Markets

Bitcoin Reserve in 100 Days of Trump’s Presidency? Market Is Still Skeptical

Published

2 months agoon

By

adminA weekend Truth Social post from President Donald Trump set in motion the first steps in creating a strategic U.S. bitcoin (BTC) reserve, but Polymarket traders are skeptical that it will happen within the first 100 days.

As of press time, Polymarket bettors are giving a 23% chance that a strategic BTC reserve will be created within the first 100 days of the Trump presidency – or by April 30th, 2025.

Rules of the contract say that the U.S. government will need to specifically hold bitcoin – and not from confiscation – by 11:59 PM ET on April 29 for this to resolve to yes. Announcements of the creation of a reserve do not count.

Chances of a reserve coming true spiked from 11% to 23% in the moments after Trump’s announcement. Another contract that asks if a reserve will be created by the end of 2025 currently has a 65% chance of resolving to yes.

Initially, Trump’s social media post announcing the creation of the reserve only named XRP and SOL as components of the reserve—which caused their value to spike—before clarifying that BTC and ETH would also be included in the reserve.

One of the most profitable traders of the 100-day crypto reserve contract is Theo5, which appears to be affiliated with a French trader who created a series of accounts, including Theo4, to directionally bet on Trump’s victory in the November 2024 election.

Theo5 currently has posted a $40,000 profit on his no position.

Meanwhile, a trader known as Polywog lost $73,000 on their yes position and also lost over $560,000 by incorrectly betting on the outcome of the 2025 election.

Source link

You may like

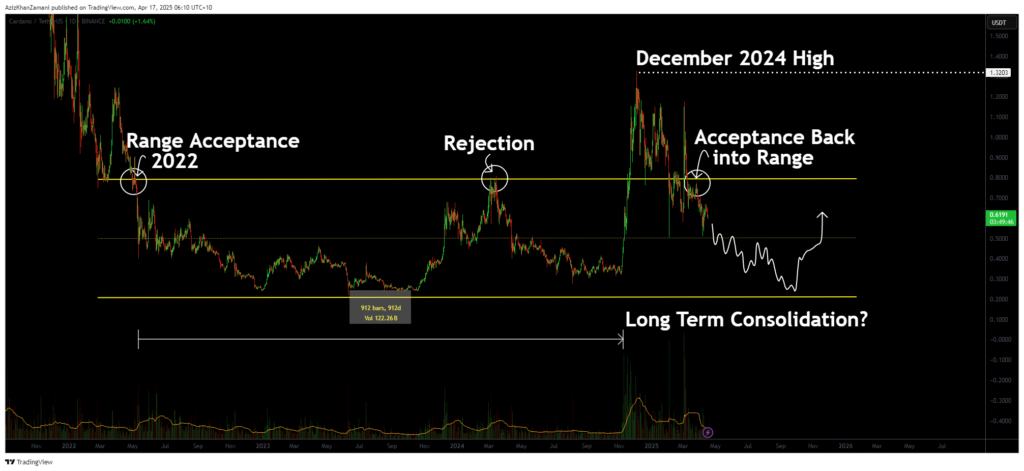

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

Bitcoin

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Published

9 hours agoon

April 16, 2025By

admin

A modest bitcoin rally to a possible challenge of the $86,000 level quickly reversed during U.S. afternoon trading hours on Wednesday as Federal Reserve Chairman Jerome Powell warned on the effects of President Trump’s tariff regime.

“The level of the tariff increases announced so far is significantly larger than anticipated,” said Powell in a speech. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

In other words, stagflation — a throwback to a sizable portion of the 1970s when the U.S. experienced weak economic activity alongside double-digit inflation.

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” continued Powell.

The price of bitcoin (BTC) fell about 2.5% in the minutes following the Powell remarks, now trading at $83,700, down 1.5% over the past 24 hours.

U.S. stocks, which had been trying to mount a comeback from opening declines, also were hit, the Nasdaq slumping 3.4% to a session low.

Powell also mentioned that as crypto is becoming more mainstream, there’s a need for a legal framework for stablecoins. He said that banking regulation around crypto will likely be “partially relaxed.”

The U.S. Senate Banking Committee cleared a bill to regulate stablecoin issuers in March, marking the first committee approval and a significant step closer to law in the U.S.

Hawkish Fed weighs on crypto and BTC

“Powell came out extremely hawkish,” Quinn Thompson, chief investment officer of hedge fund Lekker Capital, said in a Telegram message. It’s notable that Powell downplayed last week’s market turmoil characterizing it as “orderly market functioning,” he added.

“I would have at least expected him to give a nod to the elevated volatility and ruptures forming in the treasury market but he did not do that,” Thompson said.

Powell’s tone suggests that investors should temper their expectations for rate cuts in the upcoming meetings, said Thompson, which could weigh on risk assets including crypto.

“It appears a May cut is firmly off the table barring Fed intervention for bad reasons and I wouldn’t say June is a lock either,” concluded Thompson. “The bull case for crypto and bitcoin specifically is liquidity and policymaker intervention. Both of those seemed very far off based, so it’s difficult for me to paint a constructive picture in the immediate term.”

UPDATE (April 16, 18:40 UTC): Adds additional comments made by Chair Powell about stablecoins. Adds analyst comment.

Source link

Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Published

11 hours agoon

April 16, 2025By

admin

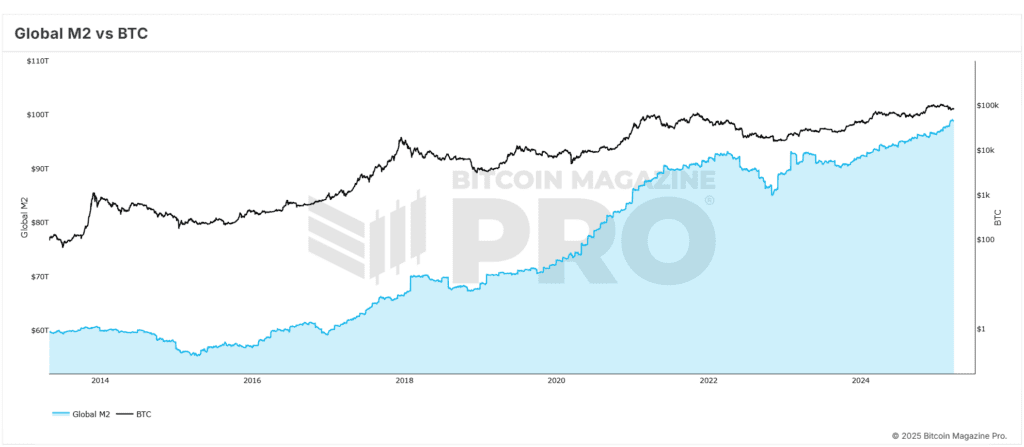

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

Bitcoin Price and Global Liquidity: A High-Impact Correlation

Crosby highlights a remarkable and consistent correlation—often exceeding 84%—between Bitcoin price and global M2 liquidity levels. As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay. Historical data supports the observation of a 56–60 day lag between monetary expansion and Bitcoin price increases.

This insight has recently proven accurate, as Bitcoin price rebounded from lows of $75,000 to above $85,000. This trend closely aligns with the forecasted recovery that Crosby and his team had outlined based on macro indicators, validating the strength and reliability of the correlation driving Bitcoin price upward.

Why the 2-Month Delay Impacts Bitcoin Price

The two-month delay in market response is a critical observation for understanding Bitcoin price movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets like BTC. Instead, there is an incubation period, typically around two months, during which liquidity filters through financial systems and begins to influence Bitcoin price.

Crosby has optimized this correlation through various backtests, adjusting timeframes and offsets. Their findings indicate that a 60-day delay yields the most predictive accuracy across both short-term (1-year) and extended (4-year) historical Bitcoin price action. This lag provides a strategic advantage to investors who monitor macro trends to anticipate Bitcoin price surges.

S&P 500 and Its Influence on Bitcoin Price Trends

Adding further credibility to the thesis, Crosby extends his analysis to traditional equity markets. The S&P 500 exhibits an even stronger all-time correlation of approximately 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driver not just for Bitcoin price, but also for broader risk-on asset classes.

By comparing liquidity trends with multiple indices, Crosby demonstrates that Bitcoin price is not an anomaly but part of a broader systemic pattern. When liquidity rises, equities and digital assets alike tend to benefit, making M2 supply an essential indicator for timing Bitcoin price movements.

Forecasting Bitcoin Price to $108,000 by June 2025

To build a forward-looking perspective, Crosby employs historical fractals from previous bull markets to project future Bitcoin price movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin price could retest and potentially surpass its all-time highs, targeting $108,000 by June 2025.

This optimistic projection for Bitcoin price hinges on the assumption that global liquidity continues its upward trajectory. The Federal Reserve’s recent statements suggest that further monetary stimulus could be deployed if market stability falters—another tailwind for Bitcoin price growth.

The Rate of Expansion Affects Bitcoin Price

While rising liquidity levels are significant, Crosby stresses the importance of monitoring the rate of liquidity expansion to predict Bitcoin price trends. The year-on-year M2 growth rate offers a more nuanced view of macroeconomic momentum. Although liquidity has generally increased, the pace of expansion had slowed temporarily before resuming an upward trend in recent months.

This trend is strikingly similar to conditions observed in early 2017, just before Bitcoin price entered an exponential growth phase. The parallels reinforce Crosby’s bullish outlook on Bitcoin price and emphasize the importance of dynamic, rather than static, macro analysis.

Final Thoughts: Preparing for the Next Bitcoin Price Phase

While potential risks such as a global recession or a significant equity market correction persist, current macro indicators point toward a favorable environment for Bitcoin price. Crosby’s data-driven approach offers investors a strategic lens to interpret and navigate the market.

For those looking to make informed decisions in a volatile environment, these insights provide actionable intelligence grounded in economic fundamentals to capitalize on Bitcoin price opportunities.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Republican States Pause Lawsuit Against SEC Over Crypto Authority

Ethereum fees drop to a 5-year low as transaction volumes lull

Bitcoin Price Holds Steady, But Futures Sentiment Signals Caution

Panama City Approves Bitcoin And Crypto Payments For Taxes, Fees, And Permits

Crypto Trader Says Solana Competitor Starting To Show Bullish Momentum, Updates Outlook on Bitcoin and Ethereum

weakness signals move toward lower support

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

What Next for ETH as Traders Swap $86M into Solana DeFi protocols ?

Why Did Bitcoin Price (BTC) Fall on Wednesday Afternoon

Solana price is up 36% from its crypto market crash lows — Is $180 SOL the next stop?

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon