Altcoin

Ethereum Foundation Revamps Leadership Amid Market Volatility

Published

2 months agoon

By

admin

The Ethereum Foundation has announced a significant shake-up in its leadership ranks, appointing two new co-executive directors as it embarks on a fresh strategic direction. Hsiao-Wei Wang and Tomasz Stańczak will jointly take the helm of the non-profit that stewards Ethereum’s development, replacing the sole executive role previously held by Aya Miyaguchi.

Related Reading

On the other hand, Miyaguchi, who served as Executive Director for seven years, is transitioning to the newly created position of Foundation President. This interesting change in leadership comes as Ethereum’s price continues to undergo a decline towards the $2,000 mark.

Co-Executive Directors Take Helm Of The Ethereum Foundation

Ethereum’s new leaders bring a blend of deep protocol expertise and industry experience. Hsiao-Wei Wang, a seven-year veteran of the Ethereum Foundation’s research team, was a key contributor to core initiatives like the Ethereum 2.0 beacon chain and sharding research. She also earned respect as a community builder by organizing Ethereum developer events in Taiwan.

Tomasz Stańczak, meanwhile, is best known as the founder of Nethermind, one of Ethereum’s major software clients, which he grew from a small project into a global blockchain infrastructure company. Stańczak’s expertise in engineering and talent development is expected to strengthen the Foundation’s technical teams, and he’s even in the process of stepping down as Nethermind’s CEO to focus on this new role.

This leadership restructuring is a shift from Ethereum’s earlier setup, where decision-making often centered on a few figures like Miyaguchi and even Ethereum creator Vitalik Buterin. Buterin, who had hinted that changes were coming, took to social media platform X to publicly congratulate Wang and Stańczak on their appointments.

In practical terms, the new directors are expected to double down on technical R&D (like scaling improvements and protocol upgrades) and nurture the developer community, all while keeping Ethereum’s ethos of a permissionless and censorship-resistant financial platform intact.

Price Action More Bearish Than Bullish

Ethereum’s market performance has been on a full decline in recent weeks, which is an extension of its underperformance in the current market cycle. After a strong start to the year when the ETH price surged to about $3,700 in early January, the momentum has been of a decline for the past two months.

Notably, ETH’s lack of a bullish price momentum has been aggravated by Bitcoin’s price crash in the past week, which has flowed into the altcoin market. This fall in the price of Ethereum has been accompanied by a decline in on-chain activity and sentiment reaching a 12-month low.

Related Reading

Transaction volumes in late February dropped about 15%, to roughly $12 billion per day, the lowest in two months, while the number of active Ethereum addresses fell by 10% over the same period.

At the time of writing, Ethereum is trading at $2,210 and is at risk of breaking below $2,200 this week.

Featured image from VOI, chart from TradingView

Source link

You may like

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

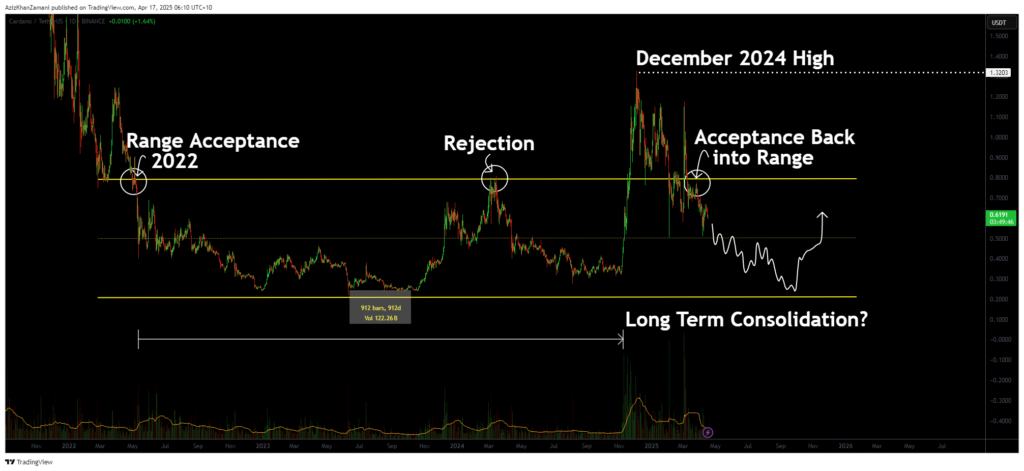

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

4 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

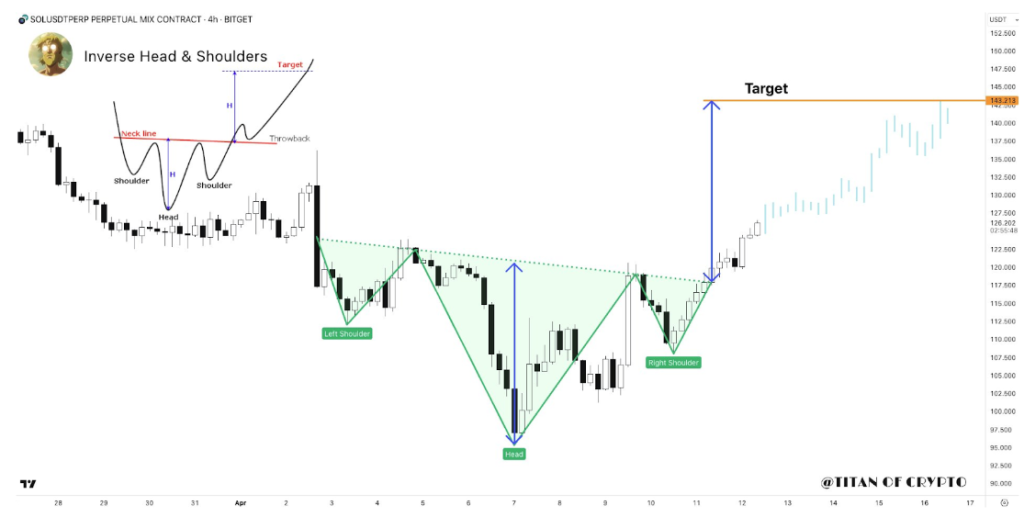

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Altcoin

Is It Time For Altcoin Season? Bitcoin Dominance Rises To Major Rejection Zone

Published

5 days agoon

April 12, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

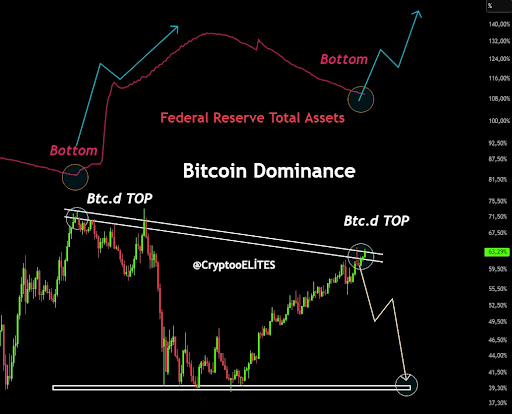

Crypto analyst El Crypto has raised the possibility of an altcoin season happening soon. The analyst alluded to Bitcoin’s dominance rising to a major rejection zone, which could be bullish for altcoins.

Altcoin Season May Be Imminent As Dominance Hits Major Rejection Zone

In an X post, El Crypto suggested that the altcoin season may be imminent as Bitcoin’s dominance hits a major resistance zone. He revealed that BTC’s dominance again touched a zone that has led to rejection every time in the last one and a half years. He added that the Stochastic Relative Strength Index (RSI) is also in the overbought area, while a bearish cross has now happened again.

Related Reading

Based on this, the analyst remarked that the market looks to be in for some fun, hinting at an altcoin season. Crypto analyst CryptoElites also affirmed that Bitcoin’s dominance has reached its peak. He further affirmed that next up is a massive altcoin rally, which will usher in the alt season.

In another X post, the crypto analyst alluded to the USDT and USDC dominance ratio. He claimed that the market was at a critical trend reaction point right now. CryptoElites then mentioned that if the stablecoins’ dominance breaks down, then the altcoin season will officially begin.

Crypto analyst Kevin Capital also looked to provide a bullish outlook towards the altcoin season. In an X post, he highlighted the global liquidity index overlaid with the Dogecoin price. In line with this, he remarked that it might be time for market participants to start paying attention to this.

So far, altcoins have been mirroring Bitcoin’s price action, suffering a similar downtrend amid the trade war. However, if the altcoin season were to kick into full gear, these altcoins could easily decouple from the flagship crypto and outperform. Ethereum is known to lead this altcoin season, but that may not be the case this time, as ETH has underperformed throughout this cycle.

Still Bitcoin Season For Now

Blockchain Center data shows that it is still Bitcoin season for now, as the flagship crypto continues to outperform most altcoins. In the past 90 days, only seven out of the top 50 coins have outperformed the flagship crypto. These coins include Mantra, GateToken, Monero, LEO, Tron, and FastToken.

Related Reading

For it to be altcoin season, 75% of the top 50 coins would need to outperform Bitcoin over the last 90 days. Although almost all coins have witnessed declines within this timeframe, BTC has suffered a 22% drop, which is less than what these altcoins have seen during this period.

At the time of writing, the Bitcoin price is trading at around $80,900, down over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Source link

Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon