Dogecoin

Elon Musk and Dogecoin: How the Billionaire Became the ‘Dogefather’

Published

2 months agoon

By

admin

As Dogecoin makes a comeback off the back of Bitcoin’s surge, some may be pondering: Where did the asset come from? What’s it for? And what’s Tesla CEO Elon Musk got to do with it?

The original meme coin’s boom largely has the world’s richest man to thank. Musk’s obsession with shitposting helped boost the coin to a top 10 cryptocurrency.

It’s been a wacky ride over the past few years, culminating in Musk’s appointment to lead a government agency called DOGE—yes, really. But we’ll explain it all.

2018: What the DOGE?

Dogecoin is the biggest and oldest meme coin and the second-biggest proof-of-work cryptocurrency. It was created in 2013 as a joke by developers Billy Markus and Jackson Palmer.

The idea was to poke fun at the huge number of altcoins and crypto projects entering the market following Bitcoin’s rapid ascent, and the coin enjoyed relative obscurity and a low price during its early years.

But then along came Musk. The eccentric billionaire asked Palmer in a 2018 tweet to help with the Twitter bot problem. Scammers had created a number of fake high-profile accounts, including Musk’s, in order to push crypto cons. The scams typically posted fake Ethereum giveaways.

It was the first real interest Musk had shown in Dogecoin.

2019: The pump begins

Musk started to pump Dogecoin the next year. “Dogecoin might be my fav cryptocurrency,” he wrote in April 2019, in response to a screenshot of a poll from the official Dogecoin account asking who should be the cryptocurrency’s CEO. “It’s pretty cool.”

The post would be the first of many to cause the asset’s value to rocket upwards. Soon after Musk’s first tweet about Dogecoin, the market cap of the coin hit $400 million and crypto exchange Huobi listed it.

Musk being Musk, however, didn’t stop there: He branded himself Dogecoin’s CEO—briefly—on Twitter before continuing to fire out tweets asking if the coin is “really a valid form of currency” or posting memes associated with the original dog-coin.

2020/2021: Bull run arrives

Musk continued to pump Dogecoin’s price here and there with his tweets, but things really got started during the 2021 bull run. Major exchanges like Coinbase Pro listed Dogecoin and the asset developed a bigger cult following, not to mention growing mainstream awareness.

DOGE gained a market cap bigger than many companies in the S&P 500. And developers exclusively told Decrypt that they had secretly been working with Musk since 2019 to make the coin a valid payment method and a greener, cheaper alternative to Bitcoin.

But things got stranger when Musk called himself the “Dogefather” ahead of a “Saturday Night Live” skit about the cryptocurrency—again sending the asset’s price roaring upwards. DOGE would jump to its all-time high price of about $0.73 at this time.

Musk’s “SNL” appearance ended up being underwhelming for Doge fans, with the SpaceX boss and his mother’s allusions to the coin ultimately pushing its price down. Still, it continued to bring the strange world of meme coins to the mainstream.

Later that year, Musk announced that his rocket company, SpaceX, would launch a satellite to the moon—completely funded by the cryptocurrency.

2022: Tesla/Twitter mania

The Doge mania continued into 2022 when Musk’s car company started accepting Dogecoin for merchandise.

Dogecoin continued to experience price bumps when Musk bought Twitter and rebranded it to X, hinting that it would also become a payments platform that might, eventually, integrate the O.G. meme coin.

Things came back to bite Musk later that year, though, when an American man hit the billionaire and Tesla and SpaceX with a $258 billion lawsuit for allegedly pumping Dogecoin—an asset with “no value at all,” according to the original filing.

But Musk and his lawyers scored a win this year when a judge sided with them and dismissed the lawsuit, calling the tech entrepreneur’s tweets about Dogecoin “aspirational and puffery,” and noting that “no reasonable investor could rely upon them.”

2024: Trump, Musk, and DOGE

Dogecoin had a relatively quiet 2023, but the meme coin has soared in recent months following Musk’s support of Republican Donald Trump’s campaign for the White House.

That’s mostly because Trump said that Musk would lead a government efficiency commission ahead of being voted back into the seat of power; Musk claimed that it would be called the Department of Governmental Efficiency—an acronym that matches Dogecoin’s ticker.

Whenever Musk mentioned his future political role with the so-called DOGE ahead of the election, the price of Dogecoin jumped.

But before Trump’s shock election win, Musk revealed what he has probably thought all along: that he isn’t seriously interested or involved in Bitcoin, Dogecoin, or any cryptocurrency. He just likes the meme coin.

“I’m actually not actively involved in crypto,” he said at a rally. “I make Dogecoin jokes and stuff because I just kind of like Dogecoin—because it’s got the best sense of humor and it has dogs and memes, and I love all those things.”

Still, the price of Dogecoin boomed higher, hitting a three-year high price of $0.48—though it’s fallen since, as of this writing. Musk has recently praised Dogecoin’s rate of inflation and tweeted out a familiar meme image of a dust cloud with the Doge face engulfing a city.

And President-elect Trump made it official that Musk would lead the administration’s new department, though planned co-lead Vivek Ramaswamy bailed in January due to other political ambitions.

Trump is even selling t-shirts showing himself and Musk alongside Doge-esque artwork. And the official DOGE website briefly featured the familiar DOGE meme imagery, boosting Dogecoin’s price in the process.

With Trump back in office, Musk’s DOGE has started aggressively interrogating U.S. government spending, grabbing headlines as it accesses potentially sensitive citizen data while upending professional norms in the process.

Edited by Andrew Hayward

Editor’s note: This story was originally published on November 13, 2024. It was last updated with new details on February 15, 2025.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

doge

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

Published

1 day agoon

April 15, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is showing signs of strength after weeks of volatility and market uncertainty. The meme-inspired cryptocurrency has held firm above crucial support levels and is now pushing toward a potential recovery rally. After reclaiming the $0.15 mark, bulls are looking to build momentum, with the $0.17 level emerging as the next major resistance to break. A successful move above this threshold could confirm a broader trend reversal and reignite bullish sentiment across the meme coin sector.

Related Reading

Supporting this outlook, recent on-chain data from Santiment shows that Dogecoin whales have been highly active—accumulating over 800 million DOGE in the last 48 hours. This surge in whale buying activity adds weight to the bullish thesis, suggesting that larger players are positioning for a move higher. The renewed accumulation, paired with improving technical conditions, has sparked optimism among traders and investors who believe Dogecoin could be gearing up for its next leg upward.

Still, caution remains, as global macroeconomic tensions continue to create unpredictable conditions across the financial markets. For Dogecoin to confirm a recovery rally, bulls must hold current levels and push through near-term resistance in the coming sessions.

Dogecoin Faces Crucial Resistance As Whale Accumulation Builds

Dogecoin is now at a pivotal point, trading just below key resistance levels after a strong rebound from recent lows. As broader market conditions improve and global tensions—especially around trade and tariffs—begin to cool, analysts are turning their attention to assets like DOGE that have lagged in performance but now show signs of potential upside. The meme coin has managed to reclaim the $0.15 mark, but to validate a broader recovery rally, bulls must push beyond the $0.17–$0.18 zone in the days ahead.

Momentum indicators are beginning to flip bullish, and some market watchers suggest that Dogecoin could be preparing for a breakout. However, sentiment remains mixed, with others pointing to the possibility of a continuation of the downtrend, particularly if resistance holds or macroeconomic conditions deteriorate. Despite this uncertainty, on-chain data paints a more optimistic picture.

Top analyst Ali Martinez shared insights on X, revealing that Dogecoin whales have accumulated over 800 million DOGE in the last 48 hours. This level of accumulation by large holders suggests renewed confidence in the asset’s short-term potential. Historically, such whale activity has often preceded strong price moves in DOGE.

For bulls to take control, Dogecoin must break above near-term resistance and sustain momentum amid a still-volatile environment. A failure to do so could see the asset slip back into consolidation or even retest previous lows. The coming week will be critical for determining whether DOGE’s next move is a breakout or another pullback.

Related Reading

DOGE Price Holds $0.16 As Bulls Aim for Breakout

Dogecoin is trading at $0.16 after failing to reclaim the 4-hour 200 Moving Average (MA) near $0.168, a level that has acted as strong short-term resistance. Despite recent bullish momentum across the crypto market, DOGE bulls are struggling to regain control. The $0.15 level now serves as critical support. If Dogecoin holds this area, there’s a strong chance it could push higher in the coming sessions.

A successful break above $0.17 would be significant, potentially opening the door to a rally toward $0.20, a level not seen since early April. However, price rejection and continued weakness around $0.168 suggest that sellers are still active, and bulls need to reclaim this moving average to build momentum.

Related Reading

If DOGE loses the $0.15 mark, downside risk increases sharply. A drop to $0.13—or even lower—is likely as bearish pressure could intensify in a volatile market. Investors will be watching closely for a clear move in either direction, as Dogecoin sits at a key inflection point. Volume and on-chain data, including recent whale accumulation, suggest potential, but confirmation must come through price action above immediate resistance.

Featured image from Dall-E, chart from TradingView

Source link

doge

Dogecoin Follows This Blueprint, Says Crypto Analyst

Published

3 days agoon

April 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

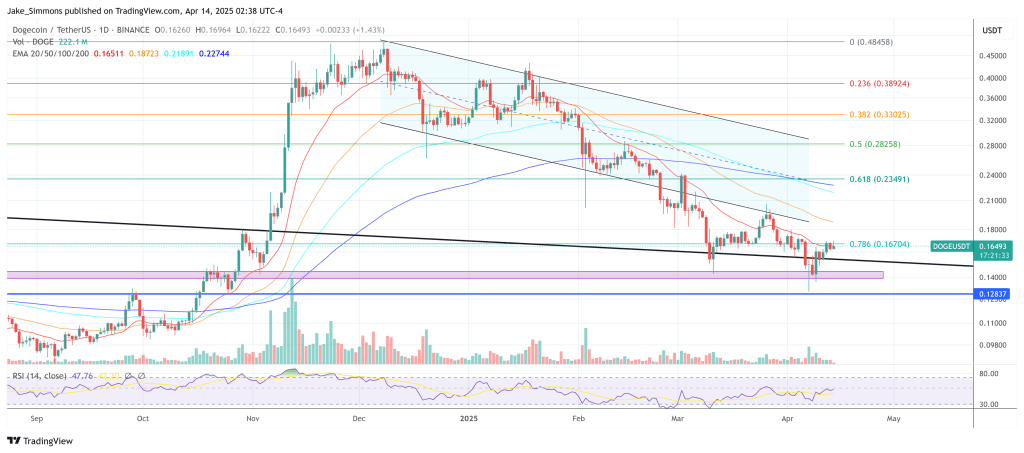

Dogecoin’s price action continues to honor the technical “blueprint” laid out by crypto analyst Kevin (@Kev_Capital_TA), who reaffirmed on Sunday that his strategic roadmap from March 22 remains intact. The weekly chart reveals an extended descending channel drawn with multiple yellow trend lines that originated in 2021 and constricted price action throughout 2022.

Within that formation, the most critical horizontal threshold appears to be $0.139, labeled on the chart as the “Last line in the sand” and described by Kevin as essential for preserving bullish market structure. He notes that maintaining durable weekly closes above this zone is paramount for further upside, while a decisive break beneath $0.139 would nullify the bullish thesis.

Dogecoin Follows The Blueprint

Dogecoin’s retracement from highs near $0.45 earlier this year has so far been contained by a confluence of support channels and Fibonacci retracement levels. According to Kevin’s chart, the primary Fib levels span from roughly $0.049 at the lower bound (0% Fib) to around $2.268 at the 1.414 extension.

Related Reading

Closer inspection shows intermediate Fibonacci markers at $0.090 (0.236), $0.138 (0.382), $0.190 (0.50), $0.262 (0.618), $0.413 (0.786), $0.542 (0.88), $0.738 (1.0), $0.934 (1.0866), and $1.543 (1.272). Since the price is hovering near $0.16–$0.17 at press time, Dogecoin has remained above the 0.382 retracement near $0.138, reinforcing Kevin’s argument that the risk-reward ratio at this level appears “absolutely phenomenal.”

Kevin’s March 22 update describes the confluence of several higher time frame indicators, including the Weekly Stochastic RSI, the 3-Day MACD, and the 2-Week Stochastic RSI, all of which he sees nearing full resets. He cites the previous weekly demand candle, which formed just above $0.139, as a key sign that buyers are stepping in to defend what he calls “the Last line of bull market support.”

The Weekly Stoch RSI on his chart is already situated at low levels, while the 3-Day MACD and 2-Week Stoch RSI appear roughly a month away from bottoming out. According to Kevin, these technical resets should serve as a springboard for Dogecoin’s next significant upward move, provided that Bitcoin, which he believes must hold above $70K in his scenario, remains stable enough to support broader market strength.

Related Reading

On Sunday, Kevin reminded his audience that this strategy, first made public on March 22, is going “exactly according to plan,” given Dogecoin’s confirmed bounce around the $0.139 region and the ongoing drift toward oversold conditions in multiple momentum gauges. He disclosed that his Patreon trading portfolio holds an average entry at $0.15 for this swing and noted that a swift rejection of sub-$0.139 weekly closes, coupled with the bullish stance of the higher time frame indicators, corroborates his confidence in Dogecoin’s recovery potential.

While he acknowledges that “lots of work” still needs to be done for Dogecoin to reclaim loftier levels near the 0.618 Fib around $0.262 or even the 0.786 Fib at $0.413, Kevin maintains that his initial thesis stands as long as the meme-inspired asset preserves its foothold above $0.139. For him, the risk of a breakdown is well-defined if the pivotal support gives way, but should the level persist, he sees the upside potential extending far beyond the current range. As of now, Dogecoin’s price continues to cling to that all-important line in the sand, keeping Kevin’s bullish blueprint very much alive.

At press time, DOGE traded at $0.16493.

Featured image created with DALL.E, chart from TradingView.com

Source link

doge

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Published

7 days agoon

April 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

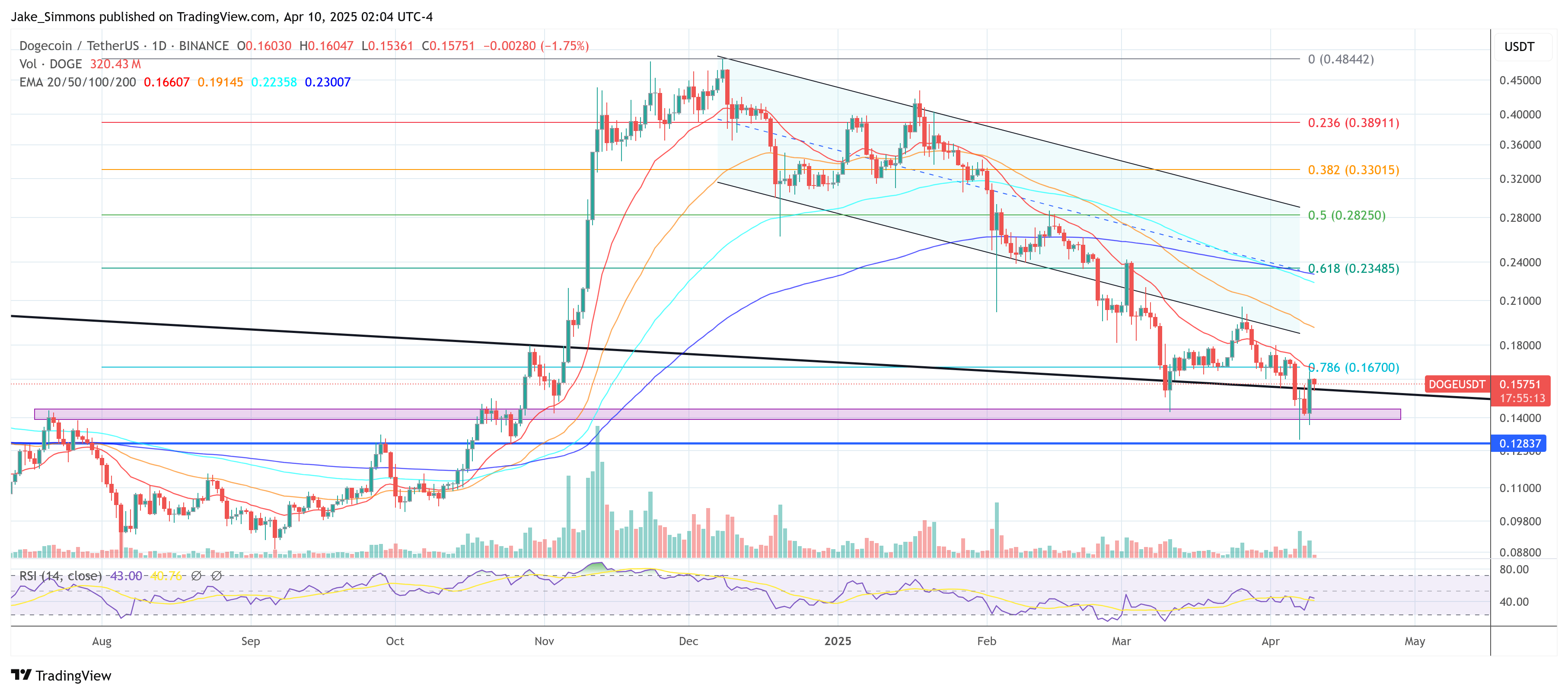

Dogecoin’s momentum has shifted dramatically following macroeconomic developments and a series of strong technical signals, according to crypto chartist Kevin (@Kev_Capital_TA). Yesterday, the broader crypto market surged after President Donald Trump announced a 90-day pause on tariffs for 75 countries, while raising China’s tariffs to 125%.

Bullish Momentum For Dogecoin

The news sent Bitcoin above the $80,000 threshold and catapulted several major altcoins, including Dogecoin, higher. “Daily Bullish divergence on Dogecoin starting to play here,” Kevin writes in his latest update, while cautioning that “obviously macro news has most to do with this, but nonetheless the charts were giving us hints ahead of time that the opportunity was not guaranteed but there.”

In the hours following the tariff announcement, Dogecoin rallied by approximately 13%, strengthening signs of a bullish divergence Kevin first flagged two days earlier. “Dogecoin came down once again to test the bull market structure ‘lines in the sand’ and somehow even though it cleanly broke through earlier in the day was able to recover and close the daily candle slightly above this support level,” he explained.

Related Reading

Kevin noted the parallel between Dogecoin’s bullish divergence and that of Bitcoin on the daily time frame, suggesting that renewed optimism for DOGE may be tied, in part, to the leading cryptocurrency’s resilience above its own pivotal support.

Kevin’s outlook is rooted in a multi-week assessment of Dogecoin’s technical posture. At the end of March, he pointed to a “weekly demand candle” and the ‘Last line of bull market support.” He emphasized how crucial it remains for Dogecoin to hold above the 0.139 mark. “It will continue to be absolutely vital that Dogecoin hold this level while it resets higher time frame indicators like the 3 Day MACD, Weekly Stoch RSI and 2W Stoch RSI all of which are getting very close to being fully reset,” he said.

DOGE Price Targets

He also described the potential upside for Dogecoin as “phenomenal” relative to the risk of losing that $0.139 threshold for multiple weekly closes. The chart’s Fibonacci retracement and extension levels suggest potential technical targets for Dogecoin that remain relevant for traders seeking directional cues.

Related Reading

These levels begin with the 0.236 at $0.09038, the 0.382 at $0.13827, the 0.5 at $0.19039, the 0.618 at $0.26216, the 0.65 at $0.28529, and the 0.70 at $0.3310. Higher up, the 0.786 reads $0.41339, the 0.88 is $0.54210, the 1.0 level marks $0.73839, and the 1.0866 is $0.93377.

Further on the extension side, the 1.272 stands at $1.54348, and the 1.414 appears at $2.26813. The analyst underscored that “as long as BTC holds these levels and does not lose $70K then I absolutely love this spot on DOGE,” highlighting how the broader market’s trajectory could shape Dogecoin’s path along these technical markers.

However, the coming days will reveal whether Dogecoin can build on the momentum that emerged amid the tariff-related market surge—and whether the well-worn phrase “the trend is your friend” will keep Dogecoin enthusiasts in a bullish mindset.

At press time, DOGE traded at $0.15751.

Featured image created with DALL.E, chart from TradingView.com

Source link

Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon