24/7 Cryptocurrency News

Analysts Predict Solana Price Next Big Move As Key Support Holds

Published

3 weeks agoon

By

admin

Solana (SOL) price remains crucial as analysts assess its next major move. The cryptocurrency has been trading within a defined range, with key support levels holding firm despite recent market volatility. While some traders anticipate a potential rally, others warn of further downside if support levels fail.

Solana Price Faces Uncertainty as Key Levels Dictate Future Movement

In a recent analysis by Crypto Jobs, Solana price fluctuates between $153 and $138, signaling a period of indecision in the crypto market. Analysts highlight that the $118 – $125 zone serves as a strong multi-year support level, which has repeatedly prevented further declines. If this level continues to hold, SOL price may see another attempt to move higher.

On the upside, the $153 – $155 range is acting as a resistance zone. A successful break above this level could trigger a move toward $180 – $185, an area where Solana has previously faced selling pressure. However, if the cryptocurrency fails to reclaim this level, it may continue consolidating in the current range or retest lower support.

Meanwhile, a recent price analysis highlighted that Solana and XRP are well-positioned for growth, according to WisdomTree’s predictions. With their expanding use cases and potential for institutional adoption, both cryptocurrencies are expected to lead the next altcoin season.

Risks of a Drop Below Key Support Levels

While Solana price has shown resilience above $125, analysts caution that a break below $115 could result in a deeper sell-off. Crypto Jobs points out that a weekly candle close below this level would likely push the price down to the $80 – $75 range, an area that has not been tested in recent months.

Another analyst, TB21Crypto, identifies $126 as a critical level that aligns with the 0.236 Fibonacci retracement. If SOL price loses this support, it could trigger a stronger bearish trend. Market conditions, liquidity levels, and broader crypto market sentiment will play a key role in determining whether Solana price can maintain its current range.

Despite short-term uncertainty, some analysts remain optimistic about Solana price long-term potential. Marzell, a well-known trader, predicts a possible 45% price surge from the $120 support level, with upside targets of $296, $339, and $384. His analysis is based on historical price movements and technical indicators, suggesting that SOL could enter a strong uptrend.

Market Outlook: Technical Indicators Turn Bullish

On the other hand, the Bull Bear Power (BBP) indicator shows a potential shift from bearish to bullish sentiment. The BBP, which had been in the negative territory indicating bearish dominance, has begun climbing towards the zero line. This transition suggests that the bears are losing control, and the bulls might soon take over, potentially leading to a price increase.

Additionally, the Relative Strength Index (RSI) for Solana price also supports a growing bullish momentum. Recently hovering around 50, which is generally considered a neutral point, the RSI is now moving upward. This upward trajectory indicates strengthening buying pressure, which could help sustain a bullish trend if the RSI continues to rise.

According to a CoinGape report, Solana price is showing signs of a potential breakout as key technical indicators turn bullish. The recent SOL whale movement of $71.95 million in SOL to Coinbase Institutional has fueled speculation about market direction. If Solana breaks the $170 resistance, analysts suggest it could rally toward $180 and potentially reach $213 in the coming weeks.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

$16.5B in Bitcoin options expire on Friday — Will BTC price soar above $90K?

$5,000,000,000,000 Asset Manager Fidelity To Launch a USD-Pegged Stablecoin: Report

Proposed Bipartisan Legislation Recognizes Bitcoin As A Technology That Supports Democracy

Wyoming Stablecoin Is Just a State-Issued CBDC by Another Name: Rep. Tom Emmer

Bitcoin faces 70% odds of another drop as April tariff fears shake markets, Nansen says

24/7 Cryptocurrency News

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

Published

16 hours agoon

March 27, 2025By

admin

Dogecoin price has been showing major strength recently with more than 14% gains on the weekly chart and eyeing a potential breakout above $0.21, after which it can kickstart rally to $2 for another 10x gains. Furthermore, Elon Musk has once again teased DOGE, sharing a Ghibli Anime character of his from a famour scene from “The Lion King”.

Dogecoin Price Eyes A 10x Breakout Ahead

In the last 24 hours, the Dogecoin price has surged another 4%, moving to $0.205 with its market cap just touching $30 billion. Additionally, the daily trading volumes have surged more than 32%, crossing $2 billion showing a strong bullish sentiment aong traders.

Additionally, the Coinglass data shows that the DOGE futures open interest is also up 4%, moving above $2 billion, while the 24-hour liquidations have soared to $13.82 million. Popular crypto analyst CryptoELITES has cited the formation of a cup-and-handle chart pattern, wherein the DOGE price is on the move to complete the cup pattern. As a result, he expects the meme coin to register 10x gains from here onwards.

Some traders also expect the DOGE price rally to continue to $8 as the meme coin breaks past the three-month trendline.

DOGE SuperTrend Indicator

Crypto analyst Ali Martinez has highlighted a potential bullish phase for Dogecoin (DOGE) based on the SuperTrend indicator. According to Martinez, the popular meme coin could enter a significant upward trend if it manages to break through the critical resistance level of $0.21.

The SuperTrend indicator usually helps to identify trend reversals and potential breakout points. Thus, surpassing this key threshold of $0.21 Dogecoin price could signal renewed investor momentum for the meme coin.

Elon Musk Teases the DOGE Ghibli Anime

In a parody of the famous scene from Disney’s “The Lion King,” Elon Musk once again teases Dogecoin with the much popular Ghibli Anime character. Instead of a lion cub, the character is holding up a Shiba Inu dog – the mascot of the Dogecoin cryptocurrency.

Theme of the day pic.twitter.com/2ioG0StAxL

— Elon Musk (@elonmusk) March 26, 2025

The animated image is reminiscent of Studio Ghibli. The Ghibli Animes are seeing massive popularity recently, and Elon Musk jumping into the trend with DOGE, could provide further catalysts for the meme coin. Furthermore, the Dogecoin price prediction charts show a probable consolidation above $0.20 for the month of April.

- Shiba Inu Price Eyes 2x Gains As SHIB Burn Rate Shoots 60,000%

- Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

- Analyst Reveals How Much Bitcoin Is Needed for Retirement in the US

- Ethereum Price Eyes $10,000 Breakout Amid Supply Squeeze Worry

- Crypto Price Today: BTC, ETH, SOL, XRP, SHIB, DOGE, LINK, PEPE, ADA

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Published

24 hours agoon

March 26, 2025By

admin

The possibility of an XRP exchange-traded fund (ETF) gaining approval is quickly becoming a reality, with experts predicting it is now only a matter of time before the U.S. Securities and Exchange Commission (SEC) gives the green light. Following a significant boost in market confidence, betting platforms, like Polymarket, show an 87% chance that the SEC will approve an XRP ETF by the end of 2025.

Ripple SEC Case End Sparks Optimism for XRP ETF

A positive outlook about an XRP exchange-traded fund’s approval has emerged after Ripple won its recent court battle. Ripple’s victory against the SEC dismantled a major barrier that prevented financial institutions from adopting its cryptocurrency. The court settlement has raised investor trust in the SEC’s approval process for an XRP Exchange-Traded Fund (ETF) thus many investors now expect approval.

According to Nate Geraci the president of The ETF Store an XRP ETF approval seems destined to happen. He predicted asset managers like BlackRock and Fidelity would dominate the space while asserting that the approval process stood just a matter of time away from completion. Geraci explains that XRP’s rising market cap position as the third non-stablecoin cryptocurrency provides institutional investors with an appealing opportunity.

“With Ripple’s legal troubles now behind it, the path to an XRP ETF approval seems clearer than ever,” Geraci noted.

XRP Market Sentiment and Polymarket Data

An increasing number of market participants expect XRP ETF approval as shown by Polymarket’s statistical analysis. Polymarket data shows investors believe the SEC will approve a spot XRP ETF before the year ends with an 87% probability.

This indicates widespread belief that the regulatory hurdles for the cryptocurrency are nearly cleared.

The introduction of an XRP ETF could trigger increased institutional interest much in the same way Bitcoin and Ethereum ETFs gained investor attention. An XRP ETF’s market entry would help traditional investors view digital assets more favorably because Bitcoin and Ethereum already demonstrated successful ETF integration.

Major Financial Firms Exploring XRP ETF

Major financial institutions like BlackRock and Fidelity among others will be instrumental in creating an XRP Exchange-Traded Fund Analysts predict BlackRock will shift its focus from Bitcoin and Ethereum to XRP ETFs because the cryptocurrency exhibits strong institutional appeal.

BlackRock’s head of ETFs, Jay Jacobs, had earlier stated that altcoins like XRP and Solana are not currently on their agenda. However, experts argue that the growing market demand and regulatory developments around XRP could soon change BlackRock’s stance.

Large asset managers including Fidelity play crucial roles when it comes to this particular market segment. The regulatory approval of XRP ETFs by the SEC will allow these financial institutions to launch XRP-related products. Such high-profile firms’ participation will speed up both the adoption and institutional utilization of XRP within portfolios.

XRP Price Predictions Amid ETF Optimism

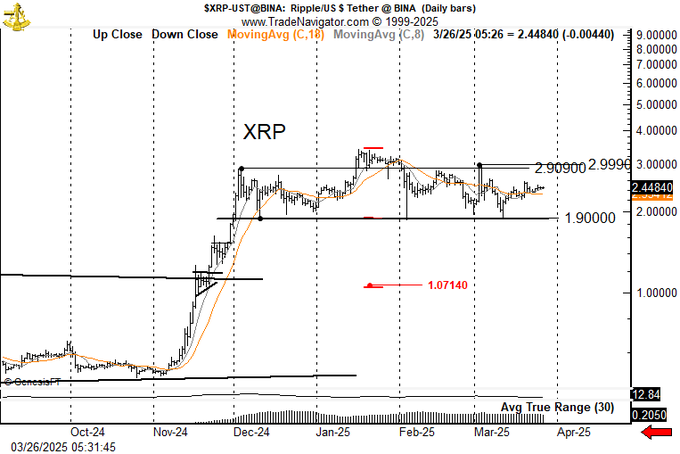

As the market anticipates the approval of an XRP ETF, different analysts have made bold price predictions for XRP. Renowned trader Peter Brandt has recently shared his technical analysis, highlighting a potential head and shoulders pattern in XRP’s price.

This pattern suggests that if XRP falls below a certain level, it could lead to significant losses, with a target price of around $1.07. However, Brandt also acknowledged that if the cryptocurrency stays above the $3 mark, shorting XRP could be risky.

On the other hand, cryptocurrency index fund manager Bitwise has offered a more optimistic price projection. Bitwise estimates that XRP could soar to as high as $29.32 by the end of the decade, assuming the cryptocurrency captures a meaningful share of the payments and tokenization sectors. In their “bull scenario,” Bitwise projects a price of $12.70 by 2030.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Published

1 day agoon

March 26, 2025By

admin

As South Korea continues to strengthen its crypto regulations, the Financial Intelligence Unit (FIU) has requested Google to block access to 17 unlicensed crypto exchanges. These unregistered virtual asset service providers (VASPs) include KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex, among many others.

Reportedly, Google has responded positively to the FIU’s request. As a result, South Korean users will no longer be able to access these listed platforms, effective yesterday.

South Korea Tightens Regulations: Google Blocks 17 Crypto Exchanges

In a recent development, South Korea’s FIU has requested Google to block users from accessing 17 unlicensed crypto exchanges, including KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex. As part of the move, Google blacklisted these platforms since yesterday.

Notably, South Korea’s decision to block access to these crypto exchanges comes amid growing concerns over crypto theft and money laundering activities. Recently, South Korea announced its potential regulatory revamp in a move to strengthen the country’s anti-money laundering rules.

Google Restricts Downloads and Updates

The Financial Services Commission (FSC) enlisted 22 unregistered platforms on March 26. In response to the South Korean financial regulator’s request, Google has blocked users’ access to the crypto exchanges that are deemed unregistered. In addition, the Google Play Store will not allow users to download or update the applications of these crypto exchanges.

Meanwhile, the FIU asserted that the financial watchdog is collaborating with Apple Korea and the Korea Communications Standards Commission (KCSC) to block both internet and App Store access to these exchange platforms.

Interestingly, the FSC believes that this strategic measure could help prevent money laundering activities involving crypto assets and potential future harm to local users. This move comes just a few days after the FIU launched a crackdown on these exchanges. It is alarming that KuCoin, one of the top crypto exchanges, is also facing intense scrutiny from FIU.

South Korea’s Crypto Regulations: What To Expect More?

Significantly, South Korean regulators mandate crypto exchanges to adhere to the country’s licensing rules before offering services. The restrictions apply to foreign platforms that cater to Korean users by offering Korean-language interfaces, conducting targeted marketing campaigns, or facilitating transactions in Korean won.

According to FIU’s official statement, the platforms that violate these laws could face up to five years in prison or fines of up to 50 million won (approximately $34,150).

South Korea vs United States: Crypto Regulatory Views

South Korea’s rigid crypto regulations come amidst the United States’ loosened norms under President Donald Trump. While South Korea is restricting access to crypto exchanges and tightening regulations, the US is dismissing prevailing crypto lawsuits.

This distinct regulatory trend highlights the two countries’ differing approaches to balancing innovation and investor protection in the rapidly evolving crypto market. The wider implications of these approaches remain differing with South Korea’s caution likely to influence Asian markets and the US’s permissiveness potentially shaping Western regulatory norms.

Nynu V Jamal

Nynu V Jamal is a passionate crypto journalist with three years of experience in blockchain, web3, and fintech spheres. She has established herself as a knowledgeable and engaging voice in the cryptocurrency and blockchain space. Her experience as an Assistant Professor in English Language and Literature has further added to her quest for crafting informative, well-researched, and accessible content.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

$16.5B in Bitcoin options expire on Friday — Will BTC price soar above $90K?

$5,000,000,000,000 Asset Manager Fidelity To Launch a USD-Pegged Stablecoin: Report

Proposed Bipartisan Legislation Recognizes Bitcoin As A Technology That Supports Democracy

Wyoming Stablecoin Is Just a State-Issued CBDC by Another Name: Rep. Tom Emmer

Bitcoin faces 70% odds of another drop as April tariff fears shake markets, Nansen says

Political Endorsements Are Driving Rug Pulls

‘Trust the Cycle’ – Pro Says Dogecoin Price Could Suddenly Hit $1

Top Conglomerate Adds 580 $BTC Amid Unprecedented Crypto Popularity. Here’s Why BTC Bull Token Could 100x

Over 400 South Korean officials disclose $9.8M in crypto holdings

Copper Partners with Everstake to Deliver Secure Staking Services for Institutional Investors

GameStop’s Bitcoin Move Looks Bold—But It Might Be Brilliant

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: