Altcoins

Litecoin Price Upsurge Cools Off – What’s Next After The $97.8 Drop?

Published

2 weeks agoon

By

admin

Litecoin’s bullish momentum has cooled off, with the price sliding back to $97.8 after struggling to sustain its recent uptrend. The pullback comes amid increasing selling pressure, raising concerns about whether this is a temporary correction or the start of a deeper decline. While LTC previously showed strength, the inability to maintain higher levels suggests that market sentiment is shifting, leaving traders questioning the coin’s next move.

As the price approaches key support levels, traders are closely monitoring market signals to determine the next move. Will buyers step in to defend LTC and spark a rebound, or will bearish pressure push the price even lower?

Litecoin Drop To $97.8: What Triggered The Pullback?

Litecoin’s retreat to $97.8 comes after failing to sustain its recent uptrend, as increasing selling pressure drove the price lower. After an initial push higher, LTC encountered strong resistance at the $113 key level, preventing further gains and triggering a pullback. This resistance rejection prompted profit-taking among traders, as many opted to secure gains rather than hold through potential volatility.

Moreover, the decline in buying momentum played a crucial role in the price drop. As bullish enthusiasm faded, buyers struggled to maintain control, allowing sellers to take over. The weakening demand led to increased downward pressure, accelerating Litecoin’s descent toward the $97.8 support level.

Broader market uncertainty also contributed to the downturn. A combination of external factors, including macroeconomic conditions and Bitcoin’s price action, likely influenced traders’ risk appetite, leading to a cautious approach toward altcoins like LTC.

Technical indicators also experienced a drop below average, prompting a correction as traders reassessed their positions. If Litecoin fails to hold above $97.8, further downside could be expected. However, a possible recovery may be on the horizon if buyers step in at this level.

Potential Scenarios: Rebound Or Further Decline?

The Litecoin price movement around the $97.8 level will be crucial in determining its next direction. Two possible scenarios could unfold—a strong rebound if buyers regain control or a deeper decline if selling pressure persists.

In a bullish scenario where LTC manages to hold above $97.8, buyers could step in, driving the price toward immediate resistance levels. A successful rebound might push Litecoin back above $113, with the next target being $131.6. After this, bullish momentum may grow, paving the way for a rally to $146.

However, in a bearish scenario where Litecoin fails to hold above $97.8, the price could face additional downside pressure. Breaking below this key support hints at a decline toward $89.7 and $76.8, and even lower support zones, making it critical for bulls to defend key levels.

Source link

You may like

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

German regulator prohibits sales of Ethena USDe

US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The ecosystem of a popular meme coin has attained two major milestones, showing the continued interest in the token that could lead to a bullish scenario. Analysts reported that Shiba Inu recently reached 1.5 million holders while its Shibarium recorded 10 million blocks, an indicator that the SHIB ecosystem could attract new users.

Related Reading

1.5 Million SHIB Holders

Crypto analysts revealed Shiba Inu successfully achieved a major milestone, offering a bright spot for the broader cryptocurrency market which has faced some challenges recently.

The project’s marketing lead, LUCIE noted that the meme coin hit 1.5 million holders on March 18, reaching such a milestone is an important achievement for any crypto.

As of writing, about 843 new holders have joined the Shiba Inu ecosystem, indicating that the token remained attractive to traders.

SHIB has reached 1.5 million on-chain holders!

pic.twitter.com/sKaAO57R6I

— 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) March 18, 2025

Analysts believe that Shiba Inu’s milestone suggests continued interest in the meme coin, fueling the token’s significant growth. It also showed a bullish outlook on the meme coin.

Market observers said that the milestone might signify the unwavering belief of its community in the token.

10 Million Blocks For Shibarium

Meanwhile, Shiba Inu’s Ethereum Layer 2 network, Shibarium also recorded a win after surpassing 10 million blocks with an estimated 10,010,974 blocks as of press time.

Crypto analysts said that this achievement is proof of the network’s longevity and reliability, adding that it could entice more new users.

Market observers noted that the network has experienced exponential growth in total addresses in the last few weeks as it now tallies almost 175 million.

Shibarium’s growth is crucial in burning SHIB tokens and a major price control mechanism. Many investors are optimistic that diminishing supply and solid demand might send the token to surge. Shibarium played an essential role in burning around 713 million SHIB.

Unmoved By The Crypto Downturn

Many analysts say that milestones achieved by Shiba Inu and Shibarium offer a great deal of hope to investors, considering the ongoing downtrend in the cryptocurrency market.

For instance, Shiba Inu tanked by about 68% in the last four months, dipping from a high of $0.00003343 in December 2024 to a low of $0.00001082 in March 2025.

On the other hand, some analysts raised their concern about Shiba Inu underperforming the competition, noting that the token only increased by 98% following the US presidential election, while the Dogecoin skyrocketed by 200%.

Related Reading

Currently, Shiba Inu is traded at $0.00001288 per token, down by 0.2% in the past 24 hours with a total market cap of over $7.5 billion.

Featured image from Getty Images, chart from TradingView

Source link

Altcoins

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Published

1 day agoon

March 20, 2025By

admin

Tron (TRX) founder Justin Sun has staked $100 million worth of Ethereum (ETH), according to the blockchain analytics platform Arkham.

Arkham notes that Sun’s staked ETH will yield $3 million worth of Ethereum per year in passive income.

In addition to staking ETH, Sun also teased that Tron’s native asset, TRX, would soon be available on the Ethereum competitor Solana (SOL).

Sun, a polarizing figure in the crypto community, says it is currently “Tron meme szn [season].” He also notes that the issuance of top stablecoin USDT on Tron recently reached a new all-time high of $64.7 billion.

The U.S. Securities and Exchange Commission (SEC) recently paused its civil case against Sun. According to recent court filings, the Tron founder and the regulatory agency jointly asked United States District Judge Edgardo Ramos if they could “move to stay [the] case to allow the parties to explore a potential resolution.” Ramos granted the application a day later.

In 2023, the SEC accused Sun – who went on to invest millions of dollars into President Donald Trump’s decentralized finance platform World Liberty Financial – and his crypto firms of fraud, selling unregistered securities and manipulating the price of the digital asset TRX via wash trading.

TRX, a layer-1 asset, is trading at $0.23 at time of writing. The 10th-ranked crypto asset by market cap is down nearly 1% in the past day but up nearly 3% in the past week.

ETH is trading at $2,033 at time of writing. The second-ranked crypto asset by market cap is up nearly 7% in the past 24 hours and more than 8% in the past seven days.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects

Source link

Altcoins

Analyst Says Bitcoin Primed for ‘Party Time’ if BTC Breaks Above Critical Level, Updates Outlook on Chainlink

Published

2 days agoon

March 20, 2025By

admin

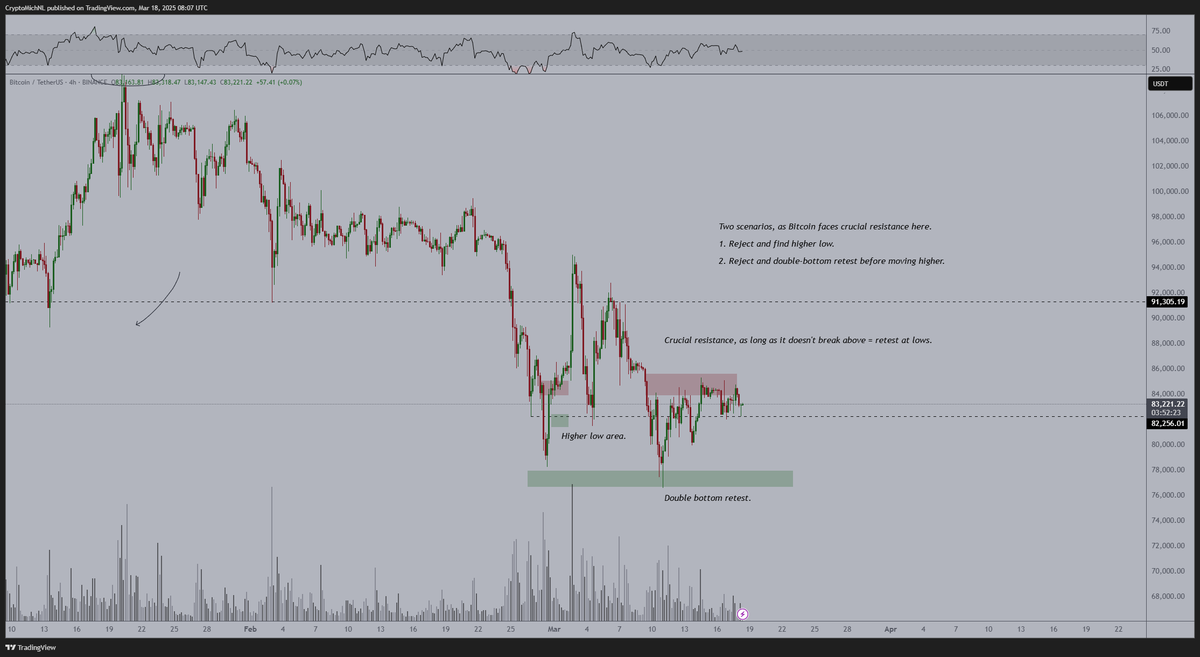

Crypto strategist Michaël van de Poppe says Bitcoin (BTC) may take off on a series of rallies if it can break through a key resistance level in the coming days.

The analyst tells his 782,000 followers on the social media platform X that Bitcoin needs to flip $84,500 into support this week in order to regain bullish momentum.

However, he warns if Bitcoin fails to break through $84,500, the flagship crypto asset may collapse in price.

“I really want to see some momentum on Bitcoin. If it doesn’t happen this week and we’ll break sub $82,000, likely we’ll see some new lows. Break $84,500 equals party time.”

Looking at his chart, the analyst says if Bitcoin fails to reclaim $84,500 as support this week, there are two likely outcomes.

“Two scenarios, as Bitcoin faces crucial resistance here:

- Reject and find a higher low [around $82,000].

- Reject and double-bottom retest [in the $70,000 range] before moving higher.”

Bitcoin is trading for $87,315 at time of writing, up 5.7% in the last 24 hours.

Next up, the analyst says that the decentralized oracle network Chainlink may be printing a double-bottom pattern against Bitcoin (LINK/BTC) on the weekly chart.

A double-bottom pattern is typically considered a bullish reversal pattern as buyers step in to create a price floor for an asset.

“LINK doing a double bottom test and back to the range low. Weekly firing up nicely. Things are heating up the right way.”

Based on the trader’s chart, he seems to predict that LINK/BTC will soar to as high as 0.000795 BTC worth $68.39.

LINK/BTC is trading for 0.0001719 BTC ($14.92) at time of writing, up nearly 2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

German regulator prohibits sales of Ethena USDe

US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash

What Would Pi Coin Price Look Like if Pi Network Reaches XRP Market Cap?

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x