Ethereum

3 DeFi Coins That Could 100X as Ethereum Foundation Deploys 30,800 ETH

Published

1 month agoon

By

admin

DeFi coins on the Ethereum network have retreated this year, aligning with other cryptocurrencies. Some of the top blue-chip DeFi crypto coins on the network may start benefiting from an investment by Ethereum Foundation, which has started to deploy its 50k ETH balance. This article explores some of the best DeFi tokens that could achieve a 100x return.

Top DeFi Coins That May 100X as Ethereum Foundation Deploys

Ethereum Foundation, which has been actively selling its ETH holdings, has started to deploy these funds to DeFi networks in its ecosystem. It has supplied 10k wETH tokens to Spark and 20.8k wETH to AAVE. It now has 9,200 ETH tokens to distribute, possibly to other DeFi networks in its ecosystem. Some of the potential DeFi coins that may benefit are Lido DAO (LDO), Morpho (MORPHO), and Uniswap (UNI).

Lido DAO (LDO)

Lido DAO is the biggest player in the decentralized finance industry with over $25 billion in staked assets. It is also the most profitable Ethereum DeFi network, making over $124 million in fees this year.

Speculation among social media users is that Ethereum Foundation may deploy some of the balance to its network.

LDO token remains much lower than its all-time high of $4.040 and technicals suggest that it has more upside to go. The chart shows that the coin has formed a cup and handle pattern. It has already completed the cup section and is now in the handle part.

As such, a rebound above the upper side at $2.48 will point to more upside, potentially to its all-time high at $4.038, up by 125% from the current level.

Morpho (MORPHO)

Morpho is one of the best DeFi coins that may surge in the near term. It is a leading DeFi network deployed on Ethereum and Base. It has accumulated over $6 billion in deposits and has $2.18 billion in active loans.

Morpho is a good DeFi crypto coin to buy because Coinbase selected it to offer crypto loans earlier this year. Also, the total value locked in its ecosystem has continued growing. As such, Ethereum Foundation may decide to deploy capital to the network to boost its ecosystem growth.

Uniswap (UNI)

Uniswap is one of the best DeFi coins that may generate substantial returns over time. Its UNI token has crashed by almost 50% from its highest point in December, making it a bargain.

Uniswap has numerous catalysts that may push it higher. It is a highly profitable network that has already made $146 million in fees this year. Uniswap also launched the Unichain mainnet that may lead to more transactions and volume. Further, Uniswap still handles billions worth of transactions a day. Its seven-day volume was $16 billion, while its monthly one was $105 billion.

Other Ethereum DeFi Crypto Coins to Buy

The other popular Ethereum DeFi Coins that may surge soon are Ethena, Maker, Compound Finance, and Rocket Pool.

Frequently Asked Questions (FAQs)

Some of the top blue-chip DeFi tokens may surge in the long term are those with strong utility and those that survived the recent bear markets. Notable names are Ethena, Morpho, AAVE, Spark, and Uniswap.

Deploying capital to its ecosystem assets is a sign that Ethereum is upbeat about its ecosystem and its long-term prospects.

The top 5 Ethereum DeFi coins by their asset value are Lido, AAVE, EigenLayer, Ether.fi, and Ethena.

crispus

Crispus is a seasoned Financial Analyst at CoinGape with over 12 years of experience. He focuses on Bitcoin and other altcoins, covering the intersection of news and analysis. His insights have been featured on renowned platforms such as BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

ETH

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Published

5 hours agoon

March 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism in the market, but the momentum was short-lived, as ETH quickly pulled back below the level and was unable to confirm a solid hold. Analysts widely agree that a strong and sustained move above $2,000 is critical for Ethereum to initiate a broader recovery rally.

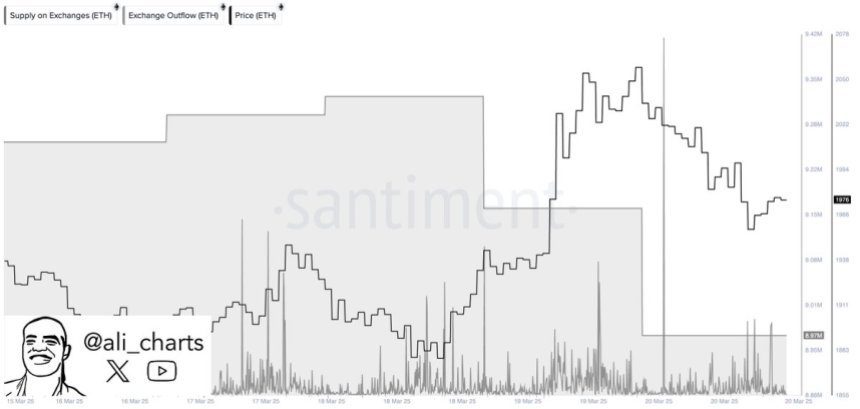

Related Reading

Despite the hesitation at resistance, on-chain data shows signs of growing investor confidence. According to Santiment, investors have withdrawn over 360,000 ETH from centralized exchanges in the last 48 hours. This shift is often interpreted as a bullish signal, suggesting that large holders are moving their assets to private wallets, possibly in anticipation of higher prices.

Meanwhile, the broader macroeconomic landscape continues to apply pressure. Trade war tensions and unpredictable policy decisions from the U.S. government have weighed heavily on both crypto and traditional markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest exchange outflows hint at a potential trend shift — one that could favor accumulation and set the stage for the next major move, provided bulls can reclaim and hold above the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has lost over 57% of its value since mid-December, falling from a high of around $4,100 to recent lows near $1,750. This sharp correction has created a challenging environment for bulls, who have repeatedly failed to reclaim and hold higher price levels.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the foundation for a recovery rally. However, a failure to do so would likely result in further downside and reinforce the bearish trend.

Related Reading

The current market landscape struggles with uncertainty. On one side, continued macroeconomic headwinds—rising trade tensions, inflation concerns, and policy shifts from the U.S. government—have weakened investor confidence and driven volatility across risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared data from Santiment, revealing that investors have withdrawn over 360,000 ETH from centralized exchanges in the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, as they suggest investors are moving assets into cold storage for long-term holding rather than preparing to sell.

This move could indicate growing confidence among large holders and signal the early stages of a new accumulation phase—provided Ethereum can hold above $2,000.

Price Holds Steady Below $2,000

Ethereum is currently trading at $1,960 after briefly attempting to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 remains a crucial barrier that bulls must overcome to shift market momentum in their favor. Despite a small bounce from recent lows, Ethereum has struggled to gain traction amid persistent market uncertainty.

Bulls need to push ETH above $2,000 and reclaim higher levels such as $2,150 and $2,300 to confirm the beginning of a recovery phase. A sustained move above these levels would not only signal a potential trend reversal but could also attract sidelined investors back into the market. Until that happens, Ethereum remains vulnerable to continued downside pressure.

Related Reading

If bulls fail to break above the $2,000 resistance in the coming sessions, Ethereum could lose support at current levels and revisit lower demand zones around $1,850 or even $1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak sentiment, the coming days are likely to be pivotal for ETH’s short-term direction. A decisive move either above or below this key range will likely set the tone for the next major price action.

Featured image from Dall-E, chart from TradingView

Source link

Altcoins

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Published

1 day agoon

March 20, 2025By

admin

Tron (TRX) founder Justin Sun has staked $100 million worth of Ethereum (ETH), according to the blockchain analytics platform Arkham.

Arkham notes that Sun’s staked ETH will yield $3 million worth of Ethereum per year in passive income.

In addition to staking ETH, Sun also teased that Tron’s native asset, TRX, would soon be available on the Ethereum competitor Solana (SOL).

Sun, a polarizing figure in the crypto community, says it is currently “Tron meme szn [season].” He also notes that the issuance of top stablecoin USDT on Tron recently reached a new all-time high of $64.7 billion.

The U.S. Securities and Exchange Commission (SEC) recently paused its civil case against Sun. According to recent court filings, the Tron founder and the regulatory agency jointly asked United States District Judge Edgardo Ramos if they could “move to stay [the] case to allow the parties to explore a potential resolution.” Ramos granted the application a day later.

In 2023, the SEC accused Sun – who went on to invest millions of dollars into President Donald Trump’s decentralized finance platform World Liberty Financial – and his crypto firms of fraud, selling unregistered securities and manipulating the price of the digital asset TRX via wash trading.

TRX, a layer-1 asset, is trading at $0.23 at time of writing. The 10th-ranked crypto asset by market cap is down nearly 1% in the past day but up nearly 3% in the past week.

ETH is trading at $2,033 at time of writing. The second-ranked crypto asset by market cap is up nearly 7% in the past 24 hours and more than 8% in the past seven days.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects

Source link

Altcoin

Ethereum To $4,000? Standard Chartered Lowers Expectations

Published

3 days agoon

March 19, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum, like the broader crypto market, has experienced a sharp drop in price in recent weeks. From a high of $3,352 at the start of 2025, Ether now trades around $1,800 and $1,900, reflecting a sharp drop to the world’s second-biggest crypto by market cap. Looking at Ether’s bigger picture, it’s down 47% from last year’s value.

Related Reading

If we go by the latest analyses and observations from commentators, Ether’s price correction will likely be extended. The altcoin is facing a huge bearish wave, with plenty of market factors undermining its price performance.

One significant factor is Standard Chartered’s recent decision to cut its price prediction by 60%, confirming market expectations.

News: Standard Chartered slashes ETH price target! 🚨

The bank cuts its 2025 ETH forecast from $10K to $4K, blaming Layer-2 networks like Base, which they say has drained $50B from Ethereum’s market value.#Ethereum #ETH #Crypto #Layer2 #Base #Blockchain

— Andres Meneses (@andreswifitv) March 17, 2025

Ethereum Faces A Descending Channel

Ethereum is currently in a price slump, and many experts expect a much deeper dive in the next few weeks. Ether’s price is currently floating above the $1,900 level as it continues its bearish price movements.

Analysts use the MACD indicator to verify and confirm the asset’s bearish sentiment. Also, the asset’s moving averages suggest a neutral trend and possible price consolidation.

Ethereum (ETH) remains in the correction zone today, trading around $1,874. The price continues to move in a descending channel, indicating a possible continuation of consolidation. Moving averages confirm the neutral trend: the price is holding below the 50-day and 200-day MA,… pic.twitter.com/R3vNqFBDkZ

— LVelarde (@0xvelarde) March 17, 2025

According to a crypto user named “LVelarde,” Ether’s price continues to follow the descending channel, suggesting price consolidation. The asset’s price is consolidating below its 5-day and 200-day moving averages, with traders looking for possible rejection or breakout. Since it fell below $2k, sentiments have been generally bearish, with many questioning its future price trends.

Standard Chartered Cuts Price Estimates For Ethereum

Even some of the biggest banks, like Standard Chartered Bank, are lowering their expectations of Ethereum. From a high of $10,000, the bank is reducing its price target to just $4,000, explaining that the Layer 2s are impacting its bottom line.

The bank added that changes and improvements to the blockchain affected its overall value, like its shift to the proof-of-stake and scaling roadmap.

Standard Chartered used Coinbase’s Base Layer 2 as an example, suggesting that the project has cost Ethereum $50 billion from its market cap. According to Geoff Kendrick, Standard Chartered analyst, Ethereum’s losses will continue as Base’s dominance in the industry continues.

Kendrick calls this the blockchain’s “midlife crisis”, adding that Ethereum’s chain has become a commodity with its Layer 2 framework.

Related Reading

Things Ethereum Can Do To Address Its Slide

According to Kendrick, Ethereum can address its downturn in two ways. First, it can leverage its security-based dominance in the context of the tokenization of real-world assets (RWA). If Ethereum focuses on security, it can maintain its 80% market share.

Second, it can charge taxes for its Layer 2s, but it’s highly unlikely. Kendrick expects Ethereum to continue its underperformance in the short term.

Featured image from Bloomberg, chart from TradingView

Source link

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

German regulator prohibits sales of Ethena USDe

US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash

What Would Pi Coin Price Look Like if Pi Network Reaches XRP Market Cap?

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: