News

THORChain ‘eerily similar’ to Terra Luna implosion: Osmosis co-founder

Published

2 months agoon

By

admin

Sunny Aggarwal, Co-Founder of Osmosis, believes THORChain’s liquidity issues mirror the 2022 Terra Luna collapse.

THORChain, a decentralized cross-chain liquidity protocol, has paused its network operations due to a significant debt crisis amounting to nearly $200 million.

This move has drawn parallels to the 2022 collapse of Terra/Luna, with Sunny Aggarwal, Co-Founder of Osmosis, a decentralized exchange in the Cosmos (ATOM) ecosystem, commented on the situation to crypto.news.

“The situation unfolding with THORChain is eerily similar to what happened with Terra/Luna implosion in 2022, where the protocol’s solvency was too heavily dependent on the price performance of the native token,” Aggarwal said.

THORChain’s design inherently positions it as reflexively long on its native token, RUNE. This means the protocol’s solvency is contingent upon RUNE’s price outperforming assets like Bitcoin (BTC) and Ethereum (ETH), which are used as collateral.

Recent market trends have not favored RUNE (RUNE), leading to financial instability.

The protocol currently faces $97 million in borrowing liabilities and $102 million in depositor and synthetic asset liabilities, pushing it to the brink of bankruptcy.

In response, THORChain has suspended its lending and savings programs, particularly affecting BTC and ETH withdrawals. This decision is part of a 90-day restructuring plan aimed at stabilizing the system and mitigating further risks.

.@THORChain is insolvent

In the event of any large debt redemption and/or savers & synths deleveraging, it is certain that TC cannot meet its bitcoin and eth denominated obligations.

Validators decided to pause the network while they vote a restructuring plan

— TCB (@1984_is_today) January 24, 2025

Terra Luna collapse

The situation mirrors the Terra/Luna collapse, where the protocol’s dependence on its native token’s value led to catastrophic failure. In May 2022, Terra, the third-largest cryptocurrency ecosystem at the time, collapsed within three days, wiping out $50 billion in valuation.

Aggarwal further stated that “it’s uncertain whether lenders can be fully compensated. Some have suggested that the shortfall could be covered by protocol fees collected over time. But this overlooks an important point: the bulk of THORChain’s liquidity comes from its lending and savers platform, ThorFi. So it doesn’t make sense to consider THORChain and ThorFi as separate entities.”

As THORChain navigates this crisis, it is clear there are inherent risks associated with protocols heavily reliant on the value of their native tokens, similar to Terra.

Effective risk management and sustainable design are crucial to prevent such scenarios and protect users’ funds.

“Essentially, Thorchain needs to maintain significant liquidity over the long term. But this will be challenging because ThorFi’s lenders and savers will logically be trying to withdraw their funds en masse,” Aggarwal said.

Source link

You may like

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Bitcoin

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

Published

59 minutes agoon

March 26, 2025By

admin

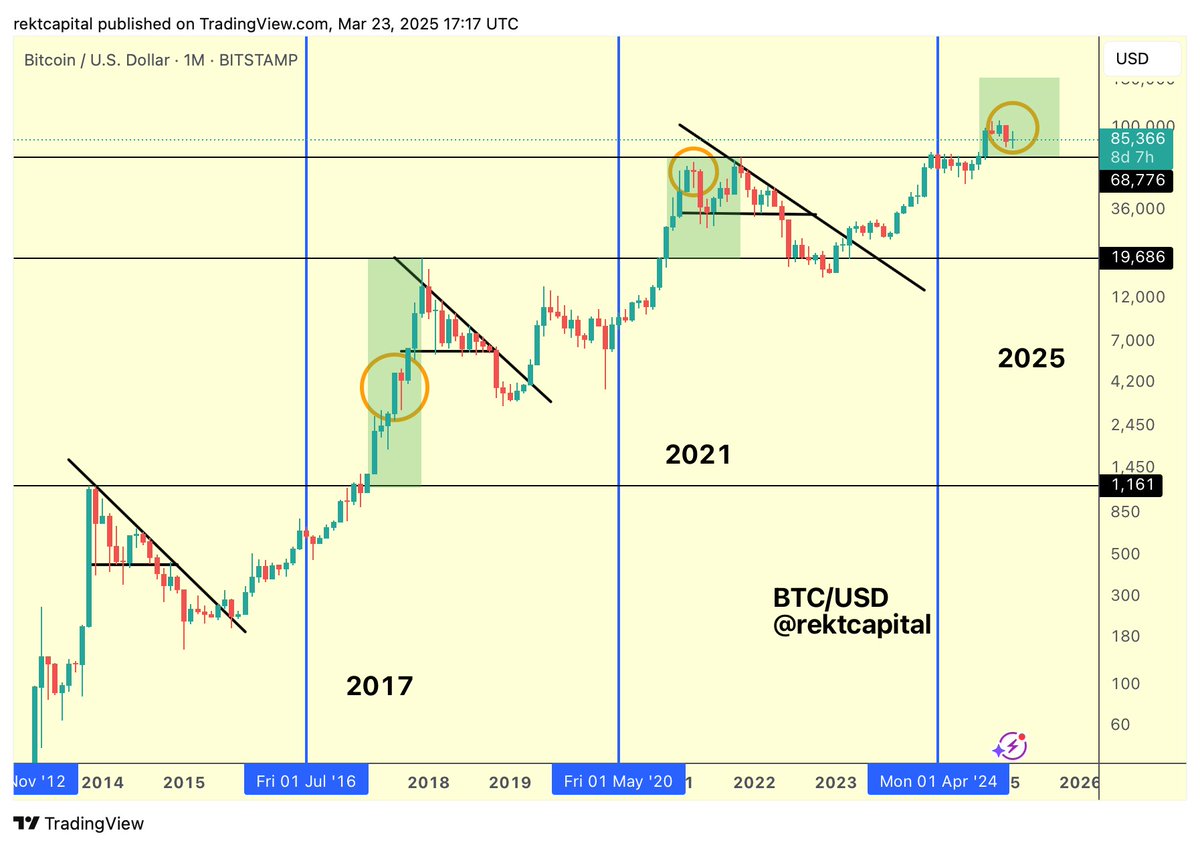

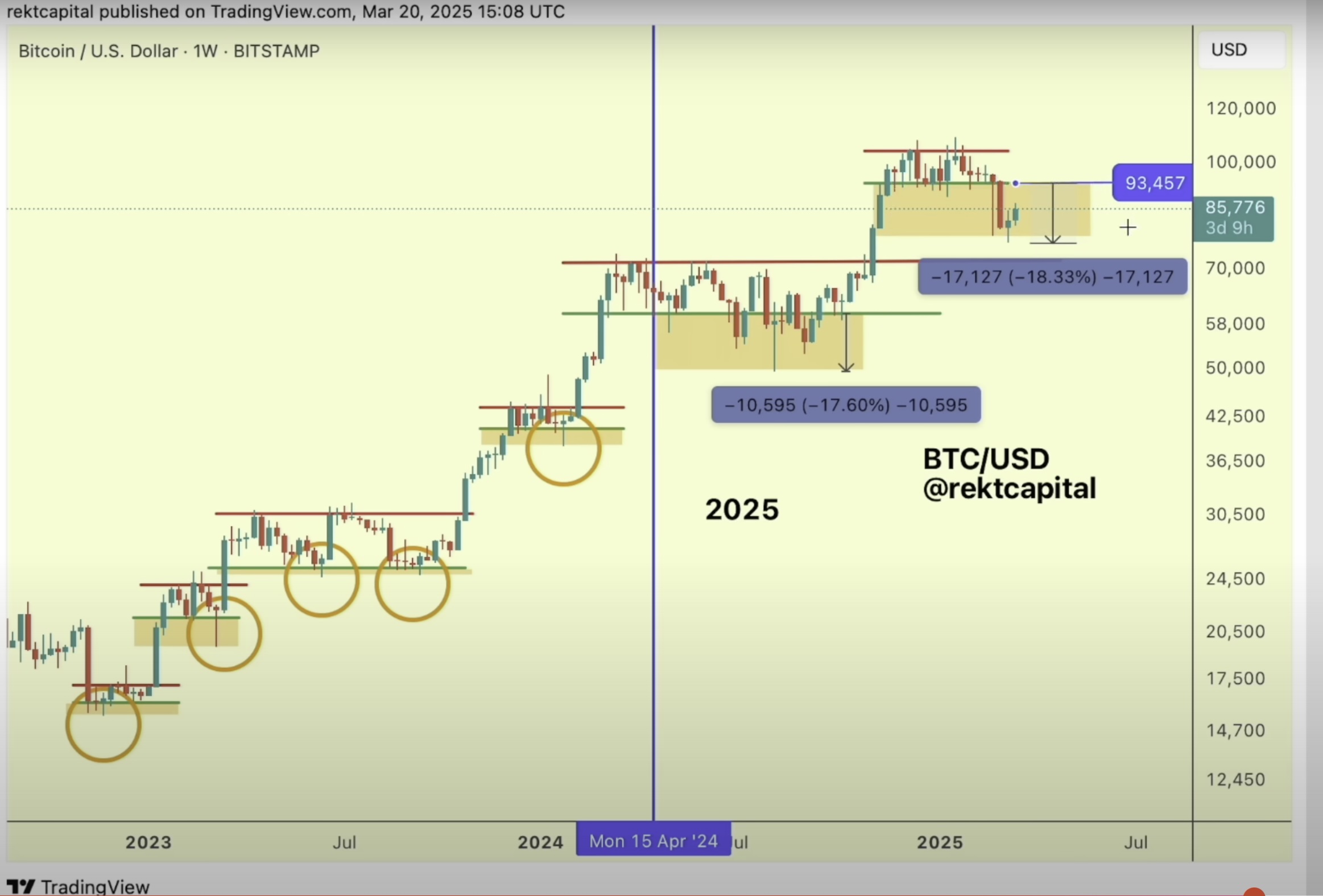

An analyst who accurately called Bitcoin’s correction in early 2024 believes BTC remains in a bull market after bouncing from a 2025 low of $76,000.

Pseudonymous analyst Rekt Capital tells his 542,00 followers on the social media platform X that Bitcoin’s current bull market cycle has yet to reach a peak.

“BTC bull market progress: 82.5%. (Progress will speed up on parabolic advances and slow down on deeper retraces).”

The analyst also tells his 107,000 YouTube subscribers that Bitcoin’s latest correction to $76,000 is not the sign of a beginning bear market based on historical precedence.

“Many people have been talking about this being a bear market, but it does look like it is a downside deviation period very similar to what we’ve seen back in the past. Obviously, these downside deviation periods are changing across time, but it’s really important to look at the charts in a level-headed manner and try and look at it in an unbiased way and not scream bear market whenever we see a pullback that is actually very similar to the one we saw here [in 2024].

This was a 32% pullback [in 2024]. This is a 30% pullback [when Bitcoin corrected to the $76,000 range this month], so very similar downside deviation in that regard, but really important to keep level-headed and look at the data, look at the chart, and zoom out when in doubt.”

In technical analysis, a downside deviation is a setup where an asset breaks its immediate support to print a false breakdown before igniting a recovery and rallying to new highs.

Bitcoin is trading for $88,028 at time of writing, up 3.4% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

GameStop Approves Adding Bitcoin To Treasury Reserves

Published

1 hour agoon

March 26, 2025By

admin

GameStop Corp. (NYSE: GME) announced that its board of directors has unanimously approved an update to the company’s investment policy, allowing Bitcoin to be held as a treasury reserve asset. The decision follows a series of engagements between GameStop Chairman and CEO Ryan Cohen and prominent figures like Michael Saylor in the Bitcoin industry.

On February 8, Cohen met with Strategy Chairman and well-known Bitcoin advocate Michael Saylor, sparking speculation that GameStop may be adding BTC to its balance sheet. A couple weeks after, Cohen responded to CoinDesk via a tweet stating “Letter received.” after receiving a letter from Strive Asset Management CEO Matt Cole, which urged GameStop to adopt Bitcoin as a reserve asset.

In its announcement, GameStop noted that its investment policy now permits investments in “certain cryptocurrency assets, including Bitcoin and U.S. dollar-denominated stablecoins.” The company also acknowledged associated risks, including the potential impact of these investments on its financial results and internal financial controls.

The policy update was disclosed alongside the company’s financial results for the fourth quarter and full fiscal year ended February 1, 2025.

For the fourth quarter, GameStop reported net sales of $1.283 billion, a decrease from $1.794 billion in the same period the prior year. Selling, general and administrative (SG&A) expenses fell to $282.5 million, compared to $359.2 million in the fourth quarter of the previous year. Net income for the quarter was $131.3 million, up from $63.1 million a year earlier. Adjusted EBITDA for the quarter was $96.5 million, compared to $88.0 million in the prior year’s fourth quarter.

GameStop also disclosed that it held $4.775 billion in cash, cash equivalents, and marketable securities at the end of the quarter. The company completed its exit from Italy and finalized the wind-down of store operations in Germany during this period.

For the full fiscal year 2024, GameStop reported net sales of $3.823 billion, down from $5.273 billion in fiscal year 2023. SG&A expenses for the year were $1.130 billion, compared to $1.324 billion in the prior year. Net income for the year reached $131.3 million, significantly higher than the $6.7 million reported in fiscal year 2023. Adjusted EBITDA for the full year was $36.1 million, compared to $64.7 million in the previous year.

The company has not yet disclosed how much Bitcoin it plans to purchase or when it will begin acquiring BTC, and CEO Ryan Cohen has not yet commented publicly on the addition of Bitcoin to GameStop’s balance sheet at the time of publishing.

Source link

Altcoins

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

Published

9 hours agoon

March 25, 2025By

admin

Solana (SOL) is green on the day on reports that BlackRock is moving its blockchain-based money market fund onto the Ethereum (ETH) competitor’s network.

Fortune reports that the world’s largest asset manager is adding its $1.7 billion BlackRock USD Institutional Digital Liquidity Fund (BUIDL) to the Solana blockchain.

Solana is trading for $145 at time of writing, up nearly 19% in the last week.

Launched a year ago, BUIDL uses traditional money market funds, which investors use to store cash in the near term and earn yield on it, combined with blockchain payment properties.

Solana is now the seventh blockchain compatible with the tokenized money market fund BUIDL, after its initial launch on Ethereum.

BlackRock’s technology partner, Securitize, says the fund is expected to exceed $2 billion in cash and Treasury bills by early April.

Says Michael Sonnenshein, COO at Securitize,

“We’re making [money market funds] unboring. We are advancing and leapfrogging some of the quote-unquote deficiencies that money markets may have in their traditional formats.”

One benefit BUIDL offers over traditional money market funds is 24/7 trading.

Says Lily Liu, president of the Solana Foundation,

“Our vision for why on-chain finance adds more value is because you can do more things with those assets on chain than you could if [they’re] sitting in your brokerage account.”

BUIDL is part of BlackRock’s long-term digital asset strategy, which includes its spot-Bitcoin (BTC) exchange-traded fund (ETF).

According to BlackRock CEO Larry Fink, the future of finance includes the “tokenization of every financial asset.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

GameStop Approves Adding Bitcoin To Treasury Reserves

Cboe Exchange Submits Filing to List Fidelity Solana ETF

How Strategy is Redefining Corporate Leverage?

Tokenized Treasuries Hit $5B Milestone as Fidelity Investments Touts RWA Potential as Collateral

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Dogecoin Price Mirroring This 2017 Pattern Suggests That A Rise To $4 Could Happen

SEC closes investigation into Immutable nearly 5 months after Wells notice

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

BlackRock Launches Bitcoin ETP In Europe

Crypto holds on to Gains, US may reverse Biden BTC sales, Tesla leads bounce

Cardano price could surge to $2 as whale purchases rise

Bitcoin Cash (BCH) Falls 1.9%, Leading Index Lower

Analyst Sets ‘Conservative’ XRP Price Target At $15, What’s Next?

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x