Ripple

Massive XRP Accumulation – Whales Bought 520 Million XRP During Market Dip

Published

2 months agoon

By

admin

XRP has shown resilience amid the market’s volatility and uncertainty, standing strong as it rebounds from recent lows. The price is now over 33% up from Monday’s low, signaling renewed momentum and a potential push toward higher levels. Despite ongoing turbulence in the broader crypto market, the price appears to be regaining strength, with investors closely watching its next move.

Related Reading

Top analyst Ali Martinez shared on-chain data revealing a key trend that has unfolded during this recent market dip. According to Martinez, whales seized the opportunity, accumulating over 520 million coins. This significant accumulation suggests that large investors remain confident in XRP’s long-term potential and could be positioned for a major price move in the coming weeks.

With XRP recovering from its recent lows and strong demand emerging at critical levels, traders are now eyeing a breakout above key resistance zones. The coming days will determine whether it can sustain its momentum and extend its rally. If whales continue to accumulate, the price could be setting up for a significant surge as market sentiment shifts toward bullish territory.

XRP Whales Prepare For A Rally

XRP has been one of the strongest-performing cryptocurrencies in the market since last November, consistently holding key levels despite volatility. As the broader market consolidates before the next big move, XRP appears well-positioned to extend its rally. Analysts are calling for a bullish cycle, citing technical and on-chain data supporting a significant price increase in the coming weeks.

Top crypto analyst Ali Martinez recently shared key on-chain metrics on X, revealing that whales took advantage of the recent market dip to accumulate 520 million XRP. This large-scale buying activity indicates strong confidence from institutional investors and high-net-worth individuals who see XRP as a valuable asset in the current market structure. While retail investors often panic and sell during corrections, whales and institutions strategically accumulate, setting the stage for a potential price surge.

Historically, whale accumulation during market downturns has been a strong indicator of future rallies, as these large players tend to position themselves ahead of major moves. The fact that XRP has bounced over 33% from Monday’s low reinforces the idea that strong hands are buying at key levels.

Related Reading

With the altcoin showing strength and buyers stepping in at crucial levels, analysts believe a breakout above supply zones is imminent. If the price continues to hold strong, the next move could take the price beyond key resistance, pushing it toward multi-year highs. The $2.70 and $2.90 levels remain critical resistance zones and once cleared, XRP could enter a parabolic phase.

Price Holding Strong Amid Market Volatility

XRP has experienced significant volatility in recent days, with sharp price swings shaking market sentiment. Currently, XRP stands at $2.37, showing resilience despite recent market turbulence. Holding above the crucial $2.30 support level is essential for maintaining bullish momentum and initiating a recovery into higher supply zones. This level has historically acted as a key demand area, and if it holds, XRP could see a strong rebound.

For bulls to regain control and confirm a trend reversal, XRP must push above the $2.72 mark. This price level represents a key supply zone, and breaking above it would signal short-term strength, allowing for a potential rally toward higher resistance levels. If buyers step in with strong volume, XRP could aim for a breakout above $3.00, setting the stage for further price appreciation.

Related Reading

However, if XRP fails to sustain support at $2.30, bearish pressure could intensify, leading to a deeper retracement. A drop below this level would likely send XRP toward the psychological $2.00 mark, where buyers would need to step in to prevent further downside. For now, all eyes are on whether XRP can reclaim key levels and maintain its bullish structure in the coming days.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

24/7 Cryptocurrency News

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

Published

15 hours agoon

April 16, 2025By

adminIn the latest development in the long-running XRP lawsuit, the US Court of Appeals has granted Ripple and the SEC’s joint motion to suspend their respective appeals. This will give both parties time to finalize the settlement in the long-running legal battle.

XRP Lawsuit: Court Grants Ripple & SEC’s Joint Motion

As revealed in a court document, the US Court of Appeals has granted Ripple and the US Securities and Exchange Commission’s (SEC) joint motion to hold the appeal in abeyance. The court has further directed the Commission to file a status report within 60 days of this order.

This court order consequently suspends the ongoing appeal and cross-appeal filed by the SEC and Ripple, respectively. As CoinGape reported, both parties had filed the joint motion to suspend the appeals in light of them reaching a settlement.

The SEC and Ripple argued that holding the appeal in abeyance will help conserve judicial and party resources while they both continue to pursue a negotiated resolution of this matter.

In March, Ripple agreed to drop its cross-appeal against the SEC following the latter’s decision to drop its appeal in the long-running XRP lawsuit. However, the matter is yet to be finalized as both parties revealed in the filing that they need additional time to obtain the Commission approval for their agreement-in-principle.

Once approved, both parties will still need to get an indicative ruling from the District Court. As part of the agreement, Ripple and the SEC had agreed that the former would only pay $50 million out of the $125 million penalty that Judge Analisa Torres awarded against the crypto firm. The Commission also agreed to request that Judge Torres lift the standard injunction that it imposed on Ripple.

Possible Reason For The Delay?

It remains unclear why the Commission has yet to approve the agreement in the XRP lawsuit. However, a possible reason could be that the SEC is holding out for Paul Atkins to assume office.

As CoinGape reported, the US Senate has confirmed Atkins as the next SEC Chair. The next step is for US President Donald Trump to sign off on the confirmation and swear him in as Gary Gensler’s successor.

Once the Commission approves the agreement, Ripple and the SEC will ask Judge Torres for relief from her earlier judgment. Once that happens, the Court of Appeals can strike out the appeal and remand the case to the District court for a full ruling on the agreement.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Price analysis

5 Biggest Ripple (XRP) Price Predictions for April 2025

Published

1 day agoon

April 15, 2025By

admin

Fifteen days into April, Ripple (XRP) price has endured volaltile swings. Reacting to recent catalysts ranging from RLUSD rollout to wew SEC Chair Paul Atkins’ confirmation—prominent analysts have pegged bold XRP price forecasts between $1.80 and $4.50.

Ripple ( XRP) Predictions for April Diverge Widely as Market Volatility Mounts

In March 2025, Ripple secured a resounding win in its long-running case with the US Securities and Exchange Commission. This positive catalyst prompted many investors, market watchers and prominent cryptocurrency analysts to make audacious price predictions for April 2025.

However, with the month now at the half-way mark, fresh developments in the US trade war and new crypto-friendly SEC chief Paul Atkin’s finally taking office have pulled XRP in different volatility swings. This examines the biggest XRP price prediction for April 2025 have fared so far.

1. Changelly $2.12 support forecast still play

According to Changelly, a widely used crypto exchange known for its algorithmic forecasts, XRP is expected to trade between $2.12 and $4.52 this month, citing increasing volume and strong momentum.

That prediction arrived just days after Ripple price surged 10% in 24 hours to reach $1.99, driven by Bitcoin’s bullish move and a marketwide uptick in sentiment following the Trump administration’s decision to pause tariff hikes on key Chinese imports.

2. RLUSD narrative: Halli Uzzi’s $3 Breakout target remain within touching distance

Other analysts have echoed similar short-term bullishness. Crypto trader Hali_uzzi noted XRP’s fundamentals are strengthening, particularly due to the rollout of Ripple’s new U.S.-dollar stablecoin, RLUSD, and expanding institutional adoption.

The trader estimates a range of $2.50 to $3.00 in April, with the potential to climb toward $15 by May if adoption trends persist.

3. Investorie’s conservative outlook signals consolidation around $2.30

Meanwhile, another analyst posting under the Investorie pseudonym issued a more measured view, forecasting an April trading range between $1.80 and $2.90, with $2.30 labeled as the “realistic” price level.

This aligns closely with XRP’s recent technical structure, which shows support around $1.85 and resistance near the psychological $2.50 mark.

4. Cryptogeek $58,000 hype falters under bearish market sentiment

However, not all predictions have been tethered to market realities. A viral post by CryptoGeekNews citing Forbes projected an astronomical price of $58,000 per XRP—a level that would imply a market cap larger than the entire global money supply. While such extreme targets often capture attention, analysts widely regard them as speculative and not grounded in institutional flows or historical precedent.

Binance was referenced in an earlier post suggesting XRP could hit $600 in 2025, though no direct source was provided, and no mention was made of April-specific targets.

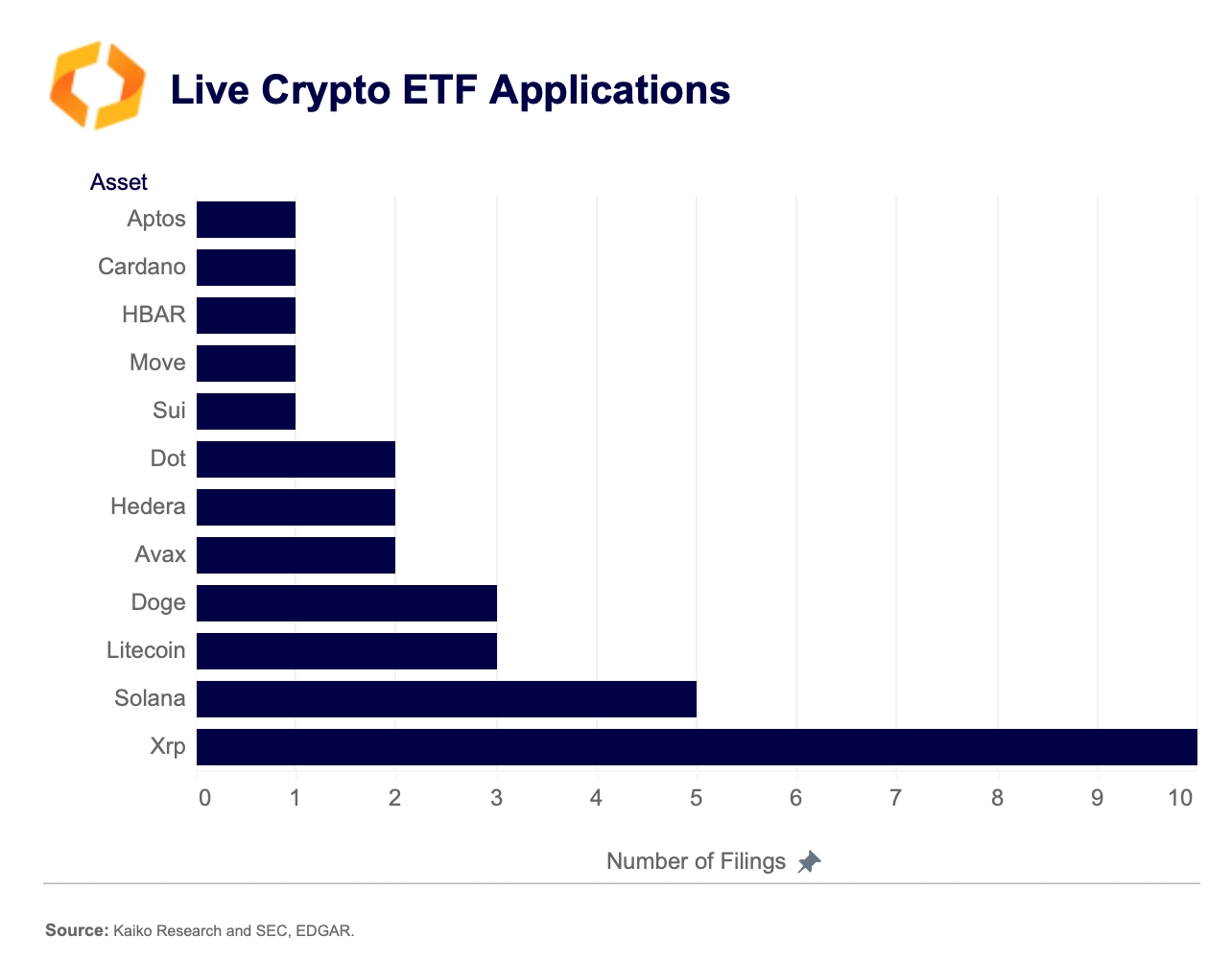

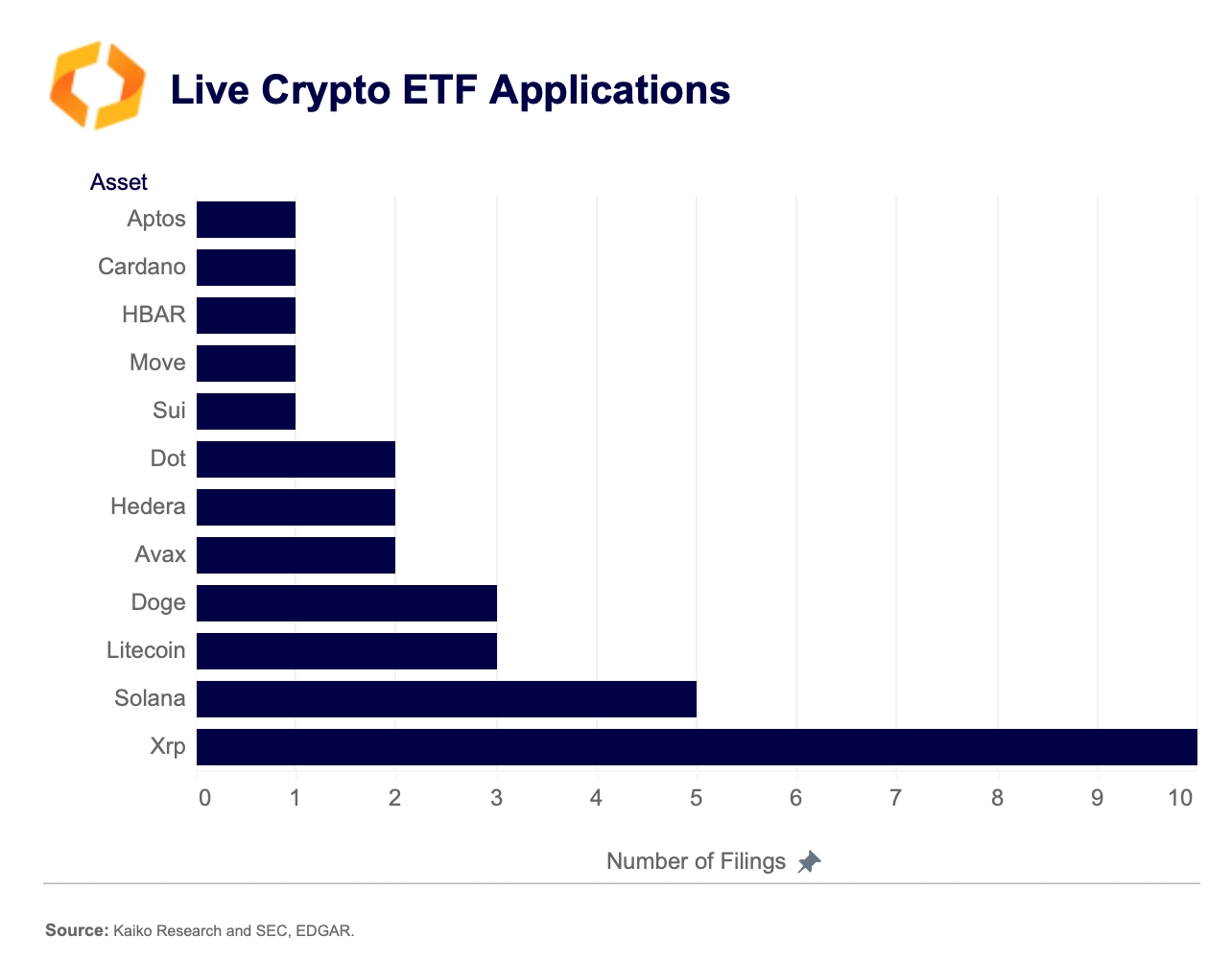

The post, however, speaks to the growing buzz surrounding a potential XRP ETF, which remains a topic of interest among investors betting on Ripple’s regulatory clarity and its real-time fiat settlement use case.

Looking Ahead:

Looking ahead, XRP’s ability to sustain April’s gains will likely depend on macroeconomic stability, crypto market leadership from Bitcoin, and Ripple’s success in onboarding institutions to the RLUSD framework. While triple- or quadruple-digit predictions make for sensational headlines, most expert analysts agree that a realistic target range for XRP this month sits between $2.30 and $4.50, barring any unforeseen catalysts.

- XRP Price Forecast Today: Eyes $2.35 With Bullish Momentum Building Above Key Support

XRP price is showing weakened bullish strength after reclaiming the mid-Bollinger Band level near $2.02,this week. However market volume indicators suggest upside continuation is possible if momentum holds.

Indicators on the 12-hour candle, shows XRP trades at $2.11, sitting comfortably above the Parabolic SAR at $1.83, which flips bullish when price closes above the blue dots. This alignment supports the case for an extended move higher, potentially toward the upper Bollinger Band at $2.27, with an intraday target of $2.35 if volume follows through.

While short-term price action has consolidated sideways, the contraction of the Bollinger Bands hints at an imminent breakout. A close above the March resistance zone near $2.20 could trigger that move. However, the Volume Delta shows persistent net selling over the past 48 hours, indicating weakened conviction behind the rally. A failure to break above $2.27 could invite sellers to retest the $2.02 mid-band and potentially expose the lower support zone at $1.76. Bulls need to maintain momentum or risk bearish reversal pressure creeping back in.

Frequently Asked Questions (FAQs)

Most analysts, including Investorie and Changelly, predict XRP trading between $2.30 and $4.50 this April, citing technical momentum.

No. While viral posts cite massive targets, such predictions lack credible fundamentals and are widely dismissed by serious market analysts.

Factors include Ripple’s SEC case win, RLUSD adoption, crypto-friendly policy shifts, and Bitcoin-led market sentiment.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ripple Whale Moves $63M As XRP Tops List for Spot ETF Approval

Published

2 days agoon

April 15, 2025By

admin

A large Ripple whale has moved 29,532,534 XRP, valued at $63.81 million, from an unknown wallet to Coinbase. This Ripple whale transfer comes at a time when XRP is making waves in the cryptocurrency market, positioning itself as one of the top candidates for a U.S. spot ETF approval.

XRP’s increasing liquidity and recent developments have placed it in direct competition with Solana (SOL) for ETF approval, with analysts predicting XRP may secure approval sooner than its rivals.

XRP’s Growing Liquidity Boosts ETF Prospects

XRP has shown a marked improvement in liquidity over the past few months, positioning itself as a strong contender for a U.S. spot ETF. A study of market depth done by Kaiko Indices shows that XRP and Solana have the deepest 1% market depth on vetted exchanges. XRP’s liquidity has increased since late 2024, outperforming that of Solana and even risen to two times that of Cardano’s ADA.

Several events have enhanced XRP’s liquidity, such as Teucrium’s launching of a 2x XRP ETF in the recent past. This leveraged product tracks European ETPs and swap agreements, offering double the daily returns of XRP.

On the launch date, it traded above $5 million, becoming the best-performing fund for the Teucrium Fund Company. Such momentum brings XRP the vital support for its objective to establish a place in the approval process for the U.S. spot ETF.

Despite the absence of a robust futures market, as seen in BTC, XRP has gradually made an increased impression in the US spot market. This triggered the token’s market share to go to the highest level since the SEC lawsuit in 2021, which triggered multiple delistings.

In this regard, Solana’s market share has decreased to 16% from the 25-30% recorded in 2022. According to analysts, XRP continues to trade significantly in the spot market, which could pave the way for approval soon.

Ripple’s Push for ETF Approval

The SEC has approved various filings for XRP spot ETFs, with a key deadline for Grayscale’s amendment scheduled for May 22. Additional good news came from the regulatory channel, confirming Paul Atkins as the new SEC Chair. Since several deadlines are set for the ETFs in the cryptocurrency market, Atkins’ leadership could determine the fate of XRP and other assets.

XRP’s situation differs from Bitcoin’s, as it lacks a robust futures market, making the cryptocurrency’s regulatory landscape more complex. However, rising liquidity and introducing the 2x XRP ETF have shifted the narrative firmly towards Ripple’s token. Therefore, the steps taken by the SEC in reaction to Grayscale’s filing will set the direction through which XRP may or may not get approval.

Despite this, according to data from Polymarket, there is a 74% chance that XRP will be approved for a spot ETF by December 31, 2025. However, there is still cautious optimism in the option market for XRP.

Data from Deribit reveals an abundance of bear call options, indicating that traders mainly hedge against further downside. This is partly due to worries from the broader market, such as macroeconomic issues that may affect crypto assets, like the Trump tariffs.

XRP Price Trend Amid Ripple Whale Moves

Looking at the technical analysis of the XRP price, there are indications of purely bullish opportunities. According to crypto analyst TheDefilink, XRP price is presently trading above key support levels on the daily charts, and as signified by the Ichimoku Cloud, the trend remains bullish.

In addition, large token transfers mean that Ripple whales are active on the market. The latest 29 million XRP transferred to Coinbase, alongside the 70 million XRP transfer between two unknown wallets, also depicts interest in XRP.

Additionally, the tightening of XRP’s Exponential Moving Averages (EMAs) suggests a potential golden cross could be forming, a pattern often associated with upward price movements.

According to the analyst, XRP price resistance levels are $2.23 and $2.50, with support levels at $1.96 and $1.61. A successful move above the $2.23 resistance could further energize the bullish sentiment surrounding XRP, aligning with a recent CoinGape XRP price analysis.

However, failure to hold the $1.96 support level might lead to a shift in market sentiment, potentially triggering a bearish correction in the short term.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

✓ Share: