Altcoin

Dogecoin Hits Weekly Support Trendline, Analyst Signals Cycle Bottom Is In

Published

2 months agoon

By

admin

Recent price decline action has seen Dogecoin rebounding at a recent multi-month low after the entire market started last week on a liquidation stretch. However, technical analysis from analyst Trader Tardigrade suggests that Dogecoin may have already established its cycle bottom before the next price surge.

Dogecoin Tests Key Weekly Support After 40% Drop

The cryptocurrency market faced a significant downturn last week, with widespread losses hitting various digital assets. Dogecoin was no exception to the sell-off, experiencing a sharp decline of nearly 40% before finding support around $0.22. This drop marked the lowest price Dogecoin has reached since the beginning of 2025, and the last time it traded at this level was in early November 2024.

Related Reading

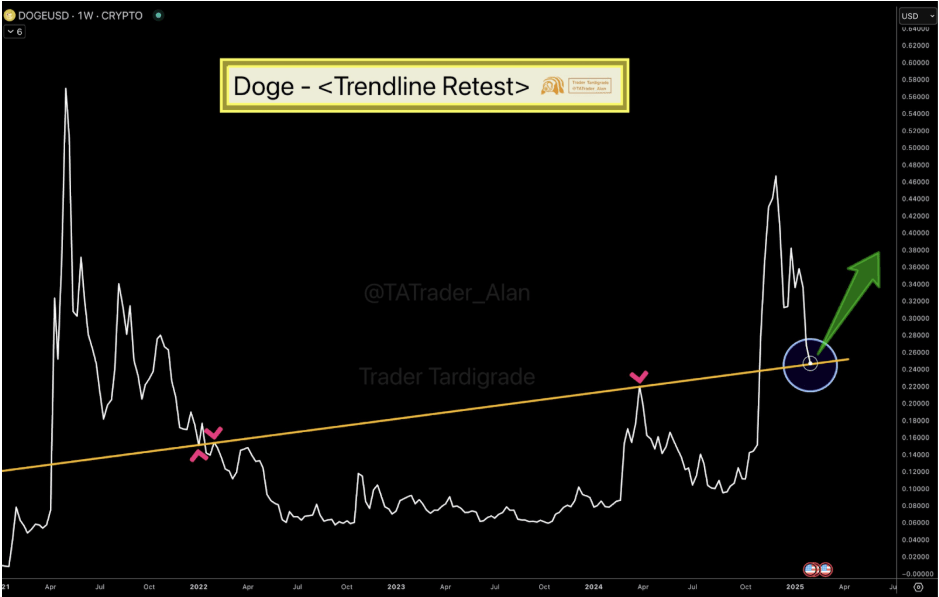

Despite the severity of the drop, technical analysis from crypto analyst Trader Tardigrade suggests that Dogecoin’s recent 2025 low may be more significant than it appears at first glance. In a social media post on platform X, the analyst shared a weekly timeframe chart highlighting that $0.22 is part of a key trendline that played a crucial role in Dogecoin’s price movements throughout 2024.

Now, with the price falling back to this level and bouncing off it, Trader Tardigrade noted that the trendline has seemingly flipped into a strong support zone.

As of now, Dogecoin has rebounded to $0.2561, reflecting a positive reaction of approximately 16% from its recent low. Notably, on-chain data from IntoTheBlock shows buyers stepped in just around this support level. However, Dogecoin’s ability to hold above this support level in the coming weeks will determine if the cryptocurrency has truly reached a bottom for the rest of this cycle.

Image From X: Trader Tardigrade

Historical Pullbacks Point To $2 Price Target

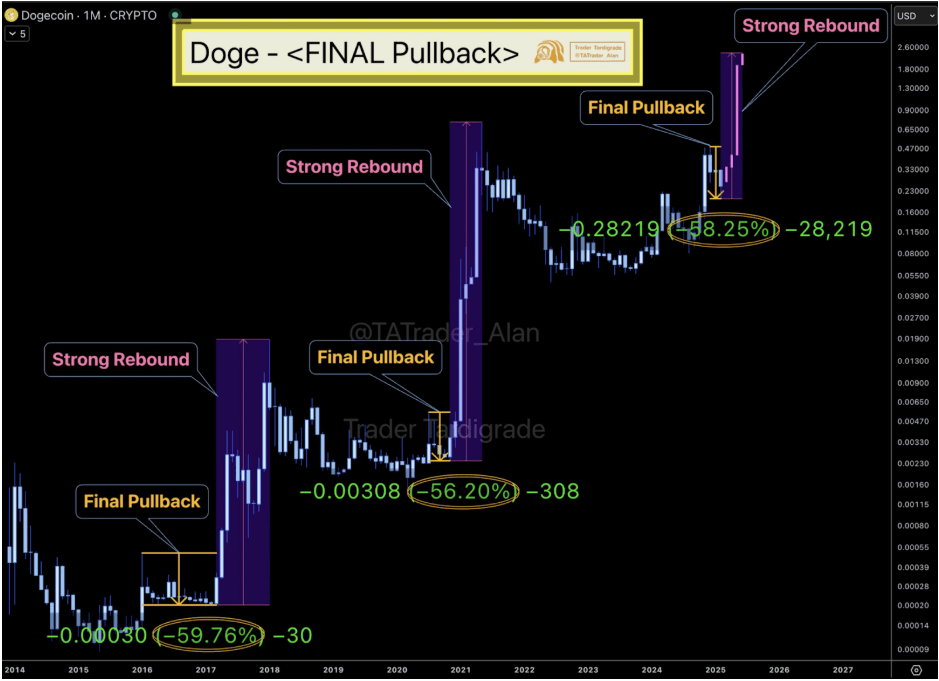

In another analysis, Trader Tardigrade highlighted a recurring pattern in which the Dogecoin price tends to experience significant pullbacks of more than 50% after a strong multi-month rally. However, these pullbacks have always been accompanied by another strong rebound rally, and Dogecoin eventually reached a new peak.

His analysis noted three major pullbacks: the first saw a decline of 59.76%, the second dropped by 56.2%, and the most recent pullback registered a 58.25% drop. Based on this historical behavior, Tardigrade noted that the recent correction might be accompanied by another strong rebound.

The last such a rebound happened, Dogecoin went on a 23,000% increase to reach its current all-time high of $0.73. From here, Trader Tardigrade predicted a similar playout to reach a price target of $2.

Image From X: Trader Tardigrade

Related Reading

The $2 price target has been a recurring prediction among crypto analysts for Dogecoin. One similar prediction came from crypto analyst Dima Potts, who predicted that Dogecoin is poised to target all-time highs between $1.50 and $2.10. For now, the first step for a bullish Dogecoin would be to break above $0.3.

Featured image from Mudrex, chart from TradingView

Source link

You may like

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

Altcoin

Cryptocurrencies to watch this week: Solana, Cronos, DOT

Published

1 day agoon

March 30, 2025By

admin

Cryptocurrencies will likely be volatile this week once President Donald Trump’s reciprocal tariffs go into effect and the U.S. publishes nonfarm payroll data.

The week started on a dull note, with most coins remaining in a bear market. At last check, Bitcoin (BTC) had dropped to $82,432.00.

The crypto fear and greed index has slumped to the fear zone 25. Some of the top cryptocurrencies to watch this week are Solana, Polkadot, and Cronos.

Solana

Solana (SOL), the popular layer-1 network, will be in the spotlight this week since its price is hovering above the key support level at $119.5. As shown above, it has failed to drop below this level several times since April last year, a sign that bears have been afraid of shorting below it.

Therefore, a drop below $119.5 will confirm a bearish breakdown and point to further downside. Besides, the Solana price formed a death cross pattern on March 3 as the 50-day and 200-day moving averages crossed each other.

A drop below $119.6 indicates a further drop to $100.

Cronos

Cronos, formerly Crypto.com, will be one of the top cryptocurrencies to watch this week because of its strong performance last week. It jumped by 30% in the last seven days, and by 54% from its lowest point this year.

Cronos price has bounced back after Crypto.com partnered with Donald Trump’s Trump Media to launch ETFs. It also rose after the community voted to allow the creation of another 70 billion CRO tokens, which will be used to create a Strategic Crypto Reserve.

The community also voted to burn 50 million CRO tokens. The daily chart shows that the Cronos price rebounded after hitting the crucial support level at $0.0715, where it failed to drop below in August and November last year.

A breakout above this month’s high of $0.1197 will point to further gains, potentially to the 50% retracement level at $0.133.

Polkadot

Polkadot (DOT) will be a top crypto to watch because its price is at a crucial support level. DOT was trading at $4.08, a few points above the key support point at $3.60.

This support is crucial since it failed to drop below it several times since 2022.

Polkadot price has also formed a falling wedge pattern, with the two lines nearing their confluence level. This price action points toward a strong bullish breakout in most periods, which may happen this week. Such a move would see DOT price jump to $12.

Source link

3M Bollinger Bands

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

Published

3 days agoon

March 28, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has once again fallen below the $2,000 mark, a psychological level it had briefly reclaimed earlier this week. The market-wide correction over the past 24 hours has weighed on Ethereum’s recovery momentum, and the leading altcoin has seen a dip in sentiment that could lead to a deeper decline or a sharp mid-term rebound.

Short-term sentiment is cautious, but a new analysis from a well-followed crypto analyst has brought attention to a significant technical event that opens up a bullish perspective for the Ethereum price.

Ethereum Hits 300-Week Moving Average Again: What Happened The Last Time?

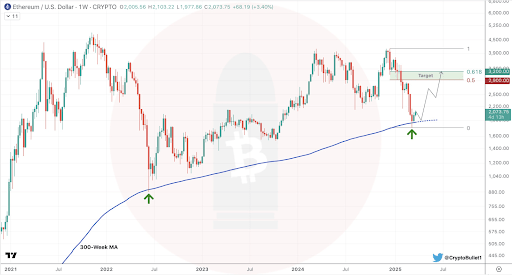

Taking to social media platform X, crypto analyst CryptoBullet pointed out that Ethereum has now touched the 300-week moving average for only the second time in its history. The first instance was in June 2022, during the market-wide crash that saw the Ethereum price plummet to as low as $880 before beginning a long, slow recovery.

Related Reading

The second occurrence has come this month, March 2025, just as Ethereum continues to extend its struggles in gaining a footing above $2,000. With Ethereum touching the 300-week moving average again, we can only look back to see what happened last time to get a perspective of what to expect now.

In June 2022, Ethereum’s touch of the 300-week moving average marked the beginning of a long-term recovery phase. After the bounce from that level, the Ethereum price surged more than 140% over the next eight weeks, eventually pushing above $2,100 in August 2022 before another correction.

Mid-Term Rebound In Focus For ETH, But Resistance Ahead

CryptoBullet noted the significance of this moving average, framing it as a key historical support zone. The analyst argued that regardless of bearish sentiment in the short term, this kind of macro-level support typically sets the stage for a meaningful bounce.

Related Reading

“Even if you’re a bear, you can’t deny that we hit a very important support level,” he wrote, adding that his price target for the coming bounce is between $2,900 and $3,200. Nonetheless, the bounce will depend on how the Ethereum price reacts to the level, as a continued downside move would cancel out any bullish momentum.

For now, Ethereum’s price is trapped under bearish sentiment, and bulls will need to reclaim the $2,000 zone before any sustainable bounce toward the $2,900 and $3,200 range can begin to materialize. Furthermore, the recent price correction in the past 24 hours increases the risks of the Ethereum price closing March below the 3M Bollinger bands, which is currently just around $2,000. A close below the 3M Bollinger bands could spell trouble for the leading altcoin.

However, if CryptoBullet’s analysis proves to be accurate, Ethereum may soon enter a period of stronger price action that plays out over the coming weeks. At the time of writing, Ethereum is trading at $1,907, down by 5.82% in the past 24 hours.

Featured image from Unsplash, chart from Tradingview.com

Source link

Altcoin

Dogecoin could rally in double digits on three conditions

Published

4 days agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

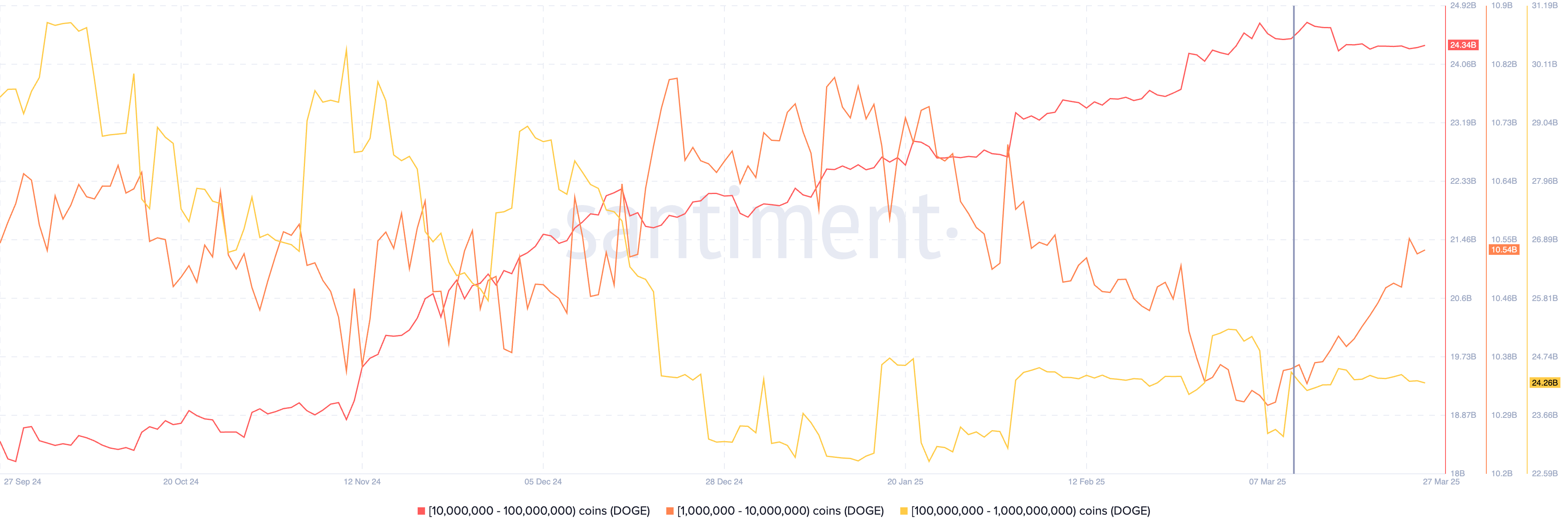

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Trump’s Crypto Dealings Are Making Regulation ‘More Complicated’: House Financial Services Chair

Pontus-X taps Oasis for private, cross-border data sharing in E.U.

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Crypto Investor’s Brave Yet Hilarious Prediction Speculates If XRP Price Will Hit $3,000 This Cycle

Dogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

California introduces ’Bitcoin rights’ in amended digital assets bill

MELANIA Insider Hayden Davis Selling Millions of Dollars Worth of Memecoin Amid 95% Drop: On-Chain Data

Toulouse starts to accept crypto for public transport

Bitcoin, Crypto Prices Slide as Trade Tensions, Inflation Risks Rattle Markets

Will BlackRock Investors Stay Bullish?

Bitcoin Could Appear on 25% of S&P 500 Balance Sheets by 2030, Analyst Says

Centralization and the dark side of asset tokenization — MEXC exec

Bitcoin Support Thins Below $78,000 As Cost Basis Clusters Shift Toward $95,000

Cryptocurrencies to watch this week: Solana, Cronos, DOT

EU Regulator Pushes for New Capital Rules for European Insurers Holding Crypto Assets

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x