Altcoins

Attention Shifting Away From Memecoins to Bitcoin, Ethereum, Solana and Cardano: Santiment

Published

1 month agoon

By

admin

Attention in the crypto sector is shifting away from memecoins and moving towards large-cap layer-1 projects, according to the digital asset analytics firm Santiment.

Santiment notes traders are more focused on Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Toncoin (TON) and Cardano (ADA), which the firm says suggests a healthier crypto market dynamic.

“A shift in trader attention from meme coins to Bitcoin and layer-1 assets is generally a sign of a more stable and sustainable market environment. Memecoins tend to attract speculative enthusiasm, often driven by hype, viral trends, and a gambling mindset rather than fundamental value. When these assets dominate discussions, it typically signals a phase of excess greed, where traders chase rapid, short-term gains without considering long-term viability.”

Santiment says a focus on Bitcoin and other layer-1 projects suggests a “more mature and informed approach” from the crypto community.

“Historically, memecoin frenzies precede market corrections, as speculative excesses often lead to sharp reversals when hype fades. When traders pivot back to assets with strong utility and established market positions, it suggests a healthier market cycle. This shift encourages a more balanced ecosystem, reducing the risk of unsustainable price surges and crashes fueled purely by speculative mania.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

Altcoin

XRP To Triple Digits? Analyst Confident In $100 Price Goal

Published

6 hours agoon

March 18, 2025By

admin

As one of the top-performing digital assets in the 4Q of 2024, it’s only natural that Ripple’s XRP attracts attention from its detractors and bullish supporters. The bearish sentiment has been wearing down the asset in the last few weeks, pushing the altcoin to as low as $1.96 last March 11th, the lowest in its three-month chart.

XRP has been highly volatile this month, trading between $2.30 and $2.47, still down by 1.6% from its previous month’s price.

The sentiment is still bearish, but for some crypto analysts like Captain, XRP is set to increase, with $100 as its realistic target. Egrag Crypto, on the other hand, offers a more conservative estimate, saying that XRP can reach double digits this cycle.

#XRP 100$ Realistic Target For This Bullrun

pic.twitter.com/lh403ilBjJ

— XRP CAPTAIN (@UniverseTwenty) March 15, 2025

Analyst Sets $100 As ‘Realistic’ Target

In a recent Twitter/X post, XRP Captain (@UniverseTwenty) shared that $100 is Ripple’s realistic target this cycle. The post has now received dozens of replies, but it leaves more questions than answers. For example, the crypto analyst failed to identify the timeframe for this surge or the factors or events that can trigger this surge.

XRP Captain’s latest tweet comes just as Egrag Crypto (@egragcrypto) added his thoughts on the coin’s direction. In the Twitter/X thread, Egrag Crypto boldly claims that XRP will hit double digits this cycle and surge to triple digits next.

#XRP = Thread (1/7) #XRP: Double Digits This Cycle, Triple Digits Next!

The thread below about #XRP was shared in the Subscribers section on February 12, 2025.

We’ve built together the Full Elliot Wave Count to assess our next Targets:

Take an in-depth look at it!

… pic.twitter.com/NKv00Y5MZD

— EGRAG CRYPTO (@egragcrypto) March 12, 2025

To justify his predictions for the short term, Egrag Crypto used his “Just Do It” chart. He explained that the measured wave or cup pattern movement has formed within the arc, then added that the potential to this movement is $13.

Will XRP Break Past $300?

Ripple has a few bullish supporters right now, with crypto commentator Dark Defender adding his thoughts on the asset’s latest performance. According to Dark Defender, XRP can surge to $333 if it duplicates its impressive performance during the 2017 bull run.

Dark Defender’s arguments and predictions for XRP received plenty of criticism. Some argue that XRP will not achieve this market price due to its market cap. Based on the current circulating tokens, XRP’s market cap will hit $1.6 trillion if its price just hits $280. Dark Defender shot down this argument and added that a crypto market cap doesn’t matter and is “just an illusion.”

Featured image from Pexels, chart from TradingView

Source link

Altcoins

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Published

16 hours agoon

March 17, 2025By

admin

A man linked to the launch of two collapsed memecoins has reportedly gone ahead with another project despite a potential Interpol Red Notice with his name on it.

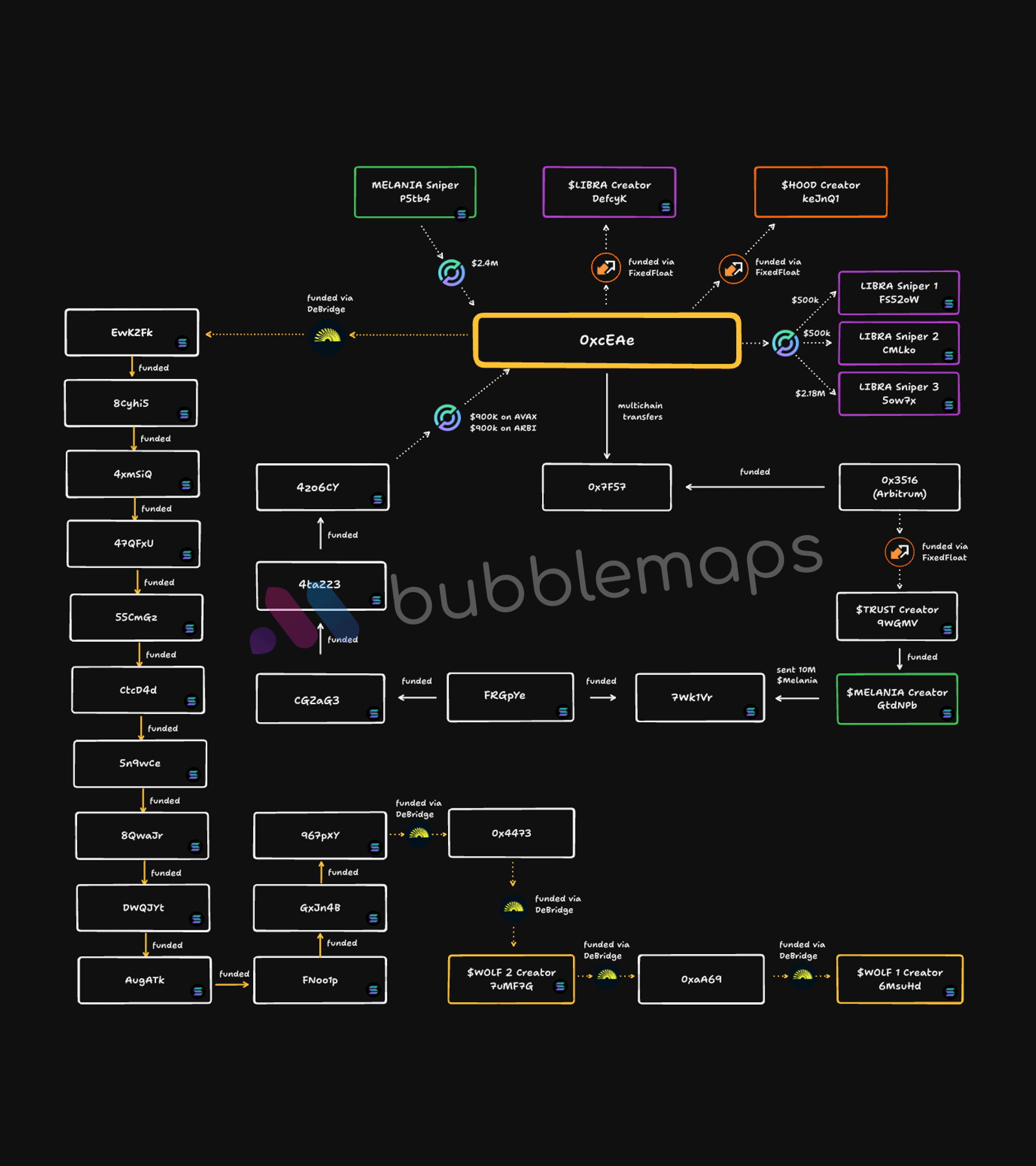

Blockchain analytics firm Bubblemaps reports that Hayden Davis was involved in launching WOLF, a coin inspired by the Wolf of Wall Street, the hit film based on former stockbroker Jordan Belfort.

Davis admitted to being behind the launch of LIBRA, a memecoin initially backed by Argentinian president Javier Milei. He was also copped for his involvement in the launch of MELANIA, a coin based on US First Lady Melania Trump. Both coins collapsed over 92% very shortly after their launch and have not recovered.

Shortly after the launch of LIBRA, Milei disavowed the memecoin, claiming he did not understand what he was getting himself into.

According to Forbes, Argentinian prosecutor Gregorio Dalbón has asked for a judge to arrange for an Interpol arrest warrant on Davis for his role in LIBRA.

Says Dalbón,

“I’m here to request the immediate detention of Hayden Mark Davis, a citizen of the United States, who is accused of being one of the principal actors behind the launch of the cryptocurrency LIBRA…

The possibility that Davis will abandon his country of residence or hide to avoid answering for his alleged acts appears to be aggravated by the economic resources he possesses, which he can use to move or remain in hiding, hindering our investigation.”

Despite the threat of being arrested, Bubblemaps says that one wallet that sniped the launch and collapse of WOLF behaved exactly the same as a wallet involved in a previous pump and dump allegedly linked to Davis.

“Starting with the WOLF creator 6MsuHd, we followed funding transfers back across 17 addresses and five cross-chain transfers.

All led to a single address: OxcEAe

The same one owned by Hayden Davis!

Why would Hayden do this?

Maybe he thought no one would trace it back to him.

He funded these wallets months before LIBRA and WOLF launched, moving money through 17 addresses and two chains.”

At time of writing, WOLF is trading for $0.00047, down nearly 99% from its all-time high of $0.0429 recorded on March 8th, according to DEX Screener.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

XRP Must Close Above This Level For Bullish Breakout: Analyst

Published

2 days agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has struggled to gain momentum, with its price caught in a downtrend since the beginning of March. Although XRP has managed to push up in the past five days after reaching a low of $1.93 on March 11, it has yet to fully recoup its losses in the first week of the month.

Related Reading

The altcoin’s long-term prospects are still on bullish speculation, but its short-term price action has frustrated traders looking for signs of a breakout. Amid this stagnation, crypto analyst Egrag Crypto has outlined specific price levels that could determine whether XRP finally reverses its course.

Analyst Identifies $2.65 As Key Level Before XRP Can Challenge $3.00

Egrag Crypto, a long-time bullish advocate for XRP, recently took to social media platform X to outline key price levels that could determine the cryptocurrency’s next significant move. He identified $2.65 as the first critical threshold the coin must reclaim to sustain meaningful bullish momentum. However, the analyst expressed concern over XRP’s repeated tests of lower boundaries, which is in reference to the recent bottom at $1.93.

According to the analyst, the frequent retests of this support level are a double-edged sword. While multiple touches on resistance can eventually trigger a breakout, repeated tests of support weaken its integrity, increasing the likelihood of a breakdown. He likened this pattern to knocking on a door that would eventually open or break. He highlighted six instances of XRP retesting this zone since December 2024 on a 12-hour candlestick chart, warning that prolonged weakness could pave the way for further downside.

For the crypto to escape this cycle and shift into bullish territory, Egrag emphasized the importance of a strong close above $3.00, not just a brief move past it. This level has served as the upper resistance trendline for the past two weeks and has been a barrier to any sustained uptrend. Failure to break and hold above $3.00 could cause continued correction in the short term and keep XRP trapped in its current range.

However, the analyst believes XRP’s chances of reaching $3.00, considering the current price action, are slim without securing a close above $2.65.

Image From X: EGRAG CRYPTO

What’s Next For XRP After $3?

March has been particularly bearish for XRP, with sellers maintaining control as it failed to reclaim lost ground. However, if XRP bulls manage to close above $3 before the end of the month, it will open up the door for the resumption of a price rally. With this in mind, Egrag set an initial target of $4.80, placing XRP at new all-time highs.

Related Reading

Interestingly, this target is modest compared to the analyst’s more ambitious long-term projections. Egrag has previously predicted that XRP could surge to $110 in the long term. At the time of writing, XRP is trading at $2.37 and is still 26.5% away from reaching $3.

Featured image from Crypto Logos, chart from TradingView

Source link

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x