Bitcoin

Has The Bitcoin Price Already Peaked?

Published

1 month agoon

By

admin

Bitcoin’s price movements have always been a subject of debate among investors and analysts. With recent market retracements, many are questioning whether Bitcoin has already reached its peak in this bull cycle. This article examines the data and on-chain metrics to assess Bitcoin’s market position and potential future movements.

For an in-depth complete analysis, refer to the original Has The Bitcoin Price Already Peaked? full video presentation available on Bitcoin Magazine Pro‘s YouTube channel.

Bitcoin’s Current Market Performance

Bitcoin recently faced a 10% retracement from its all-time high, leading to concerns about the end of the bull market. However, historical trends suggest that such corrections are normal in a bull cycle. Typically, Bitcoin experiences pullbacks of 20% to 40% multiple times before reaching its final cycle peak.

Analyzing On-Chain Metrics

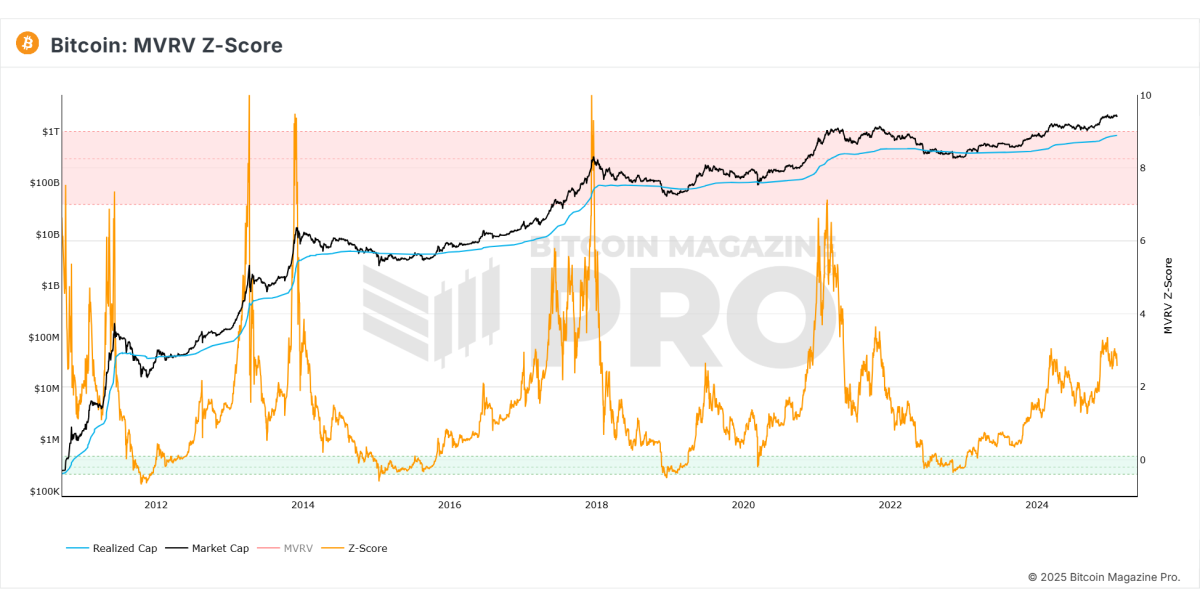

MVRV Z-Score

The MVRV Z-score, which measures the market value to realized value, currently indicates that Bitcoin still has considerable upside potential. Historically, Bitcoin’s cycle tops occur when this metric enters the overheated red zone, which is not the case currently.

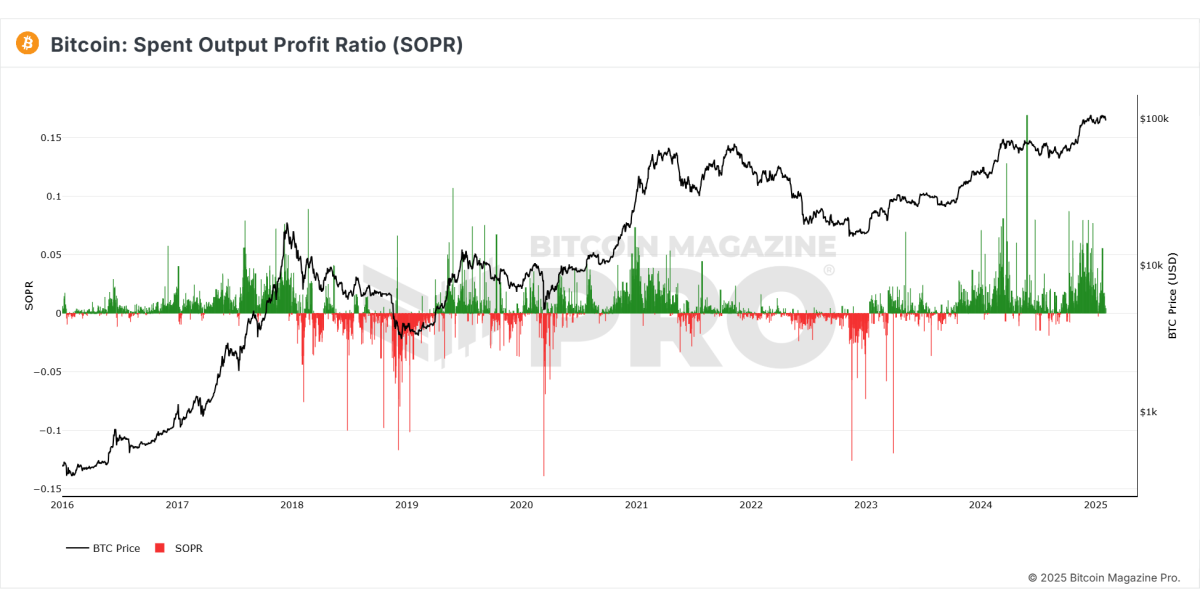

Spent Output Profit Ratio (SOPR)

This metric reveals the proportion of spent outputs in profit. Recently, the SOPR has shown decreasing realized profits, suggesting that fewer investors are selling their holdings, reinforcing market stability.

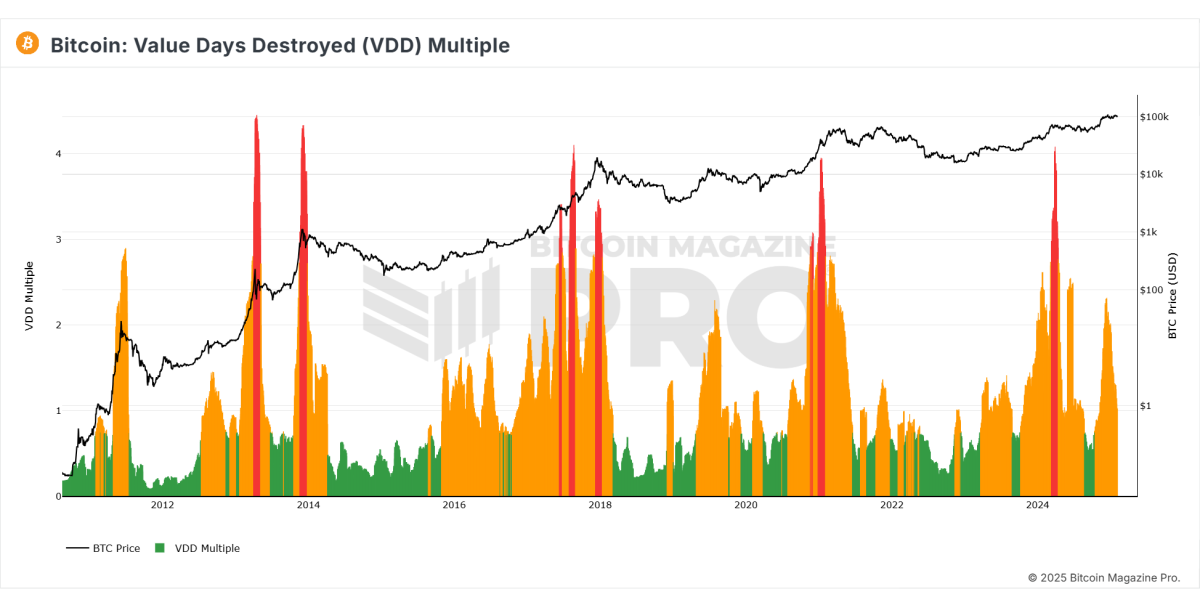

Value Days Destroyed (VDD)

VDD indicates long-term holders’ sell-offs. The metric has shown a decline in selling pressure, suggesting that Bitcoin is stabilizing at high levels rather than heading into a prolonged downtrend.

Institutional and Market Sentiment

- Institutional investors such as MicroStrategy continue accumulating Bitcoin, signaling confidence in its long-term value.

- Derivatives market sentiment has turned negative, historically indicating a potential short-term price bottom as over-leveraged traders betting against Bitcoin may get liquidated.

Macroeconomic Factors

- Quantitative Tightening: Central banks have been reducing liquidity, contributing to the temporary Bitcoin price decline.

- Global M2 Money Supply: A contraction in money supply has impacted risk assets, including Bitcoin.

- Federal Reserve Policy: There are indications from major financial institutions, including JP Morgan, that quantitative easing could return by mid-2025, which would likely boost Bitcoin’s value.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Future Outlook

- Bitcoin’s price action is showing signs of entering a consolidation phase before another potential rally.

- On-chain data suggests there is still significant room for growth before reaching cycle peaks seen in previous bull markets.

- If Bitcoin experiences further pullbacks to the $92,000 range, this could present a strong accumulation opportunity for long-term investors.

Conclusion

While Bitcoin has experienced a temporary retracement, on-chain metrics and historical data suggest that the bull cycle is not over yet. Institutional interest remains strong, and macroeconomic conditions could shift in favor of Bitcoin. As always, investors should analyze the data carefully and consider long-term trends before making any investment decisions.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Ethereum Cost Basis Data Signals Strong Support At $1,886

Solana Cofounder Advocates For Decisive Governance As SIMD-228 Proposal Fails

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Kaito AI and founder Yu Hu’s X social media accounts hacked

Which AI Actually Is the Best at ‘Being Human?’

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

Altcoins

‘Be on Guard’: Trader Says Altcoin Bounce May Be Temporary, Tracks Bitcoin’s Next Targets

Published

12 hours agoon

March 15, 2025By

admin

A widely followed crypto analyst and trader is warning that an altcoin market bounce may end up being short-lived.

In a new post, pseudonymous crypto trader Altcoin Sherpa tells his 243,900 followers on the social media platform X that alts may give up gains after bouncing based on historical precedence.

He also says Bitcoin (BTC) may soon flip $84,000 into support and that the flagship crypto asset could maintain bullish momentum by breaking through the $89,000 level.

“BTC looks like $84,000 is the first test that is going to break (to the upside) and we’re ok in that department. $89,000 would be my next level of interest overall. Alts looking like they’ll give a temporary bounce but not sure how strong (yet). Be on guard.”

Looking at his chart, the analyst suggests that if Bitcoin can regain $98,703 as support, the flagship crypto asset may print new all-time highs.

However, he warns if $78,167 breaks down as support, Bitcoin may plummet into the $60,000 range.

Bitcoin is trading for $84,154 at time of writing, up 4.6% in the last 24 hours.

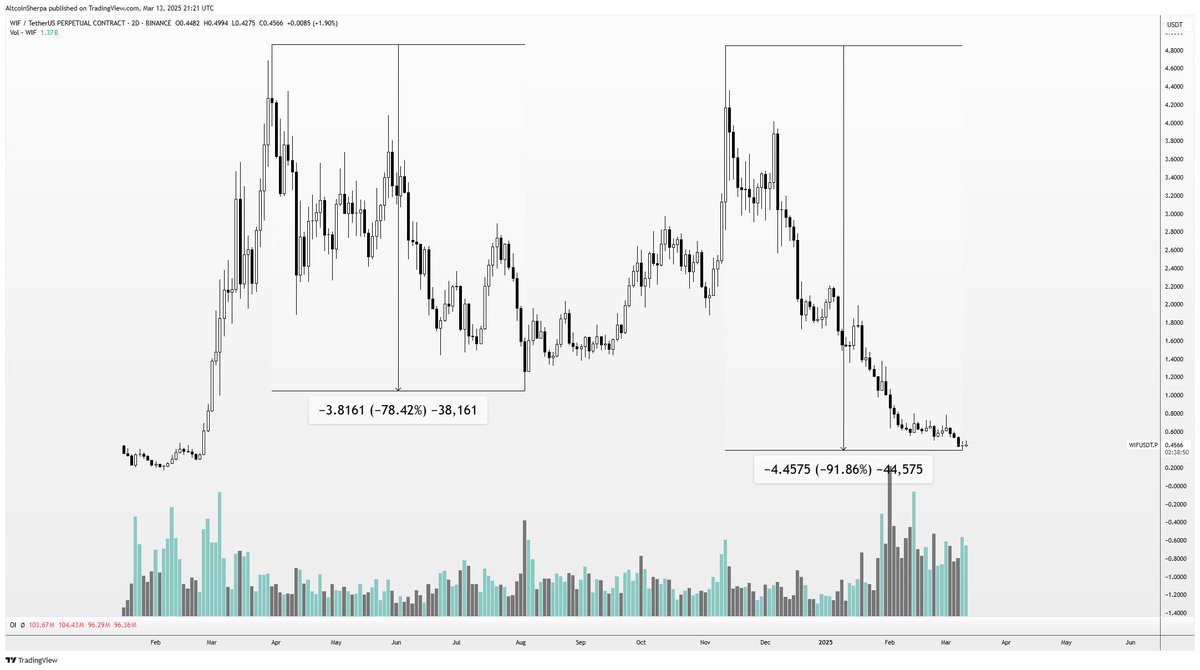

The analyst also warns that altcoins like the dogwifhat (WIF) memecoin may struggle for a long time to ever regain higher price targets if Bitcoin turns bearish.

“It’s a lot more concerning for sh**coins this go around because BTC might actually be dead for a bit. In the previous drawdown, we had a lot more hope because we assumed BTC still had more upside. If BTC dies to $50,000 or w/e (whatever), these aren’t coming back for a very long time. See WIF.”

WIF is trading for $0.50 at time of writing, up 9.7% in the last 24 hours.

He adds that altcoins may bounce even as they continue to print a bearish lower-high price structure.

“As much as everything is dead and we’re truly in a bear market for altcoins, it’s important to remember that a bounce will come and alts can still do a few x from current levels. Markets don’t move in a straight line down. Bounce coming within the next one to two months in my opinion.”

He shares the two-day chart of Ethereum (ETH) to illustrate the historical precedence of an altcoin bouncing amid a larger downtrend.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

BasicTradingTV

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

Published

18 hours agoon

March 15, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price trajectory has become a significant point of interest in light of the recent downtrend, which has disappointed many bullish traders. According to on-chain analytics platform IntoTheBlock, the recent price crash up to the current price has seen over 6.5 million BTC addresses falling into losses. Still, technical analysis suggests Bitcoin could experience further drops.

The question is whether Bitcoin will test the $70,000 mark before regaining strength or can rebound from here toward a $300,000 price target. Insights from price structure and historical patterns help provide a clearer picture of what’s next.

Bitcoin Price Decline: A Normal Cycle Within Uptrends

Despite concerns over Bitcoin’s recent price swings, crypto analyst Philip (BasicTradingTV) maintains that the market is behaving normally within a long-term bullish structure. He highlights that on the higher monthly timeframe, Bitcoin continues to create higher highs and higher lows and maintains a solid uptrend that dates back to 2017.

Related Reading

This technical outlook, which was noted on the TradingView platform, comes as a response to concerns about whether BTC is still bullish after the ongoing 25% correction from its recent all-time high.

Traders have been unsettled following the recent drop, but historical trends suggest this kind of movement is part of the market’s natural cycle. According to the analyst, Bitcoin is still forming a bullish market structure, and while short-term fluctuations may continue, the broader uptrend channel from 2017 is still in place. Furthermore, the analyst noted previous instances of 25% and 40% corrections during Bitcoin’s rallies from the lower trendline of this uptrend channel.

What’s Next For BTC? Possible Retest Of Resistance Before Rally To $300,000

With the notion of a long-term uptrend still intact, the analyst noted, however, that Bitcoin could continue its downtrend until it reaches $70,000. This level holds significant importance, as it previously marked Bitcoin’s all-time high before turning into resistance around mid-2024. After multiple attempts, Bitcoin eventually broke through this resistance toward the end of the year, leading to its new all-time high of $108,786 in January 2025.

Related Reading

As such, this $70,000 level is now a major psychological support zone, making it a key area to watch amidst the ongoing Bitcoin price correction. From here, the analyst predicted a rebound that would send BTC to reach as high as $300,000. “Levels to watch: 70.000, $300.000,” the analyst said.

At the time of writing, Bitcoin is trading at $82,555, having spent the majority of the past 24 hours trading between $79,947 and $83,436. This leaves Bitcoin still about 14% away from testing the $70,000 support level.

However, there is also the possibility that BTC may not drop as low as $70,000 before bullish sentiment takes over once again. If Bitcoin continues to follow the trajectory of past cycles, Fibonacci extensions point to price targets between $150,000 and $300,000.

Featured image from Unsplash, chart from Tradingview.com

Source link

Bitcoin

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

Published

18 hours agoon

March 15, 2025By

admin

Bitcoin has been struggling with lower lows in recent weeks, leaving many investors questioning whether the asset is on the brink of a major bear cycle. However, a rare data point tied to the US Dollar Strength Index (DXY) suggests that a significant shift in market dynamics may be imminent. This bitcoin buy signal, which has only appeared three times in BTC’s history, could point to a bullish reversal despite the current bearish sentiment.

For a more in-depth look into this topic, check out a recent YouTube video here:

Bitcoin: This Had Only Ever Happened 3x Before

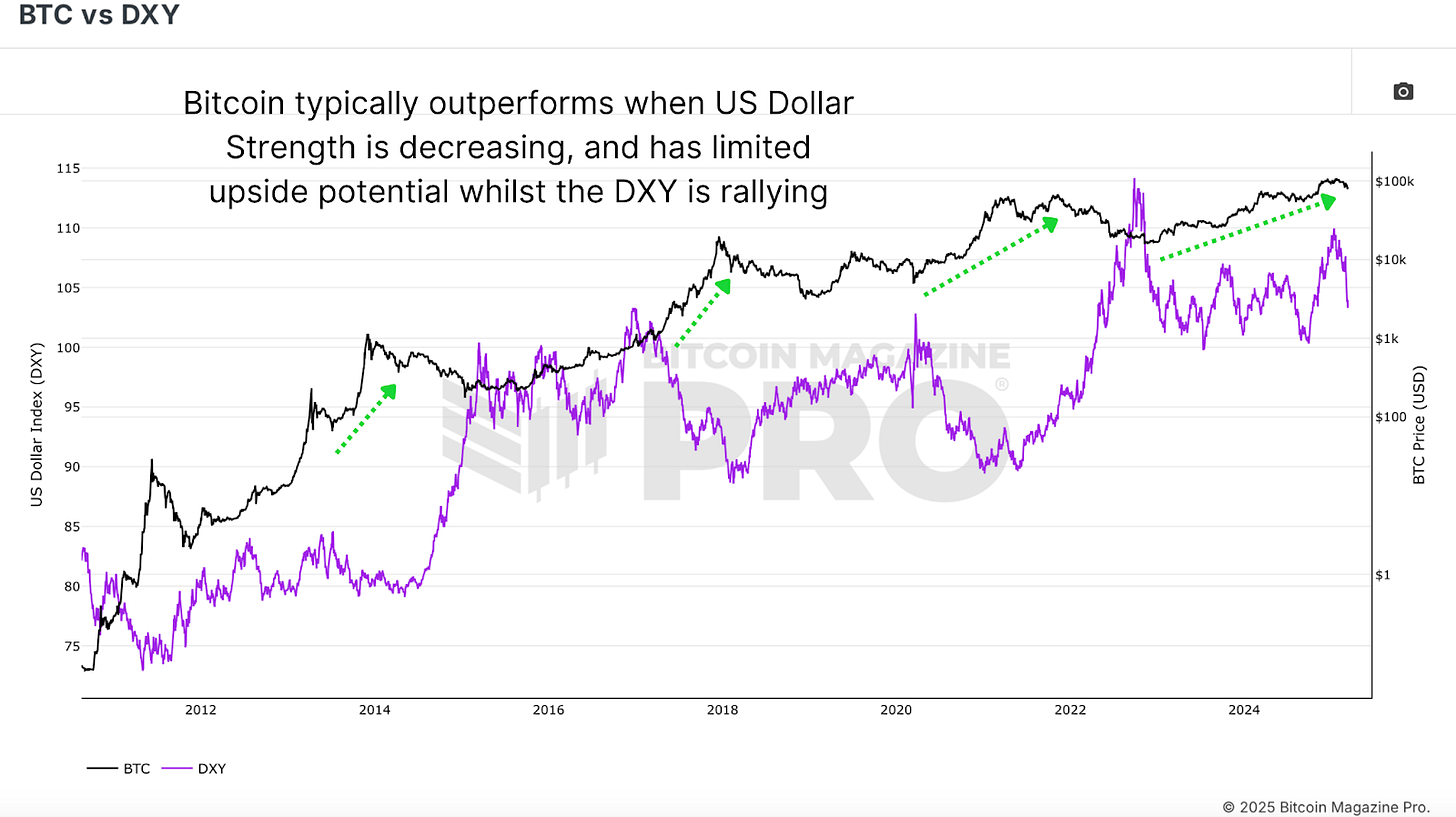

BTC vs DXY Inverse Relationship

Bitcoin’s price action has long been inversely correlated with the US Dollar Strength Index (DXY). Historically, when the DXY strengthens, BTC tends to struggle, while a declining DXY often creates favorable macroeconomic conditions for Bitcoin price appreciation.

Despite this historically bullish influence, Bitcoin’s price has continued to retreat, recently dropping from over $100,000 to below $80,000. However, past occurrences of this rare DXY retracement suggest that a delayed but meaningful BTC rebound could still be in play.

Bitcoin Buy Signal Historic Occurrences

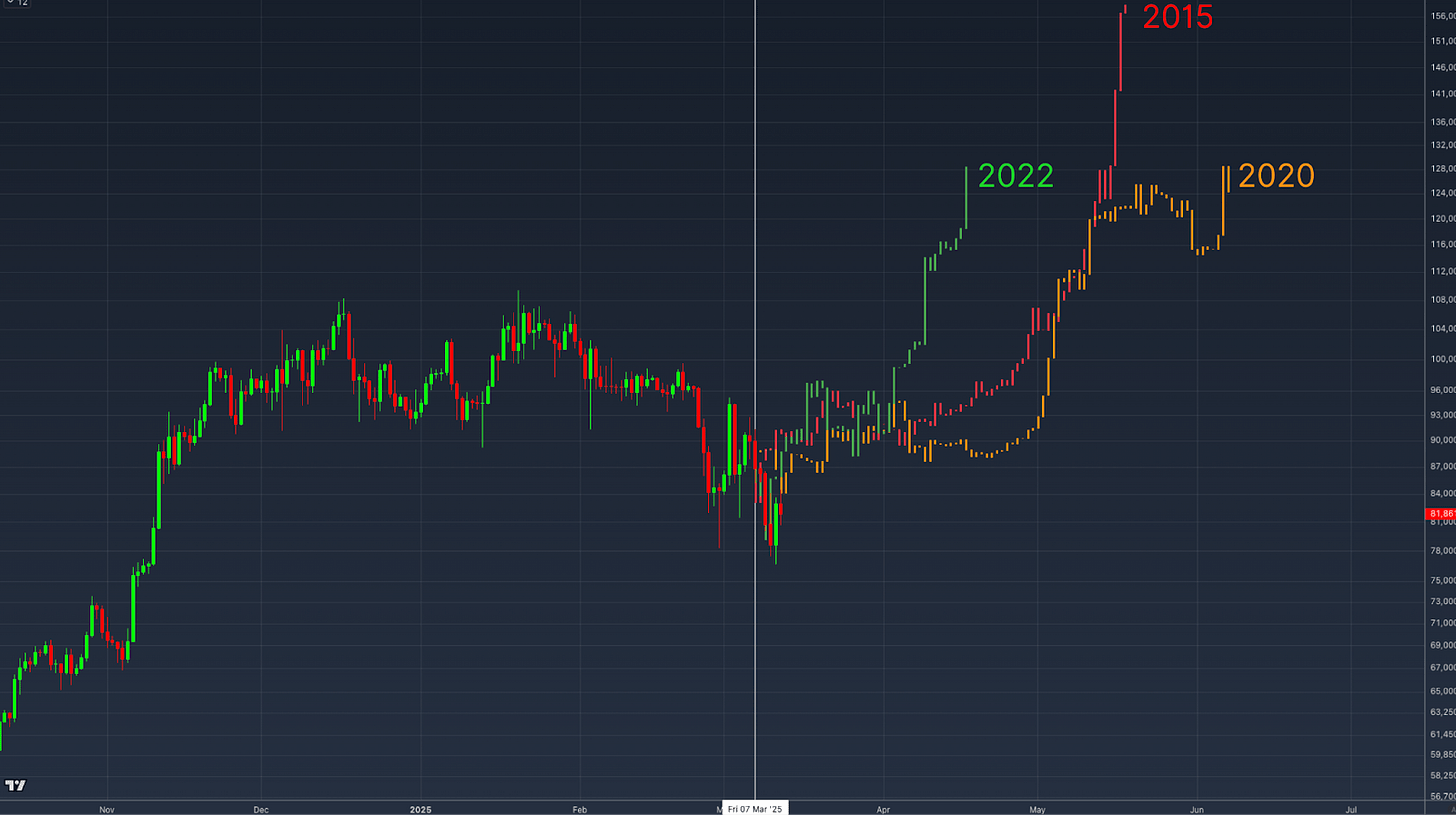

Currently, the DXY has been in a sharp decline, a decrease of over 3.4% within a single week, a rate of change that has only been observed three times in Bitcoin’s entire trading history.

To understand the potential impact of this DXY signal, let’s examine the three prior instances when this sharp decline in the US dollar strength index occurred:

- 2015 Post-Bear Market Bottom

The first occurrence was after BTC’s price had bottomed out in 2015. Following a period of sideways consolidation, BTC’s price experienced a significant upward surge, gaining over 200% within months.

The second instance occurred in early 2020, following the sharp market collapse triggered by the COVID-19 pandemic. Similar to the 2015 case, BTC initially experienced choppy price action before a rapid upward trend emerged, culminating in a multi-month rally.

- 2022 Bear Market Recovery

The most recent instance happened at the end of the 2022 bear market. After an initial period of price stabilization, BTC followed with a sustained recovery, climbing to substantially higher prices and kicking off the current bull cycle over the following months.

In each case, the sharp decline in the DXY was followed by a consolidation phase before BTC embarked on a significant bullish run. Overlaying the price action of these three instances onto our current price action we get an idea of how things could play out in the near future.

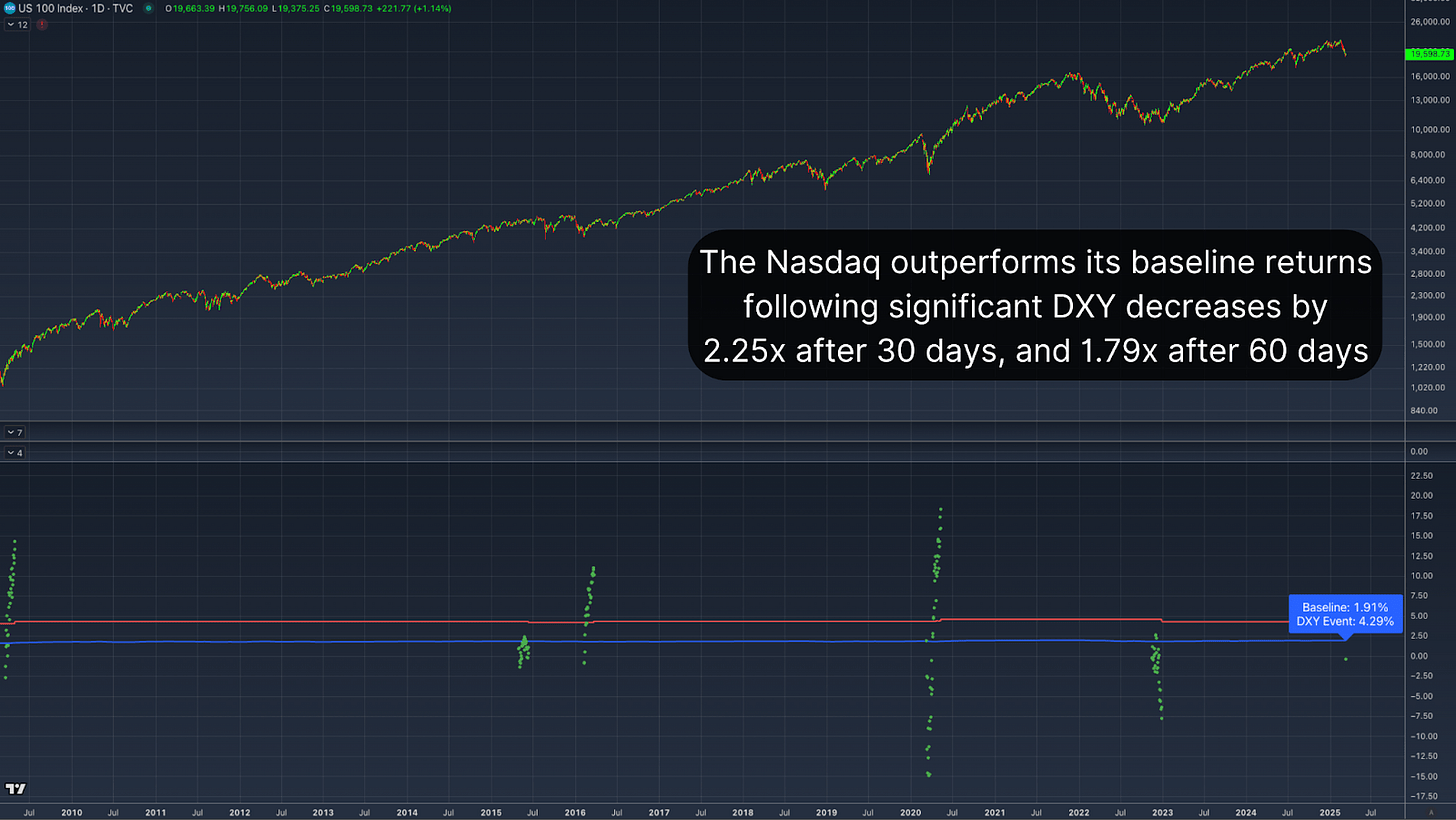

Equity Markets Correlation

Interestingly, this pattern isn’t limited to Bitcoin. A similar relationship can be observed in traditional markets, particularly in the Nasdaq and the S&P 500. When the DXY retraces sharply, equity markets have historically outperformed their baseline returns.

The all-time average 30-day return for the Nasdaq following a similar DXY decline stands at 4.29%, well above the standard 30-day return of 1.91%. Extending the window to 60 days, the Nasdaq’s average return increases to nearly 7%, nearly doubling the typical performance of 3.88%. This correlation suggests that Bitcoin’s performance following a sharp DXY retracement aligns with historical broader market trends, reinforcing the argument for a delayed but inevitable positive response.

Conclusion

The current decline in the US Dollar Strength Index represents a rare and historically bullish Bitcoin buy signal. Although BTC’s immediate price action remains weak, historical precedents suggest that a period of consolidation will likely be followed by a significant rally. Especially when reinforced by observing the same response in indexes such as the Nasdaq and S&P 500, the broader macroeconomic environment is setting up favorably for BTC.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Ethereum Cost Basis Data Signals Strong Support At $1,886

Solana Cofounder Advocates For Decisive Governance As SIMD-228 Proposal Fails

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Kaito AI and founder Yu Hu’s X social media accounts hacked

Which AI Actually Is the Best at ‘Being Human?’

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

21Shares to Liquidate Active Bitcoin and Ether Futures ETFs Amid Market Downturn

TON Society celebrates Pavel Durov leaving France as free speech win

Best New Presales to Buy as Bullish Bitcoin Signal Promises Upcoming Bull Run

Russia Is Using Bitcoin And Crypto For Its Oil Trades With China And India

‘Be on Guard’: Trader Says Altcoin Bounce May Be Temporary, Tracks Bitcoin’s Next Targets

Sacks purges crypto, but Trump? His digital empire continues

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x