Coins

Wholesome Solana Meme Coin Dev Hacked for $1.2 Million—But Says He Won’t Give Up

Published

4 weeks agoon

By

admin

Ronald Branstetter made a meme coin that skyrocketed to a market cap of $420 million, turning him from a crypto skeptic to a fan of the space. But now, six weeks since his first foray into the industry, he says that he’s lost everything in a wallet hack.

Branstetter launched Unicorn Fart Dust (UFD) from his basement in December, in an attempt to prove to his YouTube audience of gold and silver investors that crypto is worthless—or as he called it, “Unicorn Fart Dust.”

Meme coin gamblers saw this video, however, and bought the coin en masse—causing his token to skyrocket, quickly turning Branstetter’s holdings into $1.2 million worth of UFD.

On the first night the token went flying, Branstetter sold half of his holdings, but told Decrypt three weeks ago that he regretted doing so, wants to buy more, and has no plans to sell—despite admitting that the money would be life-changing.

However, on Monday afternoon, Branstetter claims that his wallet was hacked, with the attacker selling everything he had in his wallet.

On-chain data shows that over $1 million worth of UFD was sent to an unknown wallet, and then all of the tokens were sold across approximately 50 transactions before the received Solana was spread across countless wallets. That’s not to mention the approximately $200,000 worth of Solana and other tokens that were drained from Branstetter’s wallet.

Within 20 minutes of noticing the hack, the meme coin community leader started a livestream to explain the situation to his community. In the 10-minute video, Branstetter admitted that he was shook up by the experience. He broke down crying and said that he doesn’t regret creating the token, and confirmed that he wants to continue with the project.

“If I had to go back and do it all over again, I say yes, I’d do it all over again,” Branstetter said, before pausing with tears filling up his eyes. “I’d still do it over again because I know that there are still good people, and that good attracts good.”

UFD is down 24% over the last 24 hours to a current price of $0.123. It’s down 69% from its all-time high mark set just over a week ago.

Branstetter later revealed that he was tricked by a fake reporter from an unnamed organization, who may have gained unauthorized access to his accounts. After clicking the video call link, an interview did occur, but Branstetter said it “felt off from the beginning.”

Almost immediately, he said, the wallet was drained. This, unfortunately, is a common scam in the world of crypto—with some scammers impersonating Decrypt in attempts to try and swindle people in the industry.

“Nothing has changed about Unicorn Fart Dust. Unicorn Fart Dust is still [about] ‘good attracts good.’ I still believe in Unicorn Fart Dust. I still believe in the community,” Branstetter explained.

As the news broke, some people speculated that the meme coin creator had sold the tokens himself and faked the entire hack. This crowd appears to be a minority, however, as much of the UFD community has rallied behind its creator once again, sending over $425,000 of the token to a new mutli-sig wallet—intended to be controlled by the token creator.

“You have touched me very, very deeply through what has probably been some of my darkest hours,” Branstetter said in a livestream following the donations. “You are providing, right now, an example to the world of the good that a community can do.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Ethereum ‘Roll Back’ Suggestion Has Sparked Criticism. Here’s Why It Won’t Happen

Ethereum Price Could Still Reclaim $4,000 Based On This Bullish Divergence

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

Coins

Bitcoin Reaching $100K Is Start of ‘Massive Wave’ of Institutional Interest: Samson Mow

Published

3 days agoon

February 19, 2025By

admin

Bitcoin’s ascent past $100,000 might have felt like the culmination of a long-promised milestone, but according to industry veterans, what we’re witnessing is the beginning of real institutional adoption—a trend that could fundamentally transform how global capital markets work.

“Previous Bitcoin bull runs were usually muted because exchanges needed to onboard and were backlogged for months,” explains Samson Mow, CEO of Jan3, a company focused on accelerating Bitcoin adoption. “But with ETFs, now there’s no barrier to TradFi capital flowing directly into Bitcoin.”

Speaking from the Consensus 2025 conference in Hong Kong on Wednesday, Mow acknowledged that the “torrent of capital” hasn’t “poured in” just yet for Bitcoin, with institutional investors such as sovereign wealth funds merely “dipping their toes” in the still muddy waters of crypto and only investing “a droplet of what they have.”

Mow was responding to Adam Back, CEO of Blockstream, who pointed out earlier in the talk how peculiar market dynamics have been at play for Bitcoin.

“ETF inflows are a multiple of Bitcoin mined every day. MicroStrategy and other companies are buying two times plus Bitcoin mining per day,” Back said.

That’s all setting the stage for a “massive wave of maybe 10, 20 years of bullish” price action for Bitcoin as institutions embrace it, according to Mow.

The panel discussed how roughly 1.1 million Bitcoin—worth approximately $110 billion at current prices—has been absorbed by buyers between September and October of 2024, even as prices climbed 50% from $60,000 to current levels.

This unprecedented supply absorption has occurred despite what Mow describes as “manufactured” trading ranges.

“If you look at the price movement, we kind of peak, and then we stay steady and chop sideways,” Mow observed. “It’s good to say it’s consolidation, but it just looks very manufactured. There’s a very tight range in which we’re trading at. It just doesn’t look natural at all.”

Mow’s observation is a response to how Back suggested that previous structural sellers, including bankrupted firms and miners who needed cash during the bear market, have largely cleared the market.

“If we’re talking about last year, after the DeFi contagion and bankruptcies, there were some structural sellers who were sort of ‘false sellers’ and miners who were restructuring or replacing fleets or going through a less profitable period,” Back said.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

CZ Donates 150 BNB to Libra Scam Victims—Ends Up With More Than He Gave

Published

4 days agoon

February 19, 2025By

admin

What started as an act of goodwill by Binance founder Changpeng Zhao (CZ) to help victims of the LIBRA meme coin scam took an unexpected turn when Zhao received more crypto than he originally donated.

On Tuesday, Zhao pledged 150 BNB—worth approximately $100,000—to support those affected by the collapse of the controversial LIBRA coin after a college student, EnHeng, began raising funds to assist the victims.

But Zhao’s decision to publicly share his donation address led to an influx of additional crypto in the same, surpassing his initial contribution.

EnHeng, moved by the devastating losses caused by Argentina President Javier Milei–promoted LIBRA crypto, which wiped out more than 40,000 investors and resulted in over $4 billion in damages, announced their own donation of $50,000.

“When you try to make quick money, you often lose,” Zhao quipped on X. “When you give money away, you get more back.”

Despite the increased donations, Zhao made it clear that he would not keep any of the additional funds.

“I won’t be keeping a satoshi of it,” Zhao clarified in his tweet, saying he would donate the extra crypto to further support the victims, specifically those affected by other meme coins like TST and Broccoli, the latter being inspired by CZ’s pet dog.

Zhao also warned his followers not to misinterpret his actions as an endorsement of the tokens involved.

The LIBRA Scam: A Presidential Endorsement Leads to Financial Chaos

Last Friday, the LIBRA token’s launch stirred controversy after Argentine President Javier Milei publicly endorsed it on his X account.

The promotion caused the coin’s value to surge, reaching a market cap of over $4 billion within hours of its debut.

Milei initially promoted LIBRA as a project to help fund small Argentine businesses and boost the national economy, linking it to the “Viva La Libertad” initiative.

But the excitement was short-lived. Just hours later, the token crashed by over 91%, causing massive losses for investors—with some losing their life savings.

After the coin’s collapse, Milei deleted his post and disavowed any involvement with the project, claiming he had been misinformed and had no knowledge of its full details.

Fraud charges were filed against Milei and the team behind the token, accusing them of being complicit in a large-scale fraud scheme.

On-chain analysis showed that a single entity controlled 82% of LIBRA’s supply, fueling suspicions about market manipulation.

Platforms such as Jupiter and Meteora, which provided technical support for LIBRA, are under fire, with Meteora’s co-founder Ben Chow resigning amid allegations of insider trading and misconduct following the token’s collapse.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

Crypto User Burns $7 Million Ethereum to Warn of ‘Mind Control’ Through Brain Chips

Published

5 days agoon

February 18, 2025By

admin

A man identifying himself as an “ordinary programmer and entrepreneur” has burned and donated approximately $7 million worth of Ethereum as a form of protest and a personal statement against what he describes as a long-standing experience of being monitored and manipulated by a “brain-control organization.”

Now, Crypto Twitter users are trying to get what’s left of his money.

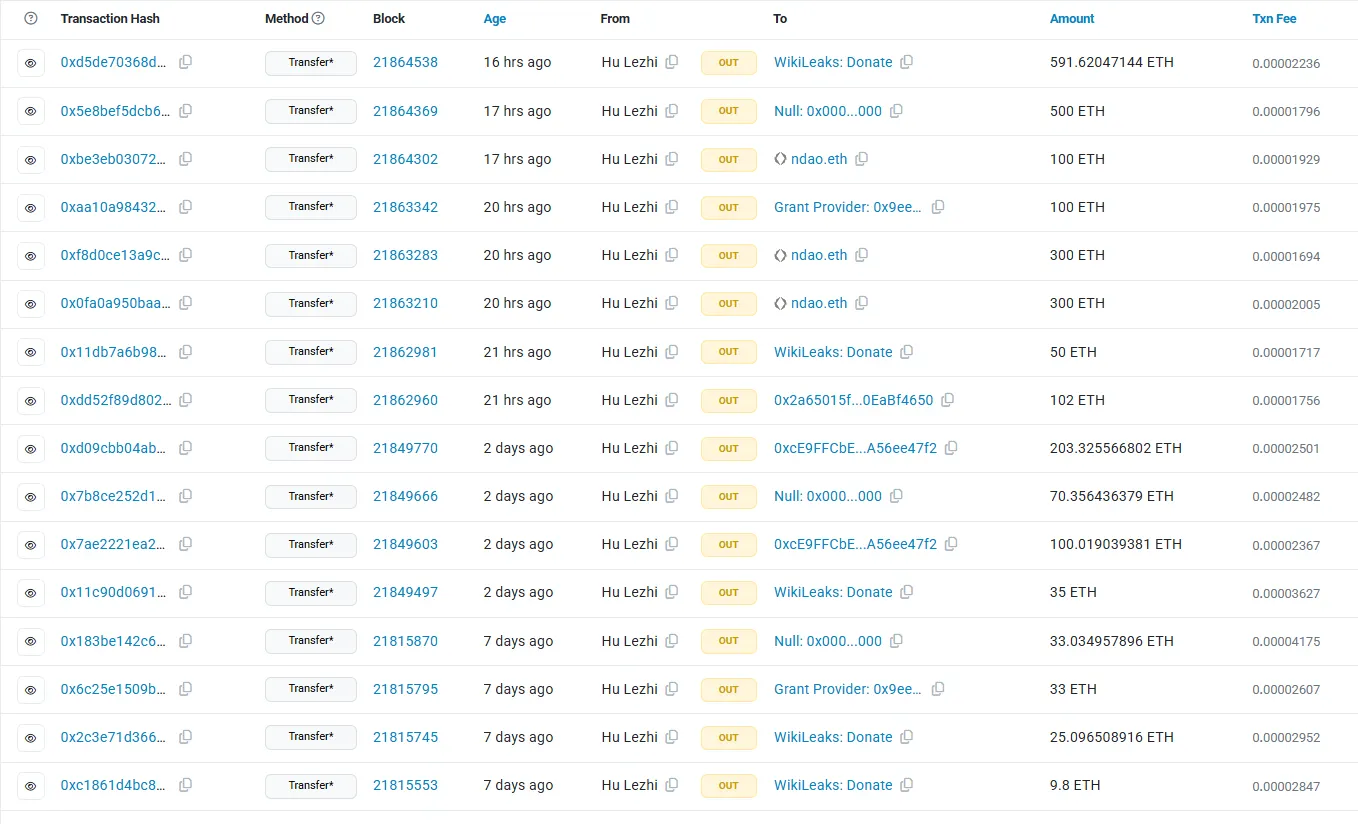

The user, who identified himself as Hu Lezhi, has sent around 2,553 ETH (worth approximately $7 million) through multiple transactions over the past week.

Of that amount, 603 ETH ($1.65 million) was permanently removed from circulation by sending it to an unspendable blockchain address, 0x00000—also known as the ETH burn address.

Hu has also inscribed a variety of unusual messages on the blockchain.

“Since October 2022, I have realized that I have been monitored and manipulated by a brain-control organization since birth,” Hu wrote on-chain. “When I became aware of the existence of this organization, they intensified their harm against me.”

“The past two years have been extremely painful, and I have now reached a point where I have completely lost my dignity as a human being,” he wrote.

One of the transactions carried messages accusing executives at Chinese hedge fund WizardQuant Capital Management of using “brain-computer weapons” to control employees.

The quant firm, founded by Wall Street veterans and based in Shanghai and Beijing, didn’t immediately respond to a request for comment by Decrypt.

Before burning his tokens, Hu donated more than 700 ETH (a bit under $2 Million) to Wikileaks address and other wallets like nda.eth, sharing more details about his supposed relationship with WizardQuant.

“There is a new mode of crime in which the victim is gradually deprived of his senses of desire until he becomes a complete slave to the digital machine, and if one day I become a victim of the final stage, I will leave the world,” the programmer inscribed on the blockchain in one of the transactions.

Some crypto Twitter users have been trying to prey on Lezhi and get him to send them any funds he has left. “Please help me, I am being persecuted too, send ETH,” wrote one user in two different transactions to Lezhi’s address.

The last transaction from Lezhi’s wallet occurred on February 17 at 7:13:35 AM UTC, when he sent another message to WikiLeaks about being “monitored and manipulated” since birth.

“I have decided to leave this world and hope that this ugly world will be destroyed soon,” he wrote.

Edited by Sebastian Sinclair and Josh Quittner

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Ethereum ‘Roll Back’ Suggestion Has Sparked Criticism. Here’s Why It Won’t Happen

Ethereum Price Could Still Reclaim $4,000 Based On This Bullish Divergence

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

US SEC Faces Backlash as Bybit Hack Highlights Lack of Oversight

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Bitcoin Faces Serious Price Compression – What Happened Last Time

FPPS Is Not A Free Lunch For Bitcoin Miners

One of the Most Reliable Indicators for Bitcoin Flashing Bullish Signal, Says Trader – Here Are His Targets

Expert reveals a shocking 10x contender

Franklin Templeton Joins Growing Pile of Solana ETF Applicants

Impact of Bybit’s $1.5B ETH Hack on ETH

Rollback Ethereum to Negate $1.4B Bybit Hack, Arthur Hayes Tells Vitalik Buterin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

SAFE rallies 20% on Bithumb listing

Will Ethereum Price Fail $3,000 Breakout as Whale Selling Prolongs?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin1 month ago

Bitcoin1 month agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News1 month ago

24/7 Cryptocurrency News1 month agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin3 months ago

Bitcoin3 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Altcoins3 weeks ago

Altcoins3 weeks agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje