Bitcoin ETF

Low Fees Are A Symptom Of Deeper Problems

Published

3 days agoon

By

admin

People tend to celebrate periods of low feerates. It’s time to clean house, consolidate any UTXOs you need to, open or close any Lightning channels you’ve been waiting on, and inscribe some stupid 8-bit jpeg into the blockchain. They’re perceived as a positive time.

They are not. We have seen explosive price appreciation the last few months, finally hitting the 100k USD benchmark that everyone took for granted as preordained during the last market cycle. That’s not normal.

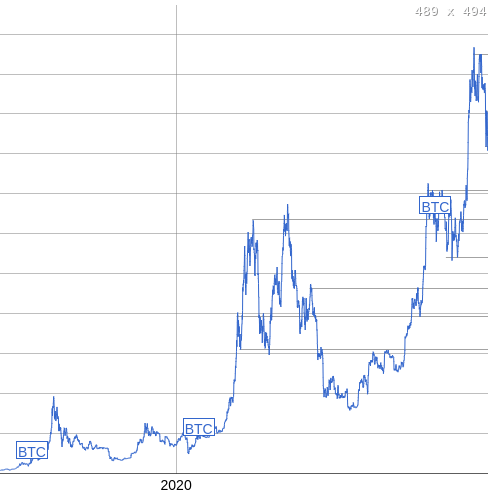

The picture on the left is the average feerate each day since 2017, the picture on the right is the average price each day since 2017. When the price was pumping, when it was highly volatile, historically we have seen feerates spike accordingly. Generally matching the growth and peaking when the price did. The people actually buying and selling transacted on-chain, people took custody of their own coins when they bought them.

This last leg up to over 100k does not seem at all to have had the same proportional affect on feerates that even moves earlier in this cycle have. Now, if you actually did look at both of those charts, I’m sure many people are going “What if this cycle is at the end?” It’s possible, but let’s say it’s not for a second.

What else could this be indicating? That the participants that are driving the market are changing. A group of people who used to be dominated by individuals who self custodied, who managed their counterparty risk by removing gains from exchanges, who generated time-sensitive on-chain activity, are transforming into a group of people simply passing around ETF shares that have no need of settling anything on-chain.

That is not a good thing. Bitcoin’s very nature is defined by the users who interact with the protocol directly. Those who have private keys to authorize transactions generating revenue for miners. Those who are sent funds, and verify transactions against consensus rules with software.

Both of those things being removed from the hands of users and placed behind the veil of custodians puts the very stability of Bitcoin’s nature at risk.

This is a serious existential issue that has to be solved. The entire stability of consensus around a specific set of rules is premised on the assumption that there are enough independent actors with separate interests that diverge, but align on a value gained from using that set of rules. The smaller the group of independent actors (and the larger the group of people “using” Bitcoin through those actors as intermediaries) the more practical it is for them to coordinate to fundamentally change them, and the more likely it is that their interests as a group will diverge in sync from the interests of the larger group of secondary users.

If things continue trending in that direction, Bitcoin very well could end up embodying nothing that those of us here today hope it can. This problem is both a technical one, in terms of scaling Bitcoin in a way that allows users to independently have control of their funds on-chain, even if only through worst-case recourse, but it is also a problem of incentive and risk management.

The system must not only scale, but it has to be able to provide ways to mitigate the risks of self custody to the degree that people are used to from the traditional financial world. Many of them actually need it.

This isn’t just a situation of “do the same thing I do because it’s the only correct way,” this is something that has implications for the foundational properties of Bitcoin itself in the long term.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

Bitcoin

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

Published

3 weeks agoon

February 25, 2025By

admin

U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) experienced the second-biggest outflows of the year on Monday, dropping $516.4 million, Farside data shows.

The withdrawals, the ninth net outflow in 10 days, reflect a growing discomfort with the largest cryptocurrency, which has traded in a narrow price range between $94,000 and $100,000 for most of this month.

On Tuesday, bitcoin broke out of its three-month channel, falling below $90,000 and sliding to as low as $88,250.

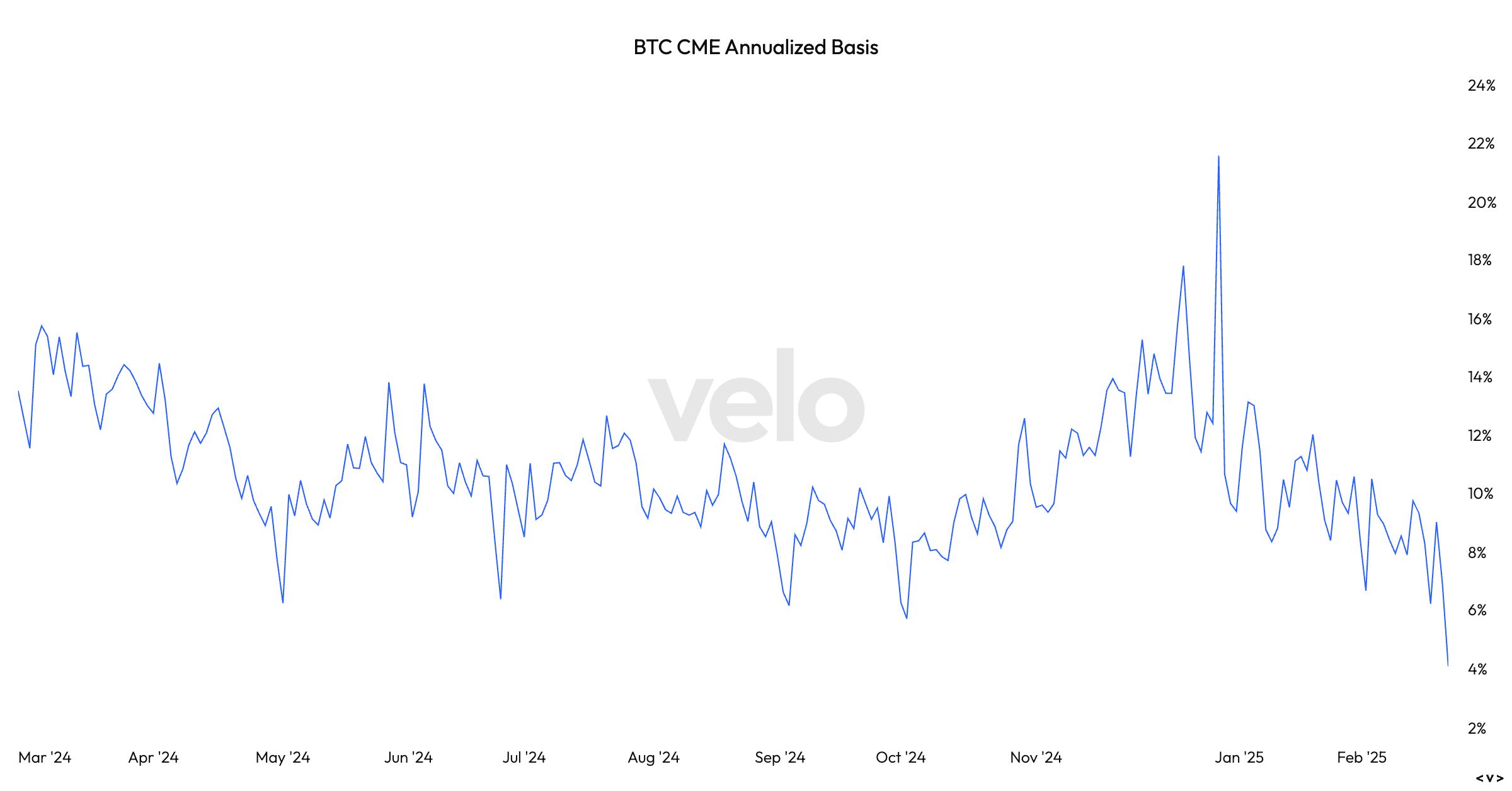

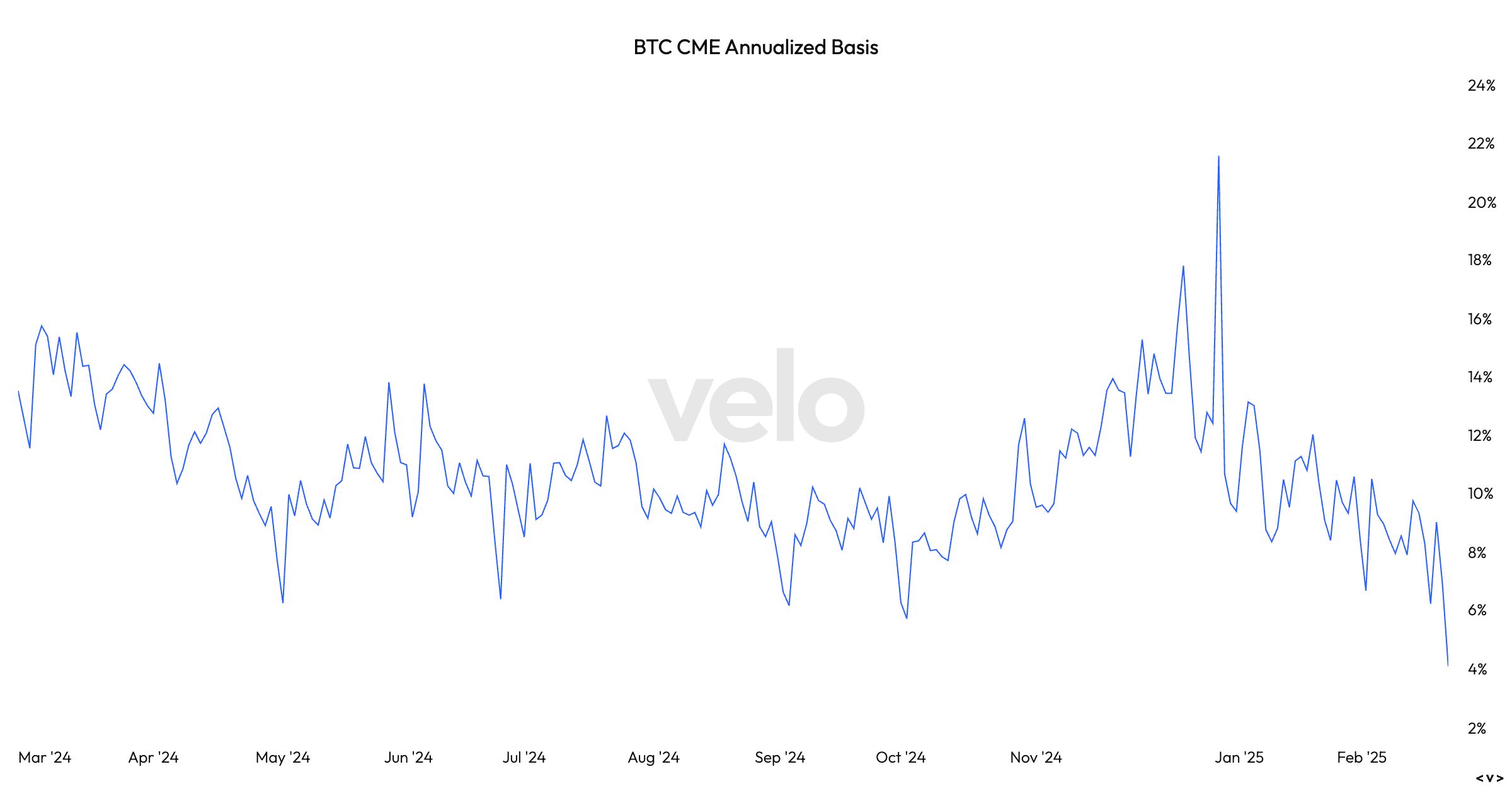

According to Velo data, the bitcoin CME annualized basis — the difference between the spot price and futures — has dropped to 4%. This is the lowest since the ETFs started trading in January 2024. This is also known as the cash-and-carry trade, which is a market-neutral strategy that seeks to profit from the mispricing between the two markets.

The strategy involves taking a long position in the spot market and a short position in the futures market. Velo data shows a one-month futures forward contract. Investors collect a premium between the spread of the spot and futures pricing until the futures contract expiry date closes.

At the current level, the basis trade is less than the so-called risk-free rate, the yield on the U.S. 10-year Treasury of 5%. The difference may persuade investors to close their positions in favor of the greater return. That could see further outflows from the ETFs. Because this is a neutral strategy, investors will also have to close their short position in the futures market.

Arthur Hayes, the co-founder of Bitmex, alludes to the basis trade unravelling in a post on X.

“Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries,” he wrote. “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo!”

Source link

State-owned Banco Nacional (BN), the largest commercial bank in Costa Rica and one of the biggest in Central America with over $7 billion in assets, is launching a spot bitcoin exchange-traded fund through its investment management arm, BN Fondos, according to local reports.

This marks the first time that Costa Ricans will have access to any type of crypto investment product through the country’s banking system.

The firm is also launching a S&P 500 ETF alongside the bitcoin vehicle. The minimum investment amount for each fund is $100. Investments will be taken in U.S. dollars instead of Costa Rican colones.

“[Costa Rican] regulation doesn’t permit investments in things that aren’t investment vehicles, and bitcoin isn’t considered an investment vehicle from a regulatory perspective, but the ETF is,” said Pablo Montes de Oca, general manager at BN Fondos.

Banco Nacional serves over 2.1 million customers in Costa Rica — more than 40% of the country’s population.

Costa Rica doesn’t have any formal crypto laws, but under the country’s constitution and civil code, as far as private parties are concerned, any activity that is not explicitly forbidden by the law is permitted. Costa Ricans are therefore technically allowed to trade and own cryptocurrencies based on the fact that no law prohibits it.

A comprehensive crypto regulation bill called the Crypto Asset Market Law was introduced at the Legislative Assembly in 2022, but it got stuck at the commission level. The bill aimed to codify the use of cryptocurrencies for the payment of goods and services in Costa Rica, but without making any of them — not even bitcoin — legal tender.

Source link

Bitcoin

Bitcoin ETFs bleed out $585m in weekly exodus, ending 6-week inflow streak

Published

4 weeks agoon

February 18, 2025By

admin

Spot Bitcoin exchange-traded funds in the United States flipped to net weekly outflows over the past week, ending their six-week inflow streak that brought in over $5 billion.

According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded $585.65 million in net weekly outflows for the week ending Feb. 14, breaking a six-week inflow streak that brought in over $5 billion.

Notably, the week began with $186.28 million in outflows on Feb. 10, which continued with $56.76 million, $251.03 million, and $157.78 million over the next three trading days. That said, the investment funds ended the week on a slightly positive note with a modest $66.19 million in net inflows.

Fidelity’s FBTC attracted the majority of inflows for the day, with $94.04 million entering the fund, ending its negative flow streak recorded over the previous four trading days. The spot Bitcoin ETF is the second-best-performing BTC fund, with $12.5 billion in cumulative net inflows since its launch.

BlackRock’s IBIT followed with an inflow of $22.26 million, while Bitwise’s BITB and Grayscale’s mini Bitcoin Trust also contributed to the positive momentum, recording inflows of $7.99 million and $6.46 million, respectively.

On the outflows side, Grayscale’s GBTC saw $46.95 million in exits, bringing its cumulative net outflows to a substantial $22.01 billion. ARK 21Shares’ ARKB and VanEck’s HODL also posted modest losses of $13.19 million and $4.43 million respectively.

At press time Bitcoin (BTC) was down 2.4% over the past week, trading at $95, 652 per coin.

Meanwhile, the nine spot Ethereum ETFs recorded $26.26 million in weekly outflows for the week ending Feb. 14. After finally beginning to gain traction with investors, ETH funds appear to be building momentum.

Similar to BTC, ETH funds ended the week on a positive note with a modest $11.65 million in net inflows, all of which flowed into Fidelity’s FETH, while the other funds saw zero flows on the day.

Ethereum (ETH) was exchanging hands at $2,685 down only 0.3% over the past week when writing.

Source link

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

BTC Regains $84K; ETH, XRP, SOL Pump

Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle

Sacks and his VC firm sold over $200M in crypto and stocks before WH role

Polkadot (DOT) Price Stability Fuels Hopes For Short-Term Recovery

Bitcoin Is A Strategic Asset, Not XRP

Bank of America Insider Helps Criminals and Illicit Businesses Launder Funds in Massive Global Conspiracy: US Department of Justice

U.S. government holds $16B in Bitcoin, eyes 1m BTC under new bill

Wales Man Loses Appeal to Dig Out Hard Drive Holding $676 Million in Bitcoin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x