crypto liquidations

US court permits Three Arrows Capital to expand claim against FTX, rejects FTX’s objections

Published

1 day agoon

By

admin

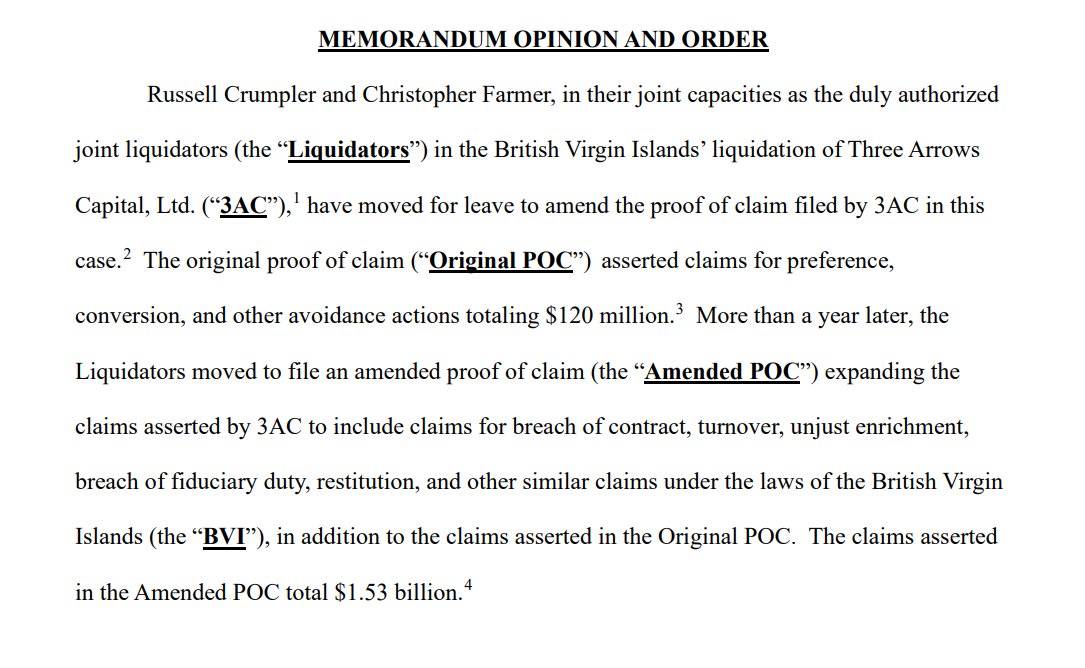

A U.S. bankruptcy court has allowed the liquidators of the defunct crypto hedge fund Three Arrows Capital to substantially increase its claim against the collapsed crypto exchange FTX from $120 million to $1.53 billion.

In a March 13 ruling by the US Bankruptcy Court for the District of Delaware, the judge ruled that FTX is to pay out $1.53 billion to Three Arrows Capital, increasing the claim from the original $120 million filed in June 2023. FTX objected to the decision, arguing it was too late and would slow down their bankruptcy process. However, the judge sided with 3AC’s liquidators, opining that they had provided sufficient notice of their claim. The judge determined that the delay in filing the larger claim was mainly due to FTX not promptly sharing relevant records with 3AC’s liquidators. 3AC liquidators needed that information to properly assess and detail their claim.

The 3AC’s liquidators are claiming that FTX held $1.53 billion in 3AC’s assets, which were then liquidated to pay off 3AC’s debts. Furthermore, 3AC liquidators argued that those transactions were avoidable and that FTX didn’t provide the information that would’ve uncovered the liquidation.

Both 3AC and FTX were once major players in the crypto world, but both are no defunct. Three Arrows Capital was one of the largest crypto hedge funds that collapsed in June 2022 due to forced liquidation of overleveraged positions in Bitcoin (BTC), Ethereum (ETH), and other altcoins. They filed for bankruptcy in July 2022. Its liquidators are now trying to recover funds by selling their remaining assets and through various lawsuits, most notably against FTX and Terraform Labs to repay its creditors.

FTX crypto exchange declared bankruptcy in Nov. 2022 and has also seen been trying to recoup funds through various lawsuits, including one against Binance and Changpeng Zhao. FTX recently started their repayment process facilitated through BitGo and Kraken exchanges.

Source link

You may like

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

Bitcoin

Bybit CEO estimates crypto wipeout crossed $8b, more than $2b reported

Published

1 month agoon

February 3, 2025By

admin

Bybit CEO Ben Zhou has suggested that the ongoing crypto market liquidation event may be significantly larger than widely reported.

According to CoinGlass data, over $2 billion in digital liquidations in 24 hours on Monday, Feb. 3, marking the single largest liquidation event in crypto history.

Several analysts estimated liquidations exceeded $2.2 billion, surpassing the COVID crash and FTX collapse, two of the most significant liquidation events ever recorded.

Yet, Zhou said the numbers may be underreported due to API limits. According to Bybit’s co-founder, the crypto exchange limits how much data is pushed to aggregators like CoinGlass. Other platforms likely use a similar capped system, Zhou said via X.

Zhou estimated that liquidations on Bybit alone accounted for $2.1 billion in losses, representing over 85% of the total reported figures. “I am afraid that today’s real total liquidation is a lot more than $2 billion. By my estimation, it should be at least $8 billion to $10 billion,” Zhou said.

Following Zhou’s comments, crypto community members debated the accuracy of the reported figures. Some speculated that previous liquidation events, such as the COVID crash and the FTX collapse, may have also been underreported.

Looking ahead, Zhou pledged that Bybit would begin sharing all liquidation data with the public. “We believe in transparency,” he stated, as digital assets reeled from a massive leverage flush.

need to dig out this data, but should be at least 4-6 times of what was reported basically.

— Ben Zhou (@benbybit) February 3, 2025

Source link

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

BTC Regains $84K; ETH, XRP, SOL Pump

Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle

Sacks and his VC firm sold over $200M in crypto and stocks before WH role

Polkadot (DOT) Price Stability Fuels Hopes For Short-Term Recovery

Bitcoin Is A Strategic Asset, Not XRP

Bank of America Insider Helps Criminals and Illicit Businesses Launder Funds in Massive Global Conspiracy: US Department of Justice

U.S. government holds $16B in Bitcoin, eyes 1m BTC under new bill

Wales Man Loses Appeal to Dig Out Hard Drive Holding $676 Million in Bitcoin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x