S. CPI and PPI data indicated that inflation risks from the tariffs were overestimated.

This shift in sentiment was further reinforced after the latest Federal Open Market Committee (FOMC) meeting on Wednesday, where the U.S. Federal Reserve announced a pause in interest rate hikes.

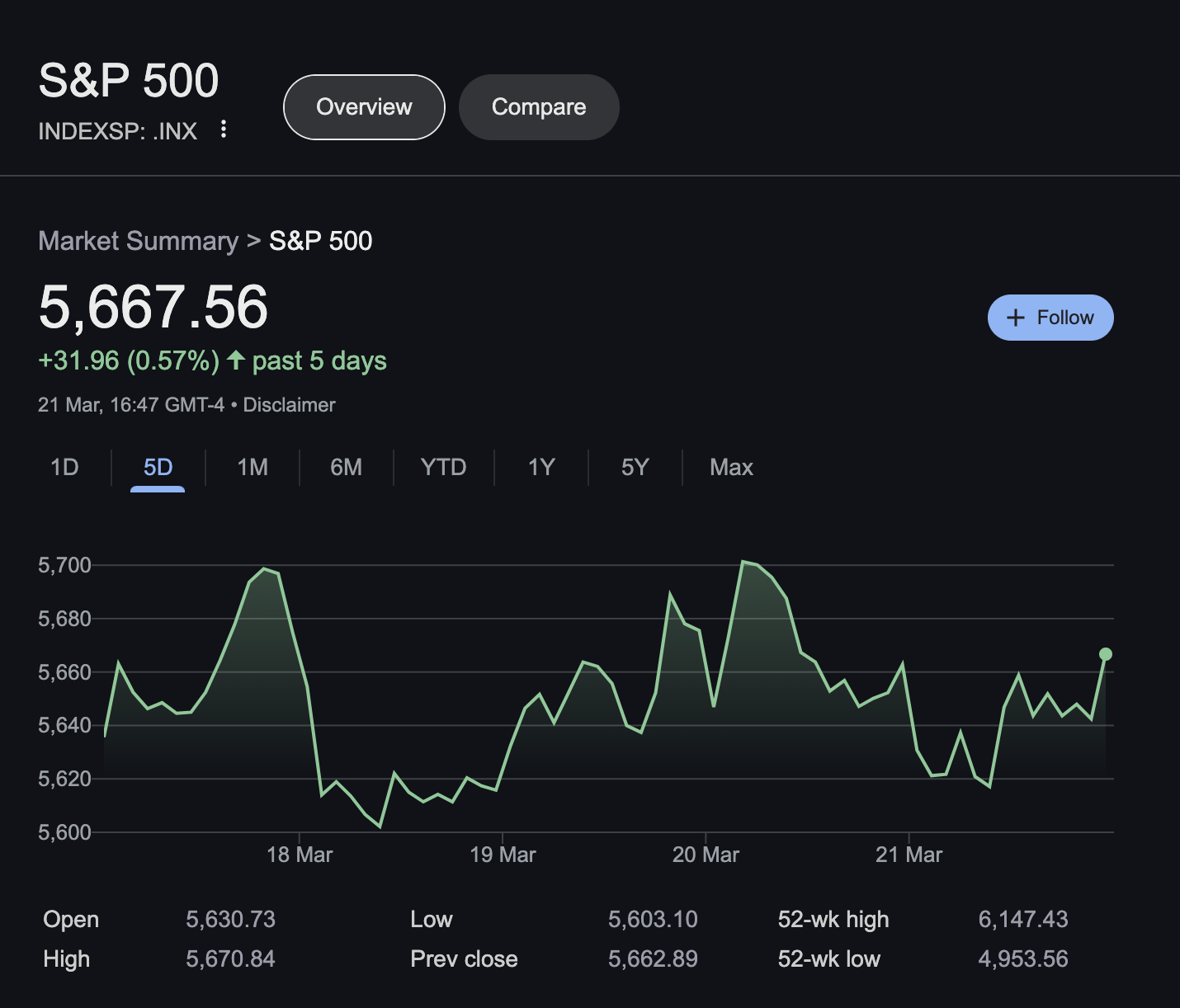

Traditional finance (TradFi) investors reacted by moving capital out of safe-haven assets like gold and into stocks, pushing the S&P 500 up by 31.7 points last week.

Crypto markets appear to be following suit, with traders increasingly rotating funds from Bitcoin and Ethereum into altcoins.

Crypto Analysts Signal Imminent Altcoin Breakout

Adding to the growing optimism around altcoins, two major crypto analysts took to social media to highlight technical indicators pointing to an incoming “Alt Season”—a market phase where altcoins significantly outperform Bitcoin.

“2025 #ALTSEASON starts in less than 3 days now,” alongside a chart illustrating past cycles of altcoin dominance relative to Bitcoin.

Crypto analyst Sensei (@SenseiBR_btc) made a bold declaration, March 21, 2025 ,

The accompanying chart showed clear historical patterns where altcoins surged against Bitcoin, with a third major rally seemingly about to begin.

In response, OBI Real Estate (@Obirealestate) weighed in on the discussion, adding, “Markets are buzzing, timing will be everything.”

Key Takeaways: Why This Weekend Matters for Altcoins

Capital Rotation: With Bitcoin and Ethereum trading sideways, traders are diverting funds toward altcoins, anticipating stronger returns.

Macro Trends: Improved inflation outlook and the Fed’s rate pause have boosted risk-on sentiment across global markets.

Technical Indicators: Historical charts from top analysts suggest that the long-awaited Alt Season could be days away from starting.

As traders look ahead, this weekend may present a critical window of opportunity to accumulate promising altcoins before a broader market breakout.

3 Top Trending Altcoins to Watch in the Week Ahead

Bitcoin (BTC) has surged past the $85,000 mark, signaling strong market sentiment despite a slight 0.9% decline in global crypto market cap over the past 24 hours. While BTC’s resilience suggests growing confidence, a look at broader market trends reveals that large-cap altcoins remain stagnant, while smaller-cap assets are seeing significant moves.

Ethereum (ETH) remains subdued at $2,000, showing only a 0.5% gain in 24 hours. Similarly, Cardano (ADA) and Binance Coin (BNB) also moved sideways, conslidating at the $0.70, $620 respectively, while Solana (SOL), trading at $132 leads the top 10 assets with a 2.4% gain.

However a closer look at the Coinmarketcap above shows low-cap altcoins, are attracting significant search traffic, a move that could attract further capital inflows in the coming trading seesions.

1. Trump Memecoin (Official Trump) – Political optimism fuels rally

The Trump-themed memecoin is trading at $11.81, up 5.9% in the last 24 hours, making it one of the most notable gainers. This rally alligns with improved sentiment surrounding recent U.S. policy discussions and Trump’s appearance at the Blockwork’s Digital Assets Summit, last week.

With increasing political relevance and heightened social media buzz, this token is one to watch closely. A break above key resistance levels in the coming days could drive further gains.

2. Pi Network (PI) – Struggling to Break $1, But Buzz is Growing

Last week, PI endured major sell-offs as the network migration trigger mixed reactions among investors. However, Pi Network is now flashing recovery signals. At press time on Sunday, March 23, PI network price is facing strong resistance at the $1 mark, struggling to establish a breakout. However, with the token has become one of the most discussed assets in the last 24 hours, investor interest is evident.

If buying pressure continues and $1 resistance caves, a significant breakout could follow, making this an asset to monitor for a potential price explosion.

3. Wormhole (W) – Cross-Chain Demand Fuels Buying Activity

Ethereum’s native cross-chain bridge token, Wormhole (W) price, has surged 23.9%, driven by increased demand as investors rotate funds across chains.

The boost in market optimism, combined with the Fed’s recent decision to pause interest rate hikes, has further supported capital flows into decentralized finance (DeFi).

With more activity on cross-chain protocols, Wormhole’s demand could continue to rise, making it a strong candidate for further upside in the days ahead.

In Summary:

While Bitcoin’s dominance remains strong above $85,000, altcoins, particularly low-cap assets, are gaining momentum. The surge in Trump memecoin, Pi Network’s rising popularity, and Wormhole’s DeFi-driven gains all signal that the altcoin market could be gearing up for major moves. Traders should watch for key breakout levels as these assets continue to gain traction

Frequently Asked Questions (FAQs)

Altcoin Season refers to a market phase where altcoins outperform Bitcoin, often driven by capital rotation and favorable macroeconomic conditions.

Analysts predict an Altcoin Season due to Bitcoin’s stagnation, improving inflation data, and the Federal Reserve’s decision to pause rate hikes.

Trump memecoin, Pi Network, and Wormhole are gaining traction due to political sentiment, technical setups, and cross-chain DeFi demand.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin race intensifies as leaders address reserve urgency

Published

1 day agoon

March 23, 2025By

admin

On March 20, investor and entrepreneur Anthony Pompliano stated on Fox News, “There’s a global race going on–Russia, Abu Dhabi, El Salvador, Bhutan–all these other countries are trying to buy Bitcoin… the same way that there was a space race there’s now a Bitcoin race.”

The idea of a Bitcoin “race” is now a reality as world leaders actively discuss the urgency of either establishing digital asset reserves or embracing cryptocurrency as legal tender.

El Salvador, in 2021, became the first country to make Bitcoin legal tender, purchasing over 2,000 Bitcoin as part of a national reserve to foster financial inclusion and economic growth. The move has been both celebrated and criticized due to Bitcoin’s volatility. Similarly, in 2022, the Central African Republic became the second country to adopt Bitcoin, viewing the cryptocurrency as a tool to improve economic development and financial inclusion in one of the world’s least developed nations.

Both countries’ actions reflect growing interest in Bitcoin as an alternative financial strategy. It’s hard-capped at 21 million, and in 10 years, most of it will be mined.

The theory is that the countries considering Bitcoin a valuable reserve asset will strive to establish as much ownership of the total BTC supply as possible.

Proponents believe scarcity and growing demand will drive Bitcoin’s value, making large BTC holders influential.

What Saylor says…

One of the most prominent Bitcoin evangelists, Michael Saylor, said that 78% of the U.S. was bought for $40 million at some point. The former CEO of MicroStrategy referred to various land acquisitions, such as the Louisiana Purchase of 1803 to illustrate why the U.S. government should buy Bitcoin now when it’s “cheap.”

In a recent speech, Saylor called the next decade “a digital gold rush” and compared Bitcoin to the Manhattan Project, dubbing it “digital energy.”

“Today, Bitcoin represents the digital capital network, controlling 99% of power within the cryptocurrency ecosystem,” he said. “The U.S. government recognizes only Bitcoin as legitimate digital capital. To secure the future of cyberspace and maintain global financial dominance, America must adopt Bitcoin strategically. Only Bitcoin—and U.S. Treasuries—have the liquidity and global trust required to serve as reliable reserve assets worldwide.”

No wonder Saylor has been vocally supportive of government officials pushing to increase the U.S.’s BTC stockpile.

President Donald Trump, Republican Sen. Cynthia Lummis, and Bo Hines, the Executive Director of the President’s Council of Advisors on Digital Assets, have all expressed a desire to increase the U.S.’s Bitcoin reserve.

Like Saylor, Pompliano (among the most vocal crypto advocates in the U.S.) considers the Trump administration’s focus on Bitcoin dominance important.

Speaking about the future price of Bitcoin, Pompliano said during a Fox News appearance that he doesn’t know when BTC will hit one million. However, he is seemingly confident that, like gold, its value will increase from where it currently is today.

At last check, Bitcoin is trading at just above $84,000.

“I think people are drastically underestimating how maniacal they are going to be about buying Bitcoin,” Pompliano said. “Everyone thinks it’s cute that they put 200,000 Bitcoin over here and now we have this reserve — they are going to continue to buy Bitcoin.”

Who participates in the Bitcoin race?

Apart from the U.S., Pompliano named Russia, El Salvador, Bhutan, and the United Arab Emirates. Indeed, all of these countries reportedly have Bitcoin holdings, but not necessarily all of them explicitly expressed their desire to buy more.

It is not quite clear how much crypto Russia holds. However, it is known that Russia has large-scale mining operations while local companies use crypto for international trade and dodging Western sanctions.

Pompliano neglected to mention several leading Bitcoin holders, including China, which is the second biggest BTC owner after the U.S.

The United Kingdom and Ukraine currently follow China, according to BitBo’s Bitcoin Treasuries page.

All these countries have different strategies:

- North Korea’s hackers steal hundreds of millions of dollars worth of crypto from crypto exchanges.

- The UK holds crypto, seized while dismantling a high-scale money-laundering operation.

- Ukraine became a notable Bitcoin holder through donations made after the intensification of the Russian-Ukrainian conflict in 2022.

- The U.S. intends to confiscate Bitcoin and crypto assets from criminal cases. It’s worth noting that many individual states are exploring the creation of local-level reserves.

More than that, some corporations, most notably Strategy (previously MicroStrategy) and asset manager BlackRock, are among the world’s biggest Bitcoin holders, capable of competing with leading nations in terms of Bitcoin dominance. Both firms own or manage around 500,000 Bitcoins (over 2% of the total supply). As of March 2025, no country holds even half that amount.

Many countries are opting out

European countries have been cautious and innovative in their interactions with blockchain solutions. For instance, Estonia is one of the world’s pioneers in adopting blockchain for elections and healthcare data management. However, the EU countries take a conservative stance when it comes to crypto reserves. High volatility and low liquidity are the main reasons for rejecting Bitcoin’s reserve establishment.

Similar reasons are cited by Switzerland, South Korea, Japan, and other countries that seem unbothered by America’s passion for winning in the Bitcoin musical chairs game. Germany went so far to sell thousands of Bitcoin.

Germany sold all their #Bitcoin at $54,000.

If they had waited, they could have made an extra $990 million.

Losers

pic.twitter.com/2G8iRFhzn9

— Crypto Rover (@rovercrc) November 6, 2024

Crypto.news asked Genius Group, a company using Bitcoin as a corporate reserve, how they time the market.

“As fundamental believers in the long-term potential of Bitcoin, we don’t try to time the market, but rather buy and hold with the intention of never selling,” a spokesperson responded.

Let’s assume the so-called Bitcoin race exists, as Pompliano described it. If we compare it to space or the Manhattan Project, we must ask ourselves: Were the countries that didn’t have spacecraft or atomic weapons in the 20th century left with nothing?

Source link

Donald Trump

Eric Trump Joins Metaplanet’s Board Of Advisers

Published

2 days agoon

March 22, 2025By

admin

Metaplanet, Japan’s largest corporate bitcoin holder, has appointed Eric Trump to its newly formed strategic board of advisers. The move aims to advance Metaplanet’s bitcoin adoption mission as bitcoin gains mainstream traction.

Metaplanet announced the move on Friday, stating that Trump’s expertise and passion for bitcoin will help drive the company’s goals. As the son of U.S. President Donald Trump, Eric Trump has emerged as an influential voice supporting the growth bitcoin and the crypto industry.

JUST IN:

Japanese public company Metaplanet appoints Eric Trump as a strategic advisor to help drive Bitcoin adoption. pic.twitter.com/9UnAFzF5Ty

— Bitcoin Magazine (@BitcoinMagazine) March 21, 2025

The advisory board will also include other high-profile figures yet to be named, according to Metaplanet. The focus will be bringing together leaders in business, politics and technology to further bitcoin’s acceptance globally.

Metaplanet Representative Director Simon Gerovich welcomed Trump’s appointment, emphasizing his business acumen and enthusiasm for the bitcoin community. Gerovich said, “His business expertise and passion for BTC will help drive our mission forward as we continue building one of the world’s leading Bitcoin Treasury Companies.”

The Tokyo-based company has aggressively accumulated bitcoin reserves, now holding over 3,200 BTC worth approximately $267 million. Earlier in March, Metaplanet purchased 150 additional bitcoins at a value of $12.5 million.

Established in 1999, Metaplanet has shifted its focus to bitcoin investment and advocacy. The company trades on the Tokyo Stock Exchange and was previously known as Red Planet Japan.

Eric Trump has increasingly backed bitcoin and cryptos. He is involved with World Liberty Financial, a Trump family’s crypto venture. His father, Donald Trump, recently signed an executive order to launch a strategic bitcoin reserve.

With bitcoin going mainstream, Metaplanet is betting on crypto-friendly advisers like Trump to drive institutional adoption. Major corporations adding bitcoin to reserves could accelerate acceptance and solidify bitcoin as a sound corporate asset.

Source link

XRP Price Reclaims Ground—Is a Bigger Push Just Getting Started?

First meta-DEX aggregator Titan launches on Solana

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: