Markets

XRP Surges 12% to Lead Crypto Rebound Ahead of U.S. FOMC

Published

4 weeks agoon

By

admin

Bitcoin (BTC) rose to nearly $103,000 to usher gains across the crypto market on Tuesday after breakthroughs from China’s DeepSeek led to a steep fall in U.S. indexes on Monday, prompted by concerns of overvaluations of its AI investments.

XRP led gains among crypto majors with a 12% surge, while Cardano’s ADA, BNB Chain’s BNB, Solana’s SOL and dogecoin (DOGE) zooming as much as 9%. Ether (ETH) gained 4.5%, while overall market capitalization rose 3%.

BTC rose nearly 4% in the past 24 hours, easing losses from Monday which saw over $1 billion in futures liquidations and an 8.5% decline in the broad-based CoinDesk 20 (CD20) at peak.

Large liquidation events often present a market buying opportunity, as CoinDesk noted on Monday, as they can signal an overstretched market that indicates a price correction has occurred, among other factors.

As such, TRUMP tokens were up 12% to lead gains among midcaps, or tokens below a $5 billion market cap.

Part of the gains in majors came as Tuttle Capital filed the first-ever 2x leveraged ETFs in the U.S. on Monday, proposing products that would return 200% of the daily price performance of nearly all major tokens, plus BONK, TRUMP and MELANIA.

Monday’s nosedive was largely attributed to breakthroughs from China’s DeepSeek, whose model was shown to outperform AI giant OpenAI’s, all while being built on a budget of $6 million and a fraction of the Graphics Processing Units (GPUs) that OpenAI uses (it recently closed a $6.6 billion round with a valuation of over $157 billion).

However, some traders state that DeepSeek’s breakthrough is among a bunch of factors that may impact bitcoin and crypto markets in the near term.

“Initial fears about DeepSeek presented a buying opportunity for crypto as the industry isn’t in direct confrontation with the Chinese AI firm,’ Nick Ruck, director at LVRG Research, told CoinDesk in a Telegram message. “Instead, founders of crypto projects that use AI can integrate DeepSeek’s open-sourced model into their projects for more efficiency and enhanced innovations.”

“However, there are still choppy waters ahead as this week is heavy with macro data releases from US agencies, including the FOMC, and earnings reports from major companies such as Apple, Meta, and ASML. We remain optimistic for Bitcoin in the long term, as policies are shaping up to be very beneficial for the crypto industry’s growth in the U.S. and abroad,” Ruck added.

Traders expect no indications of a rate cut at the two-day FOMC meeting scheduled for Jan. 28 to Jan. 29, which has typically impacted bitcoin prices as investors either prefer or move away from risk assets.

Meanwhile, Singapore-based QCP Capital provided astrological cues as part of a larger Tuesday market update.

“As we approach the Year of the Snake, the market’s twists and turns remind us of the wisdom, adaptability, and resilience this zodiac symbolizes – qualities that will be essential as we navigate 2025’s challenges and opportunities,” the firm said in a broadcast.

There may be truth to that gospel, as CoinDesk reported Monday. Bitcoin emerged highly profitable for bulls in 2024, the Chinese Year of the Dragon, while Hong Kong-based firms cautions “unpredictable twists” that eventually brings new highs — based on where “Rough Green” and “Brown Tree” snakes are in the lunar charts.

Source link

You may like

Voltage Aims To Bring Bitcoin’s Lightning Network To Every Business In The World

Ethereum DeFi Exchange Uniswap Says SEC Has Dropped Its Investigation

Strive CEO urges GameStop to adopt Bitcoin as treasury asset

Bitdeer Reports $532M Q4 Loss, Focuses on ASIC Development for 2025 Growth

Nasdaq Submits Filing To List Grayscale Polkadot ETF, DOT Price To $34?

Top Crypto to Buy as Market Shifts from Memecoins to Utility Tokens

ASIC

Bitdeer Reports $532M Q4 Loss, Focuses on ASIC Development for 2025 Growth

Published

4 hours agoon

February 25, 2025By

admin

Bitdeer Technologies Group (BTDR) said its fourth-quarter net loss widened to $531.9 million from $5 million in the year-earlier quarter.

The Singapore-based bitcoin (BTC) mining company attributed the expenses to strategic investments in developing its proprietary ASIC mining rigs.

“While our focus on ASIC development temporarily limited hashrate expansion, we made significant progress in strengthening our technology roadmap,” said Matt Kong, the firm’s chief business officer. “Owning our own ASICs allows us to rapidly deploy hashrate, lower cost and improve capital efficiency.”

Revenue fell to $69 million, down 40% from the year-earlier period, with declines across self-mining, hosting and cloud hash rate services.

The company is doubling down on growth, aiming to increase its self-mining capacity to 40 exahash per second (EH/s) by the end of 2025, which would place the company among the largest bitcoin mining operations in the world.

It also plans to scale its power infrastructure, with over 1 gigawatt (GW) of capacity set to go online next year — more than doubling the current 900 megawatts (MW).

Bitdeer said it sees potential in the ASIC market, noting strong demand for alternative suppliers. The firm is also positioning itself to supply energy for AI data centers, aiming to capitalize on rising demand for computing power.

The shares fell 28% on the day amid a broader decline in traditional and crypto markets. The stock is now trading for $9.49, more than 64% lower than its end-December all-time high.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

Bitcoin

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

Published

12 hours agoon

February 25, 2025By

admin

U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) experienced the second-biggest outflows of the year on Monday, dropping $516.4 million, Farside data shows.

The withdrawals, the ninth net outflow in 10 days, reflect a growing discomfort with the largest cryptocurrency, which has traded in a narrow price range between $94,000 and $100,000 for most of this month.

On Tuesday, bitcoin broke out of its three-month channel, falling below $90,000 and sliding to as low as $88,250.

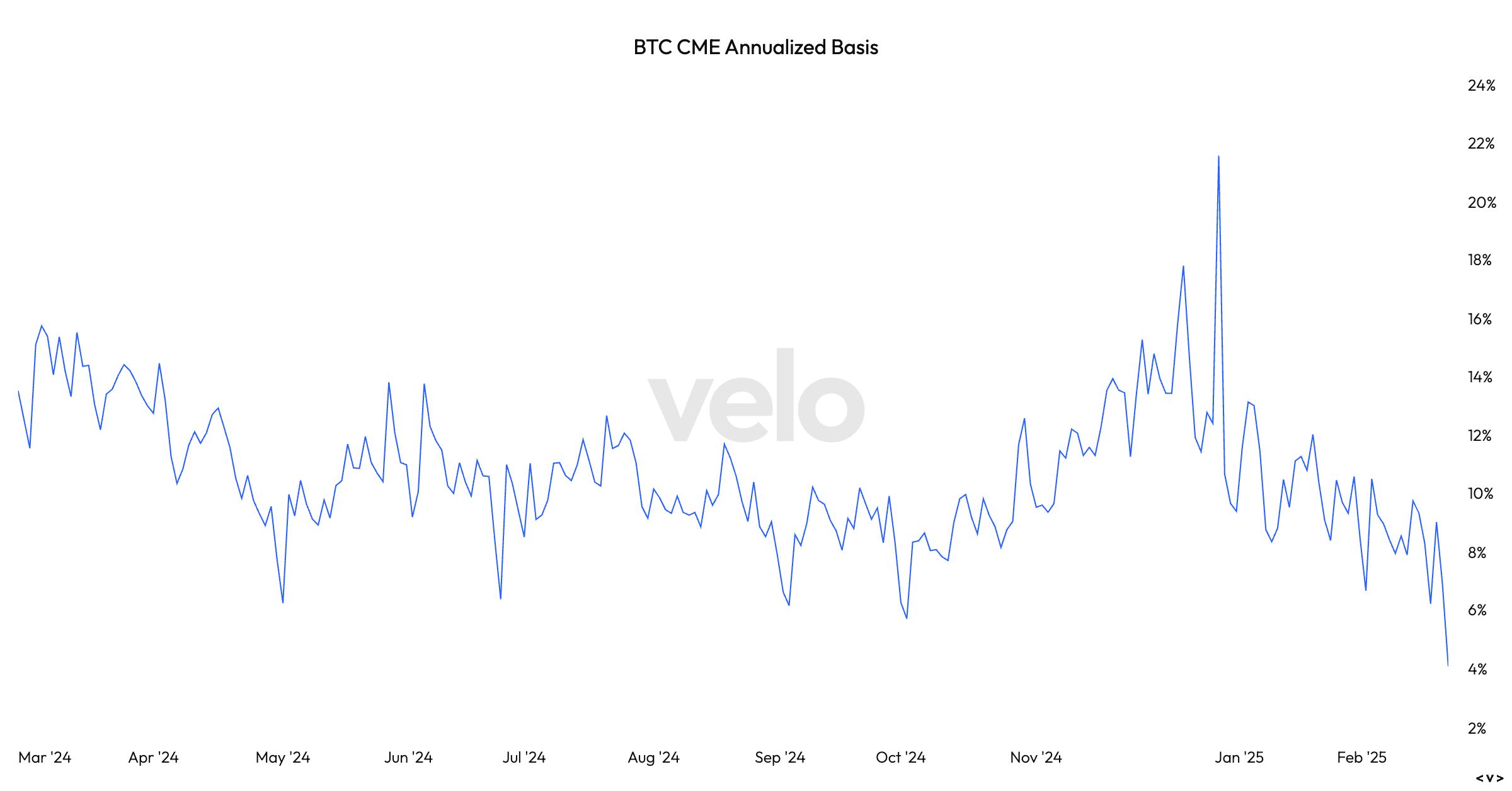

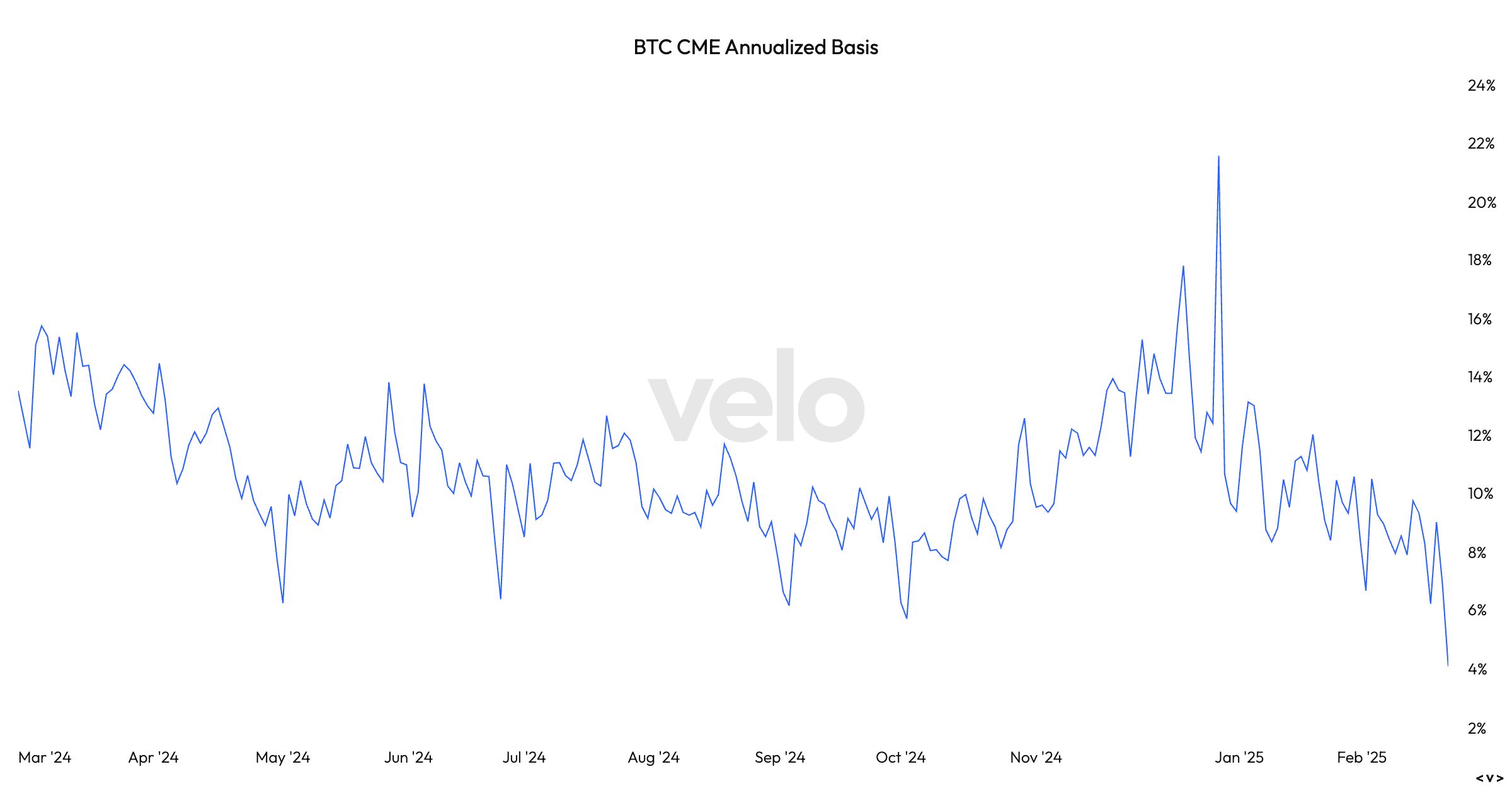

According to Velo data, the bitcoin CME annualized basis — the difference between the spot price and futures — has dropped to 4%. This is the lowest since the ETFs started trading in January 2024. This is also known as the cash-and-carry trade, which is a market-neutral strategy that seeks to profit from the mispricing between the two markets.

The strategy involves taking a long position in the spot market and a short position in the futures market. Velo data shows a one-month futures forward contract. Investors collect a premium between the spread of the spot and futures pricing until the futures contract expiry date closes.

At the current level, the basis trade is less than the so-called risk-free rate, the yield on the U.S. 10-year Treasury of 5%. The difference may persuade investors to close their positions in favor of the greater return. That could see further outflows from the ETFs. Because this is a neutral strategy, investors will also have to close their short position in the futures market.

Arthur Hayes, the co-founder of Bitmex, alludes to the basis trade unravelling in a post on X.

“Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries,” he wrote. “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo!”

Source link

Markets

Solana Plunges to Lowest Price Since October as Meme Momentum Cools

Published

1 day agoon

February 24, 2025By

admin

Solana plunged to its lowest price since mid-October in Monday trading amid ongoing concerns about its association with a scandal involving the Libra token, along with cooling sentiment toward other meme coin initiatives that have favored the network.

The native cryptocurrency of the smart contracts Solana blockchain is trading just below $153, down 9% over the past 24 hours, according to crypto markets data provider CoinGecko. SOL has dropped 25% during the past two weeks, and dipped as low as $151 on Monday.

The decline comes just 10 days after Libra lost about 90% of its value in hours, sparking accusations of fraud and calls for the impeachment of Argentine President Javier Mllei, who had promoted the token that was supposed to help the country’s small businesses in a post on X. Milei subsequently deleted the post and denied knowledge about the coin’s creation.

It also follows investors’ retreat from the once-torrid meme coin market, and even as multiple major asset managers have applied for exchange-traded funds based on the spot price of Solana—the sixth-largest digital asset with a $75 billion market capitalization.

On Friday, Franklin Templeton followed Grayscale, Bitwise, Canary, 21Shares, and VanEck in seeking a Securities and Exchange Commission green light for Solana-based funds. Bloomberg Senior Analyst Eric Balchunas has penciled in a 70% probability that the SEC will approve the ETFs.

In a text to Decrypt, Mark Connors, the chief investment officer at New York-based Bitcoin investment advisory Risk Dimensions, wrote that token launchpad Pump.fun could no “longer carry the day for the faster blockchain, leaving investors favoring integrity over potential profit as market uncertainty sets in.”

Meme coin buzz hasn’t completely disappeared; traders speculated across social media over the weekend on whether rapper Kanye West would follow through on his X posts and launch his own coin. But while traders still see glimmers of opportunity, the hype has indeed quieted compared to January and the launch of Donald Trump’s coin.

“The fallout from the Libra launch and confusion on who owns Kanye’s online [name, image, and likeness rights] accelerated a reversal in sentiment for the meme-based L1,” he added. Connors also noted that Ethereum was “no longer the middle child,” and that it “has outperformed Solana on the downside this past month, -18% vs -38% for Solana.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Voltage Aims To Bring Bitcoin’s Lightning Network To Every Business In The World

Ethereum DeFi Exchange Uniswap Says SEC Has Dropped Its Investigation

Strive CEO urges GameStop to adopt Bitcoin as treasury asset

Bitdeer Reports $532M Q4 Loss, Focuses on ASIC Development for 2025 Growth

Nasdaq Submits Filing To List Grayscale Polkadot ETF, DOT Price To $34?

Top Crypto to Buy as Market Shifts from Memecoins to Utility Tokens

Elliptic Says Lazarus Group Using eXch To Launder Stolen Funds Despite Requests From Bybit To Block Transactions

SOL takes a hit, XRP struggles; Codename:Pepe presale surges to $1m

Metaplanet Snaps Up 135 Bitcoin for $96,000 Each—Just Before Price Crash

Litecoin Price Set to Pump or Dump? ETF Speculation Heats Up

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

NEAR Protocol Reports Strong Q4 Gains As AI Initiatives Drive Double-Digit Growth

Metaplanet adds 135 Bitcoin, total holdings reach 2,235 BTC

Altseason Canceled? How Trading Syndicates, Scams and Geopolitics Buried Hopes for Growth

Bitcoin Reserve Bill Fails as South Dakota Lawmakers Shut Down Proposal

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Has The Bitcoin Price Already Peaked?

SAFE rallies 20% on Bithumb listing

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin1 month ago

Bitcoin1 month agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin3 months ago

Bitcoin3 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins4 weeks ago

Altcoins4 weeks agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x